Pound Falls Following BoE Rate Cut

08 November 2024 - 7:41AM

RTTF2

The British pound weakened against other major currencies in the

European session on Friday, after the Bank of England cut interest

rates as expected but signaled stickier inflation.

Thursday, the Monetary Policy Committee decided to lower the

rate by 25 basis points to 4.75 percent. The outcome of the two-day

meeting matched expectations.

Previously, the bank had reduced the policy rate by a

quarter-point in August, which was the first reduction since March

2020.

At the November meeting, eight members voted for a 25-bps cut,

while Catherine Mann alone voted to maintain the rate at 5.00

percent.

Monetary policy will need to continue to remain restrictive for

sufficiently long until the risks to inflation returning

sustainably to the 2% target in the medium term have dissipated

further," the bank said in a statement.

Governor Andrew Bailey underlined the importance of exercising

caution when making cutbacks in the future in order to maintain

inflation near the 2% objective.

The Federal Reserve Open Markets Committee in its monetary

policy review on Thursday unanimously decided to lower the target

range for the federal funds rate by 0.25 percentage point to 4.5 to

4.75 percent. The FOMC, that seeks to achieve maximum employment

and inflation at the rate of 2 percent over the longer run

reiterated that the risks to achieving its employment and inflation

goals were roughly in balance.

Investors await details of China's forthcoming stimulus at the

conclusion of a week-long session of China's top legislative body,

the National People's Congress (NPC) Standing Committee, later in

the day.

Possible measures may include support for local government debt

and consumer spending.

In the European trading, the pound fell to a 3-day low of 197.19

against the yen, from an early high of 198.83. On the downside

195.00 is seen as the next support level for the pound.

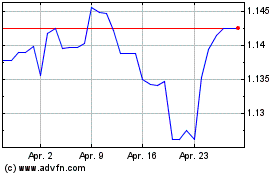

Against the Swiss franc, the U.S. dollar and the euro, the pound

edged down to 1.1288, 1.2936 and 0.8325 from early highs of 1.1334,

1.2983 and 0.8308, respectively. If the pound extends its

downtrend, it is likely to find support around 1.11 against the

franc, 1.27 against the greenback and 0.84 against the euro.

Looking ahead, Canada jobs data for October, U.S. University of

Michigan's consumer sentiment data for November and U.S. Baker

Hughes oil rig count data are slated for release in the New York

session.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Okt 2024 bis Nov 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Nov 2023 bis Nov 2024