Altamira Therapeutics Announces Pricing of up to $12.0 Million Public Offering

17 September 2024 - 11:00PM

- $4 million upfront with up to an additional $8 million of

aggregate gross proceeds upon the exercise in full for cash of

milestone-linked warrants

Altamira Therapeutics Ltd. (“Altamira” or the

“Company”) (Nasdaq: CYTO), a company dedicated to developing and

commercializing RNA delivery technology for targets beyond the

liver, today announced the pricing of a public offering of an

aggregate of 5,555,556 common shares (or pre-funded warrants in

lieu thereof) accompanied by Series A-1 common warrants to purchase

up to 5,555,556 common shares and Series A-2 common warrants to

purchase up to 5,555,556 common shares, at a combined public

offering price of $0.72 per share (or per pre-funded

warrant in lieu thereof) and accompanying Series A-1 common warrant

and Series A-2 common warrant. The Series A-1 common warrants will

have an exercise price of $0.72 per share, will be

immediately exercisable upon issuance and will expire on

the earlier of the eighteen-month anniversary of the initial

issuance date or 60 days following the date the Company publicly

announces positive biodistribution data for AM-401 or AM-411

nanoparticles. The Series A-2 common warrants will have an exercise

price of $0.72 per share, will be immediately exercisable

upon issuance and will expire on the earlier of the five-year

anniversary of the initial issuance date or six months following

the date the Company publicly announces the entry into one or more

agreements relating to the further development and

commercialization for AM-401 or AM-411, provided at least one such

agreement covers a territory that includes all or a part of the

European Union or the United States. The closing of the offering is

expected to occur on or about September 19, 2024, subject to

the satisfaction of customary closing conditions.

H.C. Wainwright & Co. is acting as the exclusive

placement agent for the offering.

The aggregate gross proceeds to the Company from

this offering are expected to be approximately $4.0 million,

before deducting the placement agent's fees and other offering

expenses payable by the Company. The potential additional gross

proceeds to the Company from the Series A-1 common warrants and

Series A-2 common warrants, if fully exercised on a cash basis,

will be approximately $8.0 million. No assurance can be given that

any of the Series A-1 common warrants or Series A-2 common warrants

will be exercised. The Company intends to use the net proceeds from

this offering for working capital and general corporate

purposes.

The securities described above are being offered

pursuant to a registration statement on Form F-1 (File No.

333-281724), as amended, originally filed on August 22, 2024 with

the Securities and Exchange Commission (the “SEC”) and declared

effective by the SEC on September 17, 2024. The offering is being

made only by means of a prospectus which forms a part of the

effective registration statement relating to the offering. A

preliminary prospectus relating to the offering has been filed with

the SEC and a final prospectus relating to the offering will be

filed with the SEC. Electronic copies of the final prospectus, when

available, may be obtained on the SEC's website at

http://www.sec.gov and may also be obtained, when available, by

contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd

Floor, New York, NY 10022, by phone at (212) 856-5711 or e-mail at

placements@hcwco.com.

The Company also has agreed that certain

existing warrants to purchase up to an aggregate of 555,556 common

shares that were previously issued in July 2023 at an exercise

price of $9.00 per common share and an expiration date of July 10,

2028 will be amended effective upon the closing of the offering

such that the amended warrants will have a reduced exercise price

of $0.72 per common share and will expire five years following the

closing of the offering.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Altamira Therapeutics

Altamira Therapeutics (Nasdaq: CYTO) is

developing and supplying peptide-based nanoparticle technologies

for efficient RNA delivery to extrahepatic tissues (OligoPhore™ /

SemaPhore™ platforms). The Company currently has two flagship siRNA

programs using its proprietary delivery technology: AM-401 for KRAS

driven cancer and AM-411 for rheumatoid arthritis, both in

preclinical development beyond in vivo proof of concept. The

versatile delivery platform is also suited for mRNA and other RNA

modalities and made available to pharma or biotech companies

through out-licensing. In addition, Altamira holds a 49% stake

(with additional economic rights) in Altamira Medica AG, which

holds its commercial-stage legacy asset Bentrio®, an OTC nasal

spray for allergic rhinitis. Further, the Company is in the process

of partnering / divesting its inner ear legacy assets. Founded in

2003, Altamira is headquartered in Hamilton, Bermuda, with its main

operations in Basel, Switzerland. For more information, visit:

https://altamiratherapeutics.com/

Forward-Looking Statements

This press release may contain statements that

constitute "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are statements other than historical

facts and may include statements that address future operating,

financial or business performance or Altamira’s strategies or

expectations and statements regarding the completion of the

offering, the satisfaction of customary closing conditions related

to the offering, the anticipated use of proceeds therefrom, the

ability of the Company to achieve certain milestone events, and the

exercise of the Series A-1 common warrants and Series A-2 common

warrants upon the achievement of such milestone events or otherwise

prior to their expiration. In some cases, you can identify these

statements by forward-looking words such as "may", "might", "will",

"should", "expects", "plans", "anticipates", "believes",

"estimates", "predicts", "projects", "potential", "outlook" or

"continue", or the negative of these terms or other comparable

terminology. Forward-looking statements are based on management's

current expectations and beliefs and involve significant risks and

uncertainties that could cause actual results, developments and

business decisions to differ materially from those contemplated by

these statements. These risks and uncertainties include, but are

not limited to, market and other conditions, the clinical utility

of Altamira’s product candidates, the timing or likelihood of

regulatory filings and approvals, Altamira’s intellectual property

position and Altamira’s financial position. These risks and

uncertainties also include, but are not limited to, those described

under the caption "Risk Factors" in Altamira’s Annual Report on

Form 20-F for the year ended December 31, 2023, and in Altamira’s

other filings with the SEC, which are available free of charge on

the SEC’s website at: www.sec.gov. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated. All forward-looking statements and all

subsequent written and oral forward-looking statements attributable

to Altamira or to persons acting on behalf of Altamira are

expressly qualified in their entirety by reference to these risks

and uncertainties. You should not place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date they are made, and Altamira does not undertake any

obligation to update them in light of new information, future

developments or otherwise, except as may be required under

applicable law.

CONTACT:

Hear@altamiratherapeutics.com

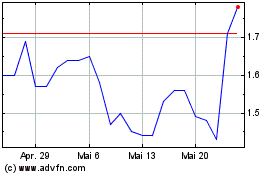

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025