U.S. Stocks Open Mixed on Earnings

25 April 2019 - 4:10PM

Dow Jones News

By Paul J. Davies

U.S. equities opened mixed Thursday, as investors continued to

weigh corporate earnings reports and poor economic data.

The Dow Jones Industrial Average fell 271 points, or 0.8%, to

26378 shortly after the opening bell, putting the index on course

for a second day of losses as shares of 3M tumbled on a

weaker-than-expected first-quarter earnings.

The S&P 500 dropped 0.1% and the Nasdaq Composite rose

0.4%.

The U.S. dollar crept up to its highest level in around two

years as economic data across the globe has turned weaker and

central banks, including the U.S. Federal Reserve and the European

Central Bank, have taken a dovish tone. Emerging markets felt the

ripples from that rally on Thursday with the Turkish lira, Russian

ruble and South African rand all sliding against the dollar.

The WSJ dollar index, which measures the dollar against a basket

of currencies, was up less than 0.1% at 91.11.

Elsewhere, the Stoxx Europe 600 index was down 0.2% and the

U.K.'s FTSE 100 dropped 0.6% as investors digested big falls in

revenue and profits in the first quarter from major banks UBS and

Barclays.

Shares of 3M fell 9.8% after the company reported first-quarter

profit and sales that missed expectations, slashed its full-year

guidance and said it would cut 2,000 jobs.

Microsoft's shares rose 4.6%. The software firm posted a 14%

increase in year-over-year quarterly sales, a larger rise than Wall

Street had anticipated.

Meanwhile, Tesla dropped 2.2% after the electric-auto maker

posted a quarterly loss that was wider than anticipated.

In Asia, the Korean Kospi index was down 0.5% after a

fourth-straight month of declining exports dragged on the local

economy. South Korean GDP shrank by 0.3% in the first quarter, its

worst performance in more than a decade. The result was a sharp

drop from 1% growth in the final quarter of 2018 and much worse

than expectations of 0.3% growth.

"The biggest quarterly contraction in Korean GDP since the

global financial crisis hit in fourth-quarter 2008 has to be bad

news," said Robert Carnell, chief economist in Asia at ING. "The

components of GDP weakness don't bode well for the quarter ahead.

It isn't hard to come up with a set of figures that would deliver

a...technical recession."

Stocks in China and Hong Kong were also lower even though the

Chinese central bank signaled support for the economy by saying it

had no intention of tightening monetary policy. Japan's central

bank was also supportive, revising its guidance to say it didn't

expect to increase interest rates for at least another year. The

Nikkei 225 rose about 0.5%.

Still, the Korean data has added to other weak numbers in recent

days, including worse-than-expected Australian inflation data and a

disappointing German business-climate survey.

Sweden is another country suffering unexpectedly low inflation,

which led its central bank on Thursday to delay its next expected

interest-rate rise, meaning it will now likely keep its main rate

at minus-0.25% for the rest of this year having previously

suggested a rise would come in the second half of 2019.

The Swedish Krona fell sharply against both the dollar and the

euro in response and was down more than 1% against both

currencies.

The steady drumbeat of signals has encouraged investors to put

more money into bonds than equities globally all year, according to

strategists at Barclays, lifting prices and pushing down

yields.

"Beyond the near-term reflationary effect of rising oil prices,

a hawkish shift [toward interest-rate rises] in central banks'

rhetoric is likely needed for bond yields to move much higher,"

they said.

U.S. 10-year Treasury yields also fell Wednesday, but were

marginally higher Thursday at 2.527% from 2.520%. Bond yields and

prices move in opposite directions.

Write to Paul J. Davies at paul.davies@wsj.com

(END) Dow Jones Newswires

April 25, 2019 09:55 ET (13:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

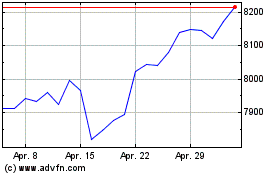

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024