Two years ago, when the Board of Directors at Skyharbour Resources

Ltd. (TSX-V:SYH) asked Jordan Trimble to find a new direction for

the Vancouver-based mining micro-cap, his choice may have seemed

like mission impossible: uranium. Trimble and the team behind

Skyharbour recognized a unique opportunity given the industry was

still writhing from the bursting of the uranium bubble in 2007, the

2008 global financial meltdown, and Japan's 2011 Fukushima nuclear

plant disaster. He knew uranium prices were at their lowest in

years. But with the world's unquenchable appetite for energy, he

also saw an undervalued market and a lot of upside potential. "I

looked at a number of commodities, and uranium really stood out for

me," says Trimble, who was appointed as the company's President and

CEO in June 2013. "Being a contrarian, there's an unprecedented

opportunity in the uranium space."

Skyharbour Resources is well positioned to prosper as the

uranium market gains strength. To pool geological expertise and

funding, it joined forces last year with Athabasca Nuclear Corp.

(TSX-V:ASC), Noka Resources (TSX-V:NX) and Lucky Strike Resources

(TSX-V:LKY) to form the Western Athabasca Syndicate Partnership,

which controls a massive, 287,130-hectare (709,513-acre) collection

of five properties the bulk of which is on the western side of

Saskatchewan's uranium-rich Athabasca Basin. The group will spend

$6 million over the two years to explore the area. Skyharbour is

responsible for providing only $1 million of that total. The

syndicate model is a unique, cost-efficient and operationally

effective structure to conduct a large exploratory program without

substantial equity dilution to shareholders.

Skyharbour Resources also owns a 60 per cent stake in the Mann

Lake uranium project on the east side of the basin, 25 kilometres

southwest of Cameco's McArthur River Mine. Trimble says Northern

Saskatchewan boasts the world's largest reserves of high-grade

uranium, which offers some shelter from commodity price volatility.

Saskatchewan is also known for its stable, pro-mining business

environment. "The basin," he says, "is really one of the only

places in the world where you want to be looking for uranium right

now."

With Trimble at the helm, Skyharbour Resources has built a

strong team with a proven track record for delivering shareholder

value. The company's directors include industry veterans Jim

Pettit, the Chairman of the Board, and Don Huston, Skyharbour's

former president and CEO.

Tom Drolet, the company's new Technical Advisor and a former

president and CEO for Ontario Hydro International, believes that

several factors – including the 72 nuclear power plants expected to

come online by 2022 in China, Russia, India and other countries –

will help increase share prices for senior and intermediate uranium

producers going forward – with junior firms following soon after.

The impact of Russia's annexation of Crimea could accelerate this

trend. "Watch out for Russian aggression as it may affect supply

from Kazakhstan," he says, "and demand increases on the China side

may move markets a bit earlier."

The board also brings impressive uranium expertise with

geologist Rick Kusmirski, the company's Head Technical Advisor and

former Exploration Manager for uranium giant Cameco Corp. From 1999

until 2012, Kusmirski was vice-president of exploration and later

president and CEO of JNR Resources, helping to boost the uranium

firm's stock from 10 cents a share to over $4 a share. JNR was

ultimately acquired by Denison Mines Corp.

Skyharbour's flagship Preston Uranium Property in the basin's

Patterson Lake region is the largest single landholding near

Fission Uranium Corp.'s Patterson Lake South high-grade uranium

discovery and the recent discovery made by NexGen Energy on the

Rook 1 Project.

Uranium mineralization in this part of the basin is quite

shallow and basement-hosted. Skyharbour and its syndicate partners

have already carried out more than $2 million in exploration on the

property and have identified over a dozen high-priority drill

targets. The company along with its syndicate partners are in the

midst of their first drill program and are one of the few groups in

the area drilling this winter season.

With only 35 per cent of the property systematically explored so

far, they have already identified 15 high-potential drill targets

using techniques similar to those employed by Fission and NexGen.

"We're highly encouraged by what we've seen to date," says Trimble.

"It has greatly exceeded our expectations and illustrates the

strong discovery potential our property boasts."

On the eastern side of the basin, Skyharbour acquired a

60-per-cent interest in the 3,473-hectare Mann Lake Uranium Project

in January from Canterra Minerals. The purchase makes Skyharbour

one of the only small-cap mining companies with a land position in

this highly prolific part of the Athabasca Basin. Nearby deposits

and mines include Cameco's McArthur River Mine and Millennium

deposit as well as Denison's Phoenix deposit.

In March, Vancouver-based International Enexco Ltd. announced a

high-grade discovery on the Mann Lake Joint Venture property, which

sits adjacent to Skyharbour's Mann Lake holding. Days later,

Denison Mines announced plans to acquire International Enexco and

their 30 percent interest in the Mann Lake Joint Venture with

Cameco and AREVA Resources Canada. Between 2006 and 2008, over $3

million in exploration was carried out on Skyharbour's Mann Lake

property including two drill programs. Trimble says work may resume

there sooner than later. "Mann Lake could very well be the dark

horse for the company going forward," he goes onto say. "The

previous drilling intersected zones with elevated uranium and boron

values which bodes well for future exploration and discovery

potential on the property."

All in all, Skyharbour is one of the only small-cap mining

companies that offers investors exposure to two of the most active

areas of the Athabasca Basin: Patterson Lake on the west side and

Mann Lake on the east side. Investors are starting to take note.

The company just completed a non-brokered placement of over

$700,000, with strong investor interest increasing the financing

from the initial target of $500,000. Trading volume has increased

significantly, and the company's share price recently hit a 52-week

high of 18 cents. The stock has gradually increased over the past

year. "That's indicative," says Trimble, "of the shareholder value

we've been creating and will continue to create in the company."

Legal Disclaimer/Disclosure:

A fee has been paid for the production and distribution of this

Report. This document is not and should not be construed as an

offer to sell or the solicitation of an offer to purchase or

subscribe for any investment. No information in this article should

be construed as individualized investment advice. A licensed

financial advisor should be consulted prior to making any

investment decision. Financial Press makes no guarantee,

representation or warranty and accepts no responsibility or

liability as to its accuracy or completeness. Expressions of

opinion are those of the author's only and are subject to change

without notice. Financial Press assumes no warranty, liability or

guarantee for the current relevance, correctness or completeness of

any information provided within this article and will not be held

liable for the consequence of reliance upon any opinion or

statement contained herein or any omission. Furthermore, we assume

no liability for any direct or indirect loss or damage or, in

particular, for lost profit, which you may incur as a result of the

use and existence of the information, provided within this

article.

Also, please note that republishing of this article in its

entirety is permitted as long as attribution and a back link to

FinancialPress.com are provided. Thank you.

CONTACT: Skyharbour Resources (TSX-V:SYH)

777 Dunsmuir Street - Suite 1610

Vancouver, BC V7Y 1K4

Telephone: (604) 687-3376

Toll Free: 1-800-567-8181

Fax: (604) 687-3119

Email: info@skyharbourltd.com

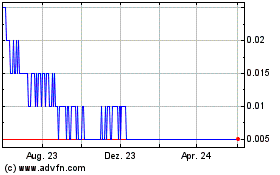

Lucky Minerals (TSXV:LKY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

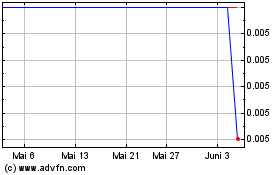

Lucky Minerals (TSXV:LKY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025