BKEN – Uplisting To QB Status

Vancouver, Canada -- April 16, 2018 -- InvestorsHub NewsWire --

www.penniesgonewild.com a leading independent micro

cap media portal with an extensive history of providing

unparalleled content for undervalued companies, reports on Bakken

Energy Corp. (OTC Pink: BKEN)

Highlights:

QB Tier

Gold

BKEN may not be at these levels much

longer.

See news, filings and more on Bakken Energy Corp. at https://www.otcmarkets.com/stock/BKEN/profile

Welcome to Orofino Gold Corporation. Orofino Gold Corp.

(ORFG.PK) is a Nevada-based gold producer that focuses on

discovery, acquisition, and expansion of mineral-rich resource

deposits primarily in the Americas. Orofino currently operates

producing mines in the Senderos de Oro area of Colombia, making it

a neighbor of nearby Ventana Gold Corp's proven La Bodega asset and

Greystar Resources Ltd's Angostura project. In addition, Orofino

has rights to other lands in the gold-producing region totaling

over 3,000 hectares as well as an option on a strong portfolio of

other small producers and development/exploration assets in the

region.

OTC QB Tier

The Company hire M&K CPAS PLLC of Houston, Texas to provide

Audited financial statements https://www.prnewswire.com/news-releases/bakken-energy-corp--the-company-announces-plans-to-hire-mk-cpas-pllc-of-houston-texas-to-provide-audited-financial-statements-628816063.html

Rumor on the street is that M&K CPAS PLLC has completed the

audited financial statements. Bakken is reviewing various business

opportunities. Official company news to confirm QB status rumored

to be coming in the coming days.

Gold

2018 Gold Price Forecast and Predictions

Jeff Clark, Senior Precious Metals

Analyst

Most price forecasts aren’t worth more than an umbrella in a

hurricane. There are so many factors, so many ever-changing

variables and dynamics, that even the most educated guess almost

always ends up wrong.

Further, some forecasts base their predictions on one issue.

“Interest rates will rise so gold will fall.” That’s not even an

accurate statement, let alone a sensible prediction (it’s

the real rate that affects gold prices—the rate

minus inflation).

So instead, my gold price forecast for

2018 will look at the primary factors that impact the gold market

to determine if each is likely to push the price higher or lower

this year. I’ll conclude with the probable prices I see based on

those factors, as well as some long-term projections.

The primary factors I think will impact the price of gold this

year are:

- The US Dollar

- Demand for Physical Gold

- Demand for Gold ETFs

- Central Bank Buying

- Activity of Commercial Speculator

- Trading Volumes on the COMEX

- Technical Indicators

- New Mine Supply

- Coming Economic and Monetary Factors

This will be fun, so let’s jump in.

The US Dollar

The US dollar fell 10.5% last year, a significant decline for a

currency and its biggest drop since 2003.

The factors that weighed on the dollar last year are expected to

exert similar pressure again this year. The biggest factor is

perhaps the Trump administration blatantly

stating it wants a weak dollar, primarily to support US

trade.

You probably know that generally speaking, the US dollar is

inversely correlated to gold, so if the dollar falls this year, as

I expect, then the gold price will…

Demand for Physical Gold

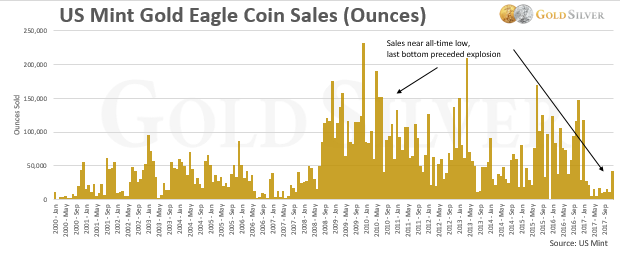

Demand for coins and bars was near an all-time low last year.

But the last time that happened it preceded a fury for demand for

metal, with the complacency peaking just before the 2008 financial

crisis.

With bullion sales at multi-year lows, it is much more

likely demand rises this year than falls.

Physical demand does not always push the price higher, but it does

support interest in gold, and the greater the interest, the more

likely gold is to…

Demand for Gold ETFs

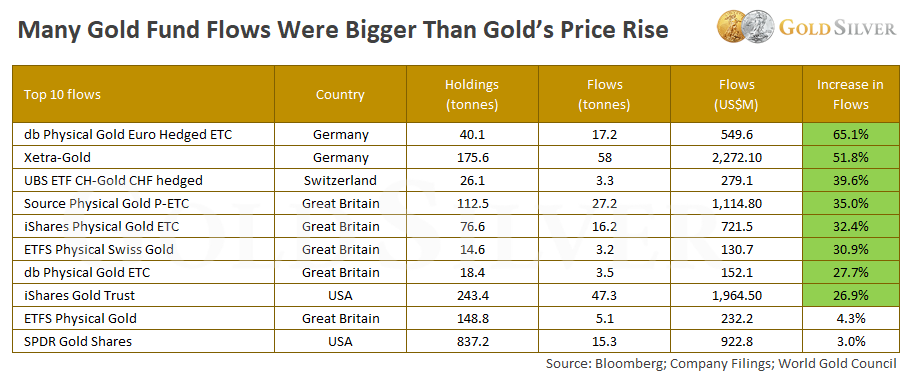

Gold-backed ETF holdings are now at their highest level since

2013.

Check out the increase in holdings from the top 10 gold ETFs in

the world last year.

This interest is likely to remain high this year, because the

reasons these investors bought gold—to hedge against overvalued

markets and insure against the increasing possibility of a

crisis—haven’t materialized yet. Continued ETF demand is

likely to push the price of gold…

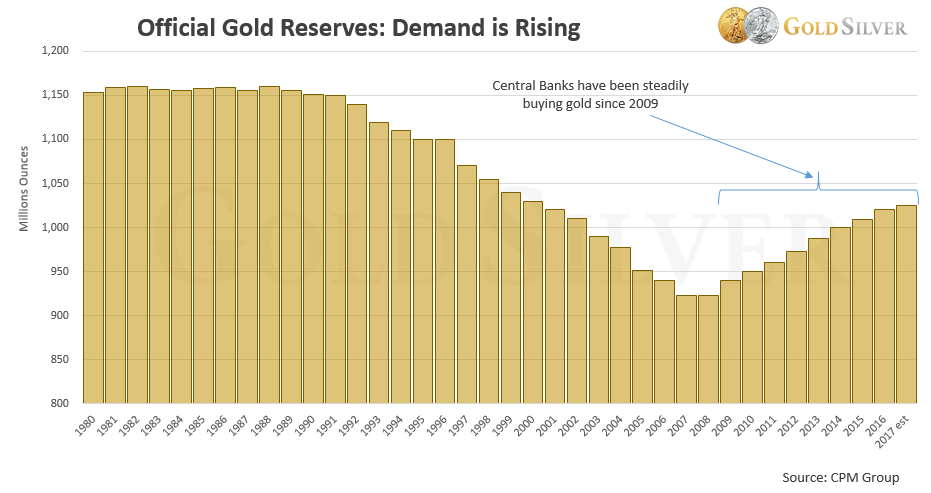

Central Bank Buying

Central banks around the world hold gold in their reserves. If they

think they need more, they buy more. Look what’s happened since

holdings bottomed in 2007:

Global central banks have been buying gold at an accelerated pace

for the past 10 years. Based on their recent activity, there is no

reason to believe they will stop. Their continued accumulation is a

source of support for the gold price.

Ongoing central bank buying = a gold price that is likely

to...

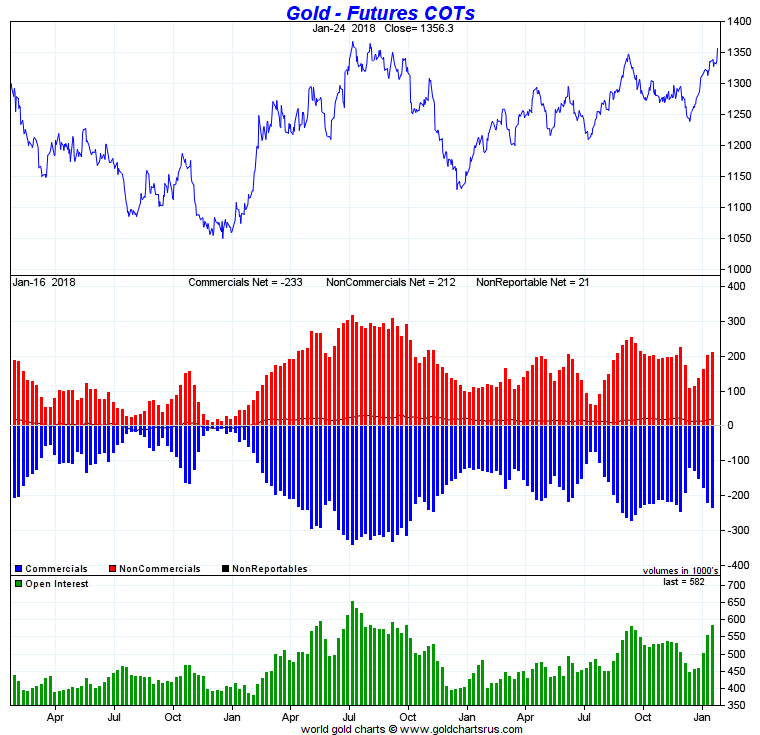

Activity of Commercial Speculators

Our friend Nick Laird at Goldchartsrus.com tracks

the “Commitment of Traders” report, which consists of the net

trading positions of commercial, non-commercial, and non-reportable

traders. Here’s the 3-year view

There has been a tug of war between these entities, though you can

see open interest is generally higher now than it was three years

ago, which corresponds to the rising price during that time period.

This data usually isn’t predictive except at extreme readings.

As of January 24, this factor provides no clear indication of

what gold will do this year.

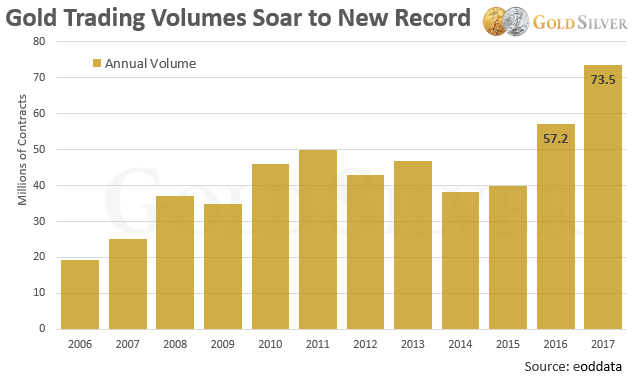

Trading Volumes on the COMEX

Meanwhile, gold-trading volumes on the COMEX have never been

higher:

Traders at the world’s largest futures market are buying more gold

contracts than they’re selling, a staunchly bullish

indicator. There’s no indication heightened activity at the

COMEX will stop, and if so the gold price will…

Technical Indicators

While most mainstream investors are ignoring gold, the technical

picture shows the price is coiling, which implies a big move is on

the way.

Our friend Dominick Graziano has amassed a seven-figure

brokerage account from his technical trading. His recent monthly

chart is eye-opening, and note his comments.

The trading range of the gold price continues to squeeze tighter

and tighter on a monthly basis, a technical sign that implies a

breakout is coming.

You can also see that the ADX (Average Directional Index)

indicator shows gold is building energy. The longer this

consolidation goes on, and the greater the buildup in energy, the

bigger the breakout will be. Dominick says that “long-term

consolidations are the most powerful when they finally break

out.”

The technical picture doesn’t tell us when this breakout will

occur, but as he says a new all-time high could be in the cards if

gold breaks to the upside.

The technical outlook for 2018 says the gold price is more than

likely to…

New Mine Supply

Almost all mining analysts, including yours truly, have been

sounding the alarm about the impending reversal in new gold

supply from mine production. Some reports say it will peak this

year, some say next year, a couple say it already has.

But regardless of the timing, the reality is that new mine

supply is about to reverse and begin a long-term decline. And the

biggest portion of coin and bar sales each year come from new mine

supply.

If demand stays at current levels or rises, and new supply

begins to fall, the gold price will respond to this basic

supply/demand equation and…

Coming Economic and Monetary Factors

All of the above reasons are fine and good, but one of the primary

reasons we’re overweight gold and silver at this point in history

is because of the numerous elevated risks that are present. Mike

discussed his Top 10 Reasons I Buy Gold and

Silver, which all point to a period that he believes will,

sooner or later, propel gold higher.

It is this big-picture backdrop for gold that tells us why

investors should hold physical bullion at this time and why the

price will ultimately end up much higher than it is now.

Here are a couple of these catalysts that could impact the gold

price in 2018:

Asset Bubbles: The bull market in stocks may or may not continue

in 2018, but no trend lasts forever. And given how far the stock

market has come, it’s only prudent to be wary of its bubbly

valuation.

If the Dow tanks or cryptos crater or bond yields soar or real

estate reverses, the resulting fear will push gold…

As the World Gold Council reports, “Should global financial markets

correct, investors could benefit from having an exposure to gold as

it has historically reduced losses during periods of financial

distress.”

Even the conservative World Bank issued a warning in their

January report: “Financial markets are vulnerable to unforeseen

negative news. They appear to be complacent.”

If investors are caught off guard, the fall in financial markets

could be bigger than average and quickly push investors into gold.

And since gold is inversely correlated to most major

asset classes, it is more likely to rise when stock markets

crash.

Inflation: Off the radar to the average Joe is the possibility

that inflation kicks in this year. Check out what’s been reported

in the past 30 days.

- Barron’s: “We expect to see inflation go up in 2018 across

developed markets relative to where it is today with the United

States leading the way.”

- Kiplinger: “Inflation will rise this year.”

- PIMCO: “Global inflation is likely to rise in 2018.”

- World Bank: “There could be faster than expected

inflation…”

- And The Wall Street Journal reported in mid-January

that “Investors Prepare for Inflation.”

This one is rather obvious: if inflation rises this year,

especially more than expected, then gold will:

What Could Push Gold Down

The primary things that could weigh on gold would be the stock

market continuing to soar or interest rates rising more than

expected, with no increase in inflation. If those things

happen and the other catalysts are subdued, then gold is likely

to:

My 2018 Gold Forecast

You can see that in my view most of the factors that impact gold

are expected to push the price higher this year.

Add it all up and my 2018 gold price forecast is:

- Minimum High: $1,420

- Potential High With No Crisis: $1,500 to $1,600

- Potential High With Major Crisis: $2,000 (new all-time

high)

- Likelihood the $1,050 Low (12-17-15) for This Cycle Is in:

80%

- Likelihood Gold Is Also Higher in 2019: 90%

- Potential 5-Year High: $3,000 to $10,000

The message from this analysis is that even if gold rises only

modestly this year, it has rarely been more important to own.

The strategy is clear: 2018 is likely to be the last year to buy

gold and silver at current levels, so dips in price should be

bought. https://goldsilver.com/blog/gold-price-forecast-predictions/

Conclusion

BKEN may not be at these levels much

longer.

See news, filings and more on Bakken

Energy Corp. at https://www.otcmarkets.com/stock/BKEN/profile

Other News:

WRFX-

WorldFlix Secures up to $16 Million in Carden Capital Deal and

Hosts Facebook Live CEO Chat

Company has seen a major surged do to a

$16 Million-dollar deal.

GRCV-

Grand Capital Ventures, Inc., Company soar on Friday not on news

but instead on changes that are coming to market makers like BMIC

and others.

MVES-

The Movie Studio, Inc. The company starting reversing after having

a panic sell-off. Recent changes on note restrictions can benefit

the company to continue its up trend.

About www.penniesgonewild.com

www.penniesgonewild.com is a

leading independent micro cap media portal with an extensive

history of providing unparalleled content for undervalued

companies. www.penniesgonewild.com focus on micro cap stocks that Wall Street stock

traders have ignored or haven’t found out about yet. We look for

strong management, innovation, strategy, execution, and the overall

potential for long- term growth. We are well known for discovering

undervalued companies. Read full disclosure at https://penniesgonewild.com/disclosure

All information contained herein as well

as on the www.penniesgonewild.com website is obtained from sources believed to be

reliable but not guaranteed to be accurate or all-inclusive. All

material is for informational purposes only, is only the opinion

of www.penniesgonewild.com and should not be construed as an offer or

solicitation to buy or sell securities. The information may include

certain forward-looking statements, which may be affected by

unforeseen circumstances and / or certain risks.

Please consult an investment

professional before investing in anything viewed within.

www.penniesgonewild.com has not been compensated for

this article. We may or may not have any shares in any companies

profiled by www.penniesgonewild.com

CONTACT:

Company: www.penniesgonewild.com

Contact Email: penniesgonewild@aol.com

SOURCE: www.penniesgonewild.com

Twitter: https://twitter.com/WildPennies

Movie Studio (PK) (USOTC:MVES)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Movie Studio (PK) (USOTC:MVES)

Historical Stock Chart

Von Jan 2024 bis Jan 2025