Toms Shoes Gets New Owners in Out-of-Court Debt Restructuring

29 Dezember 2019 - 11:53PM

Dow Jones News

By Becky Yerak

Slip-on footwear company Toms Shoes LLC, backed by Bain Capital,

is handing ownership to creditors in an out-of-court

recapitalization that includes restructuring $300 million in debt

and investing $35 million in the business.

In a letter sent Friday to Toms employees, Chief Executive Jim

Alling said the company has signed a deal transferring ownership to

investors led by Jefferies Financial Group Inc., Nexus Capital

Management LP and Brookfield Asset Management Inc.

"These organizations have all expressed a commitment to our

company, our brand and our mission," Mr. Alling said in his letter,

a copy of which was reviewed by WSJ Pro Bankruptcy. To show their

commitment and support growth, the new owners are investing $35

million into the business and restructuring its balance sheet, he

said.

The Los Angeles-based company has struggled with a

longer-than-expected turnaround effort and a debt load that matures

in late 2020. Bain Capital bought a 50% stake in the business in

2014. Reuters earlier reported on the company's restructuring

deal.

Toms was founded in 2006 by Blake Mycoskie and is known for

giving a pair of shoes to a poor child for every pair that it

sells. Earlier this month, Moody's Investors Service downgraded the

company's credit rating deeper into junk territory, declaring Toms

at heightened risk of default.

Some of the company's debt stems from Bain's 2014 leveraged

buyout, which was valued at about $625 million, The Wall Street

Journal reported at the time.

Toms has a $306.5 million senior secured term loan due in

October 2020, of which $299 million is outstanding, Moody's said.

Fitch Ratings had also said that chances were high that Toms would

default this year on its debt.

Toms has been shifting sales to its website as it looks to

survive upheaval in the retail industry. Bain Capital couldn't be

reached for immediate comment Sunday.

Soma Biswas and Lillian Rizzo contributed to this article.

Write to Becky Yerak at becky.yerak@wsj.com

(END) Dow Jones Newswires

December 29, 2019 17:38 ET (22:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

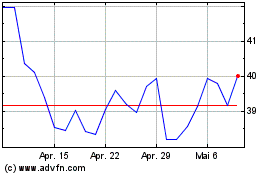

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024