Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

23 November 2024 - 1:30AM

NEWSBTC

Ethereum surged over 10% yesterday, marking an impressive recovery

alongside a very bullish day for the entire crypto market. This

surge has reignited investor optimism, especially as Ethereum

approaches its yearly highs. Key data from CryptoQuant

highlights a significant bullish signal: Ethereum’s Taker Buy

Volume hit an astonishing $1.683 billion in a single hourly candle.

This metric reflects aggressive buying activity in the futures

market, further supporting Ethereum’s potential for continued

upward momentum. Related Reading: Bitcoin Open Interest Hits ATH As

BTC Nears $100K – What To Expect? The driving force behind this

rising demand for Ethereum appears to stem from profits being

cycled out of Bitcoin. With Bitcoin consistently breaking all-time

highs, investors are reallocating gains into ETH, boosting its

price. Ethereum’s ability to capitalize on Bitcoin’s momentum

underscores its position as the second-largest cryptocurrency and a

key player in the broader market trend. However, the next few days

will be crucial for Ethereum as it nears its yearly highs. A strong

breakout above these levels could propel ETH into a new uptrend,

further strengthening its bullish narrative. Ethereum Bulls Waking

Up Ethereum bulls are finally showing signs of life after

eight months of bearish price action, with the price surging over

40% since November 5. This strong upward momentum aligns with the

broader market rally, fueling optimism that Ethereum’s recovery is

just beginning. The resurgence in bullish sentiment has positioned

Ethereum as a key focus for investors seeking opportunities in the

current market environment. According to data by CryptoQuant

analyst Maartunn, Ethereum’s Taker Buy Volume recently hit $1.683

billion in a single hourly candle, highlighting significant demand

and the involvement of high-volume trades. This aggressive buying

activity is a bullish signal, suggesting increased confidence in

Ethereum’s potential to sustain its rally. Strong demand at this

scale creates upward pressure on the price, reinforcing the bullish

narrative for ETH. Related Reading: Bitcoin Rally Driven By U.S.

Coinbase Investors – Top Analyst Shares Metrics However, Ethereum

still faces a critical hurdle at the $3,550 level, a significant

supply zone that has acted as a barrier since late July. The next

few days will be pivotal for Ethereum, as breaking above this key

resistance could signal the continuation of its upward trajectory.

Failure to do so, however, might result in a short-term

consolidation. All eyes are now on ETH, as its next moves could set

the tone for the altcoin market. ETH Holding Above Key Levels

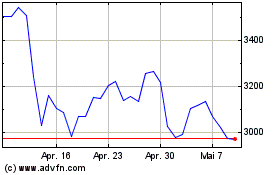

Ethereum (ETH) is trading at $3,333 after a 10% surge yesterday,

marking a significant rebound for the second-largest

cryptocurrency. The price is testing a critical supply zone just

below the $3,450 level, a resistance area that bulls need to

reclaim to confirm the uptrend and maintain momentum for new highs.

This supply zone has historically acted as a key barrier, and

breaking above it with conviction would signal strong buying

pressure and the potential for a sustained rally. Holding above the

200-day moving average (MA) at $2,959 further strengthens the

bullish case for Ethereum, as this indicator is widely regarded as

a benchmark for long-term price trends. Related Reading: Solana

Analyst Expects A Retrace Before It Breaks ATH – Targets Revealed

Should Ethereum maintain its position above the 200-day MA and push

decisively past the $3,450 level, it could pave the way for a

bullish rally, targeting higher resistance zones in the coming

days. However, failure to overcome this supply area may result in

short-term consolidation as bulls regroup to challenge the level

again. For now, the market focuses on Ethereum’s ability to clear

this crucial resistance and continue its upward trajectory.

Featured image from Dall-E, chart from TradingView

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024