Standard Chartered Predicts Bitcoin At $150,000, ETH At $8,000 By Year-End

18 März 2024 - 6:00PM

NEWSBTC

Standard Chartered’s latest research notes offer a very bullish

outlook for the major digital assets, Bitcoin (BTC) and Ethereum

(ETH), by the end of 2024 and beyond. The bank’s analysts project

Bitcoin could reach $150,000, while Ethereum could hit the $8,000

mark. These projections come amidst a backdrop of significant

developments in the crypto space, including the launch of Bitcoin

spot Exchange-Traded Funds (ETFs) and Ethereum’s recent Dencun

upgrade. Bitcoin’s Path To $150,000 The bank’s research delves deep

into the factors propelling Bitcoin’s potential surge to $150,000

by year-end. Central to this projection is the influence of Bitcoin

spot ETFs, which, since their launch on January 11, have seen rapid

inflows exceeding increases in open interest. Related Reading:

Analyst Expects Bitcoin Price Correction To Persist, Targets

$57,000 Support According to the bank, this suggests a more robust

and sustainable positioning for Bitcoin, distinct from previous

speculative peaks. “Rapid inflows to the new Bitcoin (BTC) spot

ETFs have dominated […] Most of the inflows are likely to be sticky

pension-type flows,” Geoff Kendrick and Suki Cooper elucidate,

highlighting the newfound stability in Bitcoin investment trends.

Three pivotal analyses form the cornerstone of Standard Chartered’s

Bitcoin valuation: Gold Analogy: Drawing parallels with the gold

market’s response to the introduction of US gold ETFs, the bank

estimates Bitcoin could rise to the $200,000 level, marking a 4.3x

increase from its pre-ETF price. Two-Asset Optimization: By

optimizing a portfolio with 80% gold and 20% Bitcoin at current

gold prices, the analysis suggests a Bitcoin level around $190,000.

ETF Inflows Correlation: Linear extrapolation based on the

correlation between ETF inflows and Bitcoin price points to a

possible $250,000 level, assuming total ETF inflows around the

bank’s midpoint estimate of $75 billion. Standard Chartered notes

that these three measures suggest “that $200,000 is the ‘correct’

end-2025 price level for BTC, […] and that it is likely to be the

new midpoint for a sideways trading range at that time.” Related

Reading: Bernstein Analysts Convinced Bitcoin Is Headed For

$150,000, Here’s Why Further the research notes that an “overshoot

to $250,000 is likely at some point in 2025 if ETF inflows continue

apace and/or reserve managers buy BTC.” Previously, the bank only

predicted a Bitcoin price of $100,000 by the end of 2024.

Ethereum’s Road To $8,000 Ethereum’s expected climb to $8,000 by

the end of 2024 is anchored in two transformative developments: the

Dencun upgrade and the expected approval of ETH spot ETFs. The

recent Dencun upgrade, by significantly lowering transaction costs

on layer 2 blockchains, enhances Ethereum’s competitive edge.

“Ethereum (ETH) has just undergone the ‘Dencun’ upgrade, which

dramatically lowers the cost of transactions […] making ETH more

competitive,” the research notes. The forecast also hinges on the

anticipation of US SEC approval for ETH ETFs by May 23, a decision

poised to catalyze substantial inflows into Ethereum. Drawing from

the Bitcoin ETF experience, Standard Chartered expects similar

enthusiasm for Ethereum, with projected inflows of 2.39-9.15

million ETH (equivalent to roughly $15-45 billion). This

substantial capital infusion is seen as a crucial lever for

Ethereum’s price surge. “We expect significant ETF-driven inflows

to ETH […] This could drive ETH to the $8,000 level by end-2024,”

the bank elaborates, underscoring the parallel potential for growth

akin to Bitcoin’s trajectory. The Prognosis For 2025 And Beyond

Looking further ahead, Standard Chartered ventures into the terrain

of 2025 predictions, where the bank sees the ETH-to-BTC price ratio

ascending back to the 7% level, a hallmark of the 2021-22 period.

This adjustment forecasts an Ethereum price of $14,000 by the end

of 2025, given the projected Bitcoin level of $200,000. Such a

scenario underscores the bank’s optimism about the enduring value

proposition and growth potential of these leading digital assets in

the medium term. At press time, BTC traded at $68,401. Featured

image created with DALL·E, chart from TradingView.com

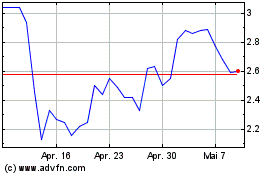

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024