TIDMUBG

RNS Number : 9581D

Unbound Group PLC

27 June 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO

DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

Unbound Group plc

(" Unbound", the "Company" or the "Group")

Termination of Formal Sale Process and Strategic Review

Update

The Company's board of directors (the "Board") provides an

update further to the initiation of the strategic review and formal

sale process announced by the Company on 19 May 2023.

Termination of Formal Sale Process

The Board announced the initiation of a strategic review and

formal sale process on 19 May 2023 to consider the options

available to maximise value for the Company's shareholders and the

Group's other stakeholders. These options included, but were not

limited to, a sale of the Company conducted under the framework of

a formal sale process in accordance with the City Code on Takeovers

and Mergers (the "Code").

No potential offers for the issued and to be issued share

capital of the Company were received that the Board considered

capable of receiving shareholder and wider stakeholder support. The

Board also confirms that there are no discussions ongoing with

potential offerors. The Board therefore announces the termination

of the formal sale process, which concludes the offer period (as

defined in the Code) in respect of the Company. As such, the

Company has ceased to be in an offer period as defined in the Code

and the requirement to make disclosures under Rule 8 of the Code

are no longer applicable with effect from the publication of this

announcement.

Strategic Review Update

Interpath as Joint Financial Adviser continues to run the

strategic review process in respect of the Group's main operating

subsidiary. Offers within this process continue to be received and

reviewed, however, these offers may result in little or no recovery

of value for the Company's existing shareholders.

Current discussions with interested parties may be altered or

terminated at any time and, accordingly, there can be no certainty

that any final proposals will be made, nor as to the terms on which

any such final proposals may be made.

Formal Restructuring Plan and Potential Equity Fundraise

In light of the recent encouraging trading performance of the

Group, as an alternative to the indicative proposals being

progressed as part of the strategic review, the Board is also

assessing the feasibility of an equity fundraise of between GBP1.5

million and GBP2 million to support implementation of a formal

restructuring plan, with a view to securing a better outcome for

the Group. The Board, in conjunction with Singer Capital Markets as

the Company's Financial Adviser, Nominated Adviser and Broker, is

engaging with certain of the Group's major shareholders and has

received some positive feedback at this early stage, with a view to

procuring broader participation in the equity fundraise. Its

implementation would be subject to the consent of the Company's

shareholders and wider stakeholders before ultimately requiring the

sanctioning of the UK Courts.

Should an equity fundraise be progressed, the Board intends to

include an open offer element to enable participation by the

Company's wider shareholder base on equal terms.

There can be no certainty that an equity raise can be achieved

nor as to the terms of any such equity raise. The Board confirms

that it continues to consider the available options and take

appropriate steps to preserve value for stakeholders in the event

that further equity funding cannot be raised and / or a formal

restructuring plan cannot be implemented.

Current Trading Update

The Group's revenues continue to be impacted by liquidity

constraints. The Group remains reliant on the waiver of certain

covenants under existing borrowing facilities and continues to

maintain constructive dialogue with its core banking partners who

have continued with their support throughout this period.

The Board is, however, encouraged that the profitability of the

business in recent months has been in line with the Board's

expectations. The positive impact on the profitability of the Group

of the implemented cost reduction measures is now becoming

increasingly evident in its financial performance. In the first

four months of the current financial year, the Group's fixed cost

base has been reduced by 9% year-on-year, with this saving expected

to increase as additional cost reduction actions take effect.

Following the seasonally loss-making months of February and

March, the Group generated unaudited EBITDA (pre-IFRS 16) of

approximately GBP1.1 million for April and May combined, an EBITDA

margin of 14%, an improvement from 9% in the prior year period. For

the first four months of the financial year, the Group is at EBITDA

breakeven.

The Board will continue to provide further updates as

appropriate.

Enquiries

Unbound Group plc c/o Alma PR

Ian Watson, CEO

Gavin Manson, CFO

Singer Capital Markets (Financial Adviser,

Nominated Adviser & Broker)

Peter Steel / Tom Salvesen / Alaina Wong +44 (0)20 7496

/ James Fischer 3000

Interpath Advisory Ltd (Joint Financial

Adviser) +44 (0)20 3989

Will Wright / Andrew Stone / Jack Brazier 2800

Alma PR Limited (Financial PR) +44 (0)20 3405 0205

Josh Royston / Sam Modlin / Hannah Campbell unbound@almapr.co.uk

Important Information

This announcement (including any information incorporated by

reference in this announcement) contains statements about the Group

that are or may be deemed to be forward looking statements. Without

limitation, any statements preceded by or followed by or that

includes the words "targets", "plans", "believes", "expects",

"aims", "intends", "will", "may", "anticipates", "estimates",

"projects" or words or terms of similar substance of the negative

thereof, may be forward looking statements.

These forward looking statements are not guarantees of future

performance. Such forward looking statements involve known and

unknown risks and uncertainties that could significantly affect

expected results and are based on certain key assumptions. Many

factors could cause actual results to differ materially from those

projected or implied in any forward looking statement. Due to such

uncertainties and risks, readers should not rely on such forward

looking statements, which speak only as of the date of this

announcement, except as required by applicable law.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities laws of such jurisdictions.

Market Abuse Regulation

The information contained within this announcement would have,

prior to its release, constituted inside information as stipulated

under Article 7 of the Market Abuse Regulation (EU) No.596/2014 as

incorporated into UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019 ("UK MAR"). Upon the

publication of this announcement via a regulatory information

service, this inside information will be considered to be in the

public domain. For the purposes of UK MAR, the person responsible

for arranging for the release of this information on behalf of

Unbound is Gavin Manson.

Other notices

Singer Capital Markets Advisory LLP ("Singer Capital Markets"),

which is authorised and regulated by the UK Financial Conduct

Authority, is acting exclusively for Unbound and for no one else

and will not be responsible to anyone other than Unbound for

providing the protections afforded to its clients or for providing

advice in relation to the matters referred to in this announcement.

Neither Singer Capital Markets, nor any of its affiliates, owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Singer Capital

Markets in connection with this announcement, any statement

contained herein or otherwise.

Interpath Ltd (trading as Interpath Advisory) is authorised and

regulated in the United Kingdom by the Financial Conduct Authority

("FCA") and is acting exclusively for the Group and for no one else

in connection with the subject matter of this announcement and will

not be responsible to anyone other than the Group for providing the

protections afforded to its clients nor for providing advice in

relation to the subject matter of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSELFMMEDSEIM

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

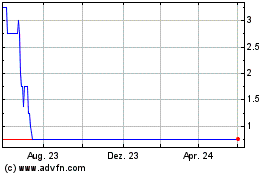

Unbound (LSE:UBG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Unbound (LSE:UBG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024