Sangoma Technologies Corporation (TSX: STC; Nasdaq: SANG)

("Sangoma" or the “Company”), a trusted leader in delivering

cloud-based Communications as a Service solutions for companies of

all sizes, today announced it has acquired NetFortris Corporation

(“NetFortris”). This acquisition further accelerates Sangoma into

the upper echelon of SaaS communications providers and extends our

industry leading suite of cloud services with new MSP capabilities,

thereby delivering even more ‘one stop shopping’ for our customers

and providing larger ‘share of wallet’ for Sangoma.

NetFortris provides UCaaS and cloud-based, fully

managed MSP (managed service provider) solutions for businesses of

all sizes and across all industries. They have approximately 250

employees and four primary offices in Dallas, Seattle, Los Angeles,

and Manila. In addition to NetFortris’ UCaaS offering, their MSP

product line delivers all the mission critical communications

services that customers need to complement their ‘as a Service’

applications, such as managed network security, managed SD-WAN,

managed network access, monitoring, etc. These MSP services are

built upon a highly integrated, end-to-end managed network, backed

up by an expert 24/7 network engineering team. NetFortris has over

6,000 customers in North America, over 60,000 seats, with very low

customer concentration, and generates expected annualized revenue

of just over USD $50 million.

Pursuant to the definitive stock purchase

agreement dated March 28, 2022, Sangoma has acquired NetFortris for

USD $68 million in upfront, fixed consideration (the “Upfront

Consideration”) and up to USD $12 million in an ‘Earn-out’ (the

“Contingent Consideration”), for total consideration of up to USD

$80 million if the Contingent Consideration is fully earned. The

transaction is now closed.

“A critical part of our existing strategy, and

of our competitive differentiation, involves providing customers

with the widest set of cloud communications services in our

industry, avoiding the need for them to buy five different services

from five different vendors,” said Bill Wignall, President and CEO

of Sangoma. “The acquisition of NetFortris further extends that

strategy in such a perfectly natural manner. Not only can customers

already get from Sangoma all the ‘aaS’ products they use today, but

now they will also be able to obtain all the other cloud-based MSP

services they know they need, such as managed network security,

managed access, and managed SD-WAN. This truly is ‘one stop

shopping’ for our customers, and it taps into that very important

new trend that so many of us in the industry see starting to

emerge. I am most excited about this acquisition, our eleventh in

eleven years, because it demonstrates our innovative, unique,

forward-looking vision and it continues to push Sangoma ahead in

the market, further differentiating us from the competition.”

Strategic and Financial Rationale

- There is growing awareness

that customers will prefer to get more and more of their

communications services from one vendor. Not only over-the-top

“aaS” cloud communication apps (UCaaS, CCaaS, TaaS, VMaaS, CPaaS,

Collaboration, etc.), but also the network

security/connectivity/redundancy/monitoring/etc. they know they

need: not only does this transaction satisfy that growing

trend, but it does so in a way which is a perfectly natural fit

with our existing strategy of offering ‘one stop shopping’, by

simply extending our industry leading suite of ‘aaS’ products, with

this new set of complementary MSP services.See what a leading

industry analyst has to say about this trend:“Our research

continues to show that customers want one vendor to go to for their

cloud communications and collaboration requirements, and many

organizations also prefer to purchase additional services – e.g.,

cybersecurity, broadband, etc. – from their UCaaS providers. With

the addition of NetFortris, Sangoma’s approach will resonate

extremely well with customers of all sizes,” said Elka Popova, VP

of Connected Work Research, at Frost & Sullivan.In addition to

our end customers, some of Sangoma’s existing channel partners are

also in the MSP business already, and this will give us the

opportunity to meet more of their need for such products and

services as well.

- Very Strong Recurring

Revenue: NetFortris generates over 90% of its revenue in

MRR, which will bring Sangoma closer to 75% (pro-forma) of our

revenue in Services.

- Increases Scale and

Position in Cloud Communications: an additional 60,000

seats and over USD $50 million in expected annualized revenue will

help maintain Sangoma’s position in the top-tier of a consolidating

market.

- Compelling

Valuation: acquiring an ‘at-scale’ cloud communications

company at approximately 1.3x revenue.

- Diversified Customer Base

with a Familiar Channel Model: a customer base of over

6,000 clients with minimal concentration, an average customer life

approaching seven years, and a channel structure that is very

similar to what Sangoma uses today, make for sticky clients.

- Opens Up New Potential

M&A Opportunities: new possible acquisition targets in

this category of MSPs, to complement those in the UCaaS space.

- Meaningful OPEX

Synergies: opportunities have been identified for expected

annual cost savings starting in the first six months.

- Strong Management and

Operating Talent: deep skills and experience are very

valuable during these times of intense competition for talent.

Transaction Details

This transaction involved a purchase by Sangoma

of 100% of the outstanding equity in NetFortris.

The Upfront Consideration of USD $68 million was

satisfied through a combination of cash and Sangoma common shares.

The upfront cash amount was USD $48.8 million and the upfront

equity amount was USD $19.2 million. Based upon the fixed, upfront

portion of the purchase price, the implied valuation is

approximately 1.3x expected annualized revenue.

The cash portion of the Upfront Consideration

was funded through a combination of cash on hand and, to minimize

dilution, an amended credit facility with its existing lenders.

Sangoma will have approximately USD $110 million of debt on a

pro-forma basis, equating to approximately 2.3x pro-forma net debt

to Adjusted EBITDA1. The equity portion of the Upfront

Consideration was satisfied by issuing approximately 1.5 million

common shares of Sangoma, and such number of common shares issued

was based on the fifteen (15)-day volume weighted average price of

Sangoma’s common shares as of March 25, 2022.

The Contingent Consideration shall be based on

the achievement of certain business performance metrics and, to the

extent earned, be paid in cash after 12 months from the date of

closing.

Advisors

INFOR Financial Inc. is serving as financial

advisor to Sangoma and Norton Rose Fulbright US LLP and Norton Rose

Fulbright Canada LLP are acting as U.S. and Canadian legal counsel

to Sangoma. Q Advisors LLC is serving as financial advisor to

NetFortris and Dentons LLP are acting as U.S. and Canadian legal

counsel to NetFortris.

Conference Call Details

Sangoma will discuss this acquisition more fully

on a conference call on Tuesday, March 29, 2022, at 8:30am EST. The

dial-in number for the call is 1-800-319-4610 (International

1-604-638-5340). Participants are requested to dial in 5 to 10

minutes before the scheduled start time and ask to join the Sangoma

call.

1Adjusted EBITDA is a non-IFRS metric used by

the Company to monitor its performance and the definition of this

term may be found in the most recently filed MD&A posted at

www.sedar.com. Net debt is a non-IFRS metric defined as the

principal balance outstanding under the Company’s credit facilities

less cash on hand.

About Sangoma Technologies Corporation

Sangoma Technologies is a trusted leader in

delivering value-based Communications as a Service (CaaS) solutions

for businesses of all sizes. Sangoma's cloud-based Services include

Unified Communication (UCaaS) business communications, Contact

Center as a Service (CCaaS), Video Meetings as a Service (MaaS),

Collaboration as a Service (Collab aaS), Communications Platform as

a Service (CPaaS), Trunking as a Service (TaaS), Fax as a Service

(FaaS), Device as a Service (DaaS), and Access Control as a Service

(ACaaS). In addition, Sangoma offers a full line of communications

Products, including premise-based UC systems, a full line of desk

phones and headsets, and a complete connectivity suite

(gateways/SBCs/telephony cards). Sangoma's products and services

are used in leading UC, PBX, IVR, contact center, carrier networks,

office productivity, and data communication applications worldwide.

Sangoma is also the primary developer and sponsor of Asterisk and

FreePBX, the world's two most widely used open-source communication

software projects.

Sangoma Technologies Corporation is publicly

traded on the Toronto Stock Exchange (TSX: STC) and Nasdaq (Nasdaq:

SANG). Additional information on Sangoma can be found at:

www.sangoma.com.

Cautionary Statement Regarding Forward Looking

Statements

This press release may contain “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws, including, without limitation, statements

regarding annual revenue of NetFortris, pro form net debt and

Adjusted EBITDA and the impact that the acquisition of NetFortris

is expected to have on the Company, such as the annualized revenue

of NetFortris bringing Sangoma closer to 75% (pro forma) of its

revenue in Services.

Forward-looking statements are neither

historical facts nor assurances of future performances. Although

Sangoma believes that its expectations reflected in these

forward-looking statements are reasonable, by their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other events contemplated by the forward-looking

statements will not occur. Such assumptions include, but are not

limited to, the business of NetFortris continuing to perform at the

same historical level, there being no material adverse changes to

NetFortris’ customer base or number of seats and such number of

seats continuing to be at least 60,000, NetFortris’ MRR remaining

consistent at over 90%, and Sangoma being able to achieve

post-closing synergies such as the ability to cross-sell

Sangoma/NetFortris products to the other’s customer base and the

amalgamation of data centers. Forward-looking statements are based

on the opinions and estimates of management at the date that the

statements are made and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in

forward-looking statements. Such factors, risks and uncertainties

include, but are not limited to, risks that the acquired business

will not perform as expected, the Company will not be able to

successfully integrate the acquired business and those factors

discussed in greater detail under the “Risk Factors” section in our

Annual Information Form and our most recent Management Discussion

& Analysis (each available under our profile on SEDAR at

www.sedar.com).

Readers are cautioned not to place undue

reliance on forward-looking statements, as there can be no

assurance that the plans, intentions or expectations upon which

they are based will occur. The forward-looking information

contained in this press release represents our expectations as of

the date specified herein and are subject to change after such

date. However, Sangoma undertakes no obligation to update

forward-looking statements if circumstances or management’s

estimates or opinions should change except as required by

law. The forward-looking statements contained in this press

release are expressly qualified by the foregoing cautionary

statements.

Sangoma Technologies Corporation

Larry Stock

Chief Corporate Officer

(256) 428-6285

lstock@sangoma.com

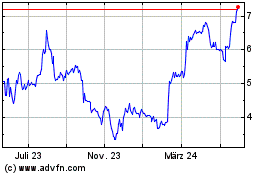

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

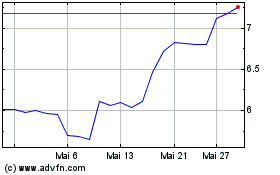

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024