Vetoquinol 2020 Sales: €427.5M (up 8.0% as Reported, up 10.9% at Constant Exchange Rate) Essentials Sales: €220.6M (up 15...

21 Januar 2021 - 6:00PM

Business Wire

Regulatory News:

Vetoquinol (Paris:VETO) CEO Matthieu Frechin said: “2020

was an exceptional year on a number of counts. Above all, it is

important to pay tribute to our teams, whose hard work and

exemplary dedication allowed us to manage the impact of the health

crisis. Year on year, we achieved double-digit sales growth at

constant exchange rates, driven by our Essentials products. This

momentum accounts for additional sales of €43 million (at constant

exchange rates). We also completed a major acquisition in the form

of the Drontal® and Profender® product ranges, entailing three

structural effects for Vetoquinol: a scale effect, a product mix

effect in the Essentials range and potential extensions, the first

of which has been confirmed in January 2021 for the Australian

market. We are optimistic for our business outlook in 2021, while

being vigilant in relation to the global sanitary situation.”

Vetoquinol Laboratory posted 2020 sales of €427.5 million, up

8.0% as reported and up 10.9% at constant exchange rates.

2020 sales of Essentials products totaled €220.6 million, up

17.3% at constant exchange rates. The momentum of Essentials

product sales was driven by the solid development of the existing

Essentials portfolio (+8.1%) and the contribution of the Drontal®

and Profender® ranges acquired on August 1st, 2020. Essentials

products accounted for 51.6% of Vetoquinol’s total sales in 2020,

up from 48.1% in 2019.

Sales of companion animal products came to €256.7 million and

accounted for 60% of total Vetoquinol sales, up 13.5% as reported;

they benefited from the impact of the lockdown associated with the

Covid-19 crisis as well as from the contribution of the Drontal®

and Profender® range. Sales of livestock products came to €170.7

million, stable as reported (+0.6%).

All strategic territories posted growth in 2020 at constant

exchange rates: +13.2% in Europe, +5.0% in the Americas and +17.4%

in Asia Pacific.

In 2020, exchange rates had a negative impact of €11.6 million

(-2.9%), primarily linked to the sharp decrease of the Brazilian

Real, and the depreciation of the Indian Rupee, USD and Canadian

dollar.

Fourth quarter sales amounted to €117.0 million, up 4.4% as

reported and up 9.3% at constant exchange rates. Acquisitions

boosted sales by 10.2%, offsetting the 4.9% negative impact of

exchange rate fluctuations and the basis effect linked to a strong

Q4 2019.

Covid-19 health situation as of January 21st, 2021

The mobilization of all its teams enabled Vetoquinol to monitor

the impact of the health crisis. The Group has preserved the health

and safety of its employees, maintained industrial activity,

continued to execute the Group’s projects and served its customers

without interruption throughout 2020.

The impact of Covid-19 has been particularly severe in the

Americas and Brazil.

Growth prospects for this market are below the target set at the

time of the Clarion acquisition. The Group is forecasting goodwill

impairment for Brazil in relation to this expected slowdown in

growth.

Vetoquinol’s financial structure as of December 31st, 2020

remains solid. Cash generation was strong during the second

semester 2020. The audit of Vetoquinol’s financial statements is in

progress at time of release.

€m

2020

2019

Variation (reported

data)

Variation (constant exchange

rates)

Variation (Like For Like)

Q1 Sales

103.4

90.9

+13.7%

+13.4%

+10.5%

Q2 Sales

92.7

92.9

-0.2%

+1.8%

+1.9%

Q3 Sales

114.4

100.1

+14.2%

+18.8%

+12.6%

Q4 Sales

117.0

112.1

+4.4%

+9.3%

-0.9%

Annual Sales

427.5

396.0

+8.0%

+10.9%

+5.8%

Next update: 2020 Annual Results - April 1st 2021 before

the opening of the stock exchange

ABOUT VETOQUINOL Vetoquinol is a leading global animal health

company that supplies drugs and non-medicinal products for the

livestock (cattle and pigs) and pet (dogs and cats) markets. As an

independent pure player, Vetoquinol designs, develops and sells

veterinary drugs and non-medicinal products in Europe, the Americas

and the Asia Pacific region. Since its foundation in 1933,

Vetoquinol has been pursuing a strategy combining innovation with

geographical diversification. The Group's hybrid growth is driven

by the reinforcement of its product portfolio coupled with

acquisitions in high potential growth markets. At December 31st

2020, Vetoquinol employs 2,409 people. Vetoquinol has been listed

on Euronext Paris since 2006 (symbol: VETO).

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators,

which are not defined by IFRS, provide additional information that

is relevant for shareholders seeking to analyze underlying trends

and Group performance and financial position. They are used by

management for performance analysis.

Essentials products: The products referred to as

“Essentials” comprise veterinary drugs and non-medical products

sold by the Vetoquinol Group. They are existing or potential

market-leading products designed to meet the daily requirements of

vets in the companion animal or livestock sector. They are intended

for sale worldwide and their scale effect improves their economic

performance.

Constant exchange rates: Application of the previous

period’s exchange rates to the current financial year, all other

things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in

terms of volume and/or price at constant exchange rates and

constant perimeter.

Fourth quarter sales reflect this pattern if we take into

account the base effect of high sales volumes in Q4 2019. As a

result, we approach the year ahead with confidence.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210121005700/en/

VETOQUINOL Investor Relations Fanny Toillon Tel.:

+33 (0)3 84 62 59 88 relations.investisseurs@vetoquinol.com

KEIMA COMMUNICATION Investor & Media Relations

Emmanuel Dovergne Tel.: +33 (0) 1 56 43 44 63

emmanuel.dovergne@keima.fr

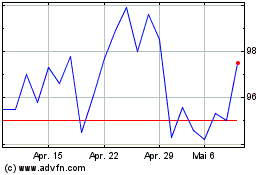

Vetoquinol (EU:VETO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Vetoquinol (EU:VETO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024