PARROT: 2022 FULL-YEAR EARNINGS

PRESS

RELEASE March

16, 2023, 8:00am CET

2022 FULL-YEAR

EARNINGS

64% growth like-for-like and at constant exchange

rates(1)

€68.5m of net cash at end-2022

Growth to continue in 2023

The Parrot group, a European leader for

professional civil drones, recorded €71.9m of consolidated revenues

in 2022, up 32% (+24% at constant

exchange rates).

Parrot has continued to capitalize on the

strategy rolled out at the end of 2018 focused on its hardware and

software offering on the market for professional microdrones. Sales

of microdrones, primarily the ANAFI for security (ANAFI USA) and

inspection (ANAFI Ai), are up 88% to represent 55% of the group’s

revenues. The 11 Pix4D software solutions focused on image analysis

(photogrammetry) for mapping, inspection, security and precision

farming represent 45% of revenues and are up 25%. Based on the “New

Scope” monitored since the start of 2022(1), the group’s revenues

came to €70.7m, with year-on-year growth of +75% (+64% at constant

exchange rates).

2022 business

In 2022, Parrot met the challenges linked to the

general environment (electronic and industrial components shortage,

inflation, health context) to respond to the growing interest in

its technologies. In line with the change in the group’s

positioning and the monitoring of its performance, the group now

has two operating segments: the microdrones business and the

photogrammetry business (details appended).

|

REVENUES (€m and % of revenues) |

FY 202212 months |

FY 202112 months |

Change |

|

A |

Microdrones |

39.2 |

55% |

20.9 |

38% |

+88% |

|

B |

Of which, consumer products(2) |

1.3 |

2% |

6.2 |

11% |

-79% |

|

C |

Photogrammetry |

32.7 |

45% |

26.2 |

48% |

+25% |

|

D |

Parrot SA |

0.7 |

1% |

0.3 |

1% |

+174% |

|

E |

Intragroup eliminations |

(0.7) |

(1)% |

-0.8 |

-2% |

-7% |

|

F |

SenseFly (activity divested in October 2021) |

- |

- |

7.7 |

14% |

-100% |

|

|

CONSOLIDATED PARROT GROUP TOTAL |

71.9 |

100% |

54.3 |

100% |

+32% |

|

|

NEW SCOPE TOTAL(1)

(=A-B+C+D+E) |

70.6 |

98% |

40.4 |

74% |

+75% |

(1) “New Scope Total” is a performance indicator

reflecting the impact of the strategy rolled out since end-2018. It

corresponds to the Parrot group’s consolidated revenues after

deducting revenues from consumer products (see 2) and revenues from

the subsidiaries divested (Micasense in January 2021, with no

revenues in 2021, and SenseFly SA and SenseFly Inc in October

2021).

(2) Consumer products: in 2022, remaining

accessories (batteries, spare parts) for consumer drones (all

ranges), whose sales were finalized in 2021.

Microdrones business

With revenues of €39.2m, the microdrones

business recorded annual growth of +88% (+82% at constant exchange

rates). Parrot has responded to the growing demand for its

microdrones by securing its purchases and production capacity.

The ANAFI USA, focused on the security and

defense markets, has been acquired by various institutions in NATO

countries (including the United States, the United Kingdom, France,

Northern Europe and Japan). With its easy deployment, robust

design, reliability and high level of cybersecurity, it is the

leading microdrone for reconnaissance and surveillance missions. It

accounts for the majority of the microdrone sales. The geopolitical

context has highlighted the strategic nature of microdrones, and

this certainly represents an accelerating factor1.

The ANAFI Ai, designed for inspection and

mapping professionals, was rolled out commercially from the first

quarter of 2022, supported by a gradual promotion strategy and the

deployment of professional client services around the world. Its

performance features, including its image precision (48 MP sensor),

its 4G connectivity, its capabilities for automating missions (Ai)

and its protection of user data, are proving very popular. Thanks

in particular to its extensive ecosystem of software partners, the

ANAFI Ai covers a growing number of use cases for the inspection of

strategic infrastructures (telecoms, energy, engineering works),

architecture and construction.

Photogrammetry business

With revenues of €32.7m, the photogrammetry

business recorded annual growth of 25% (+15% at constant exchange

rates). Photogrammetry is a technique based on the robust modeling

of the geometry of images and their acquisition to recreate an

exact 3D copy of the reality, which is used as a basis for

calculations, analysis and monitoring by many professionals. The

offering is made up of eight business software solutions and three

applications from the Pix4D brand, combined with optional equipment

(sensors, GPS) supplied by third parties. The solutions have been

adopted by 55,000 users to date.

The flagship products in the geomatics and

mapping sectors (PIX4Dmapper, PIX4Dmatic and PIX4Dsurvey) are still

the main contributors. Recognized as market-leading solutions, they

enable surveyors and drone service providers to handle increasingly

large-scale projects. The use of the business solutions

(Pix4Dreact, Pix4Dfields) launched at the end of 2019 is gradually

ramping up. The Cloud solutions deployed in businesses and major

groups from the architecture, engineering and construction (AEC) or

telecommunications sectors are meeting the needs for digital twins

and building information modeling (BIM), which are becoming the

standard for work in these industries. The photogrammetry footprint

is also expanding thanks to the diversification of compatible

equipment (fixed cameras, mobile phones).

2022 earnings

The consolidated and annual financial statements

for the year ended December 31, 2022 were approved by the Board of

Directors on March 15, 2023. The audit procedures have been carried

out by the statutory auditors and the reports will be issued once

the necessary procedures have been completed. The Universal

Registration Document will then be published on:

https://www.parrot.com/uk/corporate/reports.

An adjustment for an error has been applied to

the 2021 consolidated accounts relating to a difference in the

accounting treatment between the Swiss Code of Obligations and IFRS

that concerned the recognition of Pix4D SA’s employee benefit

plans. In accordance with IAS 19, the commitment relating to this

plan was recognized at January 1, 2021 against equity. Non-current

liabilities (provisions for pensions and other employee benefits)

for 2021 increased by €1.7m. This adjustment did not impact 2021

revenues and is notably reflected in a reduction in 2021 income

from ordinary operations by €0.8m and 2021 net income by €0.6m.

This adjustment will be detailed in a dedicated note in the notes

to the 2022 consolidated financial statements. All references to

the results for 2021 in this press release are based on the

adjusted figures.

|

CONSOLIDATED INCOME STATEMENT (IFRS, €m) |

Dec 31, 2022 |

Dec 31, 2021 (adjusted) |

Change |

|

Revenues |

71.9 |

54.3 |

+32% |

|

Cost of sales |

-16.0 |

-15.2 |

+5% |

|

Gross margin |

56.0 |

39.1 |

+43% |

|

% of revenues |

77.8% |

72.0% |

|

|

Research and development costs |

-43.6 |

-40.7 |

+7% |

|

% of revenues |

-60.6% |

-75.0% |

|

|

Sales and marketing costs |

-11.1 |

-14.1 |

-21% |

|

% of revenues |

-15.4% |

-26.0% |

|

|

Administrative costs and overheads |

-14.7 |

-13.7 |

+8% |

|

% of revenues |

-20.5% |

-25.3% |

- |

|

Production and quality costs |

-5.5 |

-5.4 |

-1% |

|

% of revenues |

-7.6% |

-10.0% |

- |

|

Income from ordinary operations |

-19.0 |

-34.9 |

+46% |

|

% of revenues |

-26.4% |

-64.4% |

- |

|

Other operating income and expenses |

-0.9 |

30.4 |

-103% |

|

EBIT |

-19.9 |

-4.5 |

- |

|

% of revenues |

-27.6% |

-8.3% |

|

|

Income from cash and cash equivalents |

0.0 |

0.0 |

- |

|

Gross finance costs |

-0.5 |

-0.2 |

- |

|

Net finance costs |

-0.5 |

-0.2 |

- |

|

Other financial income and expenses |

2.1 |

1.8 |

- |

|

Financial income and expenses |

1.6 |

1.5 |

+7% |

|

Share in income from associates |

-1.0 |

0.4 |

- |

|

Tax |

-0.4 |

0.0 |

- |

|

Net income |

-19.7 |

-2.5 |

- |

|

Net income (group share) |

-19.5 |

-2.5 |

- |

|

% of revenues |

-27.1% |

-4.6% |

- |

|

Non-controlling interests |

-0.2 |

0.0 |

- |

In 2022, based on €71.9m of revenues and €16.0m

for the cost of sales, the Parrot group recorded a gross margin of

€56.0m, representing 77.8% of its revenues. The group’s two

operating segments contributed to this on a virtually equivalent

value basis. The effective management of component purchases for

professional microdrones, despite the shortage, made it possible to

preserve the level of the group’s margin.

Building on the success of its strategy, the

Parrot group continued to allocate major resources to further

strengthening its position as a European leader, with operating

expenditure of €75.0m, up from €74.0m in 2021 (including €9.1m

allocated to the companies that were sold in October 2021). At

end-2022, the group had 542 employees (permanent and fixed-term

contracts), split between the microdrones sector and the

photogrammetry sector (versus 440 at December 31, 2021). The group

also employs 44 external contractors (52 at December 31, 2021).

R&D spending totaled €43.6m, compared with

€40.7m in 2021. In 2022, 53% was allocated to microdrones, with 47%

for photogrammetry. In these still young markets for professional

drones, innovation continues to be at the heart of the group’s

development strategy and 60% of the workforce is focused on this.

The objective is to offer customers a strong level of automation

for data capture and analysis. This involves continuously improving

the capacity to process high volumes of information, combined with

the development of artificial intelligence in equipment. With this

roadmap, the integration of drone technologies is being simplified,

while ensuring the quality and relevance of the data acquired,

particularly in terms of recurrence. This commitment is also

reflected in the continued development of the partners ecosystem.

In 2022, this was made up of more than 30 suppliers of solutions,

players from the drone industry in Europe and the United States,

which are perfectly integrated into the group’s products.

Sales and marketing costs came to €11.1m,

compared with €14.1m in 2021. They have continued to benefit from

the elimination of the resources previously allocated to the

companies divested in 2021 (-€2.2m) and the realignment around

professional activities. They are focused on growing the group’s

international footprint, present in 12 countries. Professional

client support is being set up with local partners offering

specific business expertise. The equipment and solutions are being

promoted through demonstrations of various use cases presented

during Tech Days, industry conferences or webinars for

instance.

Administrative costs and overheads represent

€14.7m, compared with €13.7m in 2021. The reduction made possible

by the divestments (-€1.8m) was offset by the strengthening of

support functions, particularly for photogrammetry, and the

spending rolled out by the parent company. They also aim to

demonstrate the better level of transparency, personal data

protection and cybersecurity (organization of bug bounties, hacking

competitions and independent audits).

Production and quality spending totaled €5.5m,

compared with €5.4m in 2021. The outsourced production process

continues to be effectively under control despite managing complex

manufacturing and assembly logistics to ensure alignment with the

highest standards of quality and security.

Thanks to its sales growth, combined with the

proactive and effectively managed allocation of resources, the

group reduced its annual current operating losses to €(19.0)m,

compared with €(34.9)m at end-2021. Other operating income and

expenses totaled €(0.9)m, with €(19.9)m of EBIT in 2022, while the

2021 figure benefited from €29.9m of non-recurring income recorded

in connection with the subsidiaries divested in January and October

2021.

Change in the cash position

The group had €68.5m of net cash at end-December

2022. Cash, cash equivalents and other current financial assets

came to €68.5m, down €14.4m compared with the previous year’s

closing position.

Cash flow from operating activities totaled

€20.1m, reflecting the resources allocated to operations, as well

as the increase in working capital requirements. This is linked to

an increase in inventory in response to the continued supply chain

disruption.

Cash flow from investment activities totaled

€8.9m, linked primarily to the collection of outstanding

receivables following the divestment of Micasense and SenseFly, as

well as the payments for the interests sold in the companies Planck

Aerosystems ($3.2m) and Chouette (€0.6m), less €1.9m of investments

in IT infrastructure and equipment.

Cash flow from financing activities came to

€4.2m, including €3.3m for the repayment of lease liabilities with

the application of IFRS 16.

A presentation of the balance sheet and cash

flow statement is appended.

Outlook

The Parrot group is deploying on

professional markets that are expanding rapidly, from microdrones

to photogrammetry, on which it has solid technological capabilities

and offers robust responses to the geopolitical and industrial

challenges seen today. However, the technological

disruption and the deep changes in operational practices are making

it difficult to assess and forecast rates of growth. To consolidate

its positioning, Parrot is moving forward with a demanding

technological roadmap, focused primarily on automation,

cybersecurity and respect for user data. The expression of its

assets is reflected in its sales and marketing strategy.

For the microdrones serving the defense

and security markets, the geopolitical situation

highlights the need for equipment ensuring high levels of both

performance and security in a context of increased sovereignty. The

ANAFI USA is now a world front-runner in this area. However, the

cycles for sales to government institutions are long and the

multi-year contracts cover different scales. With this type of

contract, the frequency and volumes of renewals of orders are

subject to adjudication by the contracting authorities. At a time

when many countries have announced significant growth in their

military budgets, Parrot is mobilizing to continue expanding its

client portfolio.

For industrial sectors, in which

microdrones and photogrammetry are combined, the

disruption and changes in operational practices have gradually

taken shape over several years, particularly for telecoms, energy

and construction, as well as more generally the inspection sector.

The improvements in terms of productivity, traceability and

security (people, infrastructure and data), and the reduced carbon

footprint (vs. aeronautical or satellite imaging) that they make

possible are at the heart of the needs of businesses and major

groups today. The capacity for investment of these clients and

prospects continues to be guided mainly by the general

environment.

In terms of photogrammetry

solutions, the ramping up of the various markets will also

involve the diversification of dedicated equipment. Mobile phones,

tablets and cameras, which are widely adopted by users, require the

marketing of specific equipment that must enable these technologies

to be used on a larger scale. The group intends to incorporate them

into its range of solutions with a view to further extending its

user base.

In this context, following a first quarter of

2023 marked by a consolidation of sales trends, Parrot is taking

action to continue moving forward with its growth. This is the

group’s core focus to gradually financially balance its operations,

and it will be able to adapt its cash consumption if necessary to

the pace of its growth.

Next financial dates

2023 first-quarter business: Thursday May 11, 2023Parrot’s

general shareholders’ meeting: Wednesday June 14, 20232023

first-half business and earnings: Friday July 28, 2023

ABOUT THE

PARROT GROUP

Parrot is Europe's leading commercial UAV group.

With a strong international presence, the Group designs, develops

and markets a complementary range of micro-UAV equipment and image

analysis software (photogrammetry) dedicated to companies, large

groups and government organizations. Its offer is mainly centered

on three vertical markets: (i) Inspection, 3D mapping and

Geomatics, (ii) Defense and Security, and Precision

agriculture.

Its ANAFI range of micro UAVs, recognized for

their performance, robustness and ease of use, features an open

source architecture and meets the highest safety standards. Its

Pix4D photogrammetry software suite for mobile and drone mapping is

based on advanced technical expertise and offers solutions tailored

to the specificities of the verticals it addresses.

The Parrot Group, founded in 1994 by Henri

Seydoux its Chairman, CEO and main shareholders, designs and

develops its products in Europe, and is headquartered in Paris.

Today, it has over 500 employees worldwide and carries out the vast

majority of its sales internationally. Parrot has been listed on

Euronext Paris since 2006 (FR0004038263 - PARRO). For more

information: www.parrot.com, www.pix4d.com

CONTACTS

| Investors,

analysts, financial mediaMarie Calleux - T. : +33 1 48 03 60

60parrot@calyptus.net |

Tech &

corporate mediaJean Miflin - T. : +33 1 48 03 60

60jean.miflin@parrot.com |

APPENDICES

The consolidated and annual financial statements

for the year ended December 31, 2022 were approved by the Board of

Directors on March 15, 2023. The audit procedures have been carried

out by the statutory auditors and the reports will be issued once

the necessary procedures have been completed. The Universal

Registration Document will then be published on:

https://www.parrot.com/uk/corporate/reports.

An adjustment for an error has been applied to

the 2021 consolidated accounts relating to a difference in the

accounting treatment between the Swiss Code of Obligations and IFRS

that concerned the recognition of Pix4D SA’s employee benefit

plans. In accordance with IAS 19, the commitment relating to this

plan was recognized at January 1, 2021 against equity. Non-current

liabilities (provisions for pensions and other employee benefits)

for 2021 increased by €1.7m. This adjustment did not impact 2021

revenues and is notably reflected in a reduction in 2021 income

from ordinary operations by €0.8m and 2021 net income by €0.6m.

This adjustment will be detailed in a dedicated note in the notes

to the 2022 consolidated financial statements. All references to

the results for 2021 in this press release are based on the

adjusted figures.

Fourth-quarter revenues

|

REVENUES (€m and % of revenues) |

Q4 20223 months |

Q4 20213 months |

Change |

|

A |

Parrot Drones |

10.0 |

51% |

6.8 |

44% |

+47% |

|

B |

Of which, consumer products(2) |

0.0 |

0% |

(0.2) |

(1)% |

ns |

|

C |

Pix4D |

9.5 |

49% |

8.7 |

56% |

+9% |

|

D |

Parrot SA |

0.2 |

1% |

0.1 |

0% |

- |

|

E |

Intragroup eliminations |

(0.2) |

(1)% |

(0.1) |

(1)% |

- |

|

F |

SenseFly (activity divested in October 2021) |

- |

-% |

0.1 |

1% |

- |

|

|

CONSOLIDATED PARROT GROUP TOTAL |

19.5 |

100% |

15.5 |

100% |

+25% |

|

|

NEW SCOPE TOTAL(1)

(=A-B+C+D+E) |

19.5 |

100% |

15.7 |

101% |

+24% |

(1) “New scope total” is a performance indicator

reflecting the impact of the strategy rolled out since end-2018. It

corresponds to the Parrot group’s consolidated revenues after

deducting revenues from consumer products (see 2) and revenues from

the subsidiaries divested (Micasense in January 2021, with no

revenues in 2021, and SenseFly SA and SenseFly Inc in October

2021).(2) Consumer products: remaining accessories (batteries,

spare parts) for consumer drones (all ranges), whose sales were

finalized in 2021.

Segment reporting

The group has adapted the monitoring of its

performance following the sale of several subsidiaries in 2021 and

the repositioning of Parrot around the professional drones

business. The segment reporting reflects the view of the chief

operating decision-maker (“CODM”) (Chairman-CEO) and is based on

the group’s internal reporting. The internal reporting elements are

prepared in accordance with the accounting principles applied by

the group. It now has two operating segments: the microdrones

business and the photogrammetry business. To make it possible to

reconcile the elements presented with the consolidated accounts,

the parent company Parrot S.A. is incorporated into the review. The

performance for each segment is analyzed by the CODM based on the

revenues and income from ordinary operations recorded. The assets

and liabilities are not specifically presented to the CODM. Only

the group’s cash position is regularly monitored.

|

€m and % of revenues |

Microdrones |

Photogrammetry |

Other(1) |

Total |

|

Revenues |

39.2 |

32.7 |

0.1 |

71.9 |

|

Income from ordinary operations |

(10.6) |

(4.0) |

(4.3) |

(19.0) |

Consolidated balance sheet

|

ASSETS (IFRS, €m) |

Dec 31, 2022 |

Dec 31, 2021 (adjusted) |

Change |

|

Non-current assets |

18.2 |

27.7 |

-34% |

|

Other intangible assets |

0.2 |

0.3 |

-34% |

|

Property, plant and equipment |

2.1 |

1.8 |

18% |

|

Right of use |

9.9 |

8.7 |

14% |

|

Investments in associates |

2.5 |

5.6 |

-55% |

|

Financial assets |

3.0 |

6.5 |

-53% |

|

Non-current lease receivables |

0.0 |

0.1 |

-100% |

|

Deferred tax assets |

0.4 |

0.8 |

-54% |

|

Other non-current assets |

0.0 |

4.0 |

-100% |

|

Current assets |

102.5 |

117.3 |

-13% |

|

Inventories |

14.9 |

4.9 |

203% |

|

Trade receivables |

6.4 |

5.2 |

24% |

|

Tax receivables |

5.9 |

6.9 |

-14% |

|

Other receivables |

6.6 |

16.9 |

-61% |

|

Current lease receivables |

0.1 |

0.5 |

-78% |

|

Cash and cash equivalents |

68.5 |

82.8 |

-17% |

|

Assets held for sale |

2.5 |

- |

|

|

Total assets |

123.2 |

145.0 |

-15% |

|

SHAREHOLDERS’ EQUITY AND LIABILITIES (IFRS, €m) |

Dec 31, 2022 |

Dec 31, 2021 (adjusted) |

Change |

|

Shareholders’ equity |

84.0 |

98.8 |

-15% |

|

Share capital |

4.6 |

4.6 |

1% |

|

Additional paid-in capital |

331.7 |

331.7 |

0% |

|

Reserves excluding earnings for the period |

-242.6 |

-242.8 |

0% |

|

Earnings for the period - Group share |

-19.5 |

-2.5 |

679% |

|

Exchange gains or losses |

8.9 |

7.4 |

20% |

|

Equity attributable to Parrot SA shareholders |

83.1 |

98.4 |

-16% |

|

Non-controlling interests |

1.0 |

0.4 |

121% |

|

Non-current liabilities |

12.5 |

12.2 |

3% |

|

Non-current financial liabilities |

0.0 |

0.0 |

- |

|

Non-current lease liabilities |

7.6 |

6.7 |

12% |

|

Provisions for pensions and other employee benefits |

1.9 |

2.8 |

-34% |

|

Deferred tax liabilities |

0.0 |

0.2 |

-100% |

|

Other non-current provisions |

0.1 |

0.4 |

-69% |

|

Other non-current liabilities |

3.0 |

1.9 |

52% |

|

Current liabilities |

26.7 |

34.0 |

-21% |

|

Current financial liabilities |

- |

0.8 |

- |

|

Current lease liabilities |

2.6 |

2.7 |

-4% |

|

Current provisions |

2.2 |

1.2 |

87% |

|

Trade payables |

9.2 |

9.9 |

-7% |

|

Current tax liabilities |

0.1 |

0.1 |

31% |

|

Other current liabilities |

12.6 |

19.4 |

-35% |

|

Liabilities held for sale |

- |

- |

- |

|

Total shareholders’ equity and liabilities |

123.2 |

145.0 |

-15% |

Consolidated cash-flow

statement

|

IFRS, €m |

Dec 31, 2022 |

Dec 31, 2021 (adjusted) |

Change |

|

OPERATING CASH FLOW |

|

|

|

|

Earnings for the period |

-19.7 |

-2.5 |

682% |

|

Share in income from associates |

1.0 |

-0.4 |

-360% |

|

Depreciation and amortization |

4.8 |

3.1 |

55% |

|

Capital gains and losses on disposals |

0.6 |

-32.9 |

-102% |

|

Tax expense |

0.4 |

0.0 |

-1046% |

|

Cost of share-based payments |

1.3 |

1.3 |

-4% |

|

Other non-cash items |

3.1 |

- |

- |

|

Net finance costs |

0.5 |

0.2 |

108% |

|

Cash flow from operations before net finance costs and tax |

-8.0 |

-31.2 |

-74% |

|

Change in working capital requirements |

-12.0 |

6.2 |

-292% |

|

Tax paid |

-0.1 |

-0.3 |

-63% |

|

Cash flow from operating activities (A) |

-20.1 |

-25.3 |

-21% |

|

INVESTING CASH FLOW |

|

|

|

|

Acquisition of property, plant and equipment and intangible

assets |

-1.9 |

-1.6 |

20% |

|

Acquisition of financial assets |

-0.1 |

-2.7 |

-97% |

|

Disposal of subsidiaries, net of cash divested |

5.8 |

24.0 |

-76% |

|

Disposal of investments in associates |

1.8 |

- |

- |

|

Disposal of financial assets |

3.3 |

3.2 |

1% |

|

Cash flow from investment activities (B) |

8.9 |

23.0 |

-61% |

|

FINANCING CASH FLOW |

|

|

|

|

Equity contributions |

-1.3 |

0.0 |

- |

|

Net finance costs |

-0.5 |

-0.2 |

108% |

|

Repayment of short-term financial debt (net) |

-3.3 |

-3.9 |

-15% |

|

Repayment of other financing |

0.9 |

- |

- |

|

Cash flow from financing activities (C) |

-4.2 |

-4.1 |

3% |

|

NET CHANGE IN CASH POSITION (D = A+B+C) |

-15.4 |

-6.4 |

140% |

|

Impact of change in exchange rates |

1.1 |

1.3 |

-17% |

|

CASH AND CASH EQUIVALENTS AT YEAR-START |

82.8 |

88.0 |

-6% |

|

CASH AND CASH EQUIVALENTS AT YEAR-END |

68.5 |

82.8 |

-17% |

***

(1) The deliveries identified and linked

directly to the war in Ukraine represented €1.6m of revenues in

2022.

- PARROT_CP_Resultats-Annuels-2022_20230316_EN_DEF

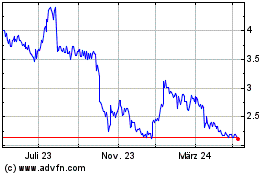

Parrot (EU:PARRO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

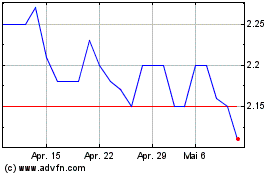

Parrot (EU:PARRO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025