UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January

2024

Commission File Number: 001-36582

Altamira Therapeutics

Ltd.

(Exact name of registrant

as specified in its charter)

Clarendon House,

2 Church Street

Hamilton HM11, Bermuda

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

EXPLANATORY NOTE

As previously reported, on

November 21, 2023, Altamira Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (the “Company”)

closed the transaction for the partial spin-off of its Bentrio® business (the “Transaction”) pursuant to that share purchase

agreement, dated November 17, 2023 (the “Purchase Agreement”) by and between Auris Medical AG (“Seller”), a wholly-owned

subsidiary of the Company, and a Swiss private equity investor (“Purchaser”). The unaudited pro forma financial information

of the Company required to be filed in connection with the Transaction is filed as Exhibit 99.1 to this Report on Form 6-K and is incorporated

by reference as though fully set forth herein.

Under the Purchase Agreement,

the Company sold a 51% stake in its subsidiary Altamira Medica AG (“Medica”) as part of its strategic repositioning around

its RNA delivery technology. Medica’s key asset is Bentrio®, a drug-free OTC nasal spray utilized for the treatment of allergic

rhinitis, which has been cleared by the FDA and is being commercialized in a growing number of countries.

Pursuant to the Purchase Agreement,

the Company received a cash consideration of CHF 2,040,000 (about $2.3 million) for the 51% stake in Medica and retained 49% of the company’s

share capital. Further, the Company is entitled to receive 25% of Medica’s future gross licensing income. The transaction also includes

the sale of Auris Medical Pty Ltd, Melbourne (Australia) and a cash contribution of CHF 1,000,000 in total to Medica’s capital by

its two shareholders pro rata of their shareholdings following the closing. Medica will continue its operations under its current name

and with current staff in collaboration with the Company, including the continued provision of certain services at cost. The Company anticipates

recording a financial gain of approximately $5.2 million from the transaction in accordance with International Financial Reporting Standards

(IFRS).

INCORPORATION BY REFERENCE

This Report on Form

6-K, including exhibit 99.1 to this Report on Form 6-K, shall be deemed to be incorporated by reference into the registration

statements on Form F-3 (Registration Numbers 333-228121, 333-249347, 333-261127, 333-264298, 333-267584, 333-272338

and 333-276427) and Form S-8 (Registration Numbers 333-232735

and 333-252141) of

Altamira Therapeutics Ltd. (formerly Auris Medical Holding Ltd.) and to be a part thereof from the date on which this report is

filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Altamira Therapeutics Ltd. |

| |

|

|

| |

By: |

/s/ Marcel Gremaud |

| |

Name: |

Marcel Gremaud |

| |

Title: |

Chief Financial Officer |

Date: January 19, 2024

EXHIBIT INDEX

3

Exhibit 99.1

ALTAMIRA THERAPEUTICS

LTD.

UNAUDITED PROFORMA CONSOLIDATED FINANCIAL INFORMATION

Overview

On November 21, 2023, Altamira Therapeutics Ltd.,

an exempted company limited by shares incorporated in Bermuda (the “Company”) closed the transaction for the partial spin-off

of its Bentrio® business pursuant to that share purchase agreement, dated November 17, 2023 by and between Auris Medical AG (“Seller”),

a wholly-owned subsidiary of the Company, and a Swiss private equity investor (“Purchaser”). Under the Purchase Agreement,

the Company sold a 51% stake in its subsidiary Altamira Medica AG (“Medica”) as part of its strategic repositioning around

its RNA delivery technology.

Basis of Presentation

The following unaudited proforma consolidated

financial information reflects adjustments to the Company’s historical financial results as reported under International Financial

Reporting Standards (“IFRS”), in connection with the sale of its Bentrio® business. The unaudited proforma consolidated

statement of comprehensive income for the year ended December 31, 2022, has been prepared with the assumption that the sale of its Bentrio®

business was completed as of January 1, 2022, and the effects of the transaction are carried forward to the unaudited proforma consolidated

statement of comprehensive income for the six months ended June 30, 2023. The unaudited proforma consolidated balance sheet as of June

30, 2023, has been prepared with the assumption that the sale of the Bentrio® business was consummated on that date.

The consolidated “as reported” column

in the unaudited proforma balance sheet and in the unaudited proforma statement of comprehensive income reflects the Company’s historical

financial statements for the periods presented and do not reflect any adjustments related to the transaction. Assumptions and estimates

underlying the proforma adjustments column are described in the accompanying notes.

The unaudited proforma consolidated financial

statements have been prepared in accordance with the rules and regulations of Regulation S-X promulgated by the U.S. Securities and Exchange

Commission (the “SEC”). The unaudited proforma consolidated financial information does not purport to be indicative of the

results of operations or the financial condition which would have actually resulted if the sale of Bentrio® business actually occurred

on the dates presented or to project our results of operations or financial position for any future period. This financial information

may not be predictive of the future results of operations or financial condition of the Company, as the Company’s future results

of operation and financial condition may differ significantly from the proforma amounts reflected herein due to a variety of factors.

The unaudited proforma financial information has

been prepared by the Company based upon assumptions deemed appropriate by the Company’s management and are based upon information

and assumptions available at the time of filing the Company’s current report on Form 6-K filed with the SEC on January 19, 2024.

The following unaudited proforma financial information should be read in conjunction with: (i) the accompanying notes to the unaudited

proforma consolidated financial information; and (ii) the audited consolidated financial statements of the Company which were included

in the Company’s annual report on Form 20-F filed with the SEC on May 16, 2023 and the Company’s unaudited semiannual report

on Form 6-K filed with the SEC on September 12, 2023.

The proforma adjustments to the statements of

comprehensive income for all periods presented do not include the following:

The non-recurring accounting gain on the partial

spin-off of Bentrio® business as of November 21, 2023; however, the gain will be included in the Company’s results for the twelve

months period ended December 31, 2023. At this time the amount of the accounting gain represents the Company’s best estimate only

and has to be considered as provisional since the accounting for the deconsolidation of the Bentrio® business, comprising the subsidiaries

Altamira Medica AG, Switzerland, and Auris Medical Pty Ltd, Australia, has not been finalized, yet. The provisional gain on the transaction

amounts to CHF 4.7 million (approximately $5.2 million) and includes the cash consideration of CHF 2.04 million, the fair value of the

retained 49% non-controlling interest of CHF 1.96 million and the disposal of (negative) net assets related to Bentrio® business in

the estimated amount of CHF (0.7) million.

Altamira Therapeutics Ltd.

Unaudited Proforma Consolidated Balance Sheet

As of June 30, 2023 (in

CHF)

| | |

| | |

Proforma Adjustments | |

| |

| | |

Consolidated

Company as

Reported | | |

Bentrio

Business

Disposition | | |

| |

Proforma

Consolidated

Company | |

| ASSETS | |

| | |

| | |

| |

| |

| Non-current assets | |

| | | |

| | | |

| |

| | |

| Property and equipment | |

| 1 | | |

| — | | |

| |

| 1 | |

| Right-of -use assets | |

| 387,737 | | |

| — | | |

| |

| 387,737 | |

| Intangible assets | |

| 3,893,681 | | |

| — | | |

| |

| 3,893,681 | |

| Investment in associated company | |

| — | | |

| 2,450,000 | | |

(1) (2) | |

| 2,450,000 | |

| Non-current financial assets | |

| 192,958 | | |

| (102,917 | ) | |

(3) | |

| 90,041 | |

| Total non-current assets | |

| 4,474,377 | | |

| 2,347,083 | | |

| |

| 6,821,460 | |

| Current assets | |

| | | |

| | | |

| |

| | |

| Inventories | |

| 270,503 | | |

| (270,503 | ) | |

(3) | |

| — | |

| Trade receivables | |

| 31,813 | | |

| (31,813 | ) | |

(3) | |

| — | |

| Other receivables | |

| 756,234 | | |

| (171,884 | ) | |

(3) (4) | |

| 584,350 | |

| Prepayments | |

| 374,376 | | |

| (230,755 | ) | |

(3) | |

| 143,621 | |

| Derivative financial instruments | |

| 247,090 | | |

| — | | |

| |

| 247,090 | |

| Cash and cash equivalents | |

| 49,569 | | |

| 1,525,232 | | |

(2) (3) (5) | |

| 1,574,801 | |

| Total current assets | |

| 1,729,585 | | |

| 820,277 | | |

| |

| 2,549,862 | |

| Total Assets | |

| 6,203,962 | | |

| 3,167,360 | | |

| |

| 9,371,322 | |

| EQUITY AND LIABILITIES | |

| | | |

| | | |

| |

| | |

| Equity | |

| | | |

| | | |

| |

| | |

| Share capital | |

| 1,590,801 | | |

| — | | |

| |

| 1,590,801 | |

| Share premium | |

| 15,560,642 | | |

| — | | |

| |

| 15,560,642 | |

| Other reserves | |

| 871,633 | | |

| (177,169 | ) | |

(3) | |

| 694,464 | |

| Accumulated deficit | |

| (19,847,641 | ) | |

| 5,792,367 | | |

(6) | |

| (14,055,274 | ) |

| Total shareholder’s equity attributable to owners of the Company | |

| (1,824,565 | ) | |

| 5,615,198 | | |

| |

| 3,790,633 | |

| Non-current liabilities | |

| | | |

| | | |

| |

| | |

| Loan | |

| 930,561 | | |

| — | | |

| |

| 930,561 | |

| Non-current lease liabilities | |

| 287,808 | | |

| — | | |

| |

| 287,808 | |

| Employee benefits | |

| 381,362 | | |

| — | | |

| |

| 381,362 | |

| Deferred income | |

| 932,200 | | |

| (932,200 | ) | |

(3) | |

| — | |

| Deferred tax liabilities | |

| 129,291 | | |

| (129,291 | ) | |

(3) | |

| — | |

| Total non-current liabilities | |

| 2,661,222 | | |

| (1,061,491 | ) | |

| |

| 1,599,731 | |

| Current liabilities | |

| | | |

| | | |

| |

| | |

| Loan | |

| 2,130,340 | | |

| — | | |

| |

| 2,130,340 | |

| Current lease liabilities | |

| 118,229 | | |

| — | | |

| |

| 118,229 | |

| Trade and other payables | |

| 1,964,138 | | |

| (900,817 | ) | |

(3) | |

| 1,063,321 | |

| Accrued expenses | |

| 1,154,598 | | |

| (485,530 | ) | |

(3) | |

| 669,068 | |

| Total current liabilities | |

| 5,637,305 | | |

| (1,386,347 | ) | |

| |

| 3,980,958 | |

| Total liabilities | |

| 8,028,527 | | |

| (2,447,838 | ) | |

| |

| 5,580,689 | |

| Total equity and liabilities | |

| 6,203,962 | | |

| 3,167,360 | | |

| |

| 9,371,322 | |

See Notes to the Unaudited Proforma Consolidated

Financial Statements.

Altamira Therapeutics Ltd.

Unaudited Proforma Consolidated Statement of

Comprehensive Income

For the Six Months Ended

June 30, 2023 (in CHF)

| | |

| | |

Proforma Adjustments | |

| |

| | |

Consolidated

Company, as

Reported | | |

Bentrio

Business

Disposition | | |

| |

Proforma

Consolidated

Company | |

| Revenue | |

| 105,469 | | |

| (105,469 | ) | |

(7) | |

| — | |

| Cost of sales | |

| (212,181 | ) | |

| 212,181 | | |

(7) | |

| — | |

| Gross profit | |

| (106,712 | ) | |

| 106,712 | | |

| |

| — | |

| Other operating income | |

| 111,405 | | |

| (40,756 | ) | |

(8) | |

| 70,649 | |

| Research and development | |

| (2,261,154 | ) | |

| 910,896 | | |

(8) | |

| (1,350,258 | ) |

| Sales and marketing | |

| (160,936 | ) | |

| 135,958 | | |

(8) | |

| (24,978 | ) |

| General and administrative | |

| (2,168,953 | ) | |

| 114,819 | | |

(8) | |

| (2,054,134 | ) |

| Operating loss | |

| (4,568,350 | ) | |

| 1,227,629 | | |

| |

| (3,358,721 | ) |

| Finance expense | |

| (861,118 | ) | |

| 8,314 | | |

(9) | |

| (852,804 | ) |

| Finance income | |

| 37,018 | | |

| (2,229 | ) | |

(9) | |

| 34,789 | |

| Loss before tax | |

| (5,410,450 | ) | |

| 1,233,714 | | |

| |

| (4,176,736 | ) |

| Income tax | |

| (10,596 | ) | |

| 10,596 | | |

(9) | |

| — | |

| Net loss attributable to owners of the Company | |

| (5,421,046 | ) | |

| 1,244,310 | | |

| |

| (4,176,736 | ) |

| Basic and diluted loss per share | |

| (25.82 | ) | |

| | | |

| |

| (19.89 | ) |

| Basic and diluted weighted-average shares outstanding 1) | |

| 209,955 | | |

| | | |

| |

| 209,955 | |

| 1) | Adjusted for the December 13, 2023, one-for-twenty reverse

share split. |

See Notes to the Unaudited Proforma Consolidated

Financial Statements.

Altamira Therapeutics Ltd.

Unaudited Proforma Consolidated Statement of

Comprehensive Income

For the Twelve Months Ended December 31, 2022

| | |

| | |

Proforma Adjustments | |

| |

| | |

Consolidated

Company, as

Reported | | |

Bentrio

Business

Disposition | | |

| |

Proforma

Consolidated

Company | |

| Revenue | |

| 305,616 | | |

| (305,616 | ) | |

(7) | |

| — | |

| Cost of sales | |

| (1,443,855 | ) | |

| 1,443,855 | | |

(7) | |

| — | |

| Gross profit | |

| (1,138,239 | ) | |

| 1,138,239 | | |

| |

| — | |

| Other operating income | |

| 709,449 | | |

| (700,122 | ) | |

(8) | |

| 9,327 | |

| Research and development | |

| (19,677,756 | ) | |

| 5,056,186 | | |

(8) | |

| (14,621,570 | ) |

| Sales and marketing | |

| (2,381,384 | ) | |

| 2,381,384 | | |

(8) | |

| — | |

| General and administrative | |

| (3,644,549 | ) | |

| 242,873 | | |

(8) | |

| (3,401,676 | ) |

| Operating loss | |

| (26,132,479 | ) | |

| 8,118,560 | | |

| |

| (18,013,919 | ) |

| Finance expense | |

| (913,006 | ) | |

| 7,524 | | |

(9) | |

| (905,482 | ) |

| Finance income | |

| 506,745 | | |

| (361,029 | ) | |

(9) | |

| 145,716 | |

| Loss before tax | |

| (26,538,740 | ) | |

| 7,765,055 | | |

| |

| (18,773,685 | ) |

| Income tax | |

| 10,329 | | |

| (2,410 | ) | |

(9) | |

| 7,919 | |

| Net loss attributable to owners of the Company | |

| (26,528,411 | ) | |

| 7,762,645 | | |

| |

| (18,765,766 | ) |

| Basic and diluted loss per share | |

| (582.58 | ) | |

| | | |

| |

| (412.11 | ) |

| Basic and diluted weighted-average shares outstanding 1) | |

| 45,536 | | |

| | | |

| |

| 45,536 | |

| 2) | Adjusted for the December 13, 2023, one-for-twenty reverse

share split. |

See Notes to the Unaudited Proforma Consolidated

Financial Statements.

NOTES TO UNAUDITED PROFORMA CONSOLIDATED FINANCIAL

STATEMENTS

The proforma adjustments are based on preliminary

estimates and assumptions by management that may be subject to change. The following adjustments have been reflected in the unaudited

proforma consolidated financial information:

| (1) | Adjustment

to reflect the recognition of the investment in an associated company of CHF 1,960,000 for the retained stake of 49% in Medica, accounted

for under the equity method. |

| (2) |

Adjustment to reflect the capital contribution of CHF 1,000,000 in total to Medica’s capital by its two shareholders following the transaction. Based on its 49% stake, the Company’s capital contribution amounted to CHF 490,000. |

| (3) |

Adjustment to reflect the elimination of assets and liabilities attributable to the Bentrio business. |

| (4) |

Adjustment to include the CHF 37,322 receivables from Medica as part of the consideration on the sale of the Bentrio business. |

| (5) |

Adjustment to include the CHF 2,040,000 consideration in cash on the sale of the Bentrio business. |

| (6) |

Adjustment to reflect the impact of the sale of Bentrio business on accumulated deficit including the estimated gain on sale and the elimination of equity of the two subsidiaries sold. |

| (7) |

Adjustment to reflect the elimination of revenue and cost of goods sold of the Bentrio business. |

| (8) |

Adjustment to reflect the elimination of operating income and expenses related to the Bentrio business. |

| (9) | Adjustment

to reflect the elimination of financial and tax income and expenses related to the Bentrio business. |

5

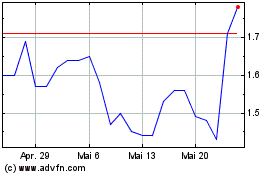

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024