BREAKING: BitMEX Fined $100 Million For US Money-Laundering Violations

15 Januar 2025 - 8:31PM

NEWSBTC

Federal judge John G. Koeltl has directed BitMEX to pay a $100

million fine, representing the latest development in an ongoing

legal dispute regarding money laundering infractions in the US.

BitMEX Faces Major Legal Setback The legal challenges for BitMEX

stem from activities between 2015 and 2020, during which the

exchange reportedly failed to adhere to the United States Bank

Secrecy Act (BSA). The BSA requires financial institutions to

assist government agencies in detecting and preventing money

laundering. Related Reading: What Bitcoin Election Patterns

Could Signal For Its Price Ahead Of January 20 Inauguration Despite

BitMEX’s attorneys arguing that a previous $110 million fine and

earlier guilty pleas from the exchange’s founders were sufficient

punishment, Judge Koeltl deemed additional financial penalties

necessary. In 2022, BitMEX’s founders, Arthur Hayes, and Benjamin

Delo, admitted guilt to comparable charges, with both consenting to

pay a $10 million criminal penalty. Exchange Implements

Enhanced KYC And AML Measures In a statement following the ruling,

the company expressed disappointment over the additional financial

penalty but noted that the amount was significantly lower than the

Department of Justice’s (DOJ) initial demands, which exceeded $200

million during plea negotiations and rose to approximately $420

million during sentencing discussions. The exchange emphasized its

commitment to compliance, stating that it has made significant

improvements to its operations since the period covered by the BSA

charges. This includes implementing a robust user

verification program and comprehensive Know Your Customer (KYC) and

Anti-Money Laundering (AML) systems. BitMEX asserts that these

advancements have been recognized by users, partners, and

regulatory stakeholders. Related Reading: Pundit Says Bitcoin Price

Will Break Above $100,000 If This Happens “We stand firm by the

statement that the BSA charge is old news,” the company remarked in

its statement. BitMEX expressed a desire to move past these legal

challenges and focus on innovation and service delivery for its

users. The exchange aims to maintain its position as a

leading, trusted, and financially stable crypto derivatives

platform, continuously launching new products and innovations to

meet user demands. Featured image from DALL-E, chart from

TradingView.com

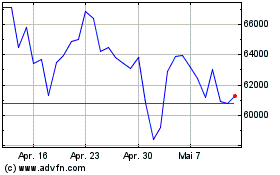

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025