INTERFOR CORPORATION (“Interfor” or the “Company”)

(TSX: IFP) recorded a Net loss in Q3’23 of $42.4 million, or $0.82

per share, compared to a Net loss of $14.1 million, or $0.27 per

share in Q2’23 and Net earnings of $3.5 million, or $0.06 per share

in Q3’22.

Adjusted EBITDA was $31.9 million on sales of $828.1 million in

Q3’23 versus $41.9 million on sales of $871.8 million in Q2’23 and

$129.5 million on sales of $1.0 billion in Q3’22.

Notable items in the quarter:

- Lumber Production Balanced with

Demand

- Lumber production totaled 1.0

billion board feet, representing a decrease of 26 million board

feet quarter-over-quarter. The decrease was primarily due to the

temporary closure of a sawmill in B.C. as a result of

wildfires.

- Lumber shipments were 1.0 billion

board feet, or 108 million board feet lower than Q2’23.

- Weak Lumber Prices

- Lumber prices continued to reflect

softened demand driven by the elevated interest rate environment

and ongoing economic uncertainty. Lumber prices strengthened at the

beginning of Q3’23 from the effects of industry production

curtailments and reduced European imports combined with increased

new home construction demand but began to weaken near the end of

Q3’23 as increased economic uncertainty drove interest rates

higher. Interfor’s average selling price was $661 per mfbm, up $12

per mfbm versus Q2’23.

- Financial Flexibility Improved

- Net debt at quarter-end was $777.7

million, or 28.7% of invested capital, with available liquidity of

$417.9 million.

- The net debt to invested capital

leverage ratio improved compared to the end of Q2’23, driven by

$107.2 million of cash flow from operations, including $70.5

million from income tax refunds.

- Collection of an additional US$24.9

million of income tax refunds related to 2022 is expected in

Q4’23.

- Strategic Capital Investments

- Capital spending was $38.5 million,

including $20.1 million of discretionary investment focused on

multi-year projects in the U.S. South region.

- Total capital expenditures planned

for 2023 remains unchanged from prior guidance at approximately

$210.0 million, while total preliminary capital expenditures for

2024 are estimated to be approximately $140.0 million.

- Ongoing Monetization of Coastal B.C.

Operations

- Over the course of Q3’23, Interfor

advanced on its plans to monetize its Coastal B.C. operations,

which consist primarily of forest tenure rights from the province

of B.C. and related log harvesting activities.

- On October 3, 2023, the Company

entered into an agreement to settle certain contractual obligations

in order to facilitate monetization of its Coastal B.C. operations.

The settlement will result in an $85.0 million provision being

recognized in the fourth quarter, 2023, the payment of which

Interfor expects to be fully funded by net proceeds from the

disposition of Coast B.C. forest tenures over the next several

years.

- On October 27, 2023, the Company

reached an agreement for the disposition of Coastal B.C. forest

tenures totalling approximately 162,000 cubic metres of allowable

annual cut (“AAC”) for net proceeds of $21.0 million. The

completion of the disposition has received Ministry of Forests

approval and is expected to close in the fourth quarter of 2023,

subject to customary conditions for a transaction of this

kind.

- Following this, Interfor held

Coastal B.C. forest tenures totalling approximately 1,411,000 cubic

metres of AAC available for disposition subject to approvals from

the Ministry of Forests.

- Softwood Lumber Duties

- On August 1, 2023, the U.S.

Department of Commerce (“DoC”) published the final rates for

countervailing (“CV”) and anti-dumping (“AD”) duties based on the

results of its fourth administrative review (“AR4”) covering

shipments for the year ended December 31, 2021. The final combined

rate for 2021 was 8.05% compared to the cash deposit rate of 8.99%

from January to November 2021 and 17.90% for December 2021. The

combined rate of 8.05% applied to new shipments effective September

13, 2023. To reflect the lower amended final rates for 2021,

Interfor recorded a $6.3 million reduction to duties expense in

Q3’23 and a corresponding receivable on its balance

sheet.

- Interfor has cumulative duties of

US$540.0 million, or approximately $10.36 per share on an after-tax

basis, held in trust by U.S. Customs and Border Protection as at

September 30, 2023. Except for US$161.8 million recorded as a

receivable in respect of overpayments arising from duty rate

adjustments and the fair value of rights to duties acquired,

Interfor has recorded the duty deposits as an expense.

Outlook

North American lumber markets over the near term are expected to

remain volatile as the economy continues to adjust to inflationary

pressures, elevated interest rates, labour shortages and

geo-political uncertainty.

Interfor expects that over the mid-term, lumber markets will

continue to benefit from favourable underlying supply and demand

fundamentals. Positive demand factors include the advanced age of

the U.S. housing stock, a shortage of available housing and various

demographic factors, while growth in lumber supply is expected to

be limited by extended capital project completion and ramp-up

timelines, labour availability and constrained global fibre

availability.

Interfor’s strategy of maintaining a diversified portfolio of

operations in multiple regions allows the Company to both reduce

risk and maximize returns on capital over the business cycle.

Interfor is well positioned with its strong balance sheet and

available liquidity to continue pursuing its strategic plans

despite ongoing economic and geo-political uncertainty globally. In

the event of a sustained lumber market downturn, Interfor maintains

flexibility to significantly reduce capital expenditures and

working capital levels, and to proactively adjust its lumber

production to match demand.

Financial and Operating

Highlights1

| |

|

For the three months ended |

|

For the nine months ended |

|

|

|

Sept. 30 |

Sept. 30 |

Jun. 30 |

|

Sept. 30 |

Sept. 30 |

|

|

Unit |

2023 |

2022 |

2023 |

|

2023 |

2022 |

|

|

|

|

|

|

|

|

|

| Financial

Highlights2 |

|

|

|

|

|

|

|

| Total sales |

$MM |

828.1 |

1,035.6 |

871.8 |

|

2,529.8 |

3,773.7 |

|

Lumber |

$MM |

667.1 |

837.8 |

723.2 |

|

2,032.8 |

3,241.1 |

|

Logs, residual products and other |

$MM |

161.0 |

197.8 |

148.6 |

|

497.0 |

532.6 |

| Operating earnings (loss) |

$MM |

(21.1) |

75.8 |

(20.8) |

|

(78.2) |

974.4 |

| Net earnings (loss) |

$MM |

(42.4) |

3.5 |

(14.1) |

|

(97.8) |

670.4 |

| Net earnings (loss) per share,

basic |

$/share |

(0.82) |

0.06 |

(0.27) |

|

(1.90) |

11.95 |

| Operating cash flow per share

(before working capital changes)3 |

$/share |

1.78 |

(0.02) |

0.68 |

|

2.93 |

10.86 |

| Adjusted EBITDA3 |

$MM |

31.9 |

129.5 |

41.9 |

|

99.8 |

1,128.2 |

| Adjusted EBITDA margin3 |

% |

3.9% |

12.5% |

4.8% |

|

3.9% |

29.9% |

| |

|

|

|

|

|

|

|

| Total assets |

$MM |

3,577.8 |

3,294.6 |

3,603.9 |

|

3,577.8 |

3,294.6 |

| Total debt |

$MM |

877.1 |

396.4 |

918.5 |

|

877.1 |

396.4 |

| Net debt3 |

$MM |

777.7 |

249.7 |

815.7 |

|

777.7 |

249.7 |

| Net debt to invested

capital3 |

% |

28.7% |

10.5% |

29.6% |

|

28.7% |

10.5% |

| Annualized return on capital

employed3 |

% |

(4.5%) |

5.6% |

(1.1%) |

|

(3.6%) |

47.8% |

| |

|

|

|

|

|

|

|

| Operating

Highlights |

|

|

|

|

|

|

|

| Lumber production |

million fbm |

997 |

986 |

1,023 |

|

3,050 |

2,918 |

|

U.S. South |

million fbm |

470 |

470 |

468 |

|

1,412 |

1,390 |

|

U.S. Northwest |

million fbm |

162 |

159 |

165 |

|

469 |

495 |

|

Eastern Canada |

million fbm |

247 |

198 |

249 |

|

745 |

505 |

|

B.C. |

million fbm |

118 |

159 |

141 |

|

424 |

528 |

| Lumber sales |

million fbm |

1,008 |

1,064 |

1,116 |

|

3,128 |

2,989 |

| Lumber - average selling

price4 |

$/thousand fbm |

661 |

800 |

649 |

|

650 |

1,084 |

| |

|

|

|

|

|

|

|

| Key

Statistics |

|

|

|

|

|

|

|

| Benchmark lumber prices5 |

|

|

|

|

|

|

|

|

SYP Composite |

US$ per mfbm |

429 |

555 |

446 |

|

439 |

785 |

|

KD H-F Stud 2x4 9’ |

US$ per mfbm |

474 |

627 |

452 |

|

451 |

937 |

|

Eastern SPF Composite |

US$ per mfbm |

510 |

657 |

474 |

|

486 |

949 |

|

Western SPF Composite |

US$ per mfbm |

412 |

550 |

372 |

|

394 |

849 |

| |

|

|

|

|

|

|

|

| USD/CAD exchange rate6 |

|

|

|

|

|

|

|

|

Average |

1 USD in CAD |

1.3414 |

1.3056 |

1.3428 |

|

1.3456 |

1.2828 |

|

Closing |

1 USD

in CAD |

1.3520 |

1.3707 |

1.3240 |

|

1.3520 |

1.3707 |

Notes:

- Figures in this table may not equal or sum to figures presented

elsewhere due to rounding.

- Financial information presented for interim periods in this

release is prepared in accordance with IFRS and is unaudited.

- Refer to the Non-GAAP Measures section of this release for

definitions and reconciliations of these measures to figures

reported in the Company’s unaudited condensed consolidated interim

financial statements.

- Gross sales including duties and freight.

- Based on Random Lengths Benchmark Lumber Pricing.

- Based on Bank of Canada foreign exchange rates.

Liquidity

Balance Sheet

Interfor’s Net debt at September 30, 2023 was $777.7 million, or

28.7% of invested capital, representing an increase of $57.3

million from the level of Net debt at December 31, 2022.

As at September 30, 2023 the Company had net

working capital of $400.0 million and available liquidity of $417.9

million, based on the available borrowing capacity under its $600.0

million Revolving Term Line (“Term Line”).

The Term Line and Senior Secured Notes are subject

to financial covenants, including a net debt to total

capitalization ratio and an EBITDA interest coverage ratio.

Management believes, based on circumstances known

today, that Interfor has sufficient working capital and liquidity

to fund operating and capital requirements for the foreseeable

future.

| |

For the three months endedSept.

30, |

|

For the nine months endedSept.

30, |

|

Millions of Canadian Dollars |

2023 |

2022 |

|

2023 |

2022 |

| Net debt |

|

|

|

|

|

| Net debt (cash), period

opening |

$815.7 |

$102.0 |

|

$720.3 |

$(162.9) |

| Repayment of Senior Secured

Notes |

- |

- |

|

(7.1) |

(7.0) |

| Term Line net drawings

(repayments) |

(61.2) |

- |

|

88.3 |

(3.9) |

| Decrease (increase) in cash

and cash equivalents |

5.6 |

130.2 |

|

(23.6) |

406.5 |

| Foreign

currency translation impact on U.S. Dollar denominated cash and

cash equivalents and debt |

17.6 |

17.5 |

|

(0.2) |

17.0 |

|

Net debt, period ending |

$777.7 |

$249.7 |

|

$777.7 |

$249.7 |

On December 16, 2022, the Company completed an expansion of its

Term Line. The commitment under the Term Line was increased by

$100.0 million to a total of $600.0 million.

On December 1, 2022, the Company issued US$200.0 million of

Series H Senior Secured Notes, bearing interest at 7.06% with

principal payments of US$66.7 million due on December 26, 2031,

2032 and on final maturity in 2033.

Capital Resources

The following table summarizes Interfor’s credit facilities and

availability as of September 30, 2023:

|

|

Revolving |

Senior |

|

| |

Term |

Secured |

|

|

Millions of Canadian Dollars |

Line |

Notes |

Total |

| Available line of credit and

maximum borrowing available |

$600.0 |

$654.0 |

$1,254.0 |

| Less: |

|

|

|

|

Drawings |

223.1 |

654.0 |

877.1 |

|

Outstanding letters of credit included in line utilization |

58.4 |

- |

58.4 |

|

Unused portion of facility |

$318.5 |

$ - |

318.5 |

| Add: |

|

|

|

|

Cash and cash equivalents |

|

|

99.4 |

|

Available liquidity at September 30, 2023 |

|

|

$417.9 |

Interfor’s Term Line matures in December 2026 and

its Senior Secured Notes have maturities in the years

2024-2033.

As of September 30, 2023, the Company had commitments for

capital expenditures totaling $114.2 million for both maintenance

and discretionary capital projects.

Non-GAAP Measures

This MD&A makes reference to the following non-GAAP

measures: EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Net debt

to invested capital, Operating cash flow per share (before working

capital changes), and Annualized return on capital employed which

are used by the Company and certain investors to evaluate operating

performance and financial position. These non-GAAP measures do not

have any standardized meaning prescribed by IFRS and are therefore

unlikely to be comparable to similar measures presented by other

issuers.

The following table provides a reconciliation of these non-GAAP

measures to figures as reported in the Company’s audited

consolidated financial statements (unaudited for interim periods)

prepared in accordance with IFRS:

|

|

For the three months ended |

For the nine months ended |

|

|

Sept. 30 |

Sept. 30 |

Jun. 30 |

Sept. 30 |

Sept. 30 |

|

Millions of Canadian Dollars except number of shares and per share

amounts |

2023 |

2022 |

2023 |

2023 |

2022 |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

|

|

|

|

| Net earnings (loss) |

$(42.4) |

$3.5 |

$(14.1) |

$(97.8) |

$670.4 |

| Add: |

|

|

|

|

|

|

Depreciation of plant and equipment |

46.7 |

40.6 |

46.7 |

138.5 |

115.3 |

|

Depletion and amortization of timber, roads and other |

7.6 |

9.8 |

9.9 |

29.7 |

28.0 |

|

Finance costs |

10.2 |

1.5 |

13.3 |

34.4 |

11.0 |

|

Income tax expense (recovery) |

(5.1) |

35.8 |

(8.1) |

(24.7) |

257.3 |

|

EBITDA |

17.0 |

91.2 |

47.7 |

80.1 |

1,082.0 |

| Add: |

|

|

|

|

|

|

Long-term incentive compensation expense (recovery) |

(1.3) |

2.5 |

2.8 |

4.1 |

(4.2) |

|

Other foreign exchange loss (gain) |

14.0 |

46.9 |

(13.7) |

0.3 |

54.4 |

|

Other expense (income) excluding business interruption

insurance |

2.2 |

(11.9) |

5.0 |

13.6 |

(9.0) |

|

Asset write-downs and restructuring costs |

- |

0.8 |

0.1 |

1.7 |

5.0 |

|

Adjusted EBITDA |

$31.9 |

$129.5 |

$41.9 |

$99.8 |

$1,128.2 |

|

Sales |

$828.1 |

$1,035.6 |

$871.8 |

$2,529.8 |

$3,773.7 |

|

Adjusted EBITDA margin |

3.9% |

12.5% |

4.8% |

3.9% |

29.9% |

|

|

|

|

|

|

|

| Net debt to invested

capital |

|

|

|

|

|

| Net debt |

|

|

|

|

|

|

Total debt |

$877.1 |

$396.4 |

$918.5 |

$877.1 |

$396.4 |

|

Cash and cash equivalents |

(99.4) |

(146.7) |

(102.8) |

(99.4) |

(146.7) |

|

Total net debt |

$777.7 |

$249.7 |

$815.7 |

$777.7 |

$249.7 |

|

Invested capital |

|

|

|

|

|

|

Net debt |

$777.7 |

$249.7 |

$815.7 |

$777.7 |

$249.7 |

|

Shareholders' equity |

1,927.9 |

2,123.3 |

1,943.2 |

1,927.9 |

2,123.3 |

|

Total invested capital |

$2,705.6 |

$2,373.0 |

$2,758.9 |

$2,705.6 |

$2,373.0 |

|

Net debt to invested capital1 |

28.7% |

10.5% |

29.6% |

28.7% |

10.5% |

|

|

|

|

|

|

|

| Operating cash flow

per share (before working capital changes) |

|

|

|

|

|

| Cash provided by operating

activities |

$107.2 |

$47.0 |

$123.0 |

$145.7 |

$722.0 |

| Cash

used in (generated from) operating working capital |

(15.7) |

(47.9) |

(88.4) |

4.8 |

(113.1) |

|

Operating cash flow (before working capital changes) |

$91.5 |

$(0.9) |

$34.6 |

$150.5 |

$608.9 |

|

Weighted average number of shares - basic (millions) |

51.4 |

54.1 |

51.4 |

51.4 |

56.1 |

|

Operating cash flow per share (before working capital changes) |

$1.78 |

$(0.02) |

$0.68 |

$2.93 |

$10.86 |

|

|

|

|

|

|

|

| Annualized return on

capital employed |

|

|

|

|

|

| Net earnings (loss) |

$(42.4) |

$3.5 |

$(14.1) |

$(97.8) |

$670.4 |

| Add: |

|

|

|

|

|

|

Finance costs |

10.2 |

1.5 |

13.3 |

34.4 |

11.0 |

|

Income tax expense (recovery) |

(5.1) |

35.8 |

(8.1) |

(24.7) |

257.3 |

|

Earnings (loss) before income taxes and finance costs |

$(37.3) |

$40.8 |

$(8.9) |

$(88.1) |

$938.7 |

|

Capital Employed |

|

|

|

|

|

|

Total assets |

$3,577.8 |

$3,294.6 |

$3,603.9 |

$3,577.8 |

$3,294.6 |

|

Current liabilities |

(345.4) |

(378.8) |

(318.9) |

(345.4) |

(378.8) |

|

Less: |

|

|

|

|

|

|

Current portion of long-term debt |

45.1 |

7.4 |

44.1 |

45.1 |

7.4 |

|

Current portion of lease liabilities |

16.0 |

15.6 |

15.8 |

16.0 |

15.6 |

|

Capital employed, end of period |

$3,293.5 |

$2,938.8 |

$3,344.9 |

$3,293.5 |

$2,938.8 |

| Capital employed, beginning of

period |

3,344.9 |

2,869.9 |

3,419.3 |

3,316.0 |

2,303.2 |

|

Average capital employed |

$3,319.2 |

$2,904.3 |

$3,382.1 |

$3,304.7 |

$2,621.0 |

|

Earnings (loss) before income taxes and finance costs divided

byaverage capital employed |

(1.1%) |

1.4% |

(0.3%) |

(2.7%) |

35.8% |

|

Annualization factor |

4.0 |

4.0 |

4.0 |

1.3 |

1.3 |

|

Annualized return on capital employed |

(4.5%) |

5.6% |

(1.1%) |

(3.6%) |

47.8% |

|

|

| Note 1: Net debt

to invested capital as of the period end. |

| CONDENSED

CONSOLIDATED STATEMENTS OF EARNINGS |

|

For the three and nine months ended September 30, 2023 and

2022 (unaudited) |

|

(millions of Canadian Dollars except per share amounts) |

Three Months |

Three Months |

Nine Months |

Nine Months |

|

|

Sept. 30, 2023 |

Sept. 30, 2022 |

Sept. 30, 2023 |

Sept. 30, 2022 |

|

|

|

|

|

|

| Sales |

$828.1 |

$1,035.6 |

$2,529.8 |

$3,773.7 |

| |

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

Production |

778.1 |

902.9 |

2,353.4 |

2,536.0 |

|

Selling and administration |

17.2 |

15.6 |

52.0 |

49.4 |

|

Long-term incentive compensation expense (recovery) |

(1.3) |

2.5 |

4.1 |

(4.2) |

|

U.S. countervailing and anti-dumping duty deposits |

0.9 |

(12.4) |

28.6 |

69.8 |

|

Depreciation of plant and equipment |

46.7 |

40.6 |

138.5 |

115.3 |

|

Depletion and amortization of timber, roads and other |

7.6 |

9.8 |

29.7 |

28.0 |

|

|

849.2 |

959.0 |

2,606.3 |

2,794.3 |

|

|

|

|

|

|

|

Operating earnings (loss) before asset write-downs

and |

|

|

|

|

|

restructuring costs |

(21.1) |

76.6 |

(76.5) |

979.4 |

|

|

|

|

|

|

| Asset

write-downs and restructuring costs |

- |

0.8 |

1.7 |

5.0 |

|

Operating earnings (loss) |

(21.1) |

75.8 |

(78.2) |

974.4 |

| |

|

|

|

|

| Finance costs |

(10.2) |

(1.5) |

(34.4) |

(11.0) |

| Other foreign exchange

loss |

(14.0) |

(46.9) |

(0.3) |

(54.4) |

| Other

income (expense) |

(2.2) |

11.9 |

(9.6) |

18.7 |

|

|

(26.4) |

(36.5) |

(44.3) |

(46.7) |

|

|

|

|

|

|

|

Earnings (loss) before income taxes |

(47.5) |

39.3 |

(122.5) |

927.7 |

| |

|

|

|

|

| Income tax expense

(recovery): |

|

|

|

|

|

Current |

(5.9) |

27.5 |

(24.0) |

242.9 |

|

Deferred |

0.8 |

8.3 |

(0.7) |

14.4 |

|

|

(5.1) |

35.8 |

(24.7) |

257.3 |

|

|

|

|

|

|

|

Net earnings (loss) |

$(42.4) |

$3.5 |

$(97.8) |

$670.4 |

|

|

|

|

|

|

| Net earnings (loss)

per share |

|

|

|

|

| Basic |

$(0.82) |

$0.06 |

$(1.90) |

$11.95 |

|

Diluted |

$(0.82) |

$0.06 |

$(1.90) |

$11.91 |

| CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| For the

three and nine months ended September 30, 2023 and 2022

(unaudited) |

|

(millions of Canadian Dollars) |

Three Months |

Three Months |

Nine Months |

Nine Months |

|

|

Sept. 30, 2023 |

Sept. 30, 2022 |

Sept. 30, 2023 |

Sept. 30, 2022 |

| |

|

|

|

|

| Net earnings

(loss) |

$(42.4) |

$3.5 |

$(97.8) |

$670.4 |

| |

|

|

|

|

| Other comprehensive

income (loss): |

|

|

|

|

| Items that will not be

recycled to Net earnings (loss): |

|

|

|

|

|

Defined benefit plan actuarial gain (loss), net of tax |

- |

(1.2) |

0.7 |

0.6 |

| |

|

|

|

|

| Items that are or may

be recycled to Net earnings (loss): |

|

|

|

|

|

Foreign currency translation differences for foreign

operations, |

|

|

|

|

|

net of tax |

26.9 |

115.0 |

(2.8) |

142.9 |

|

Total other comprehensive income (loss), net of

tax |

26.9 |

113.8 |

(2.1) |

143.5 |

|

|

|

|

|

|

|

Comprehensive income (loss) |

$(15.5) |

$117.3 |

$(99.9) |

$813.9 |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

For the three and nine months ended September 30, 2023 and

2022 (unaudited) |

|

(millions of Canadian Dollars) |

Three Months |

Three Months |

Nine Months |

Nine Months |

|

|

Sept. 30, 2023 |

Sept. 30, 2022 |

Sept. 30, 2023 |

Sept. 30, 2022 |

| |

|

|

|

|

| Cash provided by (used

in): |

|

|

|

|

| Operating

activities: |

|

|

|

|

|

Net earnings (loss) |

$(42.4) |

$3.5 |

$(97.8) |

$670.4 |

|

Items not involving cash: |

|

|

|

|

|

Depreciation of plant and equipment |

46.7 |

40.6 |

138.5 |

115.3 |

|

Depletion and amortization of timber, roads and other |

7.6 |

9.8 |

29.7 |

28.0 |

|

Deferred income tax expense (recovery) |

0.8 |

8.3 |

(0.7) |

14.4 |

|

Current income tax expense (recovery) |

(5.9) |

27.5 |

(24.0) |

242.9 |

|

Finance costs |

10.2 |

1.5 |

34.4 |

11.0 |

|

Other assets |

(6.4) |

(27.5) |

(6.1) |

(30.0) |

|

Reforestation liability |

1.5 |

(2.9) |

(0.5) |

(2.8) |

|

Provisions and other liabilities |

(2.3) |

(1.8) |

(3.8) |

(27.5) |

|

Stock option vesting |

0.2 |

0.2 |

0.6 |

0.7 |

|

Write-down of plant and equipment |

- |

0.8 |

1.5 |

3.2 |

|

Unrealized foreign exchange loss |

8.8 |

42.7 |

0.4 |

50.9 |

|

Other expense (income) |

2.2 |

(11.9) |

9.6 |

(18.7) |

|

Income taxes refunded (paid) |

70.5 |

(91.7) |

68.7 |

(448.9) |

| |

91.5 |

(0.9) |

150.5 |

608.9 |

|

Cash generated from (used in) operating working

capital: |

|

|

|

|

|

Trade accounts receivable and other |

(1.6) |

19.4 |

(39.3) |

35.1 |

|

Inventories |

(7.3) |

42.5 |

57.6 |

75.4 |

|

Prepayments |

4.6 |

0.8 |

(4.2) |

(5.9) |

|

Trade accounts payable and provisions |

20.0 |

(14.8) |

(18.9) |

8.5 |

| |

107.2 |

47.0 |

145.7 |

722.0 |

| |

|

|

|

|

| Investing

activities: |

|

|

|

|

|

Additions to property, plant and equipment |

(31.6) |

(82.5) |

(152.2) |

(194.4) |

|

Additions to roads and bridges |

(6.9) |

(3.6) |

(7.6) |

(7.7) |

|

Acquisitions, net of cash acquired |

- |

- |

0.5 |

(536.1) |

|

Proceeds on disposal of property, plant, equipment and other |

0.2 |

20.7 |

4.9 |

32.0 |

|

Investment in GreenFirst Forest Products Inc. |

- |

- |

- |

(55.6) |

|

Net proceeds from (additions to) deposits and other assets |

0.8 |

(3.4) |

2.1 |

(3.2) |

|

|

(37.5) |

(68.8) |

(152.3) |

(765.0) |

| |

|

|

|

|

| Financing

activities: |

|

|

|

|

|

Issuance of share capital, net of expenses |

- |

- |

0.1 |

0.4 |

|

Share repurchases, net of expenses |

- |

(100.4) |

- |

(327.6) |

|

Interest payments |

(9.4) |

(3.8) |

(37.5) |

(13.1) |

|

Lease liability payments |

(4.7) |

(4.2) |

(13.4) |

(12.0) |

|

Debt refinancing costs |

- |

- |

(0.2) |

(0.3) |

|

Term line net drawings (repayments) |

(61.2) |

- |

88.3 |

(3.9) |

|

Repayments of Senior Secured Notes |

- |

- |

(7.1) |

(7.0) |

|

|

(75.3) |

(108.4) |

30.2 |

(363.5) |

| |

|

|

|

|

| Foreign exchange gain

(loss) on cash and cash equivalents |

|

|

|

|

|

held in a foreign currency |

2.2 |

6.2 |

(1.8) |

14.5 |

|

Increase (decrease) in cash |

(3.4) |

(124.0) |

21.8 |

(392.0) |

| |

|

|

|

|

|

Cash and cash equivalents, beginning of

period |

102.8 |

270.6 |

77.6 |

538.6 |

|

|

|

|

|

|

| Cash and cash

equivalents, end of period |

$99.4 |

$146.6 |

$99.4 |

$146.6 |

| CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

|

September 30, 2023 and December 31, 2022

(unaudited) |

|

(millions of Canadian Dollars) |

Sept. 30, 2023 |

Dec. 31, 2022 |

|

|

|

|

| Assets |

|

|

| Current

assets: |

|

|

|

Cash and cash equivalents |

$99.4 |

$77.6 |

|

Trade accounts receivable and other |

217.0 |

174.1 |

|

Income tax receivable |

60.1 |

104.1 |

|

Inventories |

339.1 |

396.9 |

|

Prepayments |

29.8 |

25.9 |

|

|

745.4 |

778.6 |

| |

|

|

| Employee future

benefits |

17.8 |

18.4 |

| Deposits and other

assets |

279.3 |

281.6 |

| Right of use

assets |

35.7 |

34.0 |

| Property, plant and

equipment |

1,702.9 |

1,701.2 |

| Roads and

bridges |

35.2 |

38.1 |

| Timber

licences |

173.2 |

178.4 |

| Goodwill and other

intangible assets |

583.6 |

588.1 |

|

Deferred income taxes |

4.7 |

1.4 |

|

|

|

|

|

|

$3,577.8 |

$3,619.8 |

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

| Current

liabilities: |

|

|

|

Trade accounts payable and provisions |

$265.3 |

$285.5 |

|

Current portion of long-term debt |

45.1 |

7.3 |

|

Reforestation liability |

18.0 |

17.9 |

|

Lease liabilities |

16.0 |

14.8 |

|

Income taxes payable |

1.0 |

0.3 |

|

|

345.4 |

325.8 |

| |

|

|

| Reforestation

liability |

28.8 |

28.7 |

| Lease

liabilities |

20.8 |

20.5 |

| Long-term

debt |

832.0 |

790.6 |

| Employee future

benefits |

10.5 |

9.9 |

| Provisions and other

liabilities |

19.8 |

24.2 |

| Deferred income

taxes |

392.6 |

393.0 |

| |

|

|

| Equity: |

|

|

|

Share capital |

408.9 |

408.7 |

|

Contributed surplus |

6.0 |

5.5 |

|

Translation reserve |

173.1 |

175.9 |

|

Retained earnings |

1,339.9 |

1,437.0 |

|

|

|

|

|

|

1,927.9 |

2,027.1 |

|

|

|

|

|

|

$3,577.8 |

$3,619.8 |

|

Approved on behalf of the Board of Directors: |

|

“L. Sauder” |

“T.V. Milroy” |

|

Director |

Director |

FORWARD-LOOKING STATEMENTS

This release contains forward-looking information about the

Company’s business outlook, objectives, plans, strategic priorities

and other information that is not historical fact. A statement

contains forward-looking information when the Company uses what it

knows and expects today, to make a statement about the future.

Statements containing forward-looking information may include words

such as: will, could, should, believe, expect, anticipate, intend,

forecast, projection, target, outlook, opportunity, risk or

strategy. Readers are cautioned that actual results may vary from

the forward-looking information in this release, and undue reliance

should not be placed on such forward-looking information. Risk

factors that could cause actual results to differ materially from

the forward-looking information in this release are described in

Interfor’s third quarter and annual Management’s Discussion and

Analysis under the heading “Risks and Uncertainties”, which are

available on www.interfor.com and under Interfor’s profile on

www.sedarplus.ca. Material factors and assumptions used to develop

the forward-looking information in this release include the timing

and value of proceeds received from the disposition of Coast B.C.

forest tenures; volatility in the selling prices for lumber, logs

and wood chips; the Company’s ability to compete on a global basis;

the availability and cost of log supply; natural or man-made

disasters; currency exchange rates; changes in government

regulations; Indigenous reconciliation; the softwood lumber trade

dispute between Canada and the United States; environmental impacts

of the Company’s operations; labour availability; and information

systems security. Unless otherwise indicated, the forward-looking

statements in this release are based on the Company’s expectations

at the date of this release. Interfor undertakes no obligation to

update such forward-looking information or statements, except as

required by law.

ABOUT INTERFOR

Interfor is a growth-oriented forest products company with

operations in Canada and the United States. The Company has annual

lumber production capacity of approximately 5.2 billion board feet

and offers a diverse line of lumber products to customers around

the world. For more information about Interfor, visit our website

at www.interfor.com.

The Company’s unaudited condensed consolidated interim financial

statements and Management’s Discussion and Analysis for Q3’23 are

available at www.sedarplus.ca and www.interfor.com.

There will be a conference call on Friday, November 3, 2023 at

8:00 a.m. (Pacific Time) hosted by INTERFOR

CORPORATION for the purpose of reviewing the Company’s

release of its third quarter 2023 financial results.

The dial-in number is 1-888-396-8049. The

conference call will also be recorded for those unable to join in

for the live discussion and will be available until December 3,

2023. The number to call is 1-877-674-7070, Passcode

026550#.

For further information:Richard Pozzebon, Executive Vice

President and Chief Financial Officer(604) 422-3400

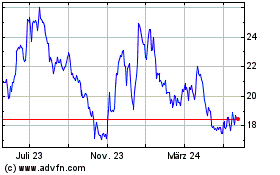

Interfor (TSX:IFP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

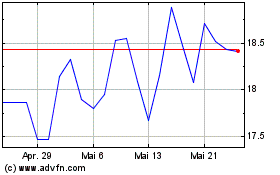

Interfor (TSX:IFP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024