Karora Resources Inc. (TSX:KRR; OTCQX:KRRGF) ("Karora" or the

“Corporation") is pleased to announce that it has amended the terms

of its previously announced bought deal financing to increase the

size of the offering to C$60,000,000 (the “Upsized Offering”).

Under the terms of the Upsized Offering, Haywood

Securities Inc. (“Haywood”), as co-lead underwriter and sole

bookrunner, and Cormark Securities Inc. (together with Haywood, the

“Co-Lead Underwriters”), as co-lead underwriter, on their own

behalf and on behalf of a syndicate of underwriters (together with

the Co-Lead Underwriters, the “Underwriters”), have agreed to

purchase, on a bought deal basis, 12,500,000 common shares in the

capital of the Corporation (the “Common Shares”) at a price of

C$4.80 per Common Share (the “Issue Price”) for gross proceeds to

the Corporation of C$60,000,000.

In addition, the Corporation has agreed to grant

the Underwriters an option to purchase up to an additional 15% of

the number of Common shares sold under the Upsized Offering at a

price per Common Share equal to the Issue Price, on the same terms

and conditions as the Upsized Offering, exercisable at any time, in

whole or in part, until the date that is 30 days following the

closing of the Upsized Offering.

The Corporation intends to use the net proceeds

received from the Upsized Offering to fund a portion of the cash

consideration due at a closing of the Lakewood Mill acquisition as

further described in the Corporation’s news release dated today

(which transaction is subject to the satisfactory completion by the

Corporation of its due diligence and other applicable closing

conditions), advancement of the Corporation's nickel exploration

and development program at Beta Hunt, and for working capital and

general corporate purposes.

The Common Shares will be offered by way of a

short form prospectus to be filed in all provinces of Canada (other

than Quebec). The Common Shares will also be sold to U.S. buyers on

a private placement basis pursuant to an exemption from the

registration requirements in Rule 144A of the United States

Securities Act of 1933, as amended, and other jurisdictions outside

of Canada provided that no prospectus filing or comparable

obligation arises.

The Upsized Offering is scheduled to close on or

about June 15, 2022 and is subject to certain conditions including,

but not limited to, the receipt of all necessary regulatory and

other approvals including the approval of the Toronto Stock

Exchange and the securities regulatory authorities.

The securities offered in the Upsized Offering

have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the “U.S. Securities Act”) or

any U.S. state securities laws, and may not be offered or sold in

the United States or to, or for the account or benefit of, United

States persons absent registration or any applicable exemption from

the registration requirements of the U.S. Securities Act and

applicable U.S. state securities laws. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy

securities in the United States, nor there be any sale of these

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

About Karora Resources

Karora is focused on increasing gold production

to a targeted range of 185,000-205,000 ounces by 2024 at its

integrated Beta Hunt Gold Mine and Higginsville Gold Operations

(“HGO”) in Western Australia. The Higginsville treatment facility

is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5

Mtpa by 2024, which is fed at capacity from Karora's underground

Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold

Mineral Resource and Reserve are hosted in multiple gold shears,

with gold intersections along a 4 km strike length remaining open

in multiple directions. HGO has a substantial Mineral gold Resource

and Reserve and prospective land package totaling approximately

1,900 square kilometers. The Corporation also owns the high grade

Spargos Reward project, which came into production in 2021. Karora

has a strong Board and management team focused on delivering

shareholder value and responsible mining, as demonstrated by

Karora’s commitment to reducing emissions across its operations.

Karora's common shares trade on the TSX under the symbol KRR and

also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning

Forward-Looking Statements

This news release contains "forward-looking

information" including without limitation statements relating to

the liquidity and capital resources of Karora, production guidance

and the potential of the Beta Hunt Mine, Higginsville Gold

Operation, the Aquarius Project and the Spargos Gold Project, the

commencement of mining at the Spargos Gold Project and the

completion of the Upsized Offering.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Karora to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Factors that could affect the outcome include, among

others: future prices and the supply of metals; the results of

drilling; inability to raise the money necessary to incur the

expenditures required to retain and advance the properties;

environmental liabilities (known and unknown); general business,

economic, competitive, political and social uncertainties; results

of exploration programs; accidents, labour disputes and other risks

of the mining industry; political instability, terrorism,

insurrection or war; or delays in obtaining governmental approvals,

projected cash operating costs, failure to obtain regulatory or

shareholder approvals. For a more detailed discussion of such risks

and other factors that could cause actual results to differ

materially from those expressed or implied by such forward-looking

statements, refer to Karora 's filings with Canadian securities

regulators, including the most recent Annual Information Form,

available on SEDAR at www.sedar.com.

Although Karora has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. Forward-looking statements contained herein

are made as of the date of this news release and Karora disclaims

any obligation to update any forward-looking statements, whether as

a result of new information, future events or results or otherwise,

except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director,

Investor

Relations T:

(416)

363-0649 www.karoraresources.com

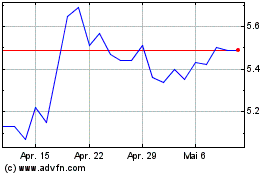

Karora Resources (TSX:KRR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

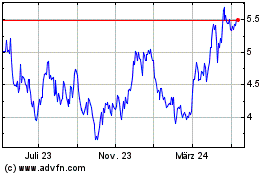

Karora Resources (TSX:KRR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025