- Proposed merger between Groupe TF1 and Groupe M6 to create

the French media group with the broadest TV, radio, digital,

content production and technology offering to the benefit of all

viewers and the French audiovisual industry.

- Acceleration of the development of a French streaming

champion combining a catch-up and live streaming offer (based on

MyTF1 & 6play) and a SVOD service.

- Building upon the know-how and complementarity of the two

groups – with strong commitment to creativity, diversity and

pluralism of opinion, promoting French and European

culture.

- Consolidated 2020 Pro Forma financials of the merged

company: €3.4bn revenues and Current operating profit of

€461M1.

- Value creation for all shareholders of both groups through

annual synergies (EBITA impact) estimated at €250M to €350M, within

three years after completion of the transaction. The combined group

will aim to distribute 90 per cent of its free cash flow in

dividends.

- Long-term support from Groupe Bouygues and RTL Group,

holding respectively 30% and 16% of the new group, following the

acquisition of an 11% stake by Groupe Bouygues from RTL Group, for

a consideration of €641M. Groupe Bouygues would have exclusive

control over the merged company, acting in concert with RTL Group

as a strategic shareholder.

- Transaction terms: special cash dividend payment of €1.50

per share to Groupe M6 shareholders; overall economic exchange

ratio of 2.10 Groupe TF1 shares for 1 Groupe M6 share2.

- Proposed merger between Groupe M6 and Groupe TF1 offering

the highest value creation to all shareholders.

- Project unanimously approved by the Boards of Groupe TF1,

Groupe Bouygues, RTL Group and Groupe M6.

- Completion of the transaction by year-end 2022, after

consultation with employees’ representatives, regulatory approvals

(antitrust and CSA) and shareholder meetings of both

companies.

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210518005616/en/

Pro Forma ownership structure (Photo:

Business Wire)

Groupe TF1, Groupe M6 (Paris:MMT), Groupe Bouygues and RTL Group

today announce that they have signed agreements to enter into

exclusive negotiations to merge the activities of Groupe TF1 and

Groupe M6 and create a major French media group. The new group

would be well positioned to master the challenges arising from the

accelerating competition with global platforms, active on the

French advertising market and in the production of quality

audiovisual content. The merger project has been unanimously

approved by the Boards of Groupe Bouygues, RTL Group, Groupe TF1

and Groupe M6.

Regulated information: disclosure of inside

information in accordance with article 17 of MAR

A French media group ready to master

the new challenges of the total video market

Groupe TF1 and Groupe M6 are active in a growing total video

market where increasingly rich, original and exclusive content is

driving long term audience growth.

This market, where linear TV remains a powerful media, is

undergoing a structural transformation, with a strong shift towards

on-demand consumption.

The combination of these two players, of the know-how of their

employees and of their strong brands, would allow the new group to

invest more and to step-up innovation. The proposed merger is

critical to ensure the long-term independence of French content

creation and to continue to offer diversified and premium local

content to the benefit of all viewers.

Ambitious industrial

project

The merged group would pursue an ambitious industrial project

focused on five key priorities:

- Strengthen the supply of French quality content

leveraging a portfolio of strong brands and ambitious investment

levels.

- Continue to guarantee the independence, reliability and

quality of information on television, radio and digital, while

respecting pluralism and preserving each channel’s identity.

- Further develop a production hub for local and international

content across all media segments, with the ambition to grow

international content sales.

- Accelerate the development of a French streaming

champion combining a catch-up and live streaming offering

(based on MyTF1 & 6play) and a SVOD service.

- Develop cutting-edge technology in streaming (notably

leveraging Groupe TF1’s assets and the Bedrock platform, jointly

owned with RTL Group) and in addressable TV advertising to

meet the needs of viewers and customers.

Gilles Pélisson, Chairman & CEO of Groupe TF1, said: “The

merger between Groupe TF1 and Groupe M6 is a great opportunity to

create a French total video champion that will guarantee

independence, quality of content, and pluralism – values that have

long been shared by our two groups. It will be an asset in

promoting French culture. Groupe TF1 now approaches a new stage in

its development, consistent with the strategic vision developed in

the past 5 years.”

Nicolas de Tavernost, CEO of Groupe M6, said: “The consolidation

of the French television and audiovisual markets is an absolute

necessity if the French audience and the industry as a whole are to

continue to play a predominant role in the face of exacerbated

international competition, which is accelerating rapidly. The

combination of the two groups' know-how will allow for an ambitious

French response. Furthermore, this proposed merger of Groupe M6 and

Groupe TF1 is the only transaction offering value creation for all

Groupe M6 shareholders.”

Olivier Roussat, CEO of Groupe Bouygues, said: “The audiovisual

market benefits from long term growth. In this context, Groupe

Bouygues is pleased to contribute to the creation of a major French

media group able to compete with the GAFANs. We are pleased with

this major development and partnership which confirm Groupe

Bouygues's commitment to the media since 1987. As shareholders with

exclusive control over the new group, we will continue to provide

it with our full support.”

Thomas Rabe, CEO of RTL Group, said: “The proposed merger of

Groupe TF1 and Groupe M6 would be a major step in implementing our

strategy to create national media champions across our European

footprint. It demonstrates how in-country consolidation creates

significant value. As a strategic investor we will be long-term

industrial partners of Groupe Bouygues.”

Strong value creation potential for all

shareholders

The merged company would have 2020 Pro Forma revenue of €3.4bn

and Current operating profit of €461M. The shareholders of Groupe

M6 and Groupe TF1 would benefit from significant value

creation.

The synergies potential (EBITA run-rate impact) is estimated at

€250M to €350M per year within three years from closing of

the transaction.

The financial policy of the combined group would allow

attractive shareholder remuneration and significant investments in

content and technology. The combined group would aim to distribute

90% of its free cash flow in dividends.

Transaction terms

The transaction would be implemented based on an overall

economic exchange ratio of 2.10 Groupe TF1 shares for each Groupe

M6 share (after distribution of a special dividend of €1.50 per

share for Groupe M6 shareholders and distribution of ordinary

dividends of €1.00 per Groupe M6 share and €0.45 per Groupe TF1

share in 20223) and based on the following steps:

- Carve-out of the activities of Groupe M6 non-related to the

broadcasting authorizations of the M6 channel granted by the CSA

within a new entity (“M6 Services”).

- Activities related to the broadcasting authorizations granted

to the M6 channel would remain in the existing Groupe M6 legal

entity which would remain listed and be renamed “M6 Edition” and

would benefit from service agreements with “M6 Services”.

- Distribution by Groupe M6 to its shareholders of:

- Shares in “M6 Services”

- A special dividend of €1.50 per share

- Merger of “M6 Services” into Groupe TF1 based on a merger

parity reflecting the overall economic exchange ratio of 2.10,

adjusted for the value of the share received in “M6 Edition”

retained by Groupe M6 shareholders.

- Contribution by RTL Group of its 48.3% stake in “M6 Edition” to

the merged entity, the remainder being owned by Groupe M6 current

free float in line with French media regulation.

- Acquisition by Groupe Bouygues of 11% of the merged entity from

RTL Group for a consideration of €641M (based on a price per Groupe

M6 share of €26.30 after payment of ordinary and special dividends

of €1.00 and €1.50 respectively).

Groupe M6 shareholders would hence receive for each of their

existing shares:

- An ordinary dividend of €1.00 per share

- A special dividend of €1.50 per share

- 1 share in “M6 Edition”

- A number of shares in the merged entity reflecting the overall

economic exchange ratio of 2.10 adjusted for the value of the share

retained in “M6 Edition”

Following these steps, Groupe Bouygues would own approximately

30% of the merged entity, which it would have exclusive control

over, as part of a shareholder agreement with RTL Group, second

largest shareholder with approximatively 16%. Free float would own

approximately 54% of the new group of which approximately 29% for

the existing float of Groupe M6 and approximately 25% for the

existing float of Groupe TF1.

Governance and

management

The Board of Directors of the merged group would consist of 12

members, including 4 directors designated by Groupe Bouygues, 2

directors designated by RTL Group, 3 independent directors, 2

directors representing the employees and 1 director representing

the employee shareholders.

At the day the operation is finalized, the management of the

combined group would include members of the current management

teams of Groupe M6 and Groupe TF1. Nicolas de Tavernost will be

proposed as Chairman and CEO of the merged entity. Gilles Pélisson

will be nominated as Deputy CEO of Groupe Bouygues in charge of

media and development.

A new name reflecting the diversity and the strength of its

assets will be given to the merged company. It would remain based

in France and listed on Euronext Paris.

A shareholder agreement will be entered into by Groupe Bouygues

and RTL Group with customary statements made to the French AMF as

appropriate. Double voting rights will also be granted to

shareholders of the new group who will register their shares with

the merged company, as customary.

The agreement will provide for representation of the parties

within governance bodies, an obligation of consultation between the

parties and rights to protect minority shareholders for the benefit

of RTL Group, ensuring the predominance of Groupe Bouygues.

The pact will also provide for a number of customary

restrictions with regards to the transfer of shares as well as a

right of first offer for the benefit of Groupe Bouygues on 5% of

the capital of the combined entity, exercisable upon the first sale

of shares by RTL Group.

Conditions and timetable

In compliance with French legislation, Groupe TF1 and Groupe M6

will initiate information and consultation procedures with the

employee representatives.

The completion of the transaction remains subject to the

approval of the extraordinary general meetings of Groupe M6 and

Groupe TF1 which would follow the receipt of the transaction

appraisal documentation from the Commissaire à la fusion et aux

apports to be designated as part of the transaction.

Completion of the transaction is also subject to customary

condition precedents in particular the approvals from the antitrust

authorities (Autorité de la Concurrence) and media regulator

(Conseil Supérieur de l'Audiovisuel). The transaction would also

give rise to a request for exemptions from the compulsory filing of

a public offer project (in particular on the basis of the

provisions of article 234-9, 4 ° of the general regulations -

Combination of a contribution or of a merger submitted to the

general meeting of shareholders with the conclusion of an agreement

constituting a concerted action between the shareholders of the

companies concerned) it being specified that article 39 V of the

1986 law on freedom of communication provides that crossing a

mandatory tender offer threshold requires the filing of a

tender-offer only for the amount of shares required to reach the

regulatory limit of 49% of the share capital and voting rights.

The transaction is aimed to close by the end of 2022.

Advisors

RTL Group: J.P. Morgan acting as exclusive financial advisor and

White & Case LLP as legal advisor.

Groupe Bouygues and Groupe TF1: Rothschild & Co acting as

exclusive financial advisor and Darrois Villey Maillot Brochier,

Vogel & Vogel and Flichy Grangé as legal advisors.

Groupe M6: Lazard acting as financial advisor and Bredin Prat,

Allen & Overy, Arsene-Taxand and Deprez Guignot (DDG) as legal

advisors.

About Groupe TF1

Groupe TF1 is a global player in the production, editing and

distribution of content.

Through its content, its ambition is to positively inspire

society.

Groupe TF1 organizes its activities into several complementary

poles:

The Broadcast division with 5 free-to-air channels (TF1,

TMC, TFX, TF1 series films, LCI), 4 thematic channels (Ushuaia TV,

Histoire TV, TV Breizh, Série Club), 2 on-demand content platforms

(MYTF1, TFOU MAX), and the TF1 PUB agency.

The Production division with Newen, which brings together

9 studios in France and internationally.

The Digital division with Unify, which brings together

the Group's native web activities and the most powerful digital

communities (including aufeminin, Marmiton, Doctissimo, My Little

Paris).

The Music division with Muzeek One, which brings together

the Group's musical activities and shows.

Present in 10 countries, the TF1 Group has nearly 3,700

employees. In 2020, it achieved a turnover of €2,081.7M (Euronext

Paris: ISIN FR0000054900).

About Groupe M6

Created in 1987 around the M6 channel, Groupe M6 is a

diversified media group based on three pillars: television with 13

channels (including M6, 2nd commercial channel on the market),

radio with 3 stations (including RTL, 1st private radio in France)

and digital with more than 30 media on the internet.

On the strength of its brands and its content, Groupe M6 has

gradually extended its activities through targeted diversification

(production and acquisition of content, cinema, digital marketing,

music, shows, etc.) and innovative offers such as 6play or

Bedrock.

About Groupe Bouygues

Groupe Bouygues is a diversified service group present in more

than 80 countries and with 129,000 employees working for human

progress in everyday life. Promising growth, its activities meet

essential and constantly changing needs: construction activities

(Bouygues Construction, Bouygues Immobilier, Colas); media (Groupe

TF1) and telecoms (Bouygues Telecom) (Euronext Paris, compartment

A: ISIN: FR0000120503)

About RTL Group

RTL Group is a leader across broadcast, content and digital,

with interests in 67 television channels, ten streaming platforms

and 38 radio stations. RTL Group also produces content throughout

the world and owns a digital video network. The television

portfolio of Europe’s largest broadcaster includes RTL Television

in Germany, M6 in France, the RTL channels in the Netherlands,

Belgium, Luxembourg, Croatia, Hungary and Antena 3 in Spain. RTL

Group’s families of TV channels are either the number one or number

two in eight European countries. The Group’s flagship radio station

is RTL in France, and it also owns or has interests in other

stations in France, Germany, Belgium, Spain and Luxembourg. RTL

Group’s content business, Fremantle, is one of the world’s largest

creators, producers and distributors of scripted and unscripted

content. Fremantle has an international network of production

teams, companies and labels in over 30 countries, producing over

12,000 hours of original programming and distributing over 30,000

hours of content worldwide. Combining the streaming-services of its

broadcasters (such as TV Now, 6play, Salto, Videoland), the digital

video network Divimove, and Fremantle’s more than 360 YouTube

channels, RTL Group has become the leading European media company

in digital video. RTL Group also owns the ad-tech businesses

Smartclip and Yospace, as well as the streaming-tech company

Bedrock. RTL AdConnect is RTL Group’s international advertising

sales house. Bertelsmann is the majority shareholder of RTL Group,

which is listed on the Luxembourg and Frankfurt stock exchanges and

in the SDAX stock index.

DISCLAIMER

This press release includes certain projections and

forward-looking statements with respect to the anticipated future

performance of the combined group.

Such information is sometimes identified by the use of the

future tense, the conditional mode and forward-looking terms such

as "estimates," "targets," "forecasts," "intends," "should," "has

the ambition to," "considers," "believes," "could" and other

similar expressions. This information is based on data, assumptions

or estimates that Groupe TF1 and Groupe M6 believe are reasonable.

Actual future results may differ materially from those projected or

forecast in the forward-looking statements, in particular due to

the uncertainties as to whether the synergies and value creation

from the transaction will be realized in the expected time frame,

the risk that the businesses will not be successfully integrated,

the possibility that the transaction will not receive the necessary

approvals, that the anticipated timing of such approvals will be

delayed or will require actions that will adversely affect the

anticipated benefits of the transaction, and the possibility that

the transaction will not be completed.

All forward-looking statements contained in this press release

are expressly qualified in their entirety by the cautionary

statements contained or referred to in this disclaimer. Each

forward-looking statement speaks only at the date of this press

release. Groupe TF1 and Groupe M6 make no undertaking to update or

revise any information or the objectives, outlook and

forward-looking statements contained in this press release or that

Groupe TF1 and Groupe M6 otherwise may make, except pursuant to any

statutory or regulatory obligations applicable to Groupe TF1 and

Groupe M6.

No statement in this press release is intended as a profit

forecast or estimate for any period. Persons receiving this press

release should not place undue reliance on forward-looking

statements.

This press release is for informational purposes only and is not

intended to and does not constitute an offer or invitation to

exchange or sell, or solicitation of an offer to subscribe for or

buy, or an invitation to exchange, purchase or subscribe for, any

securities, any part of the business or assets described herein, or

any other interests or the solicitation of any vote or approval in

any jurisdiction in connection with the proposed transaction or

otherwise. This press release should not be construed as a

recommendation to any reader of this press release.

The press release is neither a is not a prospectus, product

disclosure statement or other offering document for the purposes of

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017, as amended from time to time and

implemented in each member state of the European Economic Area and

in accordance with French laws and regulations.

1 Corresponding to the sum of the current operating profits

published by the 2 Groups 2 Detailed transaction terms on page 3 3

Dividends for 2021 fiscal year subject to board approvals and

shareholder votes

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210518005616/en/

Press contacts and Investor

Relations Groupe TF1 INVESTOR RELATIONS

comfi@tf1.fr PRESS Maylis Carcabal - +33 6 63 59 87 05 -

mcarcabal@tf1.fr

Groupe M6 INVESTOR RELATIONS Guillaume Couturié - +33 1

41 92 28 03 - guillaume.couturie@m6.fr PRESS Paul Mennesson - +33 1

41 92 61 36 - paul.mennesson@m6.fr

Groupe Bouygues INVESTOR RELATIONS investors@bouygues.com

- +33 1 44 20 10 79 PRESS Pierre Auberger - +33 1 44 20 12 01 -

pab@bouygues.com Image Sept - Anne Méaux - +33 6 89 87 61 76 -

ameaux@image7.fr

RTL Group INVESTOR RELATIONS & PRESS Oliver Fahlbusch

- +49 173 284 7873 – +352 621 265 649 -

oliver.fahlbusch@rtlgroup.com

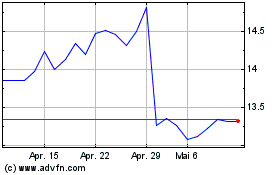

M6 Metropole Television (EU:MMT)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

M6 Metropole Television (EU:MMT)

Historical Stock Chart

Von Apr 2024 bis Apr 2025