Information Services Corporation (TSX:ISV) (“ISC”, “we” or the

“Company”) today announced its annual guidance and outlook for

2024.

Consolidated Annual Guidance

2024 (in millions of Canadian dollars except

percentages)

|

|

Guidance Ranges 2023 |

Guidance Ranges 2024 |

Estimated Year over Year Increase |

|

Revenue |

$207.0 to $212.0 |

$240.0 to $250.0 |

16% - 18% |

|

Adjusted EBITDA1 |

$71.0 to $76.0 |

$83.0 to $91.0 |

17% - 20% |

OutlookIn 2024, we expect

revenue to grow within a range of $240.0 million and $250.0 million

and adjusted EBITDA1 to grow within a range of $83.0 million and

$91.0 million. The expectations for these metrics in 2024 represent

year-over-year increases of up to 18 per cent for revenue and up to

20 per cent for adjusted EBITDA when compared to the same guidance

ranges for 2023. Our expected performance year-over-year marks the

beginning of the next phase of ISC’s growth plan. We intend to

leverage the investments and achievements of 2023 while

intensifying our focus on organic growth and continuing to execute

on accretive M&A opportunities.

Services will continue to be a significant part

of our organic growth, with a forecasted increase in transactions

and the number of customers. In Registry Operations, we expect

transactions in 2024 to be largely flat with revenue growth through

a realization of a full year of fee adjustments, including those

amended in July 2023 because of the extension of the Master

Services Agreement in Saskatchewan (the “Extension”) and regular

annual CPI fee adjustments. Our Technology Solutions segment is

also forecasted to see double-digit growth as we deliver on

existing and new solutions delivery contracts in 2024.

The key drivers of expenses in adjusted EBITDA

in 2024 are expected to be wages and salaries and cost of goods

sold. Furthermore, as a result of the Extension, the Company will

have additional operating costs associated with the enhancement of

the Saskatchewan Registries and increased interest expense arising

from additional borrowings in 2023, which are excluded from

adjusted EBITDA.

Our capital expenditures will also increase

because of the enhancement of the Saskatchewan Registries but will

remain immaterial overall. As a result, the Company expects to see

robust free cash flow in 2024, which will support the de-leveraging

of our balance sheet to realize a long-term net leverage target of

2.0x – 2.5x.

Management updateISC also

announces the upcoming retirement of Ken Budzak, Executive Vice

President, Registry Operations, effective May 2024.

Mr. Budzak has been with ISC nearly since its

inception, joining the organization in 2001. His dedication,

strategic insights and unwavering commitment have significantly

contributed to the Company's growth and success. Appointed as

Executive Vice President, Registry Operations in 2017, he has

played a pivotal role in supporting the Company's trajectory and

fostering its development.

"Ken has been an instrumental part of our

journey as both a Crown corporation and publicly traded company.

His leadership of our Saskatchewan registries business, and more

recently our Reamined Systems Inc. acquisition, has been invaluable

and has helped position the Company to be able to execute on its

growth strategy” said Shawn Peters, President and CEO. " We wish

him the very best in his well-deserved retirement."

During this transition period, the Company will

undertake a process to fill the role, ensuring it aligns with our

strategic objectives, while the strong team Ken has built will

continue to provide the exceptional performance and service that

our customers are accustomed to.

Notes1Adjusted EBITDA is not a

recognized measure under International Financial Reporting

Standards (“IFRS”) and does not have a standardized meaning

prescribed by IFRS and, therefore, it may not be comparable to

similar measures reported by other corporations. Please refer to

section 8 for “Non-IFRS Financial Measures” and “Financial Measures

and Key Performance Indicators” in Management’s Discussion and

Analysis for the three and nine months ended September 30, 2023.

Additionally, see the Non-IFRS Performance Measures section noted

below.

About ISC®Headquartered in

Canada, ISC is a leading provider of registry and information

management services for public data and records. Throughout our

history, we have delivered value to our clients by providing

solutions to manage, secure and administer information through our

Registry Operations, Services and Technology Solutions segments.

ISC is focused on sustaining its core business while pursuing new

growth opportunities. The Class A Shares of ISC trade on the

Toronto Stock Exchange under the symbol ISV.

Cautionary Note Regarding

Forward-Looking InformationThis news release contains

forward-looking information within the meaning of applicable

Canadian securities laws including, without limitation, those

contained in the “Outlook” section hereof and statements related to

the industries in which we operate, growth opportunities and our

future financial position and results of operations.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those expressed or implied by such

forward-looking information. Important factors that could cause

actual results to differ materially from the Company's plans or

expectations include risks relating to changes in economic, market

and business conditions, changes in technology and customers’

demands and expectations, reliance on key customers and licences,

dependence on key projects and clients, securing new business and

fixed-price contracts, identification of viable growth

opportunities, implementation of our growth strategy, competition,

termination risks and other risks detailed from time to time in the

filings made by the Company including those detailed in ISC’s

Annual Information Form for the year ended December 31, 2022 and

ISC’s unaudited Condensed Consolidated Interim Financial Statements

and Notes and Management’s Discussion and Analysis for the third

quarter ended September 30, 2023, copies of which are filed on

SEDAR+ at www.sedarplus.ca.

The forward-looking information in this release

is made as of the date hereof and, except as required under

applicable securities laws, ISC assumes no obligation to update or

revise such information to reflect new events or circumstances.

Non-IFRS Performance

MeasuresIncluded within this news release is reference to

certain measures that have not been prepared in accordance with

IFRS, such as adjusted EBITDA. This measure is provided as

additional information to complement those IFRS measures by

providing further understanding of our financial performance from

management’s perspective, to provide investors with supplemental

measures of our operating performance and, thus, highlight trends

in our core business that may not otherwise be apparent when

relying solely on IFRS financial measures.

Management also uses non-IFRS measures to

facilitate operating performance comparisons from period to period,

prepare annual operating budgets and assess our ability to meet

future capital expenditure and working capital requirements.

Accordingly, these non-IFRS measures should not

be considered in isolation or as a substitute for analysis of our

financial information reported under IFRS. Such measures do not

have any standardized meaning prescribed by IFRS and therefore may

not be comparable to similar measures presented by other

companies.

|

Non-IFRS Performance Measure |

Why we use it |

How we calculate it |

Most comparable IFRS financial measure |

|

Adjusted EBITDA |

- To evaluate performance and

profitability of segments and subsidiaries as well as the

conversion of revenue while excluding non-operational and

share-based volatility.

- We believe that certain investors and

analysts use adjusted EBITDA to measure our ability to service debt

and meet other performance obligations.

- Adjusted EBITDA is also used as a

component of determining short-term incentive compensation for

employees.

|

Adjusted EBITDA:EBITDA add (remove)share-based compensation

expense, acquisition, integration and other costs, gain/loss on

disposal of assets if significant |

Net income |

Investor & Media

ContactJonathan Hackshaw Senior Director, Investor

Relations & Capital MarketsToll Free: 1-855-341-8363 in North

America or 1-306-798-1137investor.relations@isc.ca

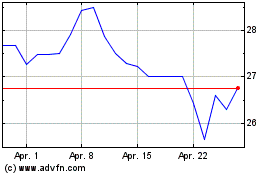

Information Services (TSX:ISV)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Information Services (TSX:ISV)

Historical Stock Chart

Von Jan 2024 bis Jan 2025