Bitcoin Hits S2F Threshold: Should You Hold Tight Or Take Profits?

22 November 2024 - 1:00PM

NEWSBTC

Bitcoin has so far continued to level up in terms of price

performance, hitting new highs consistently for the past week. As a

result of this, investors seem to be curious about whether it’s

time to secure profits or stay bullish for the next leg of the

cycle. A recent analysis by a CryptoQuant analyst, known as

Darkfost, sheds light on this and the current market sentiment,

offering insights into potential strategies for navigating the

current phase of Bitcoin’s cycle. Related Reading: Analyst Reveals

Bitcoin’s Hidden Price Zones: Key Levels Investors Need To Watch

Time to Secure Profits? Darkfost’s observations center around the

S2F reversion metric, a tool used to gauge market conditions and

identify strategic moments for buying or selling Bitcoin. According

to the analyst, this metric has reached 2.5, a historical indicator

that signals the market is “heating up.” While this doesn’t suggest

Bitcoin has reached its cycle peak, it indicates that the asset is

entering a phase where profit-taking could be a wise strategy.

Darkfost wrote: Currently, the S2F reversion has reached the 2.5

level, which historically suggests that starting to take some

profits may be prudent. This doesn’t indicate we’ve reached the

cycle’s top, but it means that the market is beginning to heat up

but stay bull. Notably, the S2F (Stock-to-Flow) reversion metric is

derived from Bitcoin’s stock-to-flow model, which compares the

asset’s existing supply with its annual production rate. This model

has historically provided insights into Bitcoin’s valuation and

potential price movements. The S2F reversion specifically measures

deviations from this model, with higher levels typically indicating

overbought conditions in the market. While the S2F metric for

Bitcoin has now reached 2.5 level, Darkfost has pointed out when to

take profit, noting: The next target for further profit-taking

would likely be when the S2F reversion metric reaches the 3.0

level. Bitcoin Market Performance Bitcoin remains in a bullish

trend. Earlier today, the asset reached a new all-time high (ATH)

of $98,310 bringing its year-to-date price performance to over

160%. Related Reading: Crypto Analyst Warns of Potential Bitcoin

Market Shift as Exchange Reserves Decline However, at the time of

writing, BTC has faced a little price correction from its peak as

it trades for $97,236, down by 1.2% from its ATH but still up by

3.1% in the past day. Analysts say the asset is primed for a

further rally to the six-figure price mark. Ali, one of the

prominent crypto analysts in the space, for instance has recently

highlighted that with Bitcoin breaking out of a bullish flag on the

lower time frames, the asset could reach $100,000 as soon as today.

#Bitcoin $BTC could reach $100,000 today as it appears to be

breaking out of a bull flag on the lower timeframes.

pic.twitter.com/UKKcXilHO4 — Ali (@ali_charts) November 21, 2024

Featured image created with DALL-E, Chart from TradingView

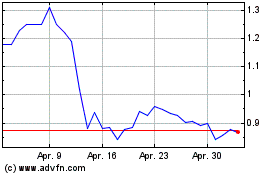

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024