- Superior property fundamentals generated record retail

occupancy of 98.3%, new leasing spread of 21.0% and same-property

NOI in excess of target range

- Development deliveries continued to add steady stream of new

and diversified NOI

RioCan Real Estate Investment Trust (“RioCan" or the "Trust”)

(TSX: REI.UN) announced today its financial results for the three

and nine months ended September 30, 2023 (the "Third Quarter").

“RioCan had a strong quarter as extensive demand for our space

drove leasing velocity, standout leasing spreads and record

occupancy. Our performance reflects the quality of our locations as

well as the track-record and cycle-tested experience of RioCan's

team,” said Jonathan Gitlin, President and CEO of RioCan. “We are

perfectly positioned to benefit from Canada's favourable retail

real estate landscape that will continue to be strong due to the

limited supply of quality space. RioCan continues to actively

manage risk, improve our balance sheet and further strengthen our

foundation to drive future growth and value creation."

Financial

Highlights

Three months ended September

30

Nine months ended September

30

(in millions, except where otherwise

noted, and per unit values)

2023

2022

2023

2022

FFO 1

$

135.4

$

134.8

$

398.4

$

397.0

FFO per unit - diluted 1

$

0.45

$

0.44

$

1.33

$

1.29

Net income (loss)

$

(73.5)

$

3.2

$

156.5

$

241.7

Weighted average Units outstanding -

diluted (in thousands)

300,471

304,005

300,508

307,534

September 30,

December 31,

As at

2023

2022

Net book value per unit

$

25.49

$

25.73

1.

A non-GAAP measurement. For definitions,

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

FFO per Unit and Net

Income

- FFO per unit for the Third Quarter was $0.45, which was $0.01

per unit higher than the same period last year.

- Same Property NOI1 growth of 3.7% contributed a $0.02 increase

in FFO per unit.

- FFO from completed developments and residential rental ramp up

drove FFO per unit higher by $0.02.

- Higher interest expense decreased FFO per unit by $0.02.

- The reduction in FFO per unit from properties sold was

partially offset by accretion from prior year unit buybacks,

resulting in a net reduction of $0.01 per unit.

- Net loss for the Third Quarter of $73.5 million compared to

$3.2 million of net income last year. The decrease was mainly due

to fair value losses of $199.5 million on investment properties in

the current quarter compared to $118.8 million in Q3 2022,

primarily from increasing capitalization rates to reflect current

market conditions resulting from rising interest rates.

- Our FFO Payout Ratio1 of 60.4%, Liquidity1 of $1.6 billion,

Unencumbered Assets1 of $8.5 billion, floating rate debt at 7.9%1

of total debt and staggered debt maturities, all contribute to our

financial flexibility and balance sheet strength.

- For 2023, we anticipate FFO per unit to be within the range of

$1.77 to $1.80, SPNOI growth of 3%, and an FFO Payout Ratio of

between 55% to 65%. Development Spending1 is expected to be between

$400 million to $450 million.

1.

A non-GAAP measurement. For definitions,

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Operation Highlights

Three months ended September

30

Nine months ended September

30

2023

2022

2023

2022

Operation Highlights (i)

Occupancy - committed (ii)

97.5 %

97.3 %

97.5 %

97.3 %

Retail occupancy - committed (ii)

98.3 %

97.8 %

98.3 %

97.8 %

Blended leasing spread

12.9 %

7.9 %

11.2 %

9.0 %

New leasing spread

21.0 %

15.9 %

14.9 %

12.4 %

Renewal leasing spread

11.2 %

6.6 %

10.2 %

8.2 %

(i)

Includes commercial portfolio only.

(ii)

Information presented as at respective

periods then ended.

- Strong leasing velocity continues to be a dominant theme as

RioCan's high-quality, necessity-based retail portfolio continued

to generate strong activity, spreads, occupancy and operating

results in the Third Quarter. Same Property NOI grew by 3.7%,

driven by increases in rent growth from contractual rent steps,

rent upon renewal and the recovery of past pandemic-related

provisions.

- Retail committed occupancy improved to an all-time high of

98.3% and in-place retail occupancy of 97.6% increased 70 basis

points sequentially.

- A robust blended leasing spread of 12.9% resulted from new and

renewal leasing spreads of 21.0% and 11.2%, respectively.

- New leasing in the Third Quarter generated average net rent per

square foot of $27.02, well above the average net rent per occupied

square foot of $21.39.

- Our strong demographic profile with a population and household

income of 260,000 and $140,000, respectively within a five

kilometre radius of the Trust's properties continues to attract

strong and stable tenants which comprise 87.4% of annualized net

rent.

RioCan Living Update 1

- Of the 13 RioCan Living™ buildings in operation 11 are

stabilized and 97.5% leased as at November 2, 2023. Total NOI

generated from our residential rental operations for the Third

Quarter was $5.6 million, an increase of $1.8 million or 46.3% over

the same period last year. An increase of approximately 8% in

average monthly rent per occupied square foot on a same property

basis contributed to the year-over-year improvement.

- Occupancy commenced at FourFifty The Well™ on August 1, 2023.

Construction of 236 units was completed in the quarter. The

remaining 356 units will be completed in phases through Q4 2023 and

early 2024. Pre-leasing commenced in March 2023 and units are

leasing at a healthy velocity and at rates in-line or above

expectations.

- The 2,605 condominium and townhouse units that are under

construction as of September 30, 2023, are expected to generate

combined sales revenue of over $800.0 million between 2023 and 2026

that can be redeployed to productive uses such as paying down debt

or development. Of RioCan’s six active condominium construction

projects, 86% of the total units have been pre-sold, representing

95% of pro-forma total revenues.

1.

Units at 100% ownership interest.

Development Highlights

Three months ended September

30

Nine months ended September

30

(in millions except square feet)

2023

2022

2023

2022

Development Highlights

Development Completions - sq. ft. in

thousands (i)

151.0

179.0

327.0

393.0

Development Spending

$

114.2

$

81.0

$

305.6

$

312.5

Development Projects Under Construction -

sq. ft. in thousands (ii)

1,685.0

2,152.0

1,685.0

2,152.0

(i)

At RioCan's ownership. Represents net

leasable area (NLA) of property under development completions.

Excludes NLA of residential inventory completions.

(ii)

Information presented as at the respective

periods then ended, includes properties under development and

residential inventory, equity-accounted joint ventures and

represents gross floor area of the respective projects.

- In the quarter, 151,000 square feet of NLA was completed,

comprised mainly of 72,000 square feet of purpose-built rental at

FourFifty The Well and 63,000 square feet of commercial space at

The Well™. For the full year, we expect to complete 630,200 square

feet of GFA of development. We expect these development completions

to contribute $25.5 million of stabilized NOI that will ramp up

over the course of 2023 and 2024.

- As at November 2, 2023, approximately 96% of the total

commercial space at The Well is leased with approximately 89% or

1,323,000 square feet (at 100% ownership interest) in tenant

possession. The retail component is 91% leased with another 2% in

late stage negotiations. New additions to the tenant roster, such

as Lululemon and Sephora, further enhance the retail mix at The

Well. The retail at The Well has been physically opening in phases,

and the majority of tenants are expected to be open by the end of

2023.

- Zoning approvals for 1.2 million square feet of residential

inventory were obtained in the quarter comprised of 83 Bloor Street

West, located in the prestigious Yorkville neighbourhood in

downtown Toronto, and East Hills South Block in Calgary. Completion

of zoning is a significant step in the value creation process.

RioCan continues to revisit zoning applications to optimize density

and use in order to improve project economics. As cost and

financing conditions persist, RioCan does not intend on commencing

any material new physical construction in the near term.

- Total zoned square footage of 16.8 million includes 1.7 million

square feet of projects under construction and 1.5 million square

feet of shovel ready projects, which can be commenced or delayed at

RioCan's discretion.

Investing and Capital

Recycling

- On September 28, 2023, RioCan entered into an agreement which

resulted in 11YV project becoming an equity-accounted joint venture

where RioCan subsequently reduced its 50.0% ownership interest to

39.6%. The resulting $10.1 million gain in the quarter was mainly

attributable to the value of the underlying residential inventory.

Subsequent to quarter end, RioCan sold an additional 2.1% interest

reducing its interest to 37.5% in the underlying 11YV project.

- As of November 2, 2023, closed and firm dispositions of

non-core assets totalled $295.2 million at a weighted average

capitalization rate of 6.92%, including closed dispositions of

$140.2 million. Closed dispositions include an enclosed centre in

Winnipeg, Manitoba and a movie theatre anchored centre in Gatineau,

Quebec, both of which were sold subsequent to quarter end.

Disposition of these non-core assets continued the Trust's program

to continually improve asset quality.

- Year-to-date, Total Acquisitions1 were $110.1 million including

the purchase of residential rental properties, certain land

assemblies for development and the purchase of an income producing

parking lot lease at a Focus Five2 project to remove a significant

encumbrance.

1.

A non-GAAP measurement. For definitions,

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

2.

Focus Five projects are large scale,

transit-oriented, mixed-use developments in the Greater Toronto

Area that the Trust is currently advancing through zoning and the

site plan approval process.

Capital Management

Update

- On September 29, 2023, RioCan issued $300.0 million of Series

AI senior unsecured debentures. These debentures were issued at a

coupon rate of 6.488% per annum and will mature on September 29,

2026. RioCan will have the option to repay Series AI debentures at

par, in whole or in part, on or after September 29, 2024. RioCan

also redeemed, in full, its $300.0 million, 3.210% Series AA

unsecured debentures upon maturity.

- The Trust's limited exposure to floating rate debt at 7.9% of

total debt serves to mitigate short-term interest rate volatility.

The proportion of floating rate debt increased when compared to

last quarter mainly due to the timing of refinancing and hedging

activities. We expect to reduce our exposure to floating rate debt

by year end.

Balance Sheet Strength

(in millions except percentages)

As at

September 30, 2023

December 31, 2022

Balance Sheet Strength

Highlights

Liquidity (i) 1

$

1,634

$

1,548

Adjusted Debt to Adjusted EBITDA (i) 1

9.45x

9.51x

Total Adjusted Debt to Total Adjusted

Assets (i) 1

46.5 %

45.2 %

Unencumbered Assets (i) 1

$

8,549

$

8,257

Unencumbered Assets to Unsecured Debt (i)

1

211 %

218 %

(i)

At RioCan's proportionate share.

- As at September 30, 2023, the Trust had $1.6 billion of

Liquidity in the form of a $1.1 billion undrawn revolving line of

credit, $0.4 billion undrawn construction lines and other bank

loans and $0.1 billion cash and cash equivalents. A new credit

facility for the construction of the Queen & Ashbridge™

condominium component was executed in the quarter.

- Pursuant to the terms of its credit agreement, the Trust has an

option to increase the commitment under its revolving line of

credit by $250 million.

- RioCan’s Unencumbered Assets of $8.5 billion, which can be used

to obtain secured financing to provide additional liquidity at

lower interest rates than unsecured debt, generated 60.0% of Annual

Normalized NOI1 and provided 2.11x coverage over Unsecured Debt1.

When compared to Q2 2023, Unencumbered Assets decreased by $81.8

million mainly from decrease in fair values.

- Adjusted Debt to Adjusted EBITDA was 9.45x on a proportionate

share basis as at September 30, 2023, compared to 9.51x as at the

end of 2022. The decrease was primarily due to higher Adjusted

EBITDA, partially offset by higher Average Total Adjusted Debt

balances.

1.

A non-GAAP measurement. For definitions,

reconciliations and the basis of presentation of RioCan's non-GAAP

measures, refer to the Basis of Presentation and Non-GAAP Measures

section in this News Release.

Conference Call and

Webcast

Interested parties are invited to participate in a conference

call with management on Friday, November 3, 2023 at 10:00 a.m.

(ET). Participants will be required to identify themselves and the

organization on whose behalf they are participating.

To access the conference call, click on the following link to

register at least 10 minutes prior to the scheduled start of the

call: Pre-registration link. Participants who pre-register at any

time prior to the call will receive an email with dial-in

credentials including a login passcode and PIN to gain immediate

access to the live call. Those that are unable to pre-register may

dial-in for operator assistance by calling 1-833-950-0062 and

entering the access code: 176245.

For those unable to participate in the live mode, a replay will

be available at 1-866-813-9403 with access code: 613637.

To access the simultaneous webcast, visit RioCan’s website at

Events and Presentations and click on the link for the webcast.

About RioCan

RioCan is one of Canada’s largest real estate investment trusts.

RioCan owns, manages and develops retail-focused, increasingly

mixed-use properties located in prime, high-density

transit-oriented areas where Canadians want to shop, live and work.

As at September 30, 2023, our portfolio is comprised of 192

properties with an aggregate net leasable area of approximately

33.6 million square feet (at RioCan's interest) including office,

residential rental and 10 development properties. To learn more

about us, please visit www.riocan.com.

Basis of Presentation and Non-GAAP

Measures

All figures included in this News Release are expressed in

Canadian dollars unless otherwise noted. RioCan’s unaudited interim

condensed consolidated financial statements ("Condensed

Consolidated Financial Statements") are prepared in accordance with

International Financial Reporting Standards (IFRS). Financial

information included within this News Release does not contain all

disclosures required by IFRS, and accordingly should be read in

conjunction with the Trust's Condensed Consolidated Financial

Statements and MD&A for the three and nine months ended

September 30, 2023, which are available on RioCan's website at

www.riocan.com and on SEDAR at www.sedar.com.

Consistent with RioCan’s management framework, management uses

certain financial measures to assess RioCan’s financial

performance, which are not in accordance with generally accepted

accounting principles (GAAP) under IFRS. Funds From Operations

(“FFO”), FFO per unit, Net Operating Income ("NOI"), Same Property

NOI, Development Spending, Total Acquisitions, Ratio of floating

rate debt to total debt, Liquidity, Adjusted Debt to Adjusted

EBITDA, Total Adjusted Debt to Total Adjusted Assets, RioCan's

Proportionate Share, Unencumbered Assets to Unsecured Debt and

Percentage of Normalized NOI Generated from Unencumbered

Assets, as well as other measures that may be discussed

elsewhere in this News Release, do not have a standardized

definition prescribed by IFRS and are, therefore, unlikely to be

comparable to similar measures presented by other reporting

issuers. RioCan supplements its IFRS measures with these Non-GAAP

measures to aid in assessing the Trust’s underlying performance and

reports these additional measures so that investors may do the

same. Non-GAAP measures should not be considered as alternatives to

net income or comparable metrics determined in accordance with IFRS

as indicators of RioCan’s performance, liquidity, cash flow, and

profitability. For full definitions of these measures, please refer

to the "Non-GAAP Measures” section in RioCan’s MD&A for the

three and nine months ended September 30, 2023.

The reconciliations for non-GAAP measures included in this News

Release are outlined as follows:

RioCan's Proportionate Share

The following table reconciles the consolidated balance sheets

from IFRS to RioCan's proportionate share basis as at September 30,

2023 and December 31, 2022:

As at

September 30, 2023

December 31, 2022

(in thousands of dollars)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Assets

Investment properties

$

13,696,048

$

422,424

$

14,118,472

$

13,807,740

$

398,701

$

14,206,441

Equity-accounted investments

395,924

(395,924)

—

364,892

(364,892)

—

Mortgages and loans receivable

229,877

—

229,877

269,339

—

269,339

Residential inventory

198,913

397,063

595,976

272,005

214,536

486,541

Assets held for sale

230,000

—

230,000

42,140

—

42,140

Receivables and other assets

292,421

51,258

343,679

259,514

37,779

297,293

Cash and cash equivalents

43,220

9,355

52,575

86,229

8,001

94,230

Total assets

$

15,086,403

$

484,176

$

15,570,579

$

15,101,859

$

294,125

$

15,395,984

Liabilities

Debentures payable

$

3,240,680

$

—

$

3,240,680

$

2,942,051

$

—

$

2,942,051

Mortgages payable

2,641,601

171,182

2,812,783

2,659,180

172,100

2,831,280

Lines of credit and other bank loans

1,007,059

207,680

1,214,739

1,141,112

89,187

1,230,299

Accounts payable and other liabilities

540,135

105,314

645,449

630,624

32,838

663,462

Total liabilities

$

7,429,475

$

484,176

$

7,913,651

$

7,372,967

$

294,125

$

7,667,092

Equity

Unitholders’ equity

7,656,928

—

7,656,928

7,728,892

—

7,728,892

Total liabilities and equity

$

15,086,403

$

484,176

$

15,570,579

$

15,101,859

$

294,125

$

15,395,984

The following tables reconcile the consolidated statements of

income (loss) from IFRS to RioCan's proportionate share basis for

the three and nine months ended September 30, 2023 and 2022:

Three months ended September 30,

2023

Three months ended September 30,

2022

(in thousands of dollars)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Revenue

Rental revenue

$

269,001

$

8,052

$

277,053

$

265,895

$

7,405

$

273,300

Residential inventory sales

—

48,977

48,977

33,812

—

33,812

Property management and other service

fees

2,408

—

2,408

5,553

—

5,553

271,409

57,029

328,438

305,260

7,405

312,665

Operating costs

Rental operating costs

Recoverable under tenant leases

87,274

884

88,158

89,405

769

90,174

Non-recoverable costs

7,880

588

8,468

7,318

627

7,945

Residential inventory cost of sales

—

38,972

38,972

26,045

—

26,045

95,154

40,444

135,598

122,768

1,396

124,164

Operating income

176,255

16,585

192,840

182,492

6,009

188,501

Other income (loss)

Interest income

5,988

672

6,660

5,684

581

6,265

Income from equity-accounted

investments

14,229

(14,229)

—

958

(958)

—

Fair value loss on investment properties,

net

(199,528)

(167)

(199,695)

(118,783)

(3,537)

(122,320)

Investment and other income (loss)

(502)

(99)

(601)

(519)

162

(357)

(179,813)

(13,823)

(193,636)

(112,660)

(3,752)

(116,412)

Other expenses

Interest costs, net

52,051

3,012

55,063

46,620

2,201

48,821

General and administrative

14,444

—

14,444

13,729

19

13,748

Internal leasing costs

3,020

—

3,020

3,088

—

3,088

Transaction and other costs

417

(250)

167

2,346

37

2,383

69,932

2,762

72,694

65,783

2,257

68,040

Income (loss) before income

taxes

$

(73,490)

$

—

$

(73,490)

$

4,049

$

—

$

4,049

Current income tax expense

20

—

20

834

—

834

Net income (loss)

$

(73,510)

$

—

$

(73,510)

$

3,215

$

—

$

3,215

Nine months ended September 30,

2023

Nine months ended September 30,

2022

(in thousands)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Revenue

Rental revenue

$

814,595

$

25,485

$

840,080

$

805,328

$

21,703

$

827,031

Residential inventory sales

—

51,857

51,857

84,786

936

85,722

Property management and other service

fees

12,366

—

12,366

17,546

—

17,546

826,961

77,342

904,303

907,660

22,639

930,299

Operating costs

Rental operating costs

Recoverable under tenant leases

279,704

2,668

282,372

281,656

2,053

283,709

Non-recoverable costs

18,923

1,733

20,656

18,895

1,789

20,684

Residential inventory cost of sales

—

40,359

40,359

69,838

422

70,260

298,627

44,760

343,387

370,389

4,264

374,653

Operating income

528,334

32,582

560,916

537,271

18,375

555,646

Other income (loss)

Interest income

18,730

1,940

20,670

14,630

1,726

16,356

Income from equity-accounted

investments

25,573

(25,573)

—

6,213

(6,213)

—

Fair value loss on investment properties,

net

(227,487)

(618)

(228,105)

(125,621)

(7,803)

(133,424)

Investment and other income (loss)

4,042

(313)

3,729

(2,082)

(44)

(2,126)

(179,142)

(24,564)

(203,706)

(106,860)

(12,334)

(119,194)

Other expenses

Interest costs, net

150,008

8,231

158,239

132,045

5,849

137,894

General and administrative

44,908

32

44,940

41,592

50

41,642

Internal leasing costs

8,763

—

8,763

8,898

—

8,898

Transaction and other costs

2,399

(245)

2,154

5,038

142

5,180

206,078

8,018

214,096

187,573

6,041

193,614

Income before income taxes

$

143,114

$

—

$

143,114

$

242,838

$

—

$

242,838

Current income tax (recovery) expense

(13,347)

—

(13,347)

1,105

—

1,105

Net income

$

156,461

$

—

$

156,461

$

241,733

$

—

$

241,733

NOI and Same Property NOI

The following table reconciles operating income to NOI and Same

Property NOI to NOI for the three and nine months ended September

30, 2023 and 2022:

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2023

2022

2023

2022

Operating Income

$

176,255

$

182,492

$

528,334

$

537,271

Adjusted for the following:

Property management and other service

fees

(2,408)

(5,553)

(12,366)

(17,546)

Residential inventory gains

—

(7,767)

—

(14,948)

Operational lease revenue from ROU

assets

1,650

1,419

5,079

4,149

NOI

$

175,497

$

170,591

$

521,047

$

508,926

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2023

2022

2023

2022

Same Property NOI

$

153,808

$

148,346

$

457,539

$

438,706

NOI from income producing properties:

Acquired (i)

358

7

787

376

Disposed (i)

338

8,111

1,867

26,485

696

8,118

2,654

26,861

NOI from completed properties under

development

8,668

3,813

22,698

12,060

NOI from properties under de-leasing

(ii)

4,586

5,481

14,683

15,889

Lease cancellation fees

442

1,175

5,183

4,729

Straight-line rent adjustment

1,660

(196)

3,260

1,078

NOI from commercial properties

15,356

10,273

45,824

33,756

NOI from residential rental

5,637

3,854

15,030

9,603

NOI

$

175,497

$

170,591

$

521,047

$

508,926

(i)

Includes properties acquired or disposed

of during the periods being compared.

(ii)

NOI from limited number of properties

undergoing significant de-leasing in preparation for redevelopment

or intensification.

FFO

The following table reconciles net income (loss) attributable to

Unitholders to FFO for the three and nine months ended September

30, 2023 and 2022:

Three months ended September

30

Nine months ended September

30

(thousands of dollars, except where

otherwise noted)

2023

2022

2023

2022

Net income attributable to Unitholders

$

(73,510)

$

3,215

$

156,461

$

241,733

Add back/(Deduct):

Fair value losses, net

199,528

118,783

227,487

125,621

Fair value losses included in

equity-accounted investments

167

3,537

618

7,803

Internal leasing costs

3,020

3,088

8,763

8,898

Transaction (gains) losses on investment

properties, net (i)

(77)

(270)

35

465

Transaction gains on equity-accounted

investments

(69)

—

(69)

—

Transaction (recoveries) costs on sale of

investment properties

(4)

1,769

507

3,084

ERP implementation costs

2,121

—

8,530

—

Change in unrealized fair value on

marketable securities

1,898

1,999

2,711

3,400

Current income tax expense (recovery)

20

834

(13,347)

1,105

Operational lease revenue from ROU

assets

1,283

1,035

3,833

2,964

Operational lease expenses from ROU assets

in equity-accounted investments

(14)

(12)

(39)

(34)

Capitalized interest on equity-accounted

investments (ii)

1,059

825

2,902

1,994

FFO

$

135,422

$

134,803

$

398,392

$

397,033

Add back:

Restructuring costs

720

—

1,344

3,779

FFO Adjusted

$

136,142

$

134,803

$

399,736

$

400,812

FFO per unit - basic

$

0.45

$

0.44

$

1.33

$

1.29

FFO per unit - diluted

$

0.45

$

0.44

$

1.33

$

1.29

FFO Adjusted per unit - diluted

$

0.45

$

0.44

$

1.33

$

1.30

Weighted average number of Units - basic

(in thousands)

300,405

303,912

300,384

307,332

Weighted average number of Units - diluted

(in thousands)

300,471

304,005

300,508

307,534

FFO for last 4 quarters

$

526,035

$

543,556

Distributions paid for last 4 quarters

$

317,500

$

308,221

FFO Payout Ratio

60.4%

56.7%

(i)

Represents net transaction gains or losses

connected to certain investment properties during the period.

(ii)

This amount represents the interest

capitalized to RioCan's equity-accounted investment in WhiteCastle

New Urban Fund 2, LP, WhiteCastle New Urban Fund 3, LP, WhiteCastle

New Urban Fund 4, LP, WhiteCastle New Urban Fund 5, LP,

RioCan-Fieldgate JV, RC (Queensway) LP, RC (Leaside) LP- Class B

and PR Bloor Street LP. This amount is not capitalized to

properties under development under IFRS, but is allowed as an

adjustment under REALPAC’s definition of FFO.

Development Spending

Total Development Spending for the three and nine months ended

September 30, 2023 and 2022 is as follows:

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2023

2022

2023

2022

Development expenditures on balance

sheet:

Properties under development

$

57,470

$

62,856

$

191,992

$

220,127

Residential inventory

51,052

15,258

100,243

78,966

RioCan's share of Development Spending

from equity-accounted joint ventures

5,711

2,913

13,345

13,423

Total Development Spending

$

114,233

$

81,027

$

305,580

$

312,516

Total Acquisitions

Total Acquisitions for the three and nine months ended September

30, 2023 and 2022 are as follows:

Three months ended September

30

Nine months ended September

30

(thousands of dollars)

2023

2022

2023

2022

Income producing properties

$

5,202

$

1,072

$

75,473

$

91,020

Properties under development

—

—

34,583

11,946

Residential inventory

—

—

—

19,440

RioCan's share of acquisitions from

equity-accounted joint ventures

—

—

—

66,497

Total Acquisitions

$

5,202

$

1,072

$

110,056

$

188,903

Total Adjusted Debt and Total Contractual Debt

The following tables reconcile total debt to Total Adjusted

Debt, total assets to Total Adjusted Assets, and total debt to

Total

Contractual Debt as at September 30, 2023 and December 31,

2022:

As at

September 30, 2023

December 31, 2022

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Debentures payable

$

3,240,680

$

—

$

3,240,680

$

2,942,051

$

—

$

2,942,051

Mortgages payable

2,641,601

171,182

2,812,783

2,659,180

172,100

2,831,280

Lines of credit and other bank loans

1,007,059

207,680

1,214,739

1,141,112

89,187

1,230,299

Total debt

$

6,889,340

$

378,862

$

7,268,202

$

6,742,343

$

261,287

$

7,003,630

Cash and cash equivalents

43,220

9,355

52,575

86,229

8,001

94,230

Total Adjusted Debt

$

6,846,120

$

369,507

$

7,215,627

$

6,656,114

$

253,286

$

6,909,400

Total assets

$

15,086,403

$

484,176

$

15,570,579

$

15,101,859

$

294,125

$

15,395,984

Cash and cash equivalents

43,220

9,355

52,575

86,229

8,001

94,230

Total Adjusted Assets

$

15,043,183

$

474,821

$

15,518,004

$

15,015,630

$

286,124

$

15,301,754

Total Adjusted Debt to Total Adjusted

Assets

45.5 %

46.5 %

44.3 %

45.2 %

As at

September 30, 2023

December 31, 2022

(thousands of dollars)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Total debt

$

6,889,340

$

378,862

$

7,268,202

$

6,742,343

$

261,287

$

7,003,630

Less:

Unamortized debt financing costs, premiums

and discounts on origination and debt assumed, and

modifications

(23,797)

(547)

(24,344)

(15,634)

(690)

(16,324)

Total Contractual Debt

$

6,913,137

$

379,409

$

7,292,546

$

6,757,977

$

261,977

$

7,019,954

Floating Rate Debt and Fixed Rate Debt

As at

September 30, 2023

December 31, 2022

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Total fixed rate debt

$

6,510,510

$

181,982

$

6,692,492

$

6,301,054

$

141,720

$

6,442,774

Total floating rate debt

378,830

196,880

575,710

441,289

119,567

560,856

Total debt

$

6,889,340

$

378,862

$

7,268,202

$

6,742,343

$

261,287

$

7,003,630

Ratio of floating rate debt to total

debt

5.5%

7.9%

6.5%

8.0%

Liquidity

As at September 30, 2023, RioCan had approximately $1.6 billion

of Liquidity as summarized in the following table:

As at

September 30, 2023

December 31, 2022

(thousands of dollars)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Undrawn revolving unsecured operating line

of credit

$

1,139,000

$

—

$

1,139,000

$

1,116,351

$

—

$

1,116,351

Undrawn construction lines and other bank

loans

251,907

190,416

442,323

267,562

70,094

337,656

Cash and cash equivalents

43,220

9,355

52,575

86,229

8,001

94,230

Liquidity

$

1,434,127

$

199,771

$

1,633,898

$

1,470,142

$

78,095

$

1,548,237

Adjusted EBITDA

The following table reconciles consolidated net income

attributable to Unitholders to Adjusted EBITDA:

Twelve months ended

September 30, 2023

December 31, 2022

(thousands of dollars)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Net income attributable to Unitholders

$

151,500

$

—

$

151,500

$

236,772

$

—

$

236,772

Add (deduct) the following items:

Income tax (recovery) expense:

Current

(13,531)

—

(13,531)

921

—

921

Fair value losses on investment

properties, net

342,994

9,023

352,017

241,128

16,208

257,336

Change in unrealized fair value on

marketable securities (i)

3,094

—

3,094

3,783

—

3,783

Internal leasing costs

12,069

—

12,069

12,204

—

12,204

Non-cash unit-based compensation

expense

10,002

—

10,002

9,056

—

9,056

Interest costs, net

198,328

10,624

208,952

180,365

8,242

188,607

Restructuring costs

1,854

—

1,854

4,289

—

4,289

ERP implementation costs

8,530

—

8,530

—

—

—

Depreciation and amortization

2,712

—

2,712

4,774

—

4,774

Transaction losses (gains) on the sale of

investment properties, net (ii)

594

(69)

525

1,024

—

1,024

Transaction costs on investment

properties

3,162

(1)

3,161

5,734

3

5,737

Operational lease revenue (expenses) from

ROU assets

4,955

(51)

4,904

4,086

(46)

4,040

Adjusted EBITDA

$

726,263

$

19,526

$

745,789

$

704,136

$

24,407

$

728,543

(i)

The fair value gains and losses on

marketable securities may include both the change in unrealized

fair value and realized gains and losses on the sale of marketable

securities. By adding back the change in unrealized fair value on

marketable securities, RioCan effectively continues to include

realized gains and losses on the sale of marketable securities in

Adjusted EBITDA and excludes unrealized fair value gains and losses

on marketable securities in Adjusted EBITDA.

(ii)

Includes transaction gains and losses

realized on the disposition of investment properties.

Adjusted Debt to Adjusted EBITDA Ratio

Adjusted Debt to Adjusted EBITDA is calculated as follows:

Twelve months ended

September 30, 2023

December 31, 2022

(thousands of dollars, except where

otherwise noted)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Adjusted Debt to Adjusted

EBITDA

Average total debt outstanding

$

6,875,311

$

292,517

$

7,167,828

$

6,756,628

$

251,888

$

7,008,516

Less: average cash and cash

equivalents

(106,768)

(10,343)

(117,111)

(74,871)

(8,791)

(83,662)

Average Total Adjusted Debt

$

6,768,543

$

282,174

$

7,050,717

$

6,681,757

$

243,097

$

6,924,854

Adjusted EBITDA (i)

$

726,263

$

19,526

$

745,789

$

704,136

$

24,407

$

728,543

Adjusted Debt to Adjusted

EBITDA

9.32

9.45

9.49

9.51

(i)

Adjusted EBITDA is reconciled in the

immediately preceding table above.

Unencumbered Assets

The tables below summarize RioCan's Unencumbered Assets to

Unsecured Debt and Percentage of Normalized NOI Generated from

Unencumbered Assets as at September 30, 2023 and December 31,

2022:

As at

September 30, 2023

December 31, 2022

(thousands of dollars, except where

otherwise noted)

Targeted

Ratios

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

Unencumbered Assets

$

8,488,425

$

60,958

$

8,549,383

$

8,200,280

$

56,228

$

8,256,508

Total Unsecured Debt

$

4,061,000

$

—

$

4,061,000

$

3,783,649

$

—

$

3,783,649

Unencumbered Assets to Unsecured

Debt

> 200%

209 %

211 %

217 %

218 %

Annual Normalized NOI - total portfolio

(i)

$

683,240

$

25,440

$

708,680

$

646,540

$

23,488

$

670,028

Annual Normalized NOI - Unencumbered

Assets (i)

$

421,432

$

3,740

$

425,172

$

370,804

$

3,440

$

374,244

Percentage of Normalized NOI Generated

from Unencumbered Assets

> 50.0%

61.7 %

60.0 %

57.4 %

55.9 %

(i)

Annual Normalized NOI are reconciled in

the table below.

Three months ended

September 30, 2023

Three months ended December 31,

2022

(thousands of dollars)

IFRS basis

Equity-accounted investments

RioCan's proportionate share

IFRS basis

Equity-accounted investments

RioCan's proportionate share

NOI (i)

$

175,497

$

6,360

$

181,857

$

166,062

$

5,872

$

171,934

Adjust the following:

Miscellaneous revenue

(1,366)

—

(1,366)

(802)

—

(802)

Percentage rent

(2,879)

—

(2,879)

(3,234)

—

(3,234)

Lease cancellation fees

(442)

—

(442)

(391)

—

(391)

Normalized NOI - total

portfolio

$

170,810

$

6,360

$

177,170

$

161,635

$

5,872

$

167,507

Annual Normalized NOI - total

portfolio(ii)

$

683,240

$

25,440

$

708,680

$

646,540

$

23,488

$

670,028

NOI from Unencumbered Assets

$

108,288

$

935

$

109,223

$

94,957

$

860

$

95,817

Adjust the following for Unencumbered

Assets:

Miscellaneous revenue

(795)

—

(795)

(518)

—

(518)

Percentage rent

(1,943)

—

(1,943)

(1,430)

—

(1,430)

Lease cancellation fees

(192)

—

(192)

(308)

—

(308)

Normalized NOI - Unencumbered

Assets

$

105,358

$

935

$

106,293

$

92,701

$

860

$

93,561

Annual Normalized NOI - Unencumbered

Assets (ii)

$

421,432

$

3,740

$

425,172

$

370,804

$

3,440

$

374,244

(i)

Refer to the NOI and Same Property NOI

table of this section for reconciliation from NOI to operating

income.

(ii)

Calculated by multiplying Normalized NOI

by a factor of 4.

Forward-Looking

Information

This News Release contains forward-looking information within

the meaning of applicable Canadian securities laws. This

information reflects RioCan’s objectives, our strategies to achieve

those objectives, as well as statements with respect to

management’s beliefs, estimates and intentions concerning

anticipated future events, results, circumstances, performance or

expectations that are not historical facts. Forward-looking

information can generally be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “would”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “should”, “plan”, “continue”, or similar expressions

suggesting future outcomes or events. Such forward-looking

information reflects management’s current beliefs and is based on

information currently available to management. All forward-looking

information in this News Release is qualified by these cautionary

statements. Forward-looking information is not a guarantee of

future events or performance and, by its nature, is based on

RioCan’s current estimates and assumptions, which are subject to

numerous risks and uncertainties, including those described in the

“Risks and Uncertainties” section in RioCan's MD&A for the

three and nine months ended September 30, 2023 and in our most

recent Annual Information Form, which could cause actual events or

results to differ materially from the forward-looking information

contained in this News Release. Although the forward-looking

information contained in this News Release is based upon what

management believes are reasonable assumptions, there can be no

assurance that actual results will be consistent with this

forward-looking information.

The forward-looking statements contained in this News Release

are made as of the date hereof, and should not be relied upon as

representing RioCan’s views as of any date subsequent to the date

of this News Release. Management undertakes no obligation, except

as required by applicable law, to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102702168/en/

RioCan Real Estate Investment Trust Dennis Blasutti Chief

Financial Officer 416-866-3033 | www.riocan.com

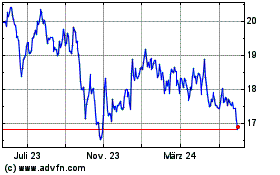

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

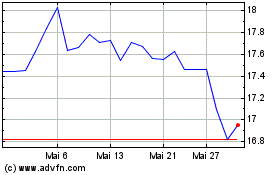

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024