Mulvihill Capital Management Inc. Announces Special Meeting for Proposed Mergers of S Split Corp. and Top 10 Split Trust into Premium Global Income Split Corp.

25 Juli 2024 - 2:00AM

(TSX: SBN, SBN.PR.A, TXT.UN, TXT.PR.A PGIC

and PGIC.PR.A) Mulvihill Capital Management Inc. (the

“

Manager”), the manager of S Split Corp.

(“

SBN”) and Top 10 Split Trust

(“

TXT”) announced today that the board of

directors of the Manager and SBN have approved a proposal to merge

(the “

Merger Proposal”) each of SBN and TXT into

Premium Global Income Split Corp. (“

Premium

Global”, formerly World Financial Split Corp.). The

implementation of the Merger Proposal is subject to receipt of

regulatory approval and securityholder approvals.

Premium Global is a mutual fund corporation with

the following investment objectives: (a) to provide Preferred

Shareholders with fixed cumulative preferential monthly cash

distributions in an amount of $0.0625 per Preferred Share,

representing a yield on the $10.00 original issue price of the

Preferred Shares of 7.5% per annum; (b) to provide Class A

Shareholders with monthly cash distributions targeted to be 12.0%

per annum payable monthly on the initial $8.00 net asset value per

Class A Share; and (c) to return the issue price to holders of both

Preferred Shares and Class A Shares at the time of redemption of

such shares on Premium Global’s termination date.

If the Merger Proposal is approved and

implemented, Premium Global will be the continuing fund and (a)

holders of Class A Shares of SBN will become holders of Class A

Shares of Premium Global, (b) holders of Preferred Shares of SBN

will become holders of Class A Shares and a lesser number of

Preferred Shares of Premium Global, (c) holders of Capital Units of

TXT will become holders of Class A Shares of Premium Global, and

(d) holders of Preferred Securities of TXT will become holders of

Class A Shares and a lesser number of Preferred Shares of Premium

Global. The exchange ratios at which Class A Shares and Preferred

Shares of SBN and at which Capital Units and Preferred Securities

of TXT will be exchanged for Class A Shares and Preferred Shares of

Premium Global will be based on the relative net asset value of the

funds and the redemption price of the Preferred Shares and

principal amount of the Preferred Securities and will be announced

by press release following the Meeting. No fractional Class A

Shares or Preferred Shares of Premium Global or cash in lieu

thereof will be issued or paid under the mergers and the number of

such shares to be issued will be rounded down to the nearest whole

share.

Shareholders of SBN and Unitholders and

Preferred Securityholders of TXT who do not wish to participate in

the proposed mergers may submit their securities for retraction or

repayment no later than August 23, 2024 in order to redeem their

securities on or about September 6, 2024 (the “Special

Retraction Date”). Unitholders who wish to redeem their

securities should vote in favour of the Merger Proposal and simply

redeem their securities no later than the Special Retraction

Date.

The mergers will be described in greater detail

in the management information circular (the

“Circular”) for the special meeting (the

“Meeting”) of the SBN and TXT’s securityholders

(the “Securityholders”). The board of directors of

the Manager and SBN have unanimously approved the Merger Proposal,

and recommends that Securityholders vote FOR the Merger Proposal.

The independent review committee of SBN and TXT have provided

positive recommendations in favour of the Merger Proposal.

The Meeting will be held virtually on August 30,

2024. Securityholders of record as of the close of business on July

26, 2024 are entitled to receive notice of and vote at the Meeting.

Securityholders are urged to vote well before the proxy deadline of

5:00 p.m. (Eastern time) on August 28, 2024.

In order for the Merger Proposal to become

effective, the Merger Proposal must be approved by a two-thirds

majority of votes cast at the Meeting by holders of the Class A

Shares and the Preferred Shares of SBN, and the holders of Capital

Units and Preferred Securities of TXT, each voting separately as a

class.

The Circular is being mailed to Securityholders

in compliance with applicable laws and will be available under each

of SBN and TXT’s profile on SEDAR+ at www.sedarplus.com. The

Circular provides important information on the Merger Proposal and

related matters. Securityholders are urged to read the Circular and

its schedules carefully and in their entirety.

For further information, please contact Investor Relations at

416.681.3966, toll free at 1-800-725-7172 or visit

www.mulvihill.com.

| John Germain, Senior

Vice-President & CFO |

Mulvihill Capital

Management Inc.121 King Street

West Suite 2600Toronto, Ontario, M5H 3T9 416.681.3966;

1.800.725.7172www.mulvihill.com info@mulvihill.com |

| |

|

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the Fund on the TSX. If

the shares are purchased or sold on the TSX, investors may pay more

than the current net asset value when buying and may receive less

than current net asset value when selling them. There are ongoing

fees and expenses associated with owning shares of the Fund. An

investment fund must prepare disclosure documents that contain key

information about the Fund. You can find more detailed information

about the Fund in these documents. Investment funds are not

guaranteed, their values change frequently and past performance may

not be repeated.

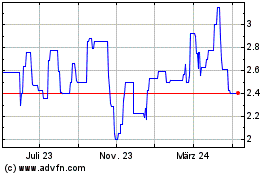

S Split (TSX:SBN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

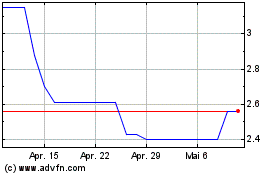

S Split (TSX:SBN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025