Bear of the Day: Silicon Labs (SLAB) - Bear of the Day

09 August 2013 - 12:30PM

Zacks

Estimates have been falling for

Silicon Labs (SLAB) after

the company reported soft second quarter results and provided weak

third quarter guidance. It is a Zacks Rank #5 (Strong Sell) stock.

Despite the negative earnings momentum, shares of

Silicon Labs still trade at a premium valuation. Investors may want

to wait for earnings momentum to turn around before establishing a

long position.

Silicon Labs develops analog-intensive,

mixed-signal integrated circuits used in a wide range of

applications such as set-top boxes, televisions, and cell phones.

The company was founded in 1996 and has a market cap of $1.7

billion.

Soft Q2 Results, Weak Guidance

Silicon Labs reported its second quarter results on

July 25. Adjusted earnings per share came in at 33 cents, missing

the Zacks Consensus Estimate by 3 cents.

Revenues declined 3% from the previous quarter to

$141.5 million, which was also below the consensus at $143.0

million. This decrease was driven by steep declines in some of the

company's legacy products.

Following the soft Q2 results, management guided Q3

EPS significantly below the consensus at the time. This prompted

analysts to revise their estimates significantly lower for both

2013 and 2014, sending the stock to a Zacks Rank #5 (Strong

Sell).

The Zacks Consensus Estimate for 2013 is now $1.46,

down from $1.73 just 30 days ago. The 2014 consensus is currently

$1.65, down from $1.94 over the same period.

You can see the big drop in consensus estimates in

the following chart:

Valuation

Shares of Silicon Labs are down more than -12%

since the Q2 earnings release. Despite this, the stock doesn't look

like a value here. Shares currently trade around 25x 12-month

forward earnings, which is a premium to the industry median 16x.

Its price to cash flow ratio of 19 is also above the industry

median of 14x.

The Bottom Line

With falling earnings estimates and premium

valuation, investors should consider avoiding this Zacks Rank #5

(Strong Sell) stock until its earnings momentum turns around.

Investors still interested in the 'Semiconductor -

Analog & Mixed' industry may want to take a look at

Microchip Technology (MCHP), which carries a Zacks Rank of 1

(Strong Buy) and trades at 19x forward earnings, or Analog

Devices (ADI), which has a Zacks Rank of 2 (Buy) and trades at

20x.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Editor of the Income

Plus Investor service.

ANALOG DEVICES (ADI): Free Stock Analysis Report

MICROCHIP TECH (MCHP): Free Stock Analysis Report

SILICON LAB INC (SLAB): Free Stock Analysis Report

To read this article on Zacks.com click here.

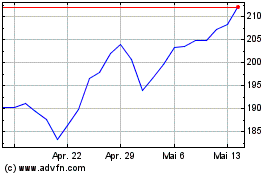

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024