Pounds Falls On Weak U.K. Employment Data

12 November 2024 - 5:42AM

RTTF2

The British pound weakened against other major currencies in the

European session on Tuesday, after the U.K. unemployment rate rose

more than expected in the third quarter and wage growth softened,

adding pressure on the Bank of England to cut interest rates

further.

Data from the Office for National Statistics showed that the

unemployment rate rose to 4.3 percent in the September quarter from

4.0 percent in three months to August period. The rate was seen at

4.1 percent.

Excluding bonus, average earnings gained 4.8 percent in three

months to September, the weakest since mid-2022. This follows an

increase of 4.9 percent in the preceding period. Wage growth was

forecast to ease to 4.7 percent.

Average earnings including bonus grew 4.3 percent annually. The

ONS said the annual increase was affected by the civil service

one-off payments made in July and August 2023. Economists had

expected an increase of 3.9 percent.

Job vacancies decreased for the 28th consecutive period in three

months to October, the ONS said. The number of vacancies declined

35,000 on the quarter to 831,000.

Data showed that payrolled employees decreased 5,000 in October

from a month ago but increased 95,000 from the previous year, to

30.4 million.

Claimant count rose by 26,700 in October after rising 10,100 in

September. However, this was smaller than economists' forecast of

30,500.

There were an estimated 48,000 working days lost because of

labor disputes in September.

Last week, the BoE had lowered its interest rate by a

quarter-point to 4.75 percent. Previously, the U.K. central bank

had reduced the policy rate by a quarter-point in August, which was

the first reduction since March 2020.

European stocks traded lower, after reports emerged that U.S.

President-elect Donald Trump will appoint Michael Waltz as his

national security adviser and Marco Rubio as secretary of state,

indicating hardline positions on China, Iran and Venezuela.

Meanwhile, according to data provider DDHQ, Trump's Republican

Party had won a majority in the U.S. House of Representatives,

signaling a majority for Republicans in both chambers of

Congress.

It is feared that Trump's aggressive tariff hikes could fuel

inflation eventually and stop the Fed from cutting rates. Tariffs

also carry the risk of retaliation from major trading partners.

On the economic front, the focus remains on U.S. consumer price

inflation data on Wednesday, and a slew of speeches by Federal

Reserve officials this week, including Fed Chair Jerome Powell on

Thursday.

In the European trading now, the pound fell to a 3-month low of

1.2792 against the U.S. dollar, from an early high of 1.2874. On

the downside, 1.26 is seen as the next support level for the

pound.

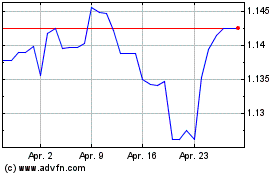

Against the Swiss franc and the yen, the pound slid to 4-day

lows of 1.1280 and 196.89 from early highs of 1.1339 and 198.06,

respectively. If the pound extends its downtrend, it is likely to

find support around 1.11 against the franc and 194.00 against the

yen.

The pound edged down to 0.8303 against the euro, from an early

high of 0.8278. The next possible downside target for the pound is

seen around the 0.84 region.

Looking ahead, Germany ZEW economic sentiment for November is

set to be released in the European session.

In the New York session, U.S. NFIB business optimism index for

October, Canada building permits for September, U.S. Redbook

report, U.S. consumer inflation expectations for October are slated

for release.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Nov 2024 bis Dez 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Dez 2023 bis Dez 2024