Kolibri Global Energy Inc. (the “Company” or

“Kolibri”) (TSX: KEI, NASDAQ: KGEI) is providing 2025

guidance for its Tishomingo field in Oklahoma.

The Company is providing its forecasted guidance for 2025 as

follows:

2025 Forecast

% Increase from 2024 Guidance

Range

Average production

4,500 to 5,100 boepd

38% to 40%

Revenue(1)

US$75 million to US$89

million

32% to 44%

Adjusted EBITDA(2)

US$58 million to US$71

million

35% to 48%

Capital expenditures

US$48 million to US$53

million

Net Debt at year end

US$25 million to US$30

million

Debt to EBITDA Ratio

Below 1.0

(1)

Assumptions include forecasted

pricing for 2025 of WTI US$70/bbl, US$2.60 Henry Hub, and NGL

pricing of US$28/boe and includes the impact of the Company’s

existing hedges.

(2)

Adjusted EBITDA is considered a

non-GAAP measure. Refer to the section entitled “Non-GAAP Measures”

of this news release

The strategy of the Company for 2025 is to further build on the

success we have had for the last few years. This includes

continuing cash flow growth, developing the Company’s reserves,

returning capital to shareholders, and testing the economics of

nonproven areas.

Based on the successful results of our first three 1.5-mile

laterals, we have designed a new full field development plan

consisting mainly of 1.5 and 2-mile laterals. The Company’s current

plan anticipates bringing nine wells on production this year.

Kolibri plans to drill and complete four 1.5-mile lateral wells

(100 percent working interest) from one pad in the second quarter,

drill two additional 1.5-mile lateral wells in the second half of

the year (99.9 percent working interest), and then fracture

stimulate these wells together with the two 1-mile lateral Velin

wells (96.7 percent working interest) that the Company had

previously drilled.

The ninth planned well, the Forguson 17-20-3H well, will be

drilled to test the economics of the Caney Formation on the

Company’s eastern acreage. Kolibri will operate and have a 46%

working interest in this well, as a large integrated oil company

has elected to participate and is expected to be drilled late in

the 2nd quarter. The Caney target on the eastern side has similar

characteristics and thickness as in the heart of Kolibri’s proved

acreage in the main part of the field, except that it is

shallower.

Kolibri has approximately 3,000 net acres on its east side

acreage. All of the eastern acreage is currently classified as

contingent resources by Kolibri’s independent reservoir engineering

firm, as no well has been completed in the Caney on this acreage.

If the Forguson well proves to be economic, in addition to adding

cash flow, it can lead to many additional development locations for

the Company.

Wolf Regener, President and CEO, commented, “We are excited to

forecast another strong year of growth in 2025, which builds upon

the tremendous growth we have already experienced in the last three

years. The average production, revenue, and adjusted EBITDA

guidance for 2025 again show significant growth from the 2024

forecast numbers, even with a US$70 WTI price assumption. The

Company intends to continue repurchasing shares and has, to date,

repurchased approximately 280,000 shares.

“The Company’s strong balance sheet and our conservative price

forecast allows us the ability to adjust the timing of the wells

planned for the second half of 2025 based on the price of oil and

the performance of the wells.

“I am also looking forward to testing the economics of our east

side acreage as a successful Forguson well would add additional

drilling locations and reserves. A successful drilling campaign on

the east side acreage could add significant additional shareholder

value.

“I’m very proud of our team’s execution this past year. Our

1.5-mile lateral wells were drilled safely and quickly with an

estimated all-in well cost averaging less than US$6.3 million per

well. In addition, the wells we drilled in 2024 were almost all

classified as possible locations by our independent reservoir

engineering firm on our year end 2023 reserve report. We are

looking forward to the new reserve report, which will incorporate

the wells we drilled, including the longer laterals, and which we

anticipate will lead to increases in our reserves value.”

NON-GAAP MEASURES

Adjusted EBITDA is not a measure recognized under Canadian

Generally Accepted Accounting Principles ("GAAP") and does

not have any standardized meaning prescribed by IFRS. Management of

the Company believes that Adjusted EBITDA is relevant for

evaluating returns on the Company's project as well as the

performance of the enterprise as a whole. Adjusted EBITDA may

differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to similar

non-GAAP measures as reported by such organizations. Adjusted

EBITDA should not be construed as an alternative to net income,

cash flows related to operating activities, working capital, or

other financial measures determined in accordance with IFRS as an

indicator of the Company's performance.

An explanation of how Adjusted EBITDA provides useful

information to an investor and the purposes for which the Company’s

management uses Adjusted EBITDA is set out in the management's

discussion and analysis under the heading “Non-GAAP Measures” which

is available under the Company's profile at www.sedarplus.ca and is

incorporated by reference into this news release.

Adjusted EBITDA is calculated as net income before interest,

taxes, depletion and depreciation and other non-cash and

non-operating gains and losses. The Company considers this a key

measure as it demonstrates its ability to generate cash from

operations necessary for future growth excluding non-cash items,

gains and losses that are not part of the normal operations of the

Company and financing costs. The following is the reconciliation of

the non-GAAP measure Adjusted EBITDA:

(US $000)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income

5,066

2,319

12,472

14,483

Income tax expense

1,646

-

4,288

-

Depletion and depreciation expense

3,611

3,790

11,205

11,503

Accretion expense

46

40

135

129

Interest expense

839

651

2,567

1,511

Unrealized (gain) loss on commodity

contracts

(1,341

)

2,579

(871

)

412

Stock based compensation

268

157

807

531

Other income

-

(1

)

(60

)

(2

)

Foreign currency (gain) loss

1

1

3

11

Adjusted EBITDA

10,136

9,536

30,546

28,578

About Kolibri Global Energy Inc.

Kolibri Global Energy Inc. is a North American energy company

focused on finding and exploiting energy projects in oil and gas.

Through various subsidiaries, the Company owns and operates energy

properties in the United States. The Company continues to utilize

its technical and operational expertise to identify and acquire

additional projects in oil and gas. The Company's shares are traded

on the Toronto Stock Exchange under the stock symbol KEI and on the

NASDAQ under the stock symbol KGEI.

Product Type Disclosure

This news release includes references to sales volumes of "oil",

"natural gas", and “barrels of oil equivalent” or “BOEs”. “Oil”

refers to light crude oil and medium crude oil combined, and

"natural gas" refers to shale gas, in each case as defined by NI

51-101. Production from our wells, primarily disclosed in this news

release in BOEs, consists of mainly oil and associated wet gas. The

wet gas is delivered via gathering system and then pipelines to

processing plants where it is treated and sold as natural gas and

NGLs.

Cautionary Statements

In this news release and the Company’s other public disclosure:

The references to barrels of oil equivalent ("Boes") reflect

natural gas, natural gas liquids and oil. Boes may be misleading,

particularly if used in isolation. A Boe conversion ratio of 6

Mcf:1 Bbl is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value. Possible reserves are those additional

reserves that are less certain to be recovered than probable

reserves. There is a 10% probability that the quantities actually

recovered will equal or exceed the sum of proved plus probable plus

possible reserves.

Readers should be aware that references to initial production

rates and other short-term production rates are preliminary in

nature and are not necessarily indicative of long-term performance

or of ultimate recovery. Readers are referred to the full

description of the results of the Company's December 31, 2023

independent reserves evaluation and other oil and gas information

contained in its Form 51-101F1 Statement of Reserves Data and Other

Oil and Gas Information for the year ended December 31, 2023, which

can be accessed electronically from the SEDAR website at

www.sedarplus.ca.

Caution Regarding Forward-Looking Information

Certain statements contained in this news release constitute

"forward-looking information" as such term is used in applicable

Canadian securities laws and “forward-looking statements” within

the meaning of United States securities laws (collectively,

“forward-looking information”), including statements regarding the

timing of and expected results from planned wells development,

projected average production, revenue and Adjusted EBITDA for 2025,

projected total capital expenditures, net debt and debt to Adjusted

EBITDA ratio for 2025, the Company’s strategy for 2025, returning

capital to shareholders in 2025, the addition of significant

additional reserves and adding more shareholder value.

Forward-looking information is based on plans and estimates of

management and interpretations of data by the Company's technical

team at the date the data is provided and is subject to several

factors and assumptions of management, including forecasted pricing

in 2025 of WTI US $70/bbl, US $2.60 Henry Hub and NGL pricing of US

$28/boe, that indications of early results are reasonably accurate

predictors of the prospectiveness of the shale intervals, that

required regulatory approvals will be available when required, that

no unforeseen delays, unexpected geological or other effects,

including flooding and extended interruptions due to inclement or

hazardous weather conditions, equipment failures, permitting delays

or labor or contract disputes are encountered, that the necessary

labor and equipment will be obtained, that the development plans of

the Company and its co-venturers will not change, that the offset

operator’s operations will proceed as expected by management, that

the demand for oil and gas will be sustained, that the price of oil

will be sustained or increase, that the Company will continue to be

able to access sufficient capital through cash flow, debt,

financings, farm-ins or other participation arrangements to

maintain its projects, and that global economic conditions will not

deteriorate in a manner that has an adverse impact on the Company's

business, its ability to advance its business strategy and the

industry as a whole. Forward-looking information is subject to a

variety of risks and uncertainties and other factors that could

cause plans, estimates and actual results to vary materially from

those projected in such forward-looking information. Factors that

could cause the forward-looking information in this news release to

change or to be inaccurate include, but are not limited to, the

risk that any of the assumptions on which such forward-looking

information is based vary or prove to be invalid, including that

the Company or its subsidiaries is not able for any reason to

obtain and provide the information necessary to secure required

approvals or that required regulatory approvals are otherwise not

available when required, that unexpected geological results are

encountered, that equipment failures, permitting delays, labor or

contract disputes or shortages of equipment, labor or materials are

encountered, the risks associated with the oil and gas industry

(e.g. operational risks in development, exploration and production;

delays or changes in plans with respect to exploration and

development projects or capital expenditures; the uncertainty of

reserve and resource estimates and projections relating to

production, costs and expenses, and health, safety and

environmental risks, including flooding and extended interruptions

due to inclement or hazardous weather conditions), the risk of

commodity price and foreign exchange rate fluctuations, that the

offset operator’s operations have unexpected adverse effects on the

Company’s operations, that completion techniques require further

optimization, that production rates do not match the Company’s

assumptions, that very low or no production rates are achieved,

that the price of oil will decline, that the Company is unable to

access required capital, that occurrences such as those that are

assumed will not occur, do in fact occur, and those conditions that

are assumed will continue or improve, do not continue or improve,

and the other risks and uncertainties applicable to exploration and

development activities and the Company's business as set forth in

the Company's management discussion and analysis and its annual

information form, both of which are available for viewing under the

Company's profile at www.sedar.com, any of which could result in

delays, cessation in planned work or loss of one or more leases and

have an adverse effect on the Company and its financial condition.

The Company undertakes no obligation to update these

forward-looking statements, other than as required by applicable

law.

Caution Regarding Future-Oriented Financial Information and

Financial Outlook

This news release may contain information deemed to be

“future-oriented financial information” or a “financial outlook”

(collectively, “FOFI”) within the meaning of applicable securities

laws. The FOFI has been prepared by management to provide an

outlook of the Company’s activities and results and may not be

appropriate for other purposes. The FOFI has been prepared based on

a number of assumptions including the assumptions discussed above

under “Caution Regarding Forward-Looking Information”. The actual

results of operations of the Company and the resulting financial

results may vary from the amounts set forth herein, and such

variations may be material. The Company and management believe that

the FOFI has been prepared on a reasonable basis, reflecting

management’s best estimates and judgments. FOFI contained in this

news release was made as of the date of this news release and the

Company disclaims any intention or obligations to update or revise

any FOFI contained in this news release, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114480489/en/

For further information, contact: Wolf E. Regener, +1

(805) 484-3613 Email: wregener@kolibrienergy.com Website:

www.kolibrienergy.com

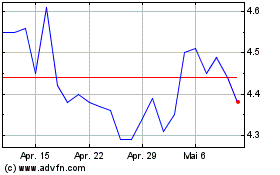

Kolibri Global Energy (TSX:KEI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

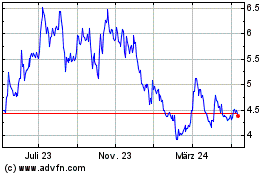

Kolibri Global Energy (TSX:KEI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025