Solid commercial performance leading to increased revenues and stable EBITDAaL, despite inflation headwinds in 2023

09 Februar 2024 - 7:00AM

Solid commercial performance leading to increased revenues and

stable EBITDAaL, despite inflation headwinds in 2023

Press releaseEmbargo until 9 February 2024

at 7:00 am Regulated information – Inside information

Financial information for the second semester and full year

2023

Solid commercial performance leading to

increased revenues and stable EBITDAaL, despite inflation headwinds

in 2023

- Mobile postpaid customer base +4% yoy / Cable customer base

+5.5% yoy

- H2 Revenues +5.9% yoy / FY 2023 Revenues +4.6% yoy

- H2 and FY 2023 EBITDAaL remain stable on a comparable

basis

|

|

Operational Highlights |

- The semester showed a positive commercial performance, thanks

to attractive offers within a competitive environment

- 71k postpaid net adds bringing total

subscribers to 3.3m, up by 4% on a comparable basis. All our brands

were successful confirming their relevant positioning

- Our back-to-school cable offers generated 26k net adds

over the period, totalling 987k customers (+5.5% yoy on a

comparable basis)

|

| Orange Belgium: key operating

figures |

reported |

Comparable1 |

|

reported |

comparable1 |

|

|

H2 2022 |

H2 2022 |

H2 2023 |

change |

change |

| Mobile postpaid customer base (in

‘000) |

2811 |

3192 |

3320 |

18.1% |

4.0% |

| Net adds (in ‘000) |

36 |

66 |

71 |

97.2% |

7.7% |

| Cable customer base (in ‘000) |

443 |

935 |

987 |

122.8% |

5.5% |

| Net

adds (in ‘000) |

26 |

31 |

26 |

0.4% |

-15.2% |

|

Financial Highlights |

- Our more for more approach, together with a solid

commercial performance, has driven revenues up by 4.6% on a

comparable basis with Service revenue growth of 6.2%

- This growth in revenues and tight cost control enabled us to

mitigate the impact of inflation (wage indexation and energy prices

notably) and thus deliver stable EBITDAaL on a comparable basis for

the semester, and slightly above our guidance for the full

year

- eCapex increased by 4.1% for the full year,

due to the RAN sharing implementation, 5G deployment and upgrading

of the cable network to provide 95% Gigabit network coverage

|

| Orange Belgium Group: key

financial figures |

reported |

comparable1 |

|

reported |

comparable1 |

reported |

comparable1 |

|

reported |

comparable1 |

|

in €m |

H2 2022 |

H2 2022 |

H2 2023 |

change |

change |

FY 2022 |

FY 2022 |

FY 2023 |

change |

change |

| Revenues |

713.9 |

952.9 |

1009.0 |

41.3% |

5.9% |

1391.2 |

1672.2 |

1749.5 |

25.8% |

4.6% |

| Retail service revenues |

519.0 |

785.2 |

823.0 |

58.6% |

4.8% |

1009.5 |

1275.7 |

1355.1 |

34.2% |

6.2% |

| |

|

|

|

|

|

|

|

|

|

|

| EBITDAaL |

206.9 |

272.6 |

272.6 |

31.8% |

0.0% |

373.7 |

449.8 |

451.3 |

20.8% |

0.3% |

| margin as % of revenues |

29.0% |

28.6% |

27.0% |

-196 bp |

-159 bp |

26.9% |

26.9% |

25.8% |

-128 bp |

0 bp |

| eCapex2 |

-134.0 |

-197.6 |

-194.9 |

45.4% |

-1.4% |

-220.0 |

-292.2 |

-304.1 |

38.2% |

4.1% |

| Adjusted Operating cash

flow3 |

72.9 |

75.0 |

77.7 |

6.6% |

3.6% |

153.7 |

157.7 |

147.2 |

-4.2% |

-6.6% |

| Net profit (loss) for the period |

31.5 |

|

4.6 |

-85.4% |

|

58.2 |

|

-10.8 |

-118.5% |

|

| Net

financial debt |

190.7 |

|

2224.0 |

|

|

190.7 |

|

2224.0 |

|

|

- Comparable base includes 7 months of VOO operating figures,

Revenues, eCapex and EBITDAaL and Adjusted Operating cash flow with

interco elimination. Comparable figures have not been audited.

- eCapex excluding licence fees.

- Adjusted Operating cash flow defined as EBITDAaL – eCapex

excluding licence fees.

Xavier Pichon, Chief Executive Officer,

commented:

2023 was definitely a pivotal year for Orange

Belgium. The acquisition of VOO was clearly a milestone event of

the year, which made us stronger in the market. We have transformed

our organization to act as One company, to maximize value creation

and to materialize synergies following this acquisition.

In recent months, we have also been laying the

foundations of our Lead the Future strategy. Regarding the first

pillar on network leadership, we recently announced that Orange

Belgium is Belgium’s first telecom provider to offer a nationwide

gigabit network, allowing 95% of Belgian citizens to enjoy very

high broadband speeds of up to 1 Gbps. We had also promising

results in terms of customer experience excellence, the second

pillar of our strategy with an optimization of our digital touch

points and our customer relation processes. We are also proud of

our achievements on the third pillar of our strategy about being a

responsible company; notably, we overachieved our digital inclusion

ambitions for 2023, while being on track with our CO2 emission

reduction target.

2024 will be a challenging year with market

evolutions but we remain very confident in our ability to execute

our strategy.

Antoine Chouc, Chief Financial Officer,

stated:

I am pleased to announce our financial results

for the second half of 2023, which for the first time include the

consolidated figures of VOO for a whole semester. Our solid

commercial performance, pricing adaptations and tight cost control

enabled us to offset the impact of inflation on our margin. We are

proud to having slightly overachieved our EBITDAaL guidance.

Following the acquisition, we are strongly

focused on executing the synergies: the MVNO migration has already

been completed, the first purchasing synergies are being unlocked

and the common go-to-markets will create significant efficiencies.

These promising results 6 months after the closing make us

confident that we will deliver the expected synergies and thus

unlock significant value and contribute to our overall growth

strategy.

For our 2024 guidance we foresee EBITDAaL

between €515m and €535m, while eCapex will be within the range of

€365m and €385m.

2023 dividend

Considering the balance sheet impact of the

acquisition of VOO, the Board of Directors will not propose any

dividend for the financial year 2023 at the Annual General

Meeting.

2024 outlook

The Company targets an EBITDAaL between €515m

and €535m. Total eCapex in 2024 is expected to be between €365m and

€385m.

New Financial Calendar

2

May

Annual General Meeting of Shareholders1

July

Start of quiet period19

July

Financial results H1 2024 (7:00 am CET) – Press release19

July

Financial results H1 2024 (2:00 pm CET) – Audio conference call

This is a preliminary agenda and is subject to

changes

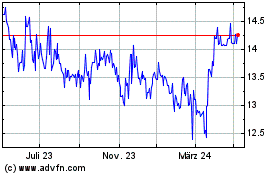

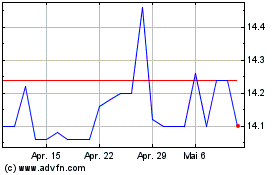

Orange Belgium (EU:OBEL)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Orange Belgium (EU:OBEL)

Historical Stock Chart

Von Nov 2023 bis Nov 2024