Filed by Ingersoll-Rand plc

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Ingersoll-Rand plc

Commission File No.: 001-34400

LEADER COMMUNICATIONS TOOLKIT: TALKING POINTS FOR USE WITH EMPLOYEES

Introduction: Announcement

|

|

|

|

•

|

On April 30, 2019 we issued an announcement that we intend to combine our Industrial segment with Gardner Denver.

|

|

|

|

|

•

|

This will include CTS, Club Car, Fluid Management, Material Handling and Power Tools, plus our pending acquisition of Precision Flow Systems, post close.

|

|

|

|

|

•

|

Our Climate segment will become a standalone company focused entirely on climate control solutions for buildings, homes and transportation.

|

|

|

|

|

•

|

This is a transformational change for Ingersoll Rand that will create two standalone companies, both well positioned to generate significant value for all stakeholders.

|

|

|

|

|

•

|

I want to provide some background about what this means and what to expect going forward.

|

About the Transaction

|

|

|

|

•

|

I understand that you will have many questions about the separation of our businesses and what it means for each of you. First, let me share a few facts:

|

|

|

|

|

•

|

A new Industrial Company

- which you’ll see referred to as “IndustrialCo” - a global leader in mission-critical flow creation and industrial technologies.

|

|

|

|

|

◦

|

Expected to take the Ingersoll Rand name and trade on the New York Stock Exchange under our existing ticker (NYSE: IR)

|

|

|

|

|

◦

|

Be led by the Gardner Denver CEO, Vicente Reynal and a leadership team from both companies

|

|

|

|

|

◦

|

Corporate operations will be based in Davidson, North Carolina

|

|

|

|

|

•

|

A new Climate Company

- “ClimateCo” - which will be a pure play global leader in climate control solutions for buildings, homes and transportation, formed from our HVAC and transport refrigeration businesses.

|

|

|

|

|

◦

|

Led by Mike Lamach and members of the existing Ingersoll Rand ELT from Climate and Corporate

|

|

|

|

|

◦

|

New company name and stock ticker - will be determined before close

|

|

|

|

|

•

|

The transaction is expected to close by early 2020, subject to regulatory approvals, Gardner Denver stockholder approval, and customary closing conditions. Upon closing, we will operate as two independent companies.

|

What to Expect

|

|

|

|

•

|

At this time, there are no changes to your reporting structure, location or responsibilities as a result of the announcement. Until the transaction closes, Ingersoll Rand and Gardner Denver will operate separately and continue to compete in the marketplace as we do today.

|

|

|

|

|

•

|

Following the close of the transaction, Industrial segment employees will be part of IndustrialCo and Climate segment employees will be part of ClimateCo. For corporate employees, we are still evaluating what each company needs to be positioned for success.

|

|

|

|

|

•

|

Over the coming weeks and months, we will share updates and more information about what this means for you. We are committed to keeping you informed as we move ahead.

|

|

|

|

|

•

|

It is possible that you may receive an inquiry from a member of the media or financial community. It is crucial that you do not respond directly to these requests, and instead send to Corporate Communications.

|

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

1

Looking to the Future / Commitment

|

|

|

|

•

|

This is a significant moment for Ingersoll Rand, and the future ahead is strong for the new IndustrialCo and ClimateCo. Both companies will be better positioned to create value for all of our stakeholders.

|

|

|

|

|

◦

|

IndustrialCo will be a global leader in mission-control flow creation and industrial technologies with a strong combined portfolio and operating platform, opportunities to compete in a broader set of markets, and strong talent that will be part of a great culture.

|

|

|

|

|

◦

|

ClimateCo will be a global leader in climate control solutions for buildings, homes and transportation, and will continue capitalizing on global sustainability megatrends that play to strengths like reducing greenhouse gas emissions and improving efficiencies for our customers. It will further build a winning culture, address customer needs, and deliver profitable growth and operational excellence

|

|

|

|

|

•

|

Thank you all for your continued dedication and hard work, and I know that I can count on you to remain focused on achieving our commitments to each other, our customers and shareholders.

|

Post-Announcement - Key Topics

1

As initial announcement communications have progressed, there are a few areas where employees remain confused or further clarity is needed. It is important to remember that at this stage, we don’t have answers to many questions, particularly those that pertain to integration or transformation work streams and outcomes for both companies.

Two Standalone Companies

(To address confusion that the companies will be one legal entity after the split)

|

|

|

|

•

|

When the transaction closes, IndustrialCo and ClimateCo will be completely independent public companies, legally registered as separate entities with their own names, traded on the New York Stock Exchange with their own stock tickers, led by their own management teams and governed by their own Board of Directors.

|

|

|

|

|

•

|

After close, there will likely be transition service agreements in place between the two companies for continuity in services and supply, but they will operate and report earnings and performance entirely independent of each other.

|

|

|

|

|

•

|

For ClimateCo employees, this means benefits will remain the same as they are under the current plan. As always, subject to collective bargaining agreements, ClimateCo reserves the right to amend or terminate any benefit plan or compensation arrangement at its discretion.

|

|

|

|

|

•

|

For IndustrialCo employees, Gardner Denver has agreed to maintain employee benefits that are substantially comparable in the aggregate to benefits before the close. As employees onboard with the new Industrial company, more information will be provided by IndustrialCo.

|

Future Operating Structure and Models

(To address rumors and speculation regarding future operating models)

|

|

|

|

•

|

Both IndustrialCo and ClimateCo will each determine the right operating models for their business for the long-term. No decisions on organization structure or operating models have been made at this early stage.

|

|

|

|

|

•

|

For IndustrialCo, a separation and integration team will be formed with individuals from both companies. This team will lead planning for how the two companies will separate and merge, from technical and financial operating systems, manufacturing operations and supply chain services, service

|

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

2

agreements, organizational design and much more. Until this work progresses, it is too early to tell what the final outcomes will be for many business processes and shared services.

|

|

|

|

•

|

For ClimateCo, a leader will be identified to guide the transformation of the remaining Climate businesses and corporate functions to ensure the go-forward business model is effective and efficient, creating an agile and premier performing company well-positioned to capitalize on new opportunities for the future.

|

|

|

|

|

•

|

No Integration or Transformation team leaders or members have been named yet.

|

Legacy & New Brand Process

(To address concerns around the transition of the Ingersoll Rand identity and the process for developing a new brand for ClimateCo)

|

|

|

|

•

|

The announcement has likely evoked a range of emotions for employees, including excitement, uncertainty and even apprehension about what the future holds. Another emotion that might not be as immediately apparent is the sense of loss some employees are expressing for the Ingersoll Rand company name and identity that has been a big part of their employment experience.

|

|

|

|

|

•

|

For employees who will be part of the Industrial company, the opportunity to build off the strong history and reputation of the Ingersoll Rand name is an exciting part of a continued journey of excellence. But it will also be a process to redefine who the newly combined company will be and what it will be known for going forward.

|

|

|

|

|

•

|

For employees who will be part of the Climate company, this moment offers an exciting prospect to redefine and recommit to who we are, our purpose, and how we serve the world - beyond just picking a new brand name. We will take a thoughtful, strategic and objective approach to this work and build off the strong family of brands that are respected leaders in their markets.

|

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

3

GENERAL EMPLOYEE FREQUENTLY ASKED QUESTIONS (FAQS)

1

Questions for Everyone

|

|

|

|

1.

|

Why are we undertaking this transaction when you said we were better together? Why now?

|

Our Climate and Industrial businesses each have very unique strategies and investment profiles. We believe there is significantly more value in creating two leading companies than in remaining as one company. The reason that we are doing this now is that we have a complementary merger partner in Gardner Denver, which, combined with our Industrial segment, creates an Industrial company (IndustrialCo) with the scale to compete and win as a standalone company.

The new Climate company (ClimateCo), as a pure play global leader in the climate control solutions space, will leverage our portfolio of leading brands, outstanding sales and service channels, and our proven business operating system to capitalize on global sustainability megatrends. With greater focus, more targeted investments and a simplified business model, we will be even better positioned to enhance value for all of our stakeholders.

|

|

|

|

2.

|

Will ClimateCo and IndustrialCo be two companies or legally still one after close?

|

IndustrialCo and ClimateCo will be completely independent public companies, legally registered as separate entities with their own names, traded on the New York Stock Exchange with their own stock tickers, led by their own management teams and governed by their own Board of Directors.

After close, there will likely be transition service agreements in place between the two companies for continuity in services and supply, but they will operate and report earnings and performance entirely independent of each other.

|

|

|

|

3.

|

Who will lead the integration from IndustrialCo and ClimateCo?

|

We are committed to a seamless and effective transition and will approach this process thoroughly.

There will be a body of work to effectively separate the Industrial businesses and industrial corporate support roles from the broader company, and in turn prepare for the integration between Gardner Denver and the Industrial businesses.

The Separation and Integration team will lead planning for how the two companies will separate and merge, from technical and financial operating systems, manufacturing operations and supply chain services, service agreements, organization of the new Industrial company, and much more.

In addition we will have a team working on the transformation of the Climate company post separation, including new branding, organizational structure and other simplification opportunities for the standalone company.

Until this work progresses, it is too early to tell what the final outcomes will be for many business processes and shared services.

The integration team will include individuals from both companies who will work through this ongoing process over the course of many months. As soon as the separation and integration leaders and team members are identified, we will communicate at that time.

|

|

|

|

4.

|

What should employees do with existing CapEx and investment projects?

|

We have a commitment to continue the growth and momentum for all of our businesses, which includes planned investments, so in most cases we will continue planned investments. However, just like in normal business operations, we continually review all decisions with a lens on what is best for the business in the long-term. For now, please keep moving forward and operating as we always have. We will communicate any changes as more information is available. If you have questions about specific projects, please speak with your SBU or Function leadership team.

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

1

|

|

|

|

5.

|

What will happen with our ongoing work/initiatives?

|

During

this period from announcement to close, we are moving forward with ongoing work and initiatives. In fact, every step we can take to enhance the business and move us forward will be to benefit everyone associated with Ingersoll Rand. We must stay focused on delivering the plans and programs that will build our success in the future. We will communicate any changes to plans as decisions are made.

|

|

|

|

6.

|

What does this mean for me? Will I still have a job?

|

There are no immediate changes to employees’ roles and day-to-day responsibilities as a result of this announcement and likely won’t be for quite some time. Until the transaction closes, which is expected to occur by early 2020, we will continue to operate as we do today and compete in the marketplace as two separate entities, Ingersoll Rand and Gardner Denver. We need to remain focused on our existing job duties to meet the needs of our customers and to deliver on our plans for 2019. We will keep you updated as we have more to share.

|

|

|

|

7.

|

Do I have the option to work for ClimateCo or IndustrialCo?

|

Following the close of the transaction, we expect all employees dedicated to the Industrial segment to transfer to IndustrialCo. This includes all employees that work in the Compression Technologies & Services, Club Car, Fluid Management, Material Handling and Power Tools strategic business units (SBUs); plus PFS employees after the expected acquisition close; and corporate function employees that are more than 50 percent dedicated to the Industrial segment or identified as moving to IndustrialCo. Likewise, employees dedicated to the Climate segment or identified as remaining with ClimateCo will become part of ClimateCo.

For employees within corporate functions

: Some teams currently support both Ingersoll Rand segments. We will identify the corporate positions and employees that will become part of IndustrialCo or ClimateCo within the coming months. We are approaching this process in good faith with the terms of the transaction, and the process will be thoughtful and thorough, with input from leadership. Each individual will receive more information as we complete the review. We will keep you updated as we have more to share.

|

|

|

|

8.

|

Can I apply for a different position in IndustrialCo or ClimateCo?

|

Providing continuity in the strength of talent was an important part of our commitment to ensure both IndustrialCo and ClimateCo are well positioned for success. Because of that obligation, it is important to know that between April 30, 2019 and the time the transaction closes, employees identified to be part of the new Industrial company are not permitted to transfer to corporate roles or Climate SBU/business roles, but may move to roles within the Industrial businesses.

Likewise, employees who will remain in a ClimateCo business or corporate role may not apply for any role in the Industrial businesses, but may move to a new Climate business or corporate role.

|

|

|

|

9.

|

Will any plants be closed?

|

Changes to plants or facilities are always subject to shifting business needs. We will continue to approach our manufacturing strategy as we do today to align operations with in-region business needs, now with a view toward the future of both the Industrial and Climate companies. Any changes will be communicated in a thoughtful manner that minimizes disruption to our people, customers and suppliers.

|

|

|

|

10.

|

What will happen to plants shared by both the Industrial and Climate segment?

|

There are four shared plants. Two will be part of IndustrialCo and two will remain with ClimateCo. To provide continuity of supply in a way that is mutually beneficial to both companies, we will establish transition services agreements for a period up to two years. In the meantime, we will operate as we do today while we evaluate a long-term plan for shared manufacturing locations, and will communicate with you and the works councils as appropriate, as more information becomes available.

|

|

|

|

11.

|

Will Ingersoll Rand be reducing headcount? On what timeline?

|

For Industrial Segment Employees

: Ingersoll Rand will continue to, and must, run its business in the ordinary course and in accordance with the terms of the transaction agreements with Gardner Denver. All employees

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

2

who are identified to transfer to IndustrialCo will have a position with IndustrialCo when it merges with Gardner Denver. Any future decisions about organizational structure after the merger will be made by IndustrialCo.

For Climate Segment and Corporate Employees

: Once the transaction is complete, we will evaluate our organizational structure and align it with a more focused business strategy and simplified business model. Though we don’t have details at this time, this evaluation may result in a reduction in headcount. We expect the transaction to close by early 2020, and plan to achieve as much simplification as possible through natural attrition and redeployment of people to new jobs.

|

|

|

|

12.

|

Is Ingersoll Rand continuing to fill open positions?

|

For Industrial Segment

: Ingersoll Rand will continue to, and must, run its business in the ordinary course and in accordance with the terms of the transaction agreement with Gardner Denver.

For Climate Segment

: In anticipation of a simplified ClimateCo organizational structure, we will continue to review all open roles to ensure they are absolutely essential.

|

|

|

|

13.

|

What do I say to my customers?

|

Please refer to the customer toolkit available on My Ingersoll Rand, which contains guidelines and helpful talking points that you can use in your conversations with your customers.

|

|

|

|

14.

|

Why are we announcing 2030 commitments when we just announced the intended split of the company?

|

We are nearing completion of our 2020 targets, and have been developing 2030 targets to keep us on the forefront of sustainability. We have been gradually sharing our 2030 direction with targeted stakeholders both internally and externally, and want to continue our positive momentum. Going forward, our 2030 aspirations will be core to the Climate company, and as part of our transition, we will work with the Industrial company’s management team to share our learnings and support their future direction.

|

|

|

|

15.

|

Have the 2030 commitments changed because of the split?

|

No. The large majority of the 2030 commitments are absolute targets (e.g. zero waste to landfill) and apply to businesses of any size.

|

|

|

|

16.

|

Where can I direct my questions?

|

Please talk to your leader with any questions. You can also submit them to the Corporate Communications email box. We will answer the most frequently asked questions on My Ingersoll Rand, and leaders and managers will be provided information to share with you as it becomes available.

Questions about IndustrialCo

|

|

|

|

17.

|

When will we learn more about changes to benefits and compensation?

|

At this time, there are no changes to your compensation or benefits as a result of this announcement. In the coming months more details will be shared by your managers and other leaders specific to what is changing for employees who will be part of IndustrialCo.

|

|

|

|

18.

|

What will happen with the Precision Flow Systems (PFS) acquisition?

|

The PFS acquisition closed on May 15, 2019 and PFS employees are now part of Ingersoll Rand. Subsequently, at transaction close with Gardner Denver, under the terms of the transaction agreement, Ingersoll Rand’s Industrial segment, which includes PFS employees, products and services, will transfer to IndustrialCo.

|

|

|

|

19.

|

Where will IndustrialCo corporate operations be based?

|

Following the completion of the transaction, IndustrialCo’s corporate operations will be based on a shared campus with ClimateCo in Davidson, North Carolina. Additional information on Davidson campus changes and utilization will be shared when it is available. There are no other location changes to share at this time.

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

3

|

|

|

|

20.

|

Can I reach out to my Gardner Denver counterpart now?

|

No. Until the transaction closes, Ingersoll Rand and Gardner Denver must avoid violating anti-trust laws and continue to operate as two separate entities and compete in the marketplace.

Questions about ClimateCo

|

|

|

|

21.

|

As a ClimateCo employee, will my benefits and compensation change?

|

For all employees of the ClimateCo, benefits will remain the same as they are under the current plan. Because the ClimateCo business is not new or part of the merger, there are no changes. As always, subject to collective bargaining agreements, ClimateCo reserves the right to amend or terminate any benefit plan or compensation arrangement at its discretion.

1

Ingersoll Rand intends to complete appropriate communication and information processes with local stakeholders and social partners per the typical process. Ingersoll Rand will adhere to local laws and regulations as applicable.

4

Additional Information and Where to Find It

In connection with the proposed transaction, Gardner Denver and Ingersoll Rand U.S. HoldCo, Inc. (“Ingersoll-Rand Industrial”) will file registration statements with the Securities and Exchange Commission (the “SEC”) registering shares of Gardner Denver common stock and Ingersoll Rand Industrial common stock in connection with the proposed transaction. Gardner Denver will also file a proxy statement, which will be sent to the Gardner Denver shareholders in connection with their vote required in connection with the proposed transaction. If the transaction is effected in whole or in part via an exchange offer, Ingersoll Rand will also file with the SEC a Schedule TO with respect thereto.

Ingersoll Rand shareholders are urged to read the prospectus and / or information statement that will be included in the registration statements and any other relevant documents when they become available, and Gardner Denver shareholders are urged to read the proxy statement and any other relevant documents when they become available, because they will contain important information about Gardner Denver, Ingersoll Rand Industrial and the proposed transaction.

The proxy statement, prospectus and/or information statement and other documents relating to the proposed transaction (when they become available) can be obtained free of charge from the SEC’s website at www.sec.gov. The proxy statement, prospectus and/or information statement and other documents (when they are available) will also be available free of charge on Ingersoll Rand’s website at http://ir.ingersollrand.com/investors/ or on Gardner Denver’s website at https://investors.gardnerdenver.com/.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This communication is not a solicitation of a proxy from any security holder of Gardner Denver. However, Ingersoll Rand, Gardner Denver and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of Gardner Denver in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Ingersoll Rand may be found in its Annual Report on Form 10-K filed with the SEC on February 12, 2019 and its definitive proxy statement relating to its 2019 Annual Meeting of Shareholders filed with the SEC on April 23, 2019. Information about the directors and executive officers of Gardner Denver may be found in its Annual Report on Form 10-K filed with the SEC on February 27, 2019, and its definitive proxy statement relating to its 2019 Annual Meeting of Shareholders filed with the SEC on March 26, 2019.

Forward-Looking Statements

This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between Ingersoll Rand and Gardner Denver. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including , but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including future financial and operating results and strategic benefits, the tax consequences of the proposed transaction, and the combined company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements.

These forward-looking statements are based on Gardner Denver and Ingersoll Rand’s current expectations and are subject to risks and uncertainties, which may cause actual results to differ materially from Gardner Denver and Ingersoll Rand’s current expectations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or

waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Gardner Denver may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Ingersoll Rand or Gardner Denver, or at all, (3) unexpected costs, charges or expenses resulting from the proposed transaction, (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of Gardner Denver and Ingersoll Rand Industrial, or at all, (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company and ClimateCo achieving revenue and cost synergies; (8) inability of the combined company and ClimateCo to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability, (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; and (14) other risk factors detailed from time to time in Ingersoll Rand and Gardner Denver’s reports filed with the SEC, including Ingersoll Rand and Gardner Denver’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this communication. Neither Ingersoll Rand nor Gardner Denver undertakes any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

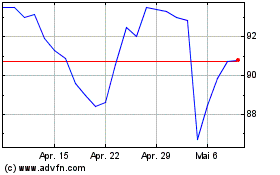

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024