Thermo Fisher to Buy Qiagen in $10.1 Billion Deal

03 März 2020 - 10:44AM

Dow Jones News

By Adria Calatayud

Thermo Fisher Scientific Inc. said Tuesday that it has agreed to

acquire Frankfurt-listed provider of molecular diagnostics Qiagen

NV in a deal that values the target at around $10.1 billion.

Thermo Fisher said its proposal values each Qiagen share at 39

euros ($43.30) in cash, representing a premium of around 23% to

Monday's closing price. Including debt of $1.4 billion, the deal is

worth $11.5 billion, Thermo Fisher said.

Waltham, Massachusetts-based Thermo Fisher, a provider of

analytical instruments and equipment for research, analysis,

discovery, and diagnostics, said the acquisition of Qiagen, which

is based in Venlo, the Netherlands, is expected to be immediately

accretive to adjusted earnings per share after close. The deal will

expand Thermo Fisher's specialty diagnostics portfolio and

complement its life-sciences offering, the company said.

In 2019, Qiagen generated revenue of $1.53 billion, Thermo

Fisher said.

The deal is expected to be completed in the first half of 2021,

subject to regulatory approvals and other customary closing

conditions, the company said.

"This acquisition provides us with the opportunity to leverage

our industry-leading capabilities and R&D expertise to

accelerate innovation and address emerging health-care needs,"

Thermo Fisher Chairman, President and Chief Executive Marc N.

Casper said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

March 03, 2020 04:29 ET (09:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

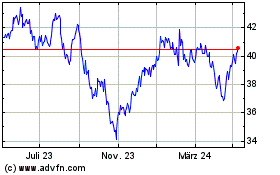

Qiagen NV (TG:QIA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

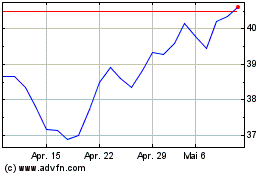

Qiagen NV (TG:QIA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024