- Sales up +10.1% on an organic basis1 in the first 9

months of the year

- Sales down -6.0% on an organic basis in the 3rd

quarter, in line with expectations (+42.9% versus Q3

19-20)

- High bases of comparison, and normalization of US cognac

consumption (post-Covid)

- Steep rise in shipments to China ahead of the Lunar New

Year

- Continued recovery in Travel Retail

- Full-year guidance confirmed

Regulatory News:

Rémy Cointreau (Paris:RCO) generated consolidated sales of

€1,304.7 million in the first nine months of 2022-2023, up +10.1%

on an organic basis (+50.3% compared to 2019-2020). Sales rose

20.2% on a reported basis, including a robust 10.1% gain from the

currency effect. Given the normalization of cognac consumption in

the United States and a high basis for comparison on the heels of

two years of exceptionally strong growth, third-quarter sales fell

back as expected by 6.0% on an organic basis, and by -0.7% as

reported. This represents a +42.9% rise compared to the third

quarter of 2019-2020.

Against this backdrop, the Cognac division saw sales

retreat -11.0% in in the third quarter, reflecting the combined

impact of an unfavorable trend in the United States and a very

steep rise in shipments to China. The Liqueurs & Spirits

division reported +10.1% growth driven by very good showings for

Cointreau and for Bruichladdich whiskies.

In the Americas, sales recorded a strong decrease in the

third quarter, while in APAC they rose vigorously, buoyed by

developments in China and continued recovery in Travel Retail and

the rest of Asia. The EMEA region was down slightly,

affected by phasing effects in continental Europe. Both the United

Kingdom and the Benelux generated strong performances.

Breakdown of sales by division:

€m

(April-December)

9M

2022-23

9M

2021-22

Change as reported

Organic change

vs. 9M 21-22

vs. 9M 19-20

Cognac

952.1

797.3

+19.4%

+8.5%

+50.5%

Liqueurs & Spirits

328.6

262.8

+25.1%

+16.7%

+54.9%

Subtotal: Group Brands

1,280.7

1,060.1

+20.8%

+10.5%

+51.6%

Partner Brands

24.0

25.7

-6.8%

-7.0%

+6.4%

Total

1,304.7

1,085.8

+20.2%

+10.1%

+50.3%

Cognac

Third-quarter sales at the Cognac division were down

-11.0%.

In the United States, sales were affected by a high basis

for comparison and the normalization of consumption, albeit at

levels significantly higher than in 2019-2020. Rémy Martin

continued its value-driven strategy, holding prices steady and

investing to raise brand desirability and awareness. Rémy Martin XO

teamed up with actor Lewis Tan, fashion influencer Jessica Wang,

Michelin-starred chef Brandon Jew, and cultural entrepreneur and

producer Danielle Chang to launch “The Lunar New Year Family

Spirit”, a campaign celebrating the Lunar New Year. Rémy Martin

also announced plans to advertise at the Superbowl with the

upcoming launch of a major TV campaign and a series of off-trade

and on-trade activations.

In APAC, the Chinese market continued to bounce

back. Despite disruptions triggered by unprecedented levels of

Covid, the Group successfully generated robust sales growth ahead

of the Chinese New Year and in anticipation of a full recovery in

business. In particular, Rémy Martin saw strong e-commerce sales

during the Double-Eleven and Super Brand Day events on the T-Mall

platform. Meanwhile, Louis XIII opened a sixth boutique in China at

Chengdu’s prestigious SKP Mall and renovated its Beijing store to

coincide with the launch of The Drop. Lastly, Louis XIII celebrated

The Drop’s official debut in Singapore with a new pop-up

store.

In the EMEA region, sales declined slightly, reflecting

phasing effects in continental Europe. The Benelux and AME2 region

rose sharply, while the UK proved resilient.

Liqueurs & Spirits

Third-quarter sales at the Liqueurs & Spirits

division rose +10.1% on an organic basis.

In the United States, the division reported a very strong

performance, buoyed by Cointreau’s excellent showing and good

momentum for Bruichladdich whiskies.

Sales were steady in the EMEA region, reflecting robust

growth in the United Kingdom and the Benelux, and some phasing

effects in continental Europe. During the quarter, the United

Kingdom launched a series of activations promoting Cointreau,

including a “Maison Cointreau” pop-up in London’s Soho district. In

the Benelux, the Group introduced its first Rémy Cointreau pop-up

bar in Amsterdam, dedicated to the art of cocktails and spirits.

Lastly, The Botanist unveiled “Look further”, a new global campaign

promoting the brand’s unique DNA, iconic bottle, exceptional

quality, active involvement in the local community, and the untamed

beauty of the Isle of Islay.

The APAC region reported an excellent showing driven by a

steep rally in Travel Retail for all brands, in particular St-Rémy

Signature, The Botanist Strength (sold exclusively in duty free

outlets), and Laddie Eight by Buichladdich.

Partner brands

Our Partner brands reported third-quarter sales growth of

+3.9% on an organic basis, buoyed by very strong trends in the

Benelux.

2022-23 outlook: full-year guidance confirmed

Rémy Cointreau confirms its objective to generate

another year of strong organic growth, including

normalization of consumption trends in the fourth quarter on the

heels of two outstanding years.

More specifically, as life returns to normal in most regions,

overall consumption is likely to settle in at “new normal” levels

(well above those observed in 2019/20) over the coming quarters,

particularly in the United States. At the same time, growth should

be tempered by high bases of comparison.

The Group intends to continue implementing its strategy focused

on medium-term brand development and underpinned by a policy of

sustained investment in marketing and communications,

particularly in the second half of the year.

As a result, organic COP margin improvement will be

driven by a solid gross margin resilience despite the inflationary

environment, and by tight control of overhead costs.

Taking into account the impact of phasing effects on sales

trends and marketing/communication spends, organic COP margin

improvement will be primarily driven by H1.

The full-year impact of currency should be positive for:

- Sales: €120/130m (versus €110/120m previously)

- COP: €55/60m

About Rémy Cointreau

All around the world, there are clients seeking exceptional

experiences; clients for whom a wide range of terroirs means a

variety of flavors. Their exacting standards are proportional to

our expertise – the finely-honed skills that we pass down from

generation to generation. The time these clients devote to drinking

our products is a tribute to all those who have worked to develop

them. It is for these men and women that Rémy Cointreau, a

family-owned French Group, protects its terroirs, cultivates

exceptional multi-centenary spirits and undertakes to preserve

their eternal modernity. The Group’s portfolio includes 14 singular

brands, such as the Rémy Martin and Louis XIII cognacs, and

Cointreau liqueur. Rémy Cointreau has a single ambition: becoming

the world leader in exceptional spirits. To this end, it relies on

the commitment and creativity of its 1,924 employees and on its

distribution subsidiaries established in the Group’s strategic

markets. Rémy Cointreau is listed on Euronext Paris.

A conference call with investors and analysts will be held today

by CFO Luca Marotta, from 9:00am (Paris time).

Related slides will also be available on the website

(www.remy-cointreau.com), in the Finance section.

Appendices

Q1 2022-23 sales (April-June 2022)

€m

Reported

22-23

Forex

22-23

Scope 22-23

Organic

22-23

Reported

21-22

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

292.3

+29.8

-

262.5

199.6

+46.4%

+31.5%

Liqueurs & Spirits

109.7

+7.9

-

101.8

85.3

+28.7%

+19.4%

Group Brands

402.0

+37.7

-

364.3

284.9

+41.1%

+27.9%

Partner Brands

7.9

+0.1

-

7.9

8.2

-3.1%

-3.8%

Total

409.9

+37.8

-

372.2

293.1

+39.9%

+27.0%

Q2 2022-23 sales (July-September 2022)

€m

Reported

22-23

Forex

22-23

Scope 22-23

Organic

22-23

Reported

21-22

Reported change

Organic change

A

B

C

A/C-1

B/C-1

Cognac

345.9

+39.6

-

306.3

265.0

+30.5%

+15.6%

Liqueurs & Spirits

104.7

+8.4

-

96.3

78.8

+32.9%

+22.2%

Group Brands

450.6

+48.1

-

402.6

343.8

+31.1%

+17.1%

Partner Brands

6.6

+0.0

-

6.6

8.4

-21.6%

-21.9%

Total

457.2

+48.1

-

409.1

352.2

+29.8%

+16.2%

First-half 2022-23 sales (April-September 2022)

€m

Reported

22-23

Forex

22-23

Scope 22-23

Organic

22-23

Reported

21-22

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

638.1

+69.4

-

568.7

464.6

+37.3%

+22.4%

Liqueurs & Spirits

214.5

+16.4

-

198.1

164.1

+30.7%

+20.7%

Group Brands

852.6

+85.8

-

766.8

628.7

+35.6%

+22.0%

Partner Brands

14.5

+0.1

-

14.5

16.6

-12.5%

-13.0%

Total

867.1

+85.8

-

781.3

645.3

+34.4%

+21.1%

Q3 2022-23 sales (October-December 2022)

€m

Reported

22-23

Forex

22-23

Scope 22-23

Organic

22-23

Reported

21-22

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

314.0

+17.8

-

296.2

332.7

-5.6%

-11.0%

Liqueurs & Spirits

114.1

+5.5

-

108.6

98.7

+15.7%

+10.1%

Group Brands

428.1

+23.3

-

404.8

431.4

-0.8%

-6.2%

Partner Brands

9.5

-

-

9.5

9.1

+3.6%

+3.9%

Total

437.6

+23.3

-

414.3

440.5

-0.7%

-6.0%

9-month 2022-23 sales (April-December 2022)

€m

Reported

22-23

Forex

22-23

Scope 22-23

Organic

22-23

Reported

21-22

Reported change

Organic

change

A

B

C

A/C-1

B/C-1

Cognac

952.1

+87.2

-

864.9

797.3

+19.4%

+8.5%

Liqueurs & Spirits

328.6

+21.9

-

306.7

262.8

+25.1%

+16.7%

Subtotal: Group Brands

1,280.7

+109.1

-

1,171.6

1,060.1

+20.8%

+10.5%

Partner Brands

24.0

+0.1

-

23.9

25.7

-6.8%

-7.0%

Total

1,304.7

+109.2

-

1,195.5

1,085.8

+20.2%

+10.1%

Definitions of alternative performance

indicators

Rémy Cointreau’s management process is based on the following

alternative performance indicators, selected for planning and

reporting purposes. The Group’s management considers that these

indicators provide users of the financial statements with useful

additional information to help them understand its performance.

These indicators should be considered as supplementing those

including in the consolidated financial statements and resulting

movements.

Organic sales growth:

Organic growth excludes the impact of exchange rate

fluctuations, acquisitions and disposals.

The impact of exchange rate fluctuations is calculated by

converting sales for the current financial year using average

exchange rates from the prior financial year.

For current-year acquisitions, sales of acquired entities are

not included in organic growth calculations. For prior-year

acquisitions, sales of acquired entities are included in the

previous financial year but are only included in current-year

organic growth with effect from the actual date of acquisition.

For significant disposals, data is post-application of IFRS 5

(which reclassifies entities disposed of under “Net earnings from

discontinued operations” for the current and prior financial year).

It thus focuses on Group performance common to both financial

years, over which local management has more direct influence.

1 All references to “on an organic basis” in this press release

refer to sales growth at constant currency and consolidation scope

2 Africa and the Middle East

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005967/en/

Investor relations: Célia d’Everlange /

investor-relations@remy-cointreau.com Media relations:

Carina Alfonso Martin / press@remy-cointreau.com

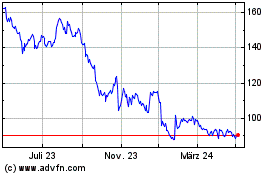

Remy Cointreau (EU:RCO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

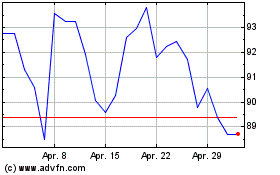

Remy Cointreau (EU:RCO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024