Winfarm : Q1 2022 revenue up +19.5%.

12 Mai 2022 - 5:45PM

Winfarm : Q1 2022 revenue up +19.5%.

PRESS RELEASE Loudéac, 12 May

2022

Q1 2022 revenue up +19.5%

-

Organic growth up 8.6%

-

Farming Supplies up 7%, illustrating the Group's ability to

continue passing on purchase price increases

-

Farming Nutrition up by a sharp 26.5% thanks to the

momentum created by the new operational management

team

-

Continued strong growth from diversification in the horse

and landscape markets (+23% and +43% respectively)

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), No. 1 French distance-seller for the farming

industry, today announced its revenue for the first

quarter of 2022.

|

In millions of euros, unaudited |

Q1 2022 |

Q1 2021 |

Change |

Change at constant scope 1 |

|

Farming supplies |

27.5 |

23.1 |

+19% |

+7% |

|

Farming nutrition |

3.0 |

2.3 |

+27% |

+27% |

|

Other |

0.3 |

0.4 |

na |

na |

|

TOTAL |

30.8 |

25.8 |

+20% |

+9% |

WINFARM recorded consolidated revenue in Q1 2022

of €30.8m, up 20% compared to Q1 2021 (+9% on a like-for-like

basis).

The Farming Supplies business

(89% of annual revenue), under the Vital Concept brand, made

revenue of €27.5m, up 19% compared to Q1 2021.

This performance includes a contribution from

BTN de Haas (consolidated from July 2021) to Q1 2022 revenue of

€2.8m. Excluding BTN de Haas, the Farming Supplies business

reported organic growth of 7%, reflecting WINFARM's ability to pass

on the new purchase price increases recorded over the period to its

selling prices. The Group also confirmed its significant

breakthrough in the agricultural contractors’ market, a new segment

targeted by WINFARM to expand and diversify its client

portfolio.

The horse and

landscape markets in which the Group has

diversified its activity continued to show high growth in Q1 2022,

at +23% and +44% respectively, a performance that was all the more

noteworthy given that it came on the heels of already strong growth

in 2021 of +28% and +54% respectively.

The Farming Nutrition business

(11% of annual revenue), under the Alphatech brand, built on the

growth momentum seen at the end of 2021 with revenue of €3.0m, up

27% on Q1 2021. Exports contributed to this performance, in

particular the growth in exports to the Middle East and Asia,

illustrating the successful roll-out of the strategy to capture new

international markets. Over the period, this activity also

benefited from the combined effect of the new operational

management team which commenced in the first half of 2021 and the

easing of health restrictions in the second half of 2021. The

aggressive acquisition of international market share in order to

establish itself as an industry leader involved making concessions

on prices which are likely to temporarily penalise business margins

over the year.

CONFIDENCE REASSERTED FOR

2022

Although raw material costs continued to

increase at the beginning of 2022, causing WINFARM to remain very

cautious, its ability to effectively pass on the purchase price

increases recorded during Q1 2022 allow the company to remain

confident that its activities will continue to be strong over the

coming months, and that it will achieve further growth in 2022.

WINFARM points out that a protraction of these costs’ increases in

2022 could temporarily penalise the Group's margins.

Next publication: H1 2022

revenue, 1 September 2022 after the market closes

About WINFARM

Founded in Loudéac, in the heart of Brittany, in

the early 1990s, WINFARM is now the French leader in distance

selling for the agricultural world. WINFARM offers farmers and

breeders comprehensive, unique and integrated solutions to help

them meet the new technological, economic, environmental and social

challenges of the next generation of agriculture. With a vast

catalogue of more than 15,500 product references (seeds,

phytosanitary, harvesting products, etc.), two-thirds of which are

own brands, WINFARM has more than 44,500 customers in France and

Belgium.

WINFARM generated revenue in 2021 of €108m. By

2025, WINFARM aims to achieve revenue of around €200m and an EBITDA

margin of about 6.5%.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, financial

communicationsBenjamin LEHARI+33 (0)1 56 88 11

11winfarm@actifin.fr |

ACTIFIN, financial press relationsJennifer

JULLIA+33 (0)1 56 88 11 19jjullia@actifin.fr |

1 Revenue excluding BTN de Haas

- WINFARM_PR_CA_T1_2022_EN final

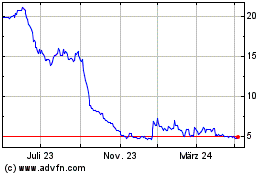

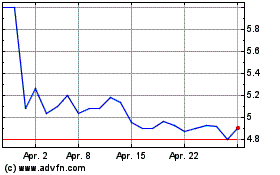

Winfarm (EU:ALWF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Winfarm (EU:ALWF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024