High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its second quarter financial and operating

results. The unaudited interim consolidated financial statements,

and management discussion & analysis (“MD&A”), for the

quarter ended June 30, 2023 will be available on SEDAR at

www.sedarplus.ca, and on High Arctic’s website at www.haes.ca. All

amounts are denominated in Canadian dollars (“CAD”), unless

otherwise indicated.

Mike Maguire, Chief Executive Officer

commented:

“In PNG we have had our first full quarter of

drilling activity with Rig 103. In Canada we have closed the

divestment of the nitrogen pumping business for a modest gain and

have aligned our G&A costs towards our reduced business

footprint.

We are working with our advisers to complete the

work to reorganize the Corporation and deliver the tax efficient

return of cash to shareholders. The proposed spin-off of the Papua

New Guinean business addresses the inefficiencies in managing two

small businesses with few synergies. The remaining publicly listed

company with Canadian assets and tax pools creates a potentially

attractive vehicle for future growth.

I look forward to presenting details of the

Reorganization to shareholders in the coming months.”

HighlightsThe following

highlights the Corporations results for Q2-2023:

- Achieved full drilling utilization

of PNG Rig 103 during the Quarter, pursuant to a 3-year contract

that was renewed in August 2022.

- Generated EBITDA from continuing

operations of $3.8 million on revenues of $17.2 million, funds flow

from continuing operations of $3.9 million and incurred capital

expenditures of $0.7 million.

- Improved liquidity with a working

capital balance of $61.8 million, which includes a cash balance of

$45.4 million, and long-term debt of $4.0 million, and

- Announced the sale of the

Corporation’s Canadian Nitrogen transportation, hauling and pumping

services business for cash consideration of $1.35 million.

2023 Strategic ObjectivesHigh Arctic’s 2023

Strategic Objectives build on the platform we created in 2022, and

include:

- Safety excellence and quality service delivery,

- Return idled assets in PNG to service,

- Scaling our Canadian business,

- Opportunities for growth and corporate transactions that

enhance shareholder value, and

- Examination of the Corporation’s optimal capital and overhead

structure.

In the following discussion, the three months

ended June 30, 2023 may be referred to as the

“Quarter” or “Q2-2023”. The

comparative three months ended June 30, 2022 may be referred to as

“Q2-2022”. References to other quarters may be

presented as “QX-20XX” with X

being the quarter/year to which the commentary relates.

RESULTS OVERVIEWThe following is a summary of

select financial information of the Corporation:

|

(unaudited) |

For the three months ended June 30 |

For the six months ended June 30 |

|

($ thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Operating Results – Continuing Operations |

|

|

|

|

|

Revenue |

$ |

17,234 |

|

$ |

25,023 |

|

$ |

26,005 |

|

$ |

53,146 |

|

| Net

income (loss) |

|

89 |

|

|

(20,230) |

|

|

(541) |

|

|

(22,803) |

|

|

per share - basic (2) |

|

0.00 |

|

|

(0.42) |

|

|

(0.01) |

|

|

(0.47) |

|

|

per share - diluted (2) |

|

0.00 |

|

|

n/a |

|

|

n/a |

|

|

n/a |

|

| Oilfield

services operating margin (1) |

|

6,466 |

|

|

5,776 |

|

|

9,359 |

|

|

11,004 |

|

| Oilfield

services operating margin as a % of revenue (1) |

|

37.5% |

|

|

23.1% |

|

|

36.0% |

|

|

20.7% |

|

| EBITDA

(1) |

|

3,805 |

|

|

(5,895) |

|

|

5,057 |

|

|

(3,003) |

|

| Adjusted

EBITDA (1) |

|

4,413 |

|

|

2,979 |

|

|

5,354 |

|

|

5,814 |

|

| Adjusted

EBITDA as % of revenue (1) |

|

25.6% |

|

|

11.9% |

|

|

20.6% |

|

|

10.9% |

|

|

Operating income (loss) |

$ |

1,296 |

|

$ |

(3,081) |

|

$ |

(681) |

|

$ |

(5,801) |

|

|

Cash Flow – Continuing Operations |

|

|

|

|

| Cash

flow from continuing operations |

$ |

1,082 |

|

$ |

6,004 |

|

$ |

1,398 |

|

$ |

6,249 |

|

|

Per share – basic and diluted (2) |

|

0.02 |

|

|

0.12 |

|

|

0.03 |

|

|

0.13 |

|

| Funds

flow from continuing operations(1) |

|

3,914 |

|

|

2,502 |

|

|

5,205 |

|

|

4,693 |

|

|

Per share - basic and diluted (2) |

|

0.08 |

|

|

0.05 |

|

|

0.11 |

|

|

0.10 |

|

| Dividend

payments |

|

730 |

|

|

487 |

|

|

1,460 |

|

|

487 |

|

|

Per share - basic and diluted (2) |

|

0.01 |

|

|

0.01 |

|

|

0.03 |

|

|

0.01 |

|

|

Capital expenditures |

$ |

702 |

|

$ |

3,134 |

|

$ |

1,098 |

|

$ |

3,280 |

|

|

|

|

As at |

| ($

thousands, except share amounts) |

|

|

June 30 2023 |

December 31, 2022 |

|

|

Financial Position |

|

|

|

(unaudited) |

|

|

|

Working capital (1) |

|

|

$ |

61,816 |

|

$ |

59,461 |

|

| Cash |

|

|

|

45,419 |

|

|

19,559 |

|

| Total assets |

|

|

|

133,505 |

|

|

133,957 |

|

| Long-term debt |

|

|

|

3,939 |

|

|

4,028 |

|

| Long-term financial

liabilities, excluding long-term debt |

|

|

|

5,016 |

|

|

4,881 |

|

| Shareholders’ equity |

|

|

$ |

112,082 |

|

$ |

115,231 |

|

| Per share - basic (1)(2) |

|

|

|

2.30 |

|

|

2.37 |

|

| Common

shares outstanding, thousands |

|

|

|

48,674 |

|

|

48,691 |

|

(1) Readers are cautioned that

Oilfield services operating margin, EBITDA from continuing

operations (Earnings from continuing operations before interest,

tax, depreciation and amortization), Adjusted EBITDA from

continuing operations, Funds flow from continuing operations,

oilfield services operating margin, working capital and

Shareholders’ equity per share - basic do not have standardized

meanings prescribed by IFRS – see “Non-IFRS Measures” for

calculations of these measures. (2) The number of common

shares used in calculating net income (loss) per share, cash flow

from (used in) operating activities per share, funds flow from

continuing operations per share, dividends per share and

shareholders’ equity per share is determined as explained in Note

10(b) of the Financial Statements.

Three-month period ended June 30, 2023

Summary:

- Revenue for the Quarter was

$17,234, a decrease of $7,789 compared to Q2-2022 at $25,023. The

combined Drilling Services segment and Ancillary Services segments

increased revenue by an aggregate $7,566 on the strength of PNG

customer demand and the Production Services segment decreased by

$16,079 with the 2022 Sale Transactions and inactivity for

remaining equipment.

- Reported adjusted EBITDA from

continuing operations of $4,413 in Q2-2023, an increase of $1,434

over Q2-2022. The favourable variance was due to the full

utilization of PNG Rig 103 in the Quarter, associated rentals and

operational momentum with PNG drilling commencement in late

Q1-2023. The Sale Transactions resulted in the removal of Canadian

well servicing and snubbing assets from the low utilization “spring

break-up” second quarter Production Services segment results.

- High Arctic generated net income of

$89 from continuing operations in Q2-2023 compared to a net loss

from continuing operations of $20,230 for Q2-2022. The return to

positive net income, albeit modest, was due to positive results in

PNG after having disposed of low margin Canadian assets in the

third quarter of 2022. The prior year net loss was impacted by

impairment of $8,679 and a $7,921 deferred tax asset charge.

- Oilfield services operating margins

improved as a percent of revenue from 23.1% in Q2-2022 to 37.5% in

Q2-2023. This improvement was primarily a result of the Sales

Transactions in 2022 that saw the disposal of certain Production

Services segment assets.

- Supported by operational

performance during the quarter High Arctic strengthened its balance

sheet as working capital increased by $2,355 and $730 was returned

to shareholders in the form of dividends.

Six-month period ended June 30, 2023

Summary:

- Revenue from continuing operations

for the first half of 2023 was $26,005, a decrease of $27,141

compared to the first half of 2022 at $53,146. The Drilling

Services segment and Ancillary Services segments increased revenue

by an aggregate $2,612 on the strength of PNG activity which gained

momentum in the second quarter of 2023 and the Production Services

segment decreased by $31,141 with the 2022 Sale Transactions and

inactivity for remaining equipment.

- Reported adjusted EBITDA from

continuing operations of $5,354 in the first half of 2023, a

decrease of $460 as compared to the first half of 2022. The

decrease is attributable to a reduced presence in Canada with the

Sale Transactions and the resulting impact primarily to the

Production Services segment. The Drilling Services segment

mitigated the decrease with the resumption of active drilling in

PNG.

- High Arctic generated a net loss of

$541 from continuing operations in YTD-2023 compared to a net loss

of $22,803 in the first half of 2022. The improvement was primarily

attributable to improved PNG operating results and non-cash charges

associated with the prior year Sales Transactions. Specifically,

YTD-2023 depreciation expense was $5,378 lower and 2022 first half

results were impacted by a $8,679 equipment impairment and $7,240

deferred tax asset charge.

- Oilfield services operating margins

improved as a percent of revenue from 20.7% in Q2-2022 to 36.0% in

the first half of 2023. This improvement is primarily a result of

the strength in Ancillary service segments and the 2022 Sales

Transactions impact on Production Services segment results.

- Supported by operational

performance during the first half of 2023, High Arctic strengthened

its balance sheet as working capital increased by $2,355 and $1,460

was returned to shareholders in the form of dividends.

Drilling Services Segment

|

|

Three months endedJune 30 |

|

Six months endedJune 30 |

|

|

($ thousands, unless otherwise noted) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

$ |

13,437 |

|

$ |

6,101 |

|

$ |

19,713 |

|

$ |

15,675 |

|

|

Oilfield services expense |

|

9,657 |

|

|

4,637 |

|

|

14,742 |

|

|

12,114 |

|

|

Oilfield services operating margin

(1) |

$ |

3,780 |

|

$ |

1,464 |

|

$ |

4,971 |

|

$ |

3,561 |

|

|

Operating margin (%) |

|

28.1% |

|

|

24.0% |

|

|

25.2% |

|

|

22.7% |

|

(1) See “Non-IFRS Measures”

Ancillary Services Segment – Continuing

Operations

|

|

Three months endedJune 30 |

|

Six months endedJune 30 |

|

|

($ thousands, unless otherwise noted) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

$ |

3,797 |

|

$ |

3,567 |

|

$ |

6,292 |

|

$ |

7,717 |

|

|

Oilfield services expense |

|

1,111 |

|

|

1,399 |

|

|

1,904 |

|

|

2,664 |

|

|

Oilfield services operating margin

(1) |

$ |

2,686 |

|

$ |

2,168 |

|

$ |

4,388 |

|

$ |

5,053 |

|

|

Operating margin (%) |

|

70.8% |

|

|

60.7% |

|

|

69.8% |

|

|

65.5% |

|

(1) See “Non-IFRS Measures”

Liquidity and Capital

Resources

|

|

Three months endedJune 30 |

|

Six months endedJune 30 |

|

|

($ thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Cash provided by (used in) continued operations: |

|

|

|

|

|

Operating activities |

$ |

1,082 |

|

$ |

6,004 |

|

$ |

1,398 |

|

$ |

6,249 |

|

|

Investing activities |

|

(769) |

|

|

(1,519) |

|

|

26,999 |

|

|

(1,925) |

|

|

Financing activities |

|

(1,505) |

|

|

(788) |

|

|

(2,469) |

|

|

(1,309) |

|

|

Effect of exchange rate changes on cash |

|

(5) |

|

|

(137) |

|

|

4 |

|

|

(93) |

|

|

Increase (decrease) in cash |

$ |

(1,197) |

|

$ |

3,560 |

|

$ |

25,932 |

|

$ |

2,922 |

|

|

|

|

As at |

| ($

thousands, unless otherwise noted) |

|

|

June 30 2023 |

|

December 31 2022 |

|

|

|

|

|

|

|

|

Current assets |

|

|

$ |

74,284 |

|

$ |

69,278 |

|

| Working capital (1) |

|

|

|

61,816 |

|

|

59,461 |

|

|

Working capital ratio (1) |

|

|

|

5.9:1 |

|

|

7.1:1 |

|

| Cash and cash equivalents |

|

|

|

45,419 |

|

|

19,559 |

|

| Net

cash (1) |

|

|

$ |

41,304 |

|

$ |

15,345 |

|

(1) See “Non-IFRS Measures”

The Bank of PNG continues to encourage the use

of the local market currency, Kina or PGK. Due to High Arctic’s

requirement to transact with international suppliers and customers,

High Arctic has received approval from the Bank of PNG to maintain

its USD account within the conditions of the Bank of PNG currency

regulations. The Corporation continues to use PGK for local

transactions when practical. Included in the Bank of PNG’s

conditions is for PNG drilling contracts to be settled in PGK,

unless otherwise approved by the Bank of PNG for the contracts to

be settled in USD. The Corporation has historically received such

approval for its contracts with its key customers in PNG. The

Corporation will continue to seek Bank of PNG approval for our

contracts to be settled in USD on a contract-by-contract basis,

however, there is no assurance the Bank of PNG grant these

approvals.

If such approvals are not received, the

Corporation’s PNG drilling contracts will be settled in PGK which

would expose the Corporation to exchange rate fluctuations related

to the PGK. In addition, this may delay the Corporation’s ability

to receive USD which may impact the Corporation’s ability to settle

USD denominated liabilities and repatriate funds from PNG on a

timely basis. The Corporation also requires the approval from the

PNG Internal Revenue Commission (“IRC”) to repatriate funds from

PNG and make payments to non-resident PNG suppliers and service

providers. While delays can be experienced for the IRC approvals,

all such approvals have eventually been received in the past.

Operating Activities

In Q2-2023, cash generated from operating

activities from continuing operations was $1,082, down from the

Q2-2022 cash generated from operating activities of $6,004. Funds

flow from continuing operations totaled $3,914 in the Quarter

(Q2-2022: $2,502), see “Non-IFRS Measures”, and a $2,832 cash

outflow from working capital changes (Q2-2022: $3,502 inflow).

In the six months ended June 30, 2023, cash

generated from operating activities from continuing operations was

$1,398, down from $6,249 in the corresponding period of 2022. Funds

flow from continuing operations totaled $5,205 in the six months

ended June 30, 2023, (YTD-2022: $4,693), see “Non-IFRS Measures”,

and a $3,807 cash outflow from working capital changes (YTD-2022:

$1,556 inflow).

Investing Activities

During Q2-2023, the Corporation’s cash used in

investing activities from continuing operations was $769 (Q2-2022:

$1,519) primarily as a result of lower capital expenditures

totalling $702 in the Quarter when compared to the (Q2-2022:

$1,710).

During the six months ended June 30, 2023, the

Corporation’s cash from investing activities from continuing

operations was $26,970 ($1,925 used in the six months to June 30,

2022) reflecting the receipt of the final cash proceeds of $28,000

from the Well Servicing Transaction in Q1-2023 offset by lower

capital expenditures totalling $1,098 (YTD-2022: $3,280) and $101

proceeds on disposal of property and equipment (YTD-2022: $1,107),

and cash outflow of $33 relating to working capital balance changes

for capital items (YTD-2022: $248).

Financing Activities

In Q2-2023, the Corporation’s cash used in

financing activities was $1,505 (Q2-2022: $788). During the

Quarter, the Corporation paid $730 in dividends (Q2-2022 $487), $43

(Q2-2022: $81) towards principal payments on its mortgage financing

(see “Mortgage Financing below”), $732 against lease liability

payments (Q2-2022: $464) and cash inflow of $Nil relating to

noncash working capital balance changes (Q2-2022: $244).

During the six months ended June 30, 2023, the

Corporation’s cash used in financing activities was $2,469

(YTD-2022: $1,309). During the period, the Corporation paid $1,460

in dividends (YTD-2022: $487), $99 (YTD-2022: $135) towards

principal payments on its mortgage financing (see “Mortgage

Financing below”), $885 against lease liability payments (YTD-2022:

$931), $25 towards purchase of common shares for cancellation

(YTD-2022: Nil) and cash inflow of $Nil relating to noncash working

capital balance changes (YTD-2022: $244).

Mortgage Financing

|

|

As at |

As at |

|

|

|

|

|

June 30, 2023 |

December 31, 2022 |

|

|

Current |

|

|

|

$ |

176 |

$ |

186 |

|

|

Non-current |

|

|

|

|

3,939 |

|

4,028 |

|

|

Total |

|

|

|

$ |

4,115 |

$ |

4,214 |

|

The Corporation has mortgage financing secured

by lands and buildings owned by High Arctic located within Alberta,

Canada. The mortgage has a remaining term of 3.4 years with a fixed

interest rate of 4.30% with payments occurring monthly. Pursuant to

the sale of the Canadian nitrogen pumping assets, the terms of

Corporation’s mortgage financing were amended. The amendments

resulted in a one-time repayment of $500 of mortgage principal on

July 28, 2023, the release of the sold assets from the general

security of the mortgage and reduced reporting obligations.

Intention to Return Capital and

ReorganizeOn May 11, 2023, the Corporation announced that

the Board of Directors intends to recommend to shareholders a tax

efficient return of capital equal to $38.2 million relating to the

Q3-2022 sale of High Arctic’s Canadian well servicing business, and

a reorganization of the Corporation.

The return of capital cash payment and a

purchase rights distribution are intended to affect a

reorganization of High Arctic’s business into two companies, with a

foreign legal entity (“High Arctic International”) owning the

Corporation’s existing PNG focused business, and High Arctic Energy

Services Inc., the current ultimate parent company within the High

Arctic group of companies, owning the Corporation’s existing North

American business (collectively the “Reorganization”). The

Reorganization is intended to unlock the value of the different

segments of High Arctic’s business by dividing the Corporation into

its distinct businesses and providing Shareholders with an

opportunity to acquire a direct equity stake in High Arctic

International while continuing to hold their current equity stake

in High Arctic.

The Board has reserved its final decision to

proceed until materials are ready to present to shareholders.

Reorganization Update:The

Corporation is working with its advisors on the reorganization

plan, the completion of which will be subject to applicable

regulatory and shareholder approvals.

If the reorganization proceeds, it is expected

to result in:

- The payout to shareholders of $38.2

million, equivalent to approximately $0.75 per fully diluted share,

by way of tax efficient return of capital distribution,

- The sale of High Arctic

International to existing shareholders who opt to participate

through issuance by the Corporation of a right for shareholders to

purchase from the Corporation one (1) ordinary share of High Arctic

Energy Services Cyprus Limited (a wholly owned subsidiary of High

Arctic immediately prior to the Reorganization) for each common

share held in High Arctic,

- A shareholder election process

whereby shareholders can:

- Do nothing, and receive their

return of capital distribution as cash;

- Elect to exercise their purchase

rights (in full or in part);

- Elect to use some or all of the

funds to be received pursuant to the return of capital, toward the

exercise of purchase rights; and

- Receipt by the Corporation of the

proceeds of the sale of ordinary shares of High Arctic

International.

Through this Reorganization, the Corporation

aims to completely divest its ownership of High Arctic

International, an unlisted company incorporated and domiciled in

Cyprus that owns the Corporations interests in its foreign

subsidiaries. For further information on the corporate structure

refer to the Annual Information Form – for the year ended December

31, 2022, located on the High Arctic website and published on

SEDAR.

The Corporation expects to announce the exercise

price for the purchase of High Arctic International and complete

the information memorandum in September. The potential Special

Shareholder meeting is anticipated be held in October and the

process concluded prior to year end.

If concluded, the Reorganization outlined above

will separate the international PNG-focused business from the TSX

listed Corporation. Following the reorganization, the Corporation

will continue to be listed and it’s remaining business will consist

of:

- a Canadian rental business centered

upon well pressure control;

- industrial real estate properties

at Clairmont (leased to a third party) and Whitecourt in Alberta,

Canada;

- a significant interest in Canada’s

largest oilfield snubbing services business, Team Snubbing Services

Inc.;

- cash proceeds of the sale of High

Arctic International; and

- approximately $130 million of

non-capital tax loss carry-forwards.

OutlookHigh Arctic is in a

position to refocus its Canadian business. The rental business is

generating solid margins and a high level of utilization which we

anticipate continuing into the traditionally busier winter period.

Opportunities to gain scale and underlying net profitability are a

priority. Team Snubbing has utilized the customary spring break-up

period to prepare additional equipment for deployment in Canada and

to establish operations in Alaska through its 50% owned Team

Snubbing International partnership. Both Alaskan snubbing packages

are now working, with a growing order book of customer

activity.

Energy security, evolving attitudes to carbon

sequestration and the longevity of Canada’s oil and gas industry as

well as growing alternative energy industries, provide

opportunities for the Corporation to prudently invest in businesses

positioned to benefit. These considerations and opportunities are

supported by the long-awaited pipeline expansion to tidewater which

is close to being realized for both oil liquids and natural gas

production. It’s a positive development and sets up a favorable

backdrop for relatively sustained upstream energy service demand as

the world accelerates a transition to responsible production and

lower emission energy consumption.

In the immediate term, the current monetary

policy environment is delivering high yield fixed interest income

for investment of surplus cash. The Corporation is moving forward

to establish new leadership in Canada to seize high margin

opportunities and set a new direction.

PNG-focused High Arctic International is

maintaining cost discipline while preparing for the anticipated

upswing in activity in the years ahead. Rig 103 has completed its

first full quarter of drilling activity since returning to work

under its operations and management contracts. In return for

utilizing the rig, High Arctic International pays the customer a

daily rig lease rate, and generates revenue based on the level of

activity and services provided. The contract for Rig 103 was

extended in 2022 to August 2025 with two 1-year options for the

customer to extend the term.

The opportunities for growth in PNG include:

building on drilling operations by deploying idle heli-portable

drilling rigs 115 and 116; supply services to the Papua-LNG

project; and, the substantive need for workers and machinery

necessary for the contemplated major capital and infrastructure

projects.

We await the final investment decision of the

TotalEnergies led Papua-LNG project expected later this year. That

project is anticipated to stimulate other exploration and appraisal

activity and is expected to be followed by the P’nyang gas field

development in the Western Province of PNG. State owned Kumul

Petroleum is advancing appraisal of other gas discoveries in PNG

and discussions continue with other exploration companies towards

future work.

NON - IFRS MEASURESThis News

Release contains references to certain financial measures that do

not have a standardized meaning prescribed by International

Financial Reporting Standards (“IFRS”) and may not be comparable to

the same or similar measures used by other companies High Arctic

uses these financial measures to assess performance and believes

these measures provide useful supplemental information to

shareholders and investors. These financial measures are computed

on a consistent basis for each reporting period and include

Oilfield services operating margin, EBITDA (Earnings before

interest, tax, depreciation, and amortization), Adjusted EBITDA,

Operating loss, Funds flow from operating activities, Working

capital Shareholders’ equity per share and Long-term financial

liabilities. These do not have standardized meanings.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at

www.sedarplus.ca and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTSThis

press release contains forward-looking statements. When used in

this document, the words “may”, “would”, “could”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”,

“expect”, and similar expressions are intended to identify

forward-looking statements. Such statements reflect the

Corporation’s current views with respect to future events and are

subject to certain risks, uncertainties, and assumptions. Many

factors could cause the Corporation’s actual results, performance,

or achievements to vary from those described in this press

release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, among

others, statements pertaining to the following: general economic

and business conditions which will include, among other things, the

outlook for energy services; continued impact of Russia-Ukraine

conflict; opportunities for growth and transactions that enhance

shareholder value; the Corporation’s ability to maintain a USD bank

account and conduct its business in USD in PNG; market fluctuations

in interest rates, commodity prices, and foreign currency exchange

rates; restrictions to repatriate funds held in PGK; expectations

regarding the Corporation’s ability to manage its liquidity risk;

raise capital and manage its debt finance agreements; projections

of market prices and costs; factors upon which the Corporation will

decide whether or not to undertake a specific course of operational

action or expansion; the Corporation’s ongoing relationship with

its major customers; the return of capital to the Corporation’s

shareholders and reorganization including divestment of the PNG

Business to shareholders, return of a capital payment, purchase

rights distribution, unlock the value of the different segments of

High Arctic’s business, obtaining applicable regulatory and

shareholder approvals; the performance of the Corporation’s

investment in Team Snubbing; upswing in PNG energy sector activity

and opportunities for growth; the final investment decision on the

Papua-LNG project and development of the P’nyang gas field;

expectations of Rig 103 to operate consistently through the term of

its contract; deploying idle heli-portable drilling rigs 115 and

116; future work with other exploration companies in PNG; scaling

the Canadian business; executing on one or more corporate

transactions; estimated credit risks and the utilization of tax

losses.

With respect to forward-looking statements

contained in this press release, the Corporation has made

assumptions regarding, among other things, its ability to: maintain

its ongoing relationship with major customers; successfully market

its services to current and new customers; devise methods for, and

achieve its primary objectives; source and obtain equipment from

suppliers; successfully manage, operate, and thrive in an

environment which is facing much uncertainty; remain competitive in

all its operations; attract and retain skilled employees; and

obtain equity and debt financing on satisfactory terms.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release, along with the risk factors set

out in the most recent Annual Information Form filed on SEDAR at

www.sedarplus.ca.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

Services

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

pressure control equipment on a rental basis to exploration and

production companies.

For further information contact:

Mike Maguire Chief Executive

Officer P: +1 (403) 988 4702P: +1 (800) 688 7143

High Arctic Energy Services Inc.Suite 2350, 330 – 5th Ave

SWCalgary, Alberta, Canada T2P 0L4

website: www.haes.caEmail: info@haes.ca

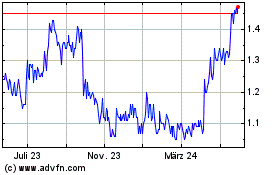

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

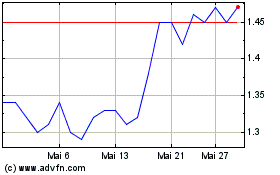

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025