TIDMVRS

RNS Number : 8443P

Versarien PLC

12 October 2023

12 October 2023

Versarien plc

("Versarien" or the "Company")

Notice of General Meeting

Versarien plc (AIM: VRS), the advanced materials engineering

group, announces that a Notice of General Meeting ("General

Meeting") will be posted to shareholders today. The General Meeting

will be held on Monday 30 October 2023 at 10.00 a.m. at the offices

of Fieldfisher LLP, Riverbank House, 2 Swan Lane, London EC4R 3TT.

The purpose of the General Meeting is to approve a share capital

reorganisation, which consists of a redesignation of the existing

ordinary shares of the Company, and renewal of the Company's share

capital authorities.

The formal notice of the General Meeting including full details

of all resolutions to be proposed ("Resolutions") is available to

view on the Company's website at www.versarien.com.

The Company values shareholder participation and values the

votes of shareholders, so it encourages all shareholders to

exercise their voting rights by completing and submitting a proxy

form as soon as possible. It would also be helpful if shareholders

could submit any questions in advance of the General Meeting via

IFC Advisory Limited, the Company's financial PR and investor

relations adviser, at versarien@investor-focus.co.uk.

Background

At the last general meeting of the Company, held on 4 July 2023,

the Company explained that it wished to renew its share capital

authorities to enable it to provide bridging finance whilst certain

assets were marketed for sale.

As described in the commercial update on 2 October 2023,

discussions remain ongoing regarding the sale of these assets, but

at this juncture there can be no certainty that sales can be

satisfactorily concluded before the existing working capital is

exhausted and consequently further funding may be required from the

capital markets.

However, the Company's existing ordinary shares have, at times,

traded on AIM at a price less than the nominal value of such

shares. Under the Companies Act 2006, a company is unable to issue

shares at a subscription price which is less than the nominal value

of shares of the same class. This means that, as the nominal value

of the Company's existing ordinary shares is currently one penny,

the Company could not issue further Ordinary Shares at a price of

less than one penny per share without a reorganisation of the

existing ordinary shares. The Board, therefore, considers it

prudent to implement the proposed share capital reorganisation in

order that the nominal value of the new ordinary shares becomes

lower than one penny therefore allowing the Company the possibility

to raise funds by issuing further shares, should the Directors

elect to do so in due course.

Additionally, the lower share price means that the authorities

granted at the Company's previous general meeting have scope to

generate less aggregate funds so the directors are seeking

shareholder approval to also renew those authorities to potentially

generate greater working capital for the Company's short and medium

term needs.

Share Capital Reorganisation and amendments to the Articles of

Association

Accordingly, it is proposed to reorganise the existing ordinary

share of 1p each ("Existing Ordinary Share") into one new ordinary

share of 0.1p ("New Ordinary Share") and one new deferred share of

0.9p each ("New Deferred Share").

The New Ordinary Shares will in all material respects, have the

same rights (including rights as to voting, dividends and return of

capital) as the Existing Ordinary Shares. The New Ordinary Shares

will be traded on AIM in the same way as the Existing Ordinary

Shares, with the exception of the difference in nominal value.

The rights attached to the New Deferred Shares will be set out

in the Articles (as per Resolution 2 in the Notice of General

Meeting). The New Deferred Shares will have little economic value

as they will not carry any rights to vote or dividend rights,

although the New Deferred Shares will rank pari passu with the New

Ordinary Shares on a return of capital on a winding up of the

Company.

The Company does not intend to make any application for the New

Deferred Shares to be admitted to trading on AIM or any other

public market. The New Deferred Shares will not be transferable

without the prior written consent of the Company. No share

certificates will be issued in respect of the New Deferred Shares.

The Board may further appoint any person to act on behalf of all

the holders of the New Deferred Shares to transfer all such shares

to the Company in accordance with the terms of the Companies

Act.

It is not intended to issue new share certificate(s) to the

holders of the New Ordinary Shares following the Share Capital

Reorganisation. Existing share certificate(s) will remain valid for

the same number of shares but with a different nominal value of

0.1p per share. Following the Share Capital Reorganisation should

you wish to receive an updated share certificate please contact the

Registrars at the address set out in this document. The nominal

value of shares already held in CREST will be updated at

approximately 8.00 a.m. on 31 October 2023.

By effecting the Share Capital Reorganisation in this way, the

total nominal value of the Company's entire issued share capital

remains the same with New Ordinary Shares having a nominal value of

0.1p plus New Deferred Shares having a nominal value of 0.9p.

The Share Capital Reorganisation is conditional upon, and

effected by, the approval of Resolutions 1 and 2 at the General

Meeting as required by the Companies Act 2006 and the Articles. If

Resolutions 1 and 2 are passed, the Share Capital Reorganisation

will become effective at 6.00 p.m. on the Record Date.

The Articles are proposed to be amended to allow for the issue

of the New Deferred Shares, which are proposed to be issued as part

of the Share Capital Reorganisation. Resolution 2 amends the

Company's existing Articles to include provision in respect of the

rights and restrictions attaching to the Deferred Shares. The

changes are set out in Part 2 of the Circular.

Recommendation

The Board considers that the Resolutions are in the best

interests of the Company and its shareholders, taken as a whole.

The Board unanimously recommends that the Shareholders to vote in

favour of the Resolutions, as the Directors intend to do so in

respect of their own beneficial holdings.

If the Resolutions are not approved at the General Meeting, the

Company may not be able to raise equity funding, and if no

alternative funding can be secured, the Company's ability to

operate as a going concern will be put at risk.

Expected timetable of principal events

2023

Publication and dispatch of the circular and Form of Proxy 12

October

Latest time and date for receipt of the Form of Proxy 10.00 a.m.

on 26 October

Time and date of the General Meeting 10.00 a.m. on 30

October

Results of the General Meeting announced through RNS 30

October

Record Date for Share Capital Reorganisation 6.00 p.m. on 30

October

Admission and dealings in New Ordinary Shares 8.00 a.m. on 31

October

All references to times in this timetable are to London times

and each of the times and dates are indicative only and may be

subject to change.

Terms used and not defined in this announcement shall have the

same meanings given to them in the Notice of General Meeting.

For further information please contact:

Versarien c/o IFC

Stephen Hodge, Chief Executive Officer

Chris Leigh, Chief Financial Officer

SP Angel Corporate Finance (Nominated Adviser and Broker)

Matthew Johnson, Adam Cowl +44 (0)20 3470 0470

IFC Advisory Limited (Financial PR and Investor Relations)

Tim Metcalfe, Zach Cohen +44 (0) 20 3934 6630

For further information please see : http://www.versarien.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGGPGUAUUPWGQG

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

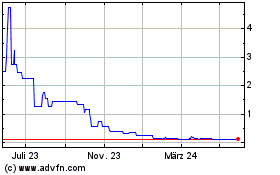

Versarien (AQSE:VRS.GB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

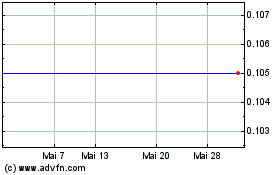

Versarien (AQSE:VRS.GB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025