Toromont Industries Ltd. (TSX: TIH) today reported financial

results for the three months and year ended December 31, 2020.

| |

|

|

|

|

|

|

|

|

|

Three months ended December 31 |

|

Years ended December 31 |

|

millions, except per share amounts |

|

2020 |

|

2019 |

% change |

|

|

2020 |

|

2019 |

% change |

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

992.2 |

$ |

1,025.2 |

(3 |

%) |

|

$ |

3,478.9 |

$ |

3,678.7 |

(5 |

%) |

| Operating income |

$ |

127.2 |

$ |

128.2 |

(1 |

%) |

|

$ |

372.4 |

$ |

412.5 |

(10 |

%) |

| Net earnings |

$ |

89.0 |

$ |

90.5 |

(2 |

%) |

|

$ |

254.9 |

$ |

286.8 |

(11 |

%) |

| Basic earnings per share

("EPS") |

$ |

1.08 |

$ |

1.10 |

(2 |

%) |

|

$ |

3.10 |

$ |

3.52 |

(12 |

%) |

|

|

|

|

|

|

|

|

|

“In what has been a unique year of challenges and opportunities,

we are very pleased with the performance of our team and overall

results,” stated Scott J. Medhurst, President and Chief Executive

Officer of Toromont Industries Ltd. “The Toromont team took

decisive action, remaining focused on safeguarding our employees,

servicing our customers’ needs and protecting our business for the

future. We were fortunate early on to have been designated an

essential service in all of our territories, and since initial

shutdowns and restrictions, we experienced gradual improvement in

most market segments for the balance of the year. We appreciate our

entire team’s incredible effort and on-going commitment to adapt to

changes in the business environment, safely support our customer’s

requirements, all while facilitating a critical system conversion

in the Atlantic and Quebec operations, which sets us up well for

the next phase of our integration.”

Highlights:

Consolidated results

- Revenues in the fourth quarter were $1 billion, down 3% from

the similar period last year. Equipment Group revenues were down 4%

on lower economic activity levels stemming mainly from the

pandemic. Revenues at CIMCO were 3% higher due mainly to progress

on construction projects within the Canadian industrial

segment.

- Operating income(1) was 1% lower in the fourth quarter on the

lower revenues, largely offset by lower expenses. Expenses were

lower than last year as initiatives implemented early on in the

year continued. Subsidies accrued under the Canada Emergency Wage

Subsidy program (“CEWS”) totalled $4.7 million in the

quarter.

- Revenues decreased 5% to $3.5 billion for the year compared to

2019. While some recovery phased in during the latter half of the

year, revenues were still below prior year levels in many areas.

Equipment Group revenues were 5% lower and CIMCO was down 7% on a

year-over-year basis.

- Operating income was 10% lower year-to-date in part reflecting

lower revenues. Gross margins declined on reduced rental fleet

utilization and lower product support margins stemming from

productivity levels associated with the pandemic. Selling and

administrative expenses were down 6% from last year on the lower

revenues. Cost containment strategies implemented early in the year

reduced expense levels and offset additional expenses incurred to

support and protect employees through the pandemic and resulting

slowdown. Subsidies accrued under the CEWS program totalled

$12.8 million for the year. Operating income margin(1)

decreased 50 basis points (“bps”) to 10.7%.

- Backlogs(1) were $557.4 million at December 31, 2020, compared

to $394.8 million at December 31, 2019. CIMCO backlogs were

healthy on strong industrial booking activity in early 2020.

Equipment Group backlogs were higher across all market segments,

reflecting improved market sentiment towards the end of

2020.

- Net earnings for the fourth quarter were $88.9 million and

basic EPS (earnings per share) was $1.08, both down 2% from the

fourth quarter of 2019 mainly due to the lower activity

levels.

- For the year, net earnings 2020 were $254.9 million, down 11%

from 2019, with basic EPS down 12% to $3.10, reflective of the

lower activity levels, most significantly experienced in Q2 of

2020.

Equipment Group

- For the fourth quarter, revenues were down $36.2 million or 4%.

Equipment revenues were lower on a tough comparable last year, and

despite improvement in construction markets, which saw some

resumption of activity and market confidence. Rental revenues were

lower on reduced activity in light equipment and a lower RPO fleet

(“rent with a purchase option”). Product support activity was off

1% from last year as market activity continues to improve from

levels experienced earlier this year.

- Operating income in the fourth quarter was down $2.8 million

(2%). Gross margins were largely unchanged while expense levels

were lower, reflecting good focus on variable cost control.

Operating income was 12.8% of revenues compared to 12.6% in the

comparable period last year.

- For the year, revenues were down 5% or $177.9 million to $3.2

billion on reduced economic activity experienced from the onset of

the pandemic earlier in the year. Equipment sales, product

support and rental activity were lower across most geographic

markets and product groups.

- For the year, operating income decreased 10% or $38.1 million

in part reflecting the lower revenues. Gross margins were lower on

reduced fleet utilization while product support margins declined on

reduced productivity. Expense levels were lower, reflecting good

focus on variable cost control. Human resource initiatives

including selective pay reductions, work share programs and the

CEWS program also served to reduce expense levels, while offsetting

some additional expenses incurred during this transitional time in

support of our workforce. Operating income was 10.9% of revenues

compared to 11.5% in the comparable period last year.

- Bookings(1) in 2020 increased $101.8 million (7%) to $1.6

billion, with increases across all market segments. Bookings in the

fourth quarter were up 36% ($148.2 million) to $563.3 million, on

strong construction, mining, and agricultural orders, partially

offset by lower power systems and material handling lift truck

orders. Backlogs increased $100.7 million (37%) to $373.0

million, most of which is expected to be delivered in 2021.

CIMCO

- Revenues in the fourth quarter were $95.3 million, up $3.2

million (3%) with good activity in both package sales and product

support. Operating income increased $1.7 million (17%) versus last

year on the higher revenues, good project execution and lower

expenses.

- For the year, revenues were down $22.0 million (7%) to $312.8

million. Revenues in Canada were lower as pandemic-related site

restrictions slowed down activity levels in both construction and

product support. US revenues reflect continued growth in both

construction and product support on generally fewer restrictions

and focus on operational execution.

- For the year, operating income was down by $2.0 million (7%) in

2020, largely reflecting the lower revenues. Operating income

margin was 8.5% unchanged versus last year as good project

execution and management of variable costs offset the lower

revenues.

- Bookings of $228.3 million for the year were up $34.7 million

(18%). Industrial activity continues to be strong with market

investment in the expansion and upgrades to the critical food

supply network, with good orders in Canada (up 51%). Recreational

activity has declined as market investment reflects facility

restrictions. Fourth quarter bookings were down $20.0 million to

$24.5 million with lower orders in both market segments, however

periodic bookings can vary.

- Backlogs of $184.4 million at December 31, 2020 were up

$61.9 million (51%), substantially all of which is expected to

be realized as revenue in 2021, subject to construction schedules.

This represents a strong level for this time of year.

Financial Position

- Toromont’s share price of $89.20 at the end of 2020, translates

to a market capitalization(1) of $7.4 billion and a total

enterprise value(1) of $7.4 billion.

- The Company maintained a very strong financial position.

Leverage, as represented by the net debt to total capitalization(1)

ratio decreased to 3% at the end of December 31, 2020

from 15% at the end of December 31, 2019.

- As approved by the Board of Directors the quarterly dividend of

31 cents per common share, is payable on April 1, 2021 to

shareholders of record on March 9, 2021.

- Return on opening shareholders’ equity was 16.6% for 2020,

compared to 21.4% for 2019, reflecting the lower net earnings

and slightly higher equity. Return on capital employed was 20.4%

for 2020, compared to 22.9% for 2019. Capital employed was

reflectively consistent year-over-year with a strong focus on asset

management.

“While market activity has improved gradually

through the latter half of the year, it remained below last year’s

level,” continued Mr. Medhurst. “Our order backlog improved heading

into 2021, and our workforce and information technology systems are

well positioned to support the current and future operating

environment. The diversity of our geographical landscape and

markets served, extensive product and service offerings, and

financial strength together with our disciplined operating culture,

continue to position us well for the long term. We are very proud

of our team’s ability to navigate through this pandemic and protect

the interests of our employees, customers and stakeholders.”

Corporate Development

The Board of Directors is pleased to announce

that it has appointed one new independent director, Mr. Ben

Cherniavsky, effective immediately.

“We are extremely pleased to have Mr.

Cherniavsky joining the Board of Directors,” said Robert M.

Ogilvie, Chair, Toromont. “In addition to his substantial

business acumen, Ben brings a wealth of knowledge about our

industry gained through over 20 years of analysis and reporting as

well as experience in public markets.”

Mr. Cherniavsky was Managing Director, Equity

Analyst & Head of Industrials Research at Raymond James, a

global investment bank. During his tenure there, he managed a team

of analysts who covering a wide range of publicly-traded industrial

and transportation companies. Mr. Cherniavsky’s direct coverage

included the infrastructure & construction sector. Prior to

Raymond James, Mr. Cherniavsky worked in public finance with

Canada’s federal Department of Finance and the University of

Toronto’s International Centre for Tax Studies at the Rotman School

of Management. Mr. Cherniavsky holds a BA from the University of

Alberta and an M.B.A. from the University of Western Ontario,

Richard Ivey School of Business.

With this addition, the Company’s Board of

Directors will consist of eleven members, of whom ten are

independent.

Financial and Operating

Results

All comparative figures in this press release

are for the fourth quarter and fiscal year ended December 31, 2020,

compared to the fourth quarter and fiscal year ended December 31,

2019. All financial information presented in this press release has

been prepared in accordance with International Financial Reporting

Standards ("IFRS") and are reported in Canadian dollars. This press

release contains only selected financial and operational highlights

and should be read in conjunction with Toromont's audited

consolidated financial statements and related notes and

Management's Discussion and Analysis ("MD&A") for the year

ended December 31, 2020, which are available on SEDAR at

www.sedar.com and on the Company's website at www.toromont.com. The

Company's audited consolidated financial statements and MD&A

contain detailed information about Toromont's financial position,

results, liquidity and capital resources, strategy, plans and

outlook, which investors are encouraged to read carefully.

Quarterly Conference Call and Webcast

Interested parties are invited to join the quarterly conference

call with investment analysts, in listen-only mode, on Thursday,

February 11, 2021 at 7:00 a.m. (ET). The call may be accessed by

telephone at 1-800-898-3989 (toll free) or 416-406-0743 (Toronto

area), participant passcode 8101001# is required. A replay of the

conference call will be available until Thursday,

February 18, 2021 by calling 1-800-408-3053 or

905-694-9451 (Toronto area) and quoting passcode 2221293# to

listen. Both the live webcast and the replay of the quarterly

conference call can be accessed at www.toromont.com.

Presentation materials to accompany the call will be available

on our investor page on our website.

Advisory

Information in this press release that is not a

historical fact is "forward-looking information". Words such as

"plans", "intends", "outlook", "expects", "anticipates",

"estimates", "believes", "likely", "should", "could", "will", "may"

and similar expressions are intended to identify statements

containing forward-looking information. Forward-looking information

in this press release reflects current estimates, beliefs, and

assumptions, which are based on Toromont’s perception of historical

trends, current conditions and expected future developments, as

well as other factors management believes are appropriate in the

circumstances. Toromont’s estimates, beliefs and assumptions are

inherently subject to significant business, economic, competitive

and other uncertainties and contingencies regarding future events

and as such, are subject to change. Toromont can give no assurance

that such estimates, beliefs and assumptions will prove to be

correct. This press release also contains forward-looking

statements about the recently acquired businesses.

Numerous risks and uncertainties could cause the

actual results to differ materially from the estimates, beliefs and

assumptions expressed or implied in the forward-looking statements,

including, but not limited to: business cycles, including general

economic conditions in the countries and regions in which Toromont

operates; commodity price changes, including changes in the price

of precious and base metals; potential risks and uncertainties

relating to the novel COVID-19 global pandemic, including an

economic downturn, reduction or disruption in supply or demand for

our products and services, or adverse impacts on our workforce,

capital resources, or share trading price or liquidity, and

increased regulation of or restrictions placed on our businesses;

changes in foreign exchange rates, including the Cdn$/US$ exchange

rate; the termination of distribution or original equipment

manufacturer agreements; equipment product acceptance and

availability of supply; increased competition; credit of third

parties; additional costs associated with warranties and

maintenance contracts; changes in interest rates; the availability

of financing; potential environmental liabilities of the acquired

businesses and changes to environmental regulation; failure to

attract and retain key employees; damage to the reputation of

Caterpillar, product quality and product safety risks which could

expose Toromont to product liability claims and negative publicity;

new, or changes to current, federal and provincial laws, rules and

regulations including changes in infrastructure spending; any

requirement of Toromont to make contributions to the registered

funded defined benefit pension plans, postemployment benefits plan

or the multi-employer pension plan obligations in which it

participates and acquired in excess of those currently

contemplated; and ability to secure insurance coverage and cost of

premiums. Readers are cautioned that the foregoing list of factors

is not exhaustive.

Any of the above mentioned risks and

uncertainties could cause or contribute to actual results that are

materially different from those expressed or implied in the

forward-looking information and statements included in this press

release. For a further description of certain risks and

uncertainties and other factors that could cause or contribute to

actual results that are materially different, see the risks and

uncertainties set out in the "Risks and Risk Management" and

"Outlook" sections of Toromont’s most recent annual MD&A, as

filed with Canadian securities regulators at www.sedar.com or at

our website www.toromont.com. Other factors, risks and

uncertainties not presently known to Toromont or that Toromont

currently believes are not material could also cause actual results

or events to differ materially from those expressed or implied by

statements containing forward-looking information.

Readers are cautioned not to place undue

reliance on statements containing forward-looking information,

which reflect Toromont’s expectations only as of the date of this

press release, and not to use such information for anything other

than their intended purpose. Toromont disclaims any obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

required by law.

About Toromont

Toromont Industries Ltd. operates through two

business segments: the Equipment Group and CIMCO. The Equipment

Group includes one of the larger Caterpillar dealerships by revenue

and geographic territory - spanning the Canadian provinces of

Newfoundland & Labrador, Nova Scotia, New Brunswick, Prince

Edward Island, Québec, Ontario and Manitoba, in addition to most of

the territory of Nunavut. The Group includes industry leading

rental operations, a complementary material handling business and

an agricultural equipment business. CIMCO is a market leader in the

design, engineering, fabrication and installation of industrial and

recreational refrigeration systems. Both segments offer

comprehensive product support capabilities. This press release and

more information about Toromont Industries Ltd. can be found at

www.toromont.com.

For more information contact:

Michael S. McMillanExecutive Vice President and

Chief Financial OfficerToromont Industries Ltd.Tel: (416)

514-4790

FOOTNOTES

- These financial metrics do not have a standardized meaning

under International Financial Reporting Standards (IFRS), which are

also referred to herein as Generally Accepted Accounting Principles

(GAAP), and may not be comparable to similar measures used by other

issuers. These measurements are presented for information purposes

only. The Company’s MD&A includes additional information

regarding these financial metrics, including definitions and a

reconciliation to the most directly comparable GAAP measures, under

the headings “Additional GAAP Measures”, “Non-GAAP Measures” and

“Key Performance Indicators.”

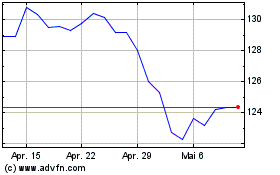

Toromont Industries (TSX:TIH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Toromont Industries (TSX:TIH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024