Russel Metals Announces Intention to Make a Normal Course Issuer Bid

18 Februar 2008 - 8:28PM

Marketwired

TORONTO, ONTARIO announced that its Board of Directors approved

a normal course issuer bid, pursuant to which Russel Metals may

purchase for cancellation up to six million of its common shares,

representing approximately 10% of its public float over the next 12

months. The number of common shares that are currently outstanding

is 63,066,092.

Russel Metals believes that the market price of its common

shares at times may not fully reflect the underlying value of its

business and its future business prospects. As a result, Russel

Metals believes that its outstanding common shares represent an

attractive investment and an appropriate and desirable use of its

available funds.

The common shares have recently traded at prices which Russel

Metals' believes do not truly reflect their value. The purchase of

six million shares will not jeopardize the ability of Russel Metals

to pay its dividend. Debt to total capitalization would be 19%.

Russel Metals would still have the ability to finance acquisitions

of approximately a size comparable to its recent acquisition of JMS

Metal Services.

Subject to approval from The Toronto Stock Exchange, purchases

may commence on February 22, 2008 and will terminate on February

21, 2009 or such earlier date as Russel Metals may complete its

purchases pursuant to the Notice of Intention. All common shares

purchased by the Company under the bid will be cancelled.

Russel Metals is one of the largest metals distribution

companies in North America. It carries on business in three

distribution segments: metals service centers, energy tubular

products and steel distributors, under various names including

Russel Metals, A.J. Forsyth, Acier Leroux, Acier Loubier, Acier

Richler, Arrow Steel Processors, B&T Steel, Baldwin

International, Comco Pipe and Supply, Fedmet Tubulars, JMS Russel

Metals, Leroux Steel, McCabe Steel, Megantic Metal, Metaux Russel,

Metaux Russel Produits Specialises, Milspec Industries, Pioneer

Pipe, Russel Metals Specialty Products, Russel Metals Williams

Bahcall, Spartan Steel Products, Sunbelt Group, Triumph Tubular

& Supply, Wirth Steel and York-Ennis.

Statements contained in this press release or on the related

conference call that relate to Russel Metals' beliefs or

expectations as to certain future events are not statements of

historical fact and are forward-looking statements. Russel Metals

cautions readers that there are important factors, risks and

uncertainties, including but not limited to economic, competitive

and governmental factors affecting Russel Metals' operations,

markets, products, services and prices that could cause its actual

results, performance or achievements to be materially different

from those forecasted or anticipated in such forward looking

statements.

The forward-looking statements in this document reflect

management's current beliefs and are based on information currently

available to management. The material assumptions applied in making

the forward-looking statements in this document include the

following: there will be steady demand in the manufacturing,

resource and construction segments of the Canadian economy, oil and

gas prices will not change materially, there will be continued

consolidation of steel producers, the recent stability in the price

of steel will continue, and the Canadian dollar will maintain

recent gains while not appreciating significantly. Although the

forward-looking statements contained in this document are based

upon what management believes to be reasonable estimates and

assumptions, Russel Metals cannot ensure that actual results will

not be materially different from those expressed or implied by

these forward-looking statements.

Contacts: Russel Metals Inc. Marion E. Britton Vice President

and Chief Financial Officer (905) 819-7407 Email:

info@russelmetals.com Website: www.russelmetals.com

Russel Metals (TSX:RUS)

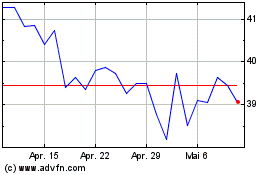

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024