Gusbourne PLC Placing of Bonds and Share Warrants (7157I)

01 September 2016 - 1:01PM

UK Regulatory

TIDMGUS

RNS Number : 7157I

Gusbourne PLC

01 September 2016

This announcement contains inside information.

Gusbourne Plc

(London - AIM: GUS) (Gusbourne or the "Company")

Placing of Secured Deep Discount Bonds and Share Warrants

The Company announced on 20 July 2016 that it intended to place

5 year Secured Deep Discount Bonds at a discount of 9% per annum

("Bonds"). The Company also announced that it would issue share

warrants ("Warrants") to Bond holders at the rate of one Warrant

for every GBP2 of the Bonds. Each Warrant will, upon exercise,

entitle the holder to subscribe for one new ordinary share in the

Company at an exercise price of 75 pence per share. The Placing was

made available to a limited selection of shareholders and other

placees. The Company limited the total amount to be raised by

subscription for the Bonds to GBP8,000,000 but with the discretion

to increase the amount to no more than GBP10,000,000.

Gusbourne is pleased to announce that it has received

applications from investors ("Investors") to subscribe for Bonds

totaling GBP4,073,034 and that all these applications have been

accepted in full ("Proceeds"). Dispatch of the Bond certificates

and Warrant certificates to individual holders is subject to the

completion of security documentation, normal for this type of

transaction.

Certain directors of the Company have applied for Bonds in the

following amounts:

-- Andrew Weeber, Chairman; GBP600,000;

-- Ian Robinson, Non-Executive Director; GBP100,000;

-- Lord Arbuthnot PC; Non-Executive Director GBP10,000; and

-- Matthew Clapp; Non-Executive Director: GBP10,000.

The Company agreed that the payment for Andrew Weeber's Bonds

would be fully satisfied out of the proceeds of the redemption of

the existing convertible bonds ("Existing Bonds") held by him and

his wife. Accordingly, subject to completion of security

documentation, approximately GBP1,755,000 of the Proceeds will be

used to repay the existing bonds in accordance with the terms of

those bonds and Andrew Weeber and his wife will reinvest GBP600,000

of those redemption proceeds in satisfying their application for

Bonds.

Lord Ashcroft KCMG PC has applied for GBP2,623,034 of Bonds.

Following the payment of the Existing Bonds, the net cash

proceeds receivable by the Company will amount to approximately

GBP2,318,000. The net cash proceeds will be used for working

capital, ongoing investment of the Gusbourne brand, and capital

expenditure in line with the Company's long term strategy to

further expand productions and sales of its international award

winning English sparkling wines.

The repayment of the Existing Bonds held by Andrew Weeber and

his wife constitutes a related party transaction under the AIM

Rules, as does the subscription by Lord Ashcroft KCMG PC. The

independent Directors consider that, having consulted with Cenkos,

the terms of these transactions are fair and reasonable insofar as

Shareholders are concerned.

Over the coming months, the Company may seek to place further

Bonds within the same series and subject to the same security and

other terms, provided that the total raised in connection with the

Bonds issuance is no more than GBP10 million.

Enquiries:

Gusbourne Plc

Andrew Weeber +44 (0)12 3375 8666

Cenkos Securities plc

Nicholas Wells +44 (0)20 7397 8920

Note: This and other press releases are available at the

Company's web site: www.gusbourneplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEUGUUUBUPQGGG

(END) Dow Jones Newswires

September 01, 2016 07:01 ET (11:01 GMT)

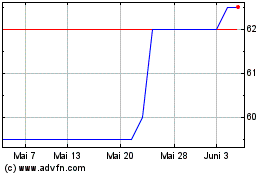

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

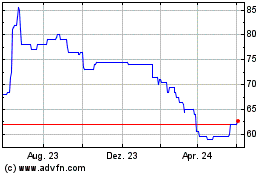

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024