Morguard North American Residential REIT Announces $70 Million Offering of Convertible Debentures

24 Januar 2018 - 10:10PM

NOT FOR DISTRIBUTION IN THE UNITED STATESOR OVER

UNITED STATES WIRE SERVICES

Morguard North American Residential Real Estate Investment Trust

(“Morguard NAR REIT” or the “REIT”) (TSX:MRG.UN), announced today

that it has entered into an agreement with a syndicate of

underwriters, co-led by RBC Capital Markets and TD Securities Inc.,

for the purchase by the underwriters, on a bought deal basis,

subject to regulatory approval, of $70,000,000 aggregate principal

amount of 4.50% convertible unsecured subordinated debentures due

March 31, 2023 (the “Debentures”). The Debentures are convertible,

at the option of the holder, into trust units of Morguard NAR REIT

at $20.20 per trust unit. Morguard NAR REIT has granted an

over-allotment option exercisable at any time up to 30 days after

Closing, to acquire additional Debentures up to the lesser of

$10,500,000 aggregate principal amount of Debentures and the

Underwriters respective “Over-Allocation Position” as at the

closing date.

As part of the transaction, Morguard Corporation

has agreed to purchase $5,000,000 of the Debentures being

offered.

Morguard NAR REIT will, by January 30, 2018,

file with the securities commissions and other similar regulatory

authorities in each of the provinces and territories of Canada,

excluding Quebec, a preliminary short form prospectus relating to

the issuance of the Debentures. The offering is expected to

close on or about February 13, 2018.

The REIT intends to use the net proceeds from

the Offering to fund the redemption of all of the REIT’s 4.65%

convertible unsecured subordinated debentures (current outstanding

balance of $60.0 million) which mature on March 30, 2018 and which

have a par call date of April 1, 2017. The REIT intends to use the

remainder of the net proceeds, if any, to fund future acquisitions,

for debt repayment and for general trust purposes.

This press release does not constitute an offer

to sell, or the solicitation of an offer to buy, any securities in

any jurisdiction. The securities being offered have not been and

will not be registered under the U.S. Securities Act of 1933 and

state securities laws. Accordingly, the securities may not be

offered or sold to U.S. persons except pursuant to applicable

exemptions from registration requirements.

About Morguard North American

Residential REIT

The REIT is an unincorporated, open-ended real

estate investment trust which owns, through a limited partnership,

interests in a portfolio of 16 Canadian residential apartment

communities, located in Alberta and Ontario, and 30 U.S.

residential apartment communities located in Colorado, Texas,

Louisiana, Illinois, Georgia, Florida, North Carolina, Virginia and

Maryland consisting of approximately 13,000 residential suites.

For more information, please visit

Morguard.com.

Certain information in this press release may

constitute forward-looking statements that involve a number of

risks and uncertainties, including statements regarding the outlook

for the REIT’s business results of operations, proposed use of

proceeds from the offering (including any redemption) and the

timing thereof. Forward-looking statements use the words “believe,”

“expect,” “anticipate,” “may,” “should,” “intend,” “estimate” and

other similar terms, which do not relate to historical matters.

Such forward-looking statements involve known and unknown risks and

uncertainties and other factors that may cause the actual results

to differ materially from those indicated. Such factors include,

but are not limited to, general economic conditions, the

availability of new competitive supply of commercial real estate

that may become available either through construction or sublease,

the REIT’s ability to maintain occupancy and to lease or re-lease

space on a timely basis at current or anticipated rates, tenant

bankruptcies, financial difficulties and defaults, changes in

interest rates, changes in operating costs, the REIT’s ability to

obtain adequate insurance coverage at a reasonable cost, the

ability to complete potential acquisitions and the availability of

financing. The REIT believes that the expectations reflected in

forward-looking statements are based on reasonable assumptions;

however, the REIT can give no assurance that actual results will be

consistent with these forward-looking statements. Except as

required by applicable law, the REIT disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise.

Readers should be cautioned not to place undue reliance on the

forward-looking statements.

For further information:

Mr. K. Rai Sahi, Chairman and Chief Executive OfficerMorguard

North American Residential Real Estate Investment Trust55 City

Centre DriveSuite 1000Mississauga, OntarioL5B 1M3Tel:

905-281-3800www.morguard.com

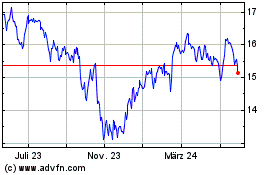

Morguard North American ... (TSX:MRG.UN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

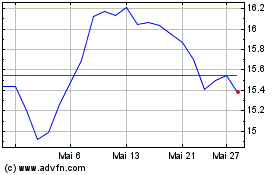

Morguard North American ... (TSX:MRG.UN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025