TIDMVRS

RNS Number : 3696X

Versarien PLC

20 December 2023

20 December 2023

Versarien plc

("Versarien" or the "Company")

Company Update and Notice of General Meeting

Versarien plc (AIM: VRS), the advanced materials engineering

group, announces that a Notice of General Meeting ("General

Meeting") will be posted to shareholders today. The General Meeting

will be held on Wednesday 10 January 2024 at 10.00 a.m. at the

offices of Fieldfisher LLP, Riverbank House, 2 Swan Lane, London

EC4R 3TT. The purpose of the General Meeting is to approve a share

capital reorganisation, which consists of a redesignation of the

existing ordinary shares of the Company, and renewal of the

Company's share capital authorities.

The formal notice of the General Meeting including full details

of all resolutions to be proposed ("Resolutions") is available to

view on the Company's website at www.versarien.com.

The Company values shareholder participation and values the

votes of shareholders, so it encourages all shareholders to

exercise their voting rights by completing and submitting a proxy

form as soon as possible. It would also be helpful if shareholders

could submit any questions in advance of the General Meeting via

IFC Advisory Limited, the Company's financial PR and investor

relations adviser, at versarien@investor-focus.co.uk.

Background and Current Trading

At the last general meeting of the Company held on 30 October

2023 the Company explained that it wished to sub-divide its share

capital and renew its share capital authorities to enable it to

access bridging finance whilst certain assets were marketed for

sale.

The sale of those assets, in particular the interest in the

mature businesses, has not progressed as expected although the

Company continues to market them for sale. There is continued

interest in the South Korean assets and IP, however any transaction

is not expected to complete until next year and is likely to raise

less cash, at least initially, than was first anticipated.

The Group audit for the year ended 30 September 2023 ("FY23") is

ongoing and the FY23 results are expected to be released in early

February. The FY23 financial highlights, subject to audit, are

expected to be as follows:

-- Group revenues of GBP5.45m (2022: 18-month period GBP11.11m)

-- *Adjusted LBITDA of GBP3.03m (2022: 18-month period GBP2.40m)

-- H2 Adjusted LBITDA of GBP1.02m compared to H1 of GBP2.01m

-- Asset impairments of GBP7.5m treated as an exceptional item (30 September 2022: GBP1.33m)

-- Cash at bank of GBP0.60m (30 September 2022: GBP1.35m)

-- Post period end, placing to raise gross proceeds of c. GBP0.45m

*Adjusted LBITDA (Loss Before Interest, Tax, Depreciation and

Amortisation) excludes Exceptional items, Share-based payment

charges and other losses.

The Company continues to pursue its stated turnaround strategy

and it is the view of the Board that the Company now has a pipeline

of opportunities that could result in an improvement in the

financial condition of the Company in the short to medium term.

Since 21 July 2023, 28 new contracts have been won representing

approximately GBP1.0m of income over six to eighteen months and the

Company is pursuing 69 other contractual opportunities with a

potential aggregate value to the Company of approximately

GBP1.05m.

The open opportunities cover a number of sectors and situations

including Graphene-Wear(TM) coatings for textiles, Cementene(TM),

3D concrete printing, Polygrene(TM), commercial R&D, grants and

licensing and reflect, in part, the adoption of the turnaround

strategy. This improvement, albeit a first step, reflects the

efforts of the Company's management to move the business towards

being financially viable going forward. The Company's current

projections show an EBITDA positive position being reached in the

second half of 2025, assuming the conversion of sufficient

opportunities into revenue for the Company.

The sale of assets remains an integral part of the turnaround

strategy, but fundamentally, the Board now has sufficient

confidence in the business pipeline to seek the authority to issue

further equity to bridge the funding gap to profitability. This

further funding will be required to secure the future of Versarien

as, in the absence of any asset sales or the implementation of

further cost reduction measures, the Company has limited cash

resources, which as of 19 December stood at GBP0.42m together with

GBP0.12m available to draw from its invoice finance facility.

The nominal value of the Existing Ordinary Shares is currently

0.1 pence and, whilst the Existing Ordinary Shares are currently

trading at a premium to that nominal value, the Board believes that

there is a risk that any future fundraise could be at a discount

that reduces the issue price to less than 0.1 pence per Existing

Ordinary Share. Under the Companies Act, a company is unable to

issue shares at a subscription price which is less than the nominal

value and the Company would then not be able to proceed with that

fundraise. The Board, therefore, considers it prudent to implement

the proposed Share Capital Reorganisation in order that the nominal

value of the New Ordinary Shares is set at a level substantially

lower than the current trading price of the Existing Ordinary

Shares. This should provide the Company with greater flexibility to

raise funds by issuing further shares.

Whilst the Board will look to secure any further funding above

the current nominal value of the Existing Ordinary Shares, it needs

the flexibility should the ultimate placing price of any equity

raise be below the current nominal value of the Ordinary Shares.

Whilst the Board would naturally hope that this would not be the

case, it would seem imprudent, in the current circumstances and

with an uncertain stock market outlook, not to further amend the

nominal value as a protection mechanism.

Additionally, the Directors are seeking shareholder approval to

renew and increase the Company's authority to issue new equity as

well as its authority to issue new equity for cash other than on a

pre-emptive basis. Each of these authorities is for up to an

aggregate nominal value of GBP99,233.90 (992,339,000 New Ordinary

Shares), being approximately 200 per cent. of the issued share

capital of the Company as at 19 December 2023. Unless previously

revoked or varied, these authorities will expire at the conclusion

of the next Annual General Meeting of the Company, expected to be

held in March 2024.

Share Capital Reorganisation and amendments to the Articles of

Association

Accordingly, it is proposed to sub-divide each Existing Ordinary

Share into one New Ordinary Share and one New Deferred Share.

The New Ordinary Shares will in all material respects, have the

same rights (including rights as to voting, dividends and return of

capital) as the Existing Ordinary Shares. The New Ordinary Shares

will be traded on AIM in the same way as the Existing Ordinary

Shares, with the exception of the difference in nominal value.

The rights attached to the New Deferred Shares will be set out

in the Articles (as per Resolution 2 in the Notice of General

Meeting). The New Deferred Shares will have little economic value

as they will not carry any rights to vote or dividend rights,

although the New Deferred Shares will rank pari passu with the New

Ordinary Shares on a return of capital or on a winding up of the

Company.

The Company does not intend to make any application for the New

Deferred Shares to be admitted to trading on AIM or any other

public market. The New Deferred Shares will not be transferable

without the prior written consent of the Company. No share

certificates will be issued in respect of the New Deferred Shares.

The Board may further appoint any person to act on behalf of all

the holders of the New Deferred Shares to transfer all such shares

to the Company in accordance with the terms of the Companies

Act.

It is not intended to issue new share certificate(s) to the

holders of the New Ordinary Shares following the Share Capital

Reorganisation. Existing share certificate(s) will remain valid for

the same number of shares but with a different nominal value of

0.01p per share. The nominal value of shares already held in CREST

will be updated at approximately 8.00 a.m. on 11 January 2024.

By effecting the Share Capital Reorganisation in this way, the

total nominal value of the Company's entire issued share capital

remains the same with New Ordinary Shares having a nominal value of

0.01p plus New Deferred Shares having a nominal value of 0.09p each

(as well as the existing deferred shares of 0.9p each).

The Share Capital Reorganisation is conditional upon, and

effected by, the approval of Resolutions 1 and 2 at the General

Meeting as required by the Companies Act 2006 and the Articles. If

Resolutions 1 and 2 are passed, the Share Capital Reorganisation

will become effective at 6.00 p.m. on the Record Date.

The Articles are proposed to be amended to allow for the issue

of the New Deferred Shares, which are proposed to be issued as part

of the Share Capital Reorganisation. Resolution 2 amends the

Company's existing Articles to include provision in respect of the

rights and restrictions attaching to the Deferred Shares. The

changes are set out in Part 2 of the Circular.

Recommendation

The Board considers that the Resolutions are in the best

interests of the Company and its shareholders, taken as a whole.

The Board unanimously recommends that the Shareholders to vote in

favour of the Resolutions, as the Directors intend to do so in

respect of their own beneficial holdings.

If the Resolutions are not approved at the General Meeting, the

Company will not be able to raise equity funding, and if no

alternative funding can be secured, the Company's ability to

operate as a going concern will be put at risk.

Expected timetable of principal events

2023/2024

Publication and dispatch of the circular and Form of Proxy

20 December

Latest time and date for receipt of the Form of Proxy 10.00 a.m.

on 8 January

Time and date of the General Meeting 10.00 a.m. on 10

January

Results of the General Meeting announced through RNS 10

January

Record Date for Share Capital Reorganisation 6.00 p.m. on 10

January

Admission and dealings in New Ordinary Shares 8.00 a.m. on 11

January

All references to times in this timetable are to London times

and each of the times and dates are indicative only and may be

subject to change.

Terms used and not defined in this announcement shall have the

same meanings given to them in the Notice of General Meeting.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please contact:

Versarien c/o IFC

Stephen Hodge, Chief Executive Officer

Chris Leigh, Chief Financial Officer

SP Angel Corporate Finance (Nominated

Adviser and Broker) +44 (0)20 3470

Matthew Johnson, Adam Cowl 0470

IFC Advisory Limited (Financial PR and

Investor Relations) +44 (0)20 3934

Tim Metcalfe, Zach Cohen 6630

For further information please see : http://www.versarien.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGFZMMZNLDGFZM

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

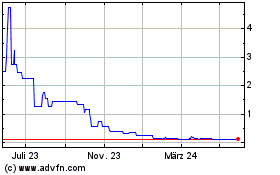

Versarien (AQSE:VRS.GB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

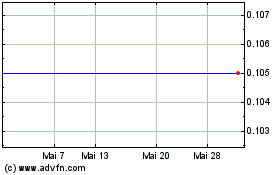

Versarien (AQSE:VRS.GB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024