EXEL Industries : Third quarter 2023–2024 sales up 2.1%

23 Juli 2024 - 8:15AM

UK Regulatory

EXEL Industries : Third quarter 2023–2024 sales up 2.1%

Third quarter 2023-2024 sales: up 2.1%

Growing third quarter despite high base effect |

|

|

2022-2023 |

2023-2024 |

Change

(reported) |

Change

(LFL*) |

Q3 sales

(April 2024–June 2024) |

Reported |

Reported |

€m |

% |

€m |

% |

AGRICULTURAL SPRAYING

|

155.2 |

151.7 |

-3.5 |

-2.2% |

-2.4 |

-1.6% |

SUGAR BEET HARVESTING

|

34.1 |

39.1 |

+5.0 |

+14.7% |

+5.1 |

+15.0% |

LEISURE

|

57.8 |

54.0 |

-3.8 |

-6.5% |

-5.1 |

-8.8% |

INDUSTRY

|

62.8 |

71.7 |

+8.8 |

+14.1% |

+8.9 |

+14.1% |

|

EXEL Industries Group |

310.0 |

316.5 |

+6.5 |

+2.1% |

+6.5 |

+2.1% |

|

|

2022-2023 |

2023-2024 |

Change

(reported) |

Change

(LFL*) |

9-month sales

(October 2023–June 2024)) |

Reported |

Reported |

€m |

% |

€m |

% |

|

AGRICULTURAL SPRAYING |

392.0 |

400.1 |

+8.1 |

+2.1% |

+14.5 |

+3.7% |

SUGAR BEET HARVESTING

|

87.9 |

83.4 |

-4.5 |

-5.2% |

-3.3 |

-3.7% |

LEISURE

|

119.9 |

112.4 |

-7.4 |

-6.2% |

-13.8 |

-11.6% |

INDUSTRY

|

193.2 |

213.4 |

+20.2 |

+10.4% |

+23.3 |

+12.0% |

|

EXEL Industries Group |

793.0 |

809.3 |

+16.3 |

+2.0% |

+20.6 |

+2.6% |

Third quarter 2023-2024

sales

The EXEL Industries Group posted revenue of

€316.5 million for the third quarter of 2023-2024,

up 2.1%. At constant consolidation scope and

foreign exchange rates, revenue was also up

2.1%.

The scope effect represents €1.9

million in revenue for the third quarter, reflecting the

acquisition of the Devaux group in June 2023.

-

AGRICULTURAL SPRAYING DOWN

2.2%

Agricultural spraying is seeing varied evolution

across regions. Flat sales in Europe and Australia contrasted with

a more challenging situation in North America, where volumes are in

decline following a good beginning of the year. Distributors in all

Group regions are focusing on reducing inventories, resulting in a

slowdown in order intake.

- SUGAR

BEET HARVESTING UP 14.7%

Third quarter business was mainly driven by

sales of sugar beet harvesters in Europe and North America. In

Eastern Europe, the expected slowdown in sales continues. Once

again in this quarter, sales volumes of used machinery and spare

parts sustained their momentum.

Garden business declined during the third

quarter in a challenging market exacerbated by adverse weather

conditions at the start of the season. Sales volumes fell in Italy

and the UK, although market share increased slightly. Meanwhile,

revenue made some progress in France, driven by sales of hand-held

sprayers and garden tools.

Industrial spraying sales were driven by Europe,

particularly the German automotive sector. In the other main Group

regions, i.e. Asia and the USA, sales remained steady in line with

the second quarter trend.

The technical hose market continues to pose challenges, but the

commercial reorganization is now complete.

2023-2024 outlook

-

AGRICULTURAL SPRAYING

- Agricultural commodity prices

remain low after a slight upswing in spring.

- Harvest yields in North America and

Eastern Europe are positive. On the other hand, harvests in France

are expected to be disappointing.

- Order intake is down again this

quarter. As a result, cost-cutting measures are currently being

implemented in order to adjust production facilities to changes in

the order book.

- SUGAR

BEET HARVESTING

- During the fourth quarter and up to

the end of the financial year, sales of sugar beet harvesters are

expected to align with those of last year.

- The Group continues to focus this

year on clearing its stock of used machinery.

-

LEISURE

- Uncertainty prevails concerning

weather conditions during the fourth quarter amid a declining

market in Western Europe.

- Despite a slight easing of interest

rates, the nautical order book is looking relatively thin.

Distributors are focusing on reducing their inventories, which

remain high, in the face of low demand.

- Wauquiez is preparing to launch the

new W55 in the fall.

-

INDUSTRY

- A number of projects, mainly

automotive, will be delivered during the fourth quarter. Meanwhile,

sales of standard products are expected to follow the trend set in

the first three quarters of the fiscal year.

- The Group is keeping a close eye on

developments in the Chinese economy, while new projects in North

America, mainly in the automation sector, should sustain business

in the region over the coming quarters.

Daniel Tragus, Chief Executive Officer of the EXEL

Industries Group

|

“EXEL Industries posted a fine third quarter performance driven

by industry, setting a trend that is expected to continue

throughout the fourth quarter. The Group remains prudent however,

particularly with regard to agricultural spraying, and continues to

take steps to adjust production to a decreasing order book. Under

these circumstances, EXEL Industries is focusing on improving

its operational efficiency while keeping an eye on developments in

its markets during the fourth quarter.” |

Upcoming events

- October

25, 2024, before market opening: Q4 2023-2024 sales

- December

19, 2024, before market opening: 2023-2024 full-year

results

- EXEL Industries_Press release_2023-2024-Q3_EN

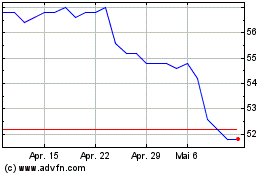

Exel Industries (EU:EXE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Exel Industries (EU:EXE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024