Bitcoin Traders No Longer Extremely Greedy: Rebound Signal?

03 April 2024 - 9:30PM

NEWSBTC

Data shows that Bitcoin investor sentiment has cooled to the lowest

level since February, something that could facilitate a rebound in

the price. Bitcoin Fear & Greed Index Now Points At Just

‘Greed’ The “Fear & Greed Index” is an indicator created by

Alternative that tells us about the general sentiment among

investors in the Bitcoin and broader cryptocurrency sector. This

metric uses a numeric scale from zero to hundred to represent the

sentiment. To calculate the score, the index considers the data of

five factors: volatility, trading volume, social media sentiment,

market cap dominance, and Google Trends. Related Reading: Bitcoin

Supply In Loss Hits 10% After Crash: What Happened Last Time All

values of the indicator above the 53 mark suggest the presence of

greed among the investors, while below the 47 level implies a

fearful market. The region between these two corresponds to the

neutral sentiment. Here is how the latest value of the Bitcoin Fear

& Greed Index looks: The value of the index appears to be 71 at

the moment | Source: Alternative As is visible above, the Bitcoin

Fear & Greed Index currently has a value of 71, implying that

the investors share a majority sentiment of greed. Just yesterday,

the index’s value had been notably higher than this, implying that

there has been a bit of a cooldown of sentiment in the past 24

hours. Below is a chart that shows the trend in the index over the

past year. The value of the indicator seems to have registered a

plunge recently | Source: Alternative Besides the three core

sentiments, there are also two “extreme” sentiments: extreme greed

and extreme fear. The former occurs at values above 75, while the

latter occurs under 25. The Bitcoin Fear & Greed Index was 79

yesterday, implying that the market had been extremely greedy. The

indicator has been regularly inside this zone for the past month,

so the current normal greed values go against the trend. The

sentiment among investors has naturally been so high recently

because the BTC price has gone through a sharp rally in this period

and has explored fresh all-time highs (ATHs). The Bitcoin price has

historically tended to go against the majority’s expectations. And

the stronger this expectation has been, the more likely such a

contrary move will occur. Due to this reason, the extreme

sentiments have been where reversals in the asset have been the

most probable to take place in the past. For instance, the current

ATH of the asset formed when the index was at a value of 88.

Related Reading: Bitcoin Traders Spread “Buy The Dip” As BTC

Plunges Below $66,000 With the recent price drawdown, sentiment has

also taken a hit. The fact that it has fallen out of the extreme

greed zone, though, may be conducive to a bottom forming. The

earlier bottom, around 20 March, also formed when the index exited

the zone. The current level of the Bitcoin Fear & Greed Index

is not only lower than it was then but also the lowest since 11

February, when the asset was still trading around $48,000. BTC

Price Bitcoin is now down to the $65,800 level after facing a

drawdown of more than 7% over the last few days. Looks like the

price of the asset has plunged to lows recently | Source: BTCUSD on

TradingView Featured image from Kanchanara on Unsplash.com,

Alternative.me, chart from TradingView.com

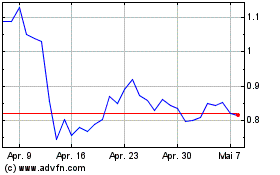

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024