Titanium Transportation Group Inc. ("Titanium" or the "Company")

(

TSX:TTNM, OTCQX:TTNMF), announces that the

Toronto Stock Exchange (the “

TSX”) has accepted

Titanium’s notice to make a normal course issuer bid (the

“

Bid”) to purchase for cancellation up to

2,236,184 common shares in the capital of the Company

(“

Common Shares”) in total, being 5% of the issued

and outstanding Common Shares as at the day prior to Titanium’s

notice to the TSX, to be transacted through the facilities of the

TSX. The actual number of Common Shares that may be purchased

pursuant to the Bid will be determined by management of the Company

(“

Management”). The Bid will commence on October

18, 2023 and will terminate on October 17, 2024, or such earlier

time as the Bid is completed or terminated at the option of

Titanium.

Purchases pursuant to the Bid will be made by

Canaccord Genuity Corp. (“Canaccord”) on behalf of

the Company. Decisions regarding the timing of purchases under the

Bid will be determined by Management based on market conditions,

share price and other factors. Management may elect to not purchase

any Common Shares under the Bid, or may elect to suspend or

discontinue the Bid at any time. Any purchases pursuant to the Bid

will be financed from the working capital of Titanium.

In accordance with the rules of the TSX

governing normal course issuer bids, the total number of Common

Shares the Company is permitted to purchase is subject to a daily

purchase limit of 8,024 Common Shares, representing 25% of the

average daily trading volume of Common Shares on the TSX calculated

for the six-month period ended September 30, 2023, being

approximately 32,098 Common Shares. However, the Company may make

one block purchase per calendar week which exceeds the daily

repurchase restriction. The price that Titanium will pay for any

Common Shares under the Bid will be the prevailing market price on

the TSX at the time of such purchase.

The Board of Directors of Titanium believes that

the underlying value of the Company may not be accurately reflected

at times in the market price of the Common Shares. Accordingly, the

purpose of the Bid is to enhance long-term shareholder value

through the purchase and cancellation of Common Shares at a

discount to the underlying value of the Company. Furthermore, the

purchases by Titanium will help mitigate the dilutive effects of

any future potential issuances of additional Common Shares as

consideration for capital raises, joint ventures or asset

acquisitions.

A copy of the Form 12 (Notice of Intention to

Make a Normal Course Issuer Bid) filed with the TSX in connection

with the Bid can be obtained from the Company upon request without

charge.

As of the close of business on October 5, 2023

(being the day prior to Titanium’s aforementioned notice to the TSX

regarding the Bid), the Company had 44,723,685 Common Shares issued

and outstanding.

Under the Company’s previous Bid, which had

started on September 13, 2022, and ended on September 12, 2023, up

to 2,242,765 Common Shares were approved for purchase through the

facilities of the TSX, and the Company ultimately purchased 723,970

Common Shares at an average price of approximately $2.7015.

Automatic Securities Purchase

Plan

In connection with the Bid, Titanium has entered

into an Automatic Securities Purchase Plan

(“ASPP”) with Canaccord. The ASPP is intended to

allow for the purchase of Common Shares under the Bid when Titanium

would ordinarily not be permitted to purchase Common Shares due to

regulatory restrictions and customary self-imposed blackout

periods.

Pursuant to the ASPP, Titanium has provided

instructions to the designated broker to make purchases under the

Bid in accordance with the terms of the ASPP, which may not be

varied or suspended during the term of the ASPP. Such purchases

will be determined by the designated broker at its sole discretion

based on purchasing parameters set by Titanium in accordance with

the rules of the TSX, applicable securities laws and the terms of

the ASPP. Common Shares will be purchased through the facilities of

the TSX or through a Canadian alternative trading system. The ASPP

has been pre-cleared by the TSX and will be implemented on October

18, 2023, and if not terminated sooner based on the terms of the

ASPP, will end on October 17, 2024.

Outside of pre-determined blackout periods,

Common Shares may be purchased under the Bid based on management’s

discretion, in compliance with TSX rules and applicable securities

laws. All purchases made under the ASPP will be included in

computing the number of Common Shares purchased under the Bid.

About Titanium

Titanium is a leading North American

transportation company with asset-based trucking operations and

logistics brokerages servicing Canada and the United States, with

approximately 1000 power units, 3,300 trailers and 1,300 employees

and independent owner operators. Titanium provides truckload,

dedicated, and cross-border trucking services, logistics, and

warehousing and distribution to over 1,000 customers. In the U.S.,

Titanium has established both asset-based and brokerage operations

in Canada and the U.S. with eighteen (18) locations. Titanium is a

recognized purchaser of asset-based trucking companies, having

completed thirteen (13) transactions since 2011. Titanium ranked

among top 500 companies in the inaugural Financial Times Americas’

Fastest Growing Companies in 2020. The Company was ranked by

Canadian Business as one of Canada's Fastest Growing Companies for

eleven (11) consecutive years. For three (3) consecutive years,

Titanium has also been ranked one of Canada’s Top Growing Companies

by the Globe and Mail’s Report on Business of Canada. Titanium is

currently listed on the Toronto Stock Exchange under the symbol

“TTNM" and “TTNMF” on the OTCQX.

Forward-Looking Statements

Certain statements in this news release constitute

"forward-looking information" within the meaning of applicable

Canadian securities legislation. Forward-looking statements and

information are provided for the purpose of providing information

about management's expectations and plans relating to the future.

All of the forward-looking information made in this news release is

qualified by the cautionary statements below and those made in our

other filings with the securities regulators in Canada.

Forward-looking information contained in forward-looking statements

can be identified by the use of words such as "are expected," "is

forecast," "is targeted," "approximately," "plans," "anticipates,"

"projects," "anticipates," "continue," "estimate," "believe" or

variations of such words and phrases or statements that certain

actions, events or results "may," "could," "would," "might," or

"will" be taken, occur or be achieved. All statements, other than

statements of historical fact, may be considered to be or include

forward-looking information. This news release contains

forward-looking information regarding, among other things, the

number of Common Shares to be purchased pursuant to the Bid and the

benefits of the Bid, including the enhancement of long term

shareholder value, Titanium's future outlook and anticipated

events, including the financial position, business strategy,

budgets, litigation, projected costs, capital expenditures,

financial results, taxes and plans and objectives of or involving

Titanium. The Company has made numerous assumptions with respect to

forward-looking information contained herein, including, among

other things, assumptions set forth in the AIF and the Company’s

most recent management’s discussion and analysis, as well as other

public disclosure documents that can be accessed under the issuer

profile of "Titanium Transportation Group Inc." on SEDAR at

www.sedar.com. Forward-looking information involves a number of

known and unknown risks and uncertainties, including among others:

the risk of Titanium not meeting the forecast plans regarding its

operations and financial performance; the impact of the COVID-19

pandemic on the Company’s business and results of operations, the

performances of domestic and international economies and their

effect on shipping volumes, weather conditions, labour relations,

pricing and competitors’ marketing activities and other risks

inherent to the transportation industry, which, if incorrect, may

cause actual results to differ materially from those anticipated by

the Company and described herein. Accordingly, readers should not

place undue reliance on forward-looking information.

The forward-looking information set forth herein reflects the

Company's reasonable expectations as at the date of this news

release and is subject to change after such date. The Company

disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law. The forward-looking information contained in this news release

is expressly qualified by this cautionary statement.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any State in which such offer, solicitation or sale

would be unlawful. The securities being offered have not been, nor

will they be, registered under the United States Securities Act of

1933, as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the United States Securities Act of

1933, as amended, and applicable state securities laws.

CONTACT INFORMATION

Titanium Transportation Group Inc.Ted Daniel, CPA, CAChief

Executive Officer(905) 266-3011investors@ttgi.comwww.ttgi.com

For Investors James Bowen,

CFA416-519-9442James.Bowen@loderockadvisors.com

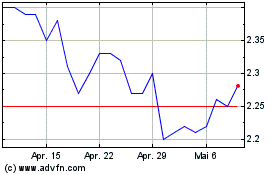

Titanium Transportation (TSX:TTNM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Titanium Transportation (TSX:TTNM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024