Knight Therapeutics Inc. (TSX: GUD) ("Knight" or “the Company”), a

leading pan-American (ex-US) specialty pharmaceutical company,

today reported financial results for its first quarter ended March

31, 2023. All currency amounts are in thousands except for share

and per share amounts. All currencies are Canadian unless otherwise

specified.

Q1 2023 Highlights

Financials

- Revenues were $82,597, an increase

of $18,790 or 29% over the same period in prior year.

- Gross margin of $40,762 or 49%

compared to $32,477 or 51% in the same period in prior year.

- Adjusted EBITDA1 was $18,237, an

increase of $4,925 or 37% over the same period in prior year.

- Adjusted EBITDA per share2 of

$0.17, an increase of $0.05 or 45% over the same period in prior

year.

- Net loss on financial assets

measured at fair value through profit or loss of $11,847.

- Net loss was $3,937, compared to

net loss of $18,811 in the same period in prior year.

- Cash inflow from operations was $3,711, compared to a cash

inflow from operations of $12,879 in the same period in prior

year.

Corporate Developments

- Purchased 2,243,905 common shares

through Knight’s NCIB at an average price of $4.83 for an aggregate

cash consideration of $10,830.

Products

- Submitted marketing authorization

application for tafasitamab in combination with lenalidomide for

the treatment of adult patients with relapsed or refractory diffuse

large B-cell lymphoma (DLBCL) who are not eligible for autologous

stem cell transplantation (ASCT) to ANMAT in Argentina in

Q1-23.

- Launched Palbocil® (palbociclib) in

Argentina in March 2023.

- Obtained regulatory approval for

Bapocil® (palbociclib) in Chile in March 2023.

Subsequent Events

- Shareholders re-elected Jonathan

Ross Goodman, Samira Sakhia, James C. Gale, Robert N. Lande,

Michael J. Tremblay, Nicolás Sujoy and Janice Murray on the Board

of Directors.

- Purchased an additional 1,144,520

common shares through NCIB for an aggregate cash consideration of

$5,359.

“I am excited to report impressive Q1 revenues

of over $82,000, a 29% growth compared to the same period last

year, and a record adjusted EBITDA of over $18,000, representing a

growth of 37%. This strong performance is a testament to the hard

work and dedication of our team and the continued success of our

portfolio and recent launches. I am also proud to announce that we

acquired $16 million of shares under the Normal Course Issuer Bid

this year, further demonstrating our commitment to delivering value

to our shareholders,” said Samira Sakhia, President and Chief

Executive Officer of Knight Therapeutics Inc.

1 Adjusted EBITDA is a non-GAAP measure, refer

to section “Non-GAAP measures” and “Reconciliation to adjusted

EBITDA” for additional details.2 Adjusted EBITDA per share is a

non-GAAP ratio, refer to section “Non-GAAP measures” for additional

details.

SELECT FINANCIAL RESULTS REPORTED UNDER

IFRS[In thousands of Canadian dollars]

| |

|

|

|

|

Change |

|

|

|

Q1-23 |

|

Q1-22 |

|

$1 |

|

%2 |

|

|

|

|

|

|

|

|

| Revenues |

|

82,597 |

|

63,807 |

|

18,790 |

|

29 |

% |

| Gross margin |

|

40,762 |

|

32,477 |

|

8,285 |

|

26 |

% |

| Gross margin % |

|

49 |

% |

51 |

% |

|

|

| Operating expenses4 |

|

35,129 |

|

32,793 |

|

(2,336 |

) |

7 |

% |

|

Net loss |

|

(3,937 |

) |

(18,811 |

) |

14,874 |

|

79 |

% |

|

EBITDA3 |

|

18,237 |

|

13,312 |

|

4,925 |

|

37 |

% |

|

Adjusted EBITDA3 |

|

18,237 |

|

13,312 |

|

4,925 |

|

37 |

% |

1 A positive variance represents a positive impact to net income

(loss) and a negative variance represents a negative impact to net

income (loss)2 Percentage change is presented in absolute values3

EBITDA and adjusted EBITDA are non-GAAP measures, refer to the

definitions in section “Non-GAAP measures” for additional details4

Operating expenses include selling and marketing expenses, general

and administrative expenses, research and development expenses,

amortization and impairment of intangible assets

SELECT FINANCIAL RESULTS AT CONSTANT

CURRENCY[In thousands of Canadian dollars]

|

|

|

Q1-23 |

|

Q1-22 |

|

Variance |

|

|

Excluding impact of IAS 293 |

|

|

|

ConstantCurrency3 |

|

$1 |

|

%2 |

|

|

|

|

|

|

|

|

|

Revenues |

|

82,667 |

|

66,020 |

|

16,647 |

|

25 |

% |

| Gross margin |

|

41,386 |

|

35,153 |

|

6,233 |

|

18 |

% |

|

Gross margin % |

|

50 |

% |

53 |

% |

|

|

|

Operating expenses4 |

|

34,827 |

|

32,914 |

|

(1,913 |

) |

6 |

% |

|

EBITDA3 |

|

18,237 |

|

14,193 |

|

4,044 |

|

28 |

% |

|

Adjusted EBITDA3 |

|

18,237 |

|

14,193 |

|

4,044 |

|

28 |

% |

1 A positive variance represents a positive impact to adjusted

EBITDA and a negative variance represents a negative impact to

adjusted EBITDA2 Percentage change is presented in absolute values3

Financial results at constant currency and excluding impact of IAS

29, EBITDA and adjusted EBITDA are non-GAAP measures, refer to the

specific sections for additional details4 Operating expenses

include selling and marketing expenses, general and administrative

expenses, research and development expenses, amortization and

impairment of intangible assets

SELECT BALANCE SHEET ITEMS[In

thousands of Canadian dollars]

| |

|

|

|

|

|

Change |

|

|

|

03-31-23 |

|

12-31-22 |

|

$ |

|

%1 |

|

| |

|

|

|

|

|

|

|

| Cash, cash equivalents and

marketable securities |

|

160,469 |

|

172,674 |

|

(12,205 |

) |

7 |

% |

| Trade and other receivables |

|

160,472 |

|

151,669 |

|

8,803 |

|

6 |

% |

| Inventory |

|

98,988 |

|

92,489 |

|

6,499 |

|

7 |

% |

| Financial assets |

|

164,808 |

|

176,563 |

|

(11,755 |

) |

7 |

% |

| Accounts payable and accrued

liabilities |

|

110,994 |

|

108,730 |

|

2,264 |

|

2 |

% |

|

Bank loans |

|

75,333 |

|

70,072 |

|

5,261 |

|

8 |

% |

1 Percentage change is presented in absolute values

Revenues: For the quarter ended

March 31, 2023, revenues, excluding the impact of IAS 29, was

$82,667 an increase of $18,833 or 30% compared to the same prior

year period. The revenues by therapeutic areas are as follows:

| |

|

Excluding impact of IAS 293 |

| |

|

|

|

|

|

Change |

|

Therapeutic Area |

|

Q1-23 |

|

Q1-22 |

|

$1 |

|

%2 |

|

| Oncology/Hematology |

|

29,141 |

|

23,816 |

|

5,325 |

|

22 |

% |

| Infectious Diseases |

|

30,848 |

|

26,682 |

|

4,166 |

|

16 |

% |

| Other Specialty |

|

22,678 |

|

13,336 |

|

9,342 |

|

70 |

% |

|

Total |

|

82,667 |

|

63,834 |

|

18,833 |

|

30 |

% |

1 A positive variance represents a positive impact to net income

due to the application of IAS 29 and a negative variance represents

a negative impact to net income due to the application of IAS 292

Percentage change is presented in absolute values3 Revenues

excluding the impact of IAS 29 is a non-GAAP measure, refer to

section “Non-GAAP measures” for additional details.

The change in revenues by therapeutic areas is

explained by the following:

-

Oncology/Hematology: The oncology/hematology

portfolio grew by approximately $7,600 due to continued growth of

key promoted products including Halaven®, Lenvima® and Trelstar®

and the assumption of commercial activities of Akynzeo® in Brazil,

Argentina and Canada. This increase is offset by a reduction in

revenues of our mature and branded generics products due to their

lifecycle including the market entrance of new competitors.

- Infectious

Diseases: : The infectious disease portfolio grew by

approximately $7,800, excluding the impact of the planned

transition and termination of the Gilead Amendment. This growth is

driven by our key promoted products and the buying patterns of

certain customers. In addition, Knight recorded revenues of $2,400

in Q1-23 related to a one-time sales contract with the Ministry of

Health in Brazil for Ambisome® (“2022 MOH Contract”). The 2022

MOH Contract was signed in December 2022 for a total value of

$18,400 of which $7,000 was delivered in 2022, $2,400 in Q1-23 and

$9,000 in April 2023.In addition to the full amount of the 2022 MOH

Contract of $18,400, subsequent to the quarter, Knight received an

order for an additional $9,000 (“2023 MOH Contract”) from the

Ministry of Health of Brazil which was delivered in April

2023.

- Other Specialty:

The Other Specialty portfolio grew by approximately $6,200

excluding the impact of the change in accounting treatment of

Exelon® from net profit transfer to revenues with related cost of

sales. The increase is mainly due to advance purchases of Exelon®

driven by the commercial transition from Novartis to Knight in

certain countries as well as the purchasing patterns of certain

customers.

Gross margin: Under IFRS, gross

margin, as a percentage of revenues, was 49% in Q1-23 and 51% in

Q1-22. Excluding the impact of IAS 29, gross margin, as a

percentage of revenues, was 50% in Q1-23 and 53% in Q1-22. The

decrease in gross margin, as a percentage of revenues, is due to

product mix including Exelon® recorded as a net profit transfer in

Q1-22 compared to revenues with related cost of sales in Q1-23.

Selling and marketing

(“S&M”): For the quarter ended March 31, 2023, S&M

expenses were $10,665, an increase of $975 or 10% compared to the

same period in prior year. Excluding the impact of IAS 29, the

increase is $1,014 or 10%.

General and administrative

(“G&A”): For the quarter ended March 31, 2023, G&A

expenses were $9,106, an increase of $274 or 3%, compared to the

same period in prior year. Excluding the impact of IAS 29, the

increase is $342 or 4%.

Research and development

(“R&D”): For the quarter ended March 31, 2023, R&D

expenses were $4,187, an increase of $1,204 or 40%, compared to the

same period in prior year. Excluding the impact of IAS 29, the

increase is $1,260 or 44%. The increase is driven by compensation

expense and medical initiatives related to key promoted products

including Akynzeo® in-licensed in H2-22.

Amortization and impairment of

intangible assets: For the quarter ended March 31, 2023,

amortization and impairment of intangible assets was $11,171, a

decrease of $117 or 1%.

Interest income: Interest

income is the sum of interest income on financial instruments

measured at amortized cost and other interest income. For the

quarter ended March 31, 2023, interest income was $3,352, an

increase of 126% or $1,872, compared to the same period in prior

year due to higher interest rates on cash and marketable

securities.

Interest expense: For the

quarter ended March 31, 2023, interest expense was $2,791, an

increase of $1,680 or 151%, compared to the same period in prior

year due to higher average loan balance resulting from IFC loan

received in December 2022 and higher variable interest rates,

partially offset by principal repayments of Itaú Unibanco Brasil

and Bancolombia bank loans in 2022.

Adjusted EBITDA: For the

quarter ended March 31, 2023, adjusted EBITDA was $18,237, an

increased of $4,925 or 37%. The decrease in adjusted EBITDA is

driven by an increase in gross margin of $8,285, offset by an

increase in operating expenses.

Net loss: For the quarter ended

March 31, 2023, net loss was $3,937 compared to net loss of $18,811

for the same period in prior year. The variance mainly resulted

from the above-mentioned items and (1) a net loss on the

revaluation of financial assets measured at fair value through

profit or loss of $11,847 versus a net loss of $16,363 in the same

period in prior year, mainly due to unrealized revaluations of the

strategic fund investments, (2) a foreign exchange gain of $73

versus a foreign exchange loss of $6,189 and (3) the income tax

recovery of $1,009 in Q1-23 of driven by the recognition of certain

deferred tax assets due to timing differences related to our

financial assets, tax loss in certain jurisdictions and certain

intercompany transactions, offset by current income tax expense due

to operating income, compared to the income tax recovery of $3,501

in Q1-22 driven by the recognition of certain deferred tax assets

due tax losses generated and timing differences related to our

financial assets.

Cash, cash equivalents and marketable

securities: As at March 31, 2023, Knight had $160,469 in

cash, cash equivalents and marketable securities, a decrease of

$12,205 or 7% as compared to December 31, 2022. The variance is

primarily due to outflows certain regulatory and sales milestones

on certain products, including AKYNZEO® and ALOXI® from Helsinn,

shares repurchased through NCIB, partially offset by cash inflows

from operating activities and proceeds from the disposal of

Medimetriks.

Financial assets: As at March

31, 2023, financial assets were at $164,808, a decrease of $11,755

or 7%, as compared to the prior year, mainly due to negative

mark-to-market adjustments of $11,522 driven by the decline in the

share prices of the publicly-traded equities of our strategic fund

investments, distributions of $509, offset by foreign exchange

gains of $623. Given the nature of the fund investments there could

be significant fluctuations in the fair value of the underlying

assets.

Bank Loans: As at March 31,

2023, bank loans were at $75,333, an increase of $5,261 or 8% as

compared to December 31, 2022, due to accrued interest of $2,186

and the appreciation of BRL, COP, CLP and MXN against CAD.

Product Updates

Knight launched Palbocil® (palbociclib) in

Argentina in March 2023. Palbocil® / Bapocil® (palbociclib) is

indicated for the treatment of patients with hormone receptor (HR)

positive, human epidermal growth factor receptor 2 (HER2)-negative

locally advanced or metastatic breast cancer in combination with an

aromatase inhibitor as initial endocrine-based therapy in

post-menopausal women; or fulvestrant in patients with disease

progression after prior endocrine therapy. In addition, in March

2023, Knight obtained regulatory approval for Bapocil®

(palbociclib) in Chile.

Corporate Updates

NCIB

During the three-month period ended March 31,

2023, the Company purchased 2,243,905 common shares at an average

price of $4.83 for aggregate cash consideration of $10,830.

Subsequent to quarter-end up to May 5, 2023, the Company purchased

an additional 1,144,520 common shares at an average purchase price

of $4.68 for an aggregate cash consideration of $5,359.

Financial Outlook Update

Knight provides guidance on revenues1 on a

non-GAAP basis. This is due to both the difficulty in predicting

Argentinian inflation rates and its IAS 29 impact.

For fiscal 2023, Knight has updated its guidance

and expects to generate $300 to $320 million in revenue, an

increase of $20 million on the lower and upper range. The adjusted

EBITDA, as a percentage of revenues is expected to be between 14%

to 15% of revenues. The increase in the financial outlook is

primarily due to an improvement in the forecasted LATAM currencies

against the Canadian dollar and the 2023 MOH Contract for

Ambisome®. The guidance is based on a number of assumptions,

including but not limited to the following:

- no revenues for

business development transactions not completed as at May 10,

2023

- discontinuation

of certain distribution agreements

- no interruptions

in supply whether due to global supply chain disruptions or general

manufacturing issues

- no new generic

entrants on our key pharmaceutical brands

- no unforeseen

changes to government mandated pricing regulations

- successful

commercial execution on product listing arrangements with HMOs,

insurers, key accounts, and public payers

- successful

execution and uptake of newly launched products

- no significant

restrictions or economic shut down due to global pandemics

- foreign currency

exchange rates remaining within forecasted ranges

Should any of the assumptions differ, the

financial outlook and the actual results may vary materially. Refer

to the risks and assumptions referred to in the Forward-Looking

Statements section of this news release for further details.

1 Revenues excluding the impact of IAS 29

is a non-GAAP measure, refer to the definitions in section

“Non-GAAP measures” for additional details

Conference Call

Notice

Knight will host a conference call and audio webcast to discuss

its first quarter ended March 31, 2023, today at 8:30 am ET. Knight

cordially invites all interested parties to participate in this

call.

Date: Thursday, May 11,

2023Time: 8:30 a.m. ETTelephone:

Toll Free: 1-855-669-9657 or International

1-412-317-0790Webcast: www.knighttx.com or

WebcastThis is a listen-only audio webcast. Media Player is

required to listen to the broadcast.

Replay: An archived replay will be available

for 30 days at www.knighttx.com

About Knight Therapeutics Inc.

Knight Therapeutics Inc., headquartered in

Montreal, Canada, is a specialty pharmaceutical company focused on

acquiring or in-licensing and commercializing pharmaceutical

products for Canada and Latin America. Knight's Latin American

subsidiaries operate under United Medical, Biotoscana Farma and

Laboratorio LKM. Knight Therapeutics Inc.'s shares trade on TSX

under the symbol GUD. For more information about Knight

Therapeutics Inc., please visit the company's web site at

www.knighttx.com or www.sedar.com.

Forward-Looking Statement

This document contains forward-looking

statements for Knight Therapeutics Inc. and its subsidiaries. These

forward-looking statements, by their nature, necessarily involve

risks and uncertainties that could cause actual results to differ

materially from those contemplated by the forward-looking

statements. Knight Therapeutics Inc. considers the assumptions on

which these forward-looking statements are based to be reasonable

at the time they were prepared but cautions the reader that these

assumptions regarding future events, many of which are beyond the

control of Knight Therapeutics Inc. and its subsidiaries, may

ultimately prove to be incorrect. Factors and risks, which could

cause actual results to differ materially from current expectations

are discussed in Knight Therapeutics Inc.'s Annual Report and in

Knight Therapeutics Inc.'s Annual Information Form for the year

ended December 31, 2022 as filed on www.sedar.com. Knight

Therapeutics Inc. disclaims any intention or obligation to update

or revise any forward-looking statements whether because of new

information or future events, except as required by law.

CONTACT INFORMATION:

|

Investor Contact: |

|

|

| Knight Therapeutics Inc. |

|

|

| Samira Sakhia |

|

Arvind Utchanah |

| President & Chief Executive

Officer |

|

Chief Financial Officer |

| T: 514.484.4483 |

|

T. +598.2626.2344 |

| F: 514.481.4116 |

|

|

|

Email: info@knighttx.com |

|

Email: info@knighttx.com |

|

Website: www.knighttx.com |

|

Website: www.knighttx.com |

IMPACT OF HYPERINFLATION[In

thousands of Canadian dollars]

The Company applies IAS 29, Financial Reporting

in Hyperinflation Economies, as the Company's Argentine

subsidiaries used the Argentine Peso as their functional currency.

IAS 29 requires that the financial statements of an entity whose

functional currency is the currency of a hyperinflationary economy

be adjusted based on an appropriate general price index to express

the effects of inflation. If the Company did not apply IAS 29, the

effect on the Company's operating income would be as follows:

|

|

Q1-23 |

|

|

|

Reportedunder IFRS |

|

Excluding impactof IAS 291 |

|

Variance |

|

|

|

$2 |

|

%3 |

|

|

|

|

|

|

|

|

|

Revenues |

|

82,597 |

|

82,667 |

|

(70 |

) |

0 |

% |

|

Cost of goods sold |

|

41,835 |

|

41,281 |

|

(554 |

) |

1 |

% |

|

Gross margin |

|

40,762 |

|

41,386 |

|

(624 |

) |

2 |

% |

|

Gross margin (%) |

|

49 |

% |

50 |

% |

|

|

| |

|

|

|

|

|

| Expenses |

|

|

|

|

|

| Selling and marketing |

|

10,665 |

|

10,713 |

|

48 |

|

0 |

% |

| General and administrative |

|

9,106 |

|

8,887 |

|

(219 |

) |

2 |

% |

| Research and development |

|

4,187 |

|

4,102 |

|

(85 |

) |

2 |

% |

| Amortization and impairment of

intangible assets |

|

11,171 |

|

11,125 |

|

(46 |

) |

0 |

% |

|

Operating income |

|

5,633 |

|

6,559 |

|

(926 |

) |

14 |

% |

1 Financial results excluding the impact of hyperinflation (IAS

29) is a non-GAAP measure. Refer to the definitions in section

“Non-GAAP measures” for additional details2 A positive variance

represents a positive impact to net income due to the application

of IAS 29 and a negative variance represents a negative impact to

net income due to the application of IAS 293 Percentage change is

presented in absolute values

NON-GAAP MEASURES [In thousands

of Canadian dollars]

Non-GAAP measures

The Company discloses non-GAAP measures and

adjusted EBITDA per share ratio that do not have standardized

meanings prescribed by IFRS. The Company believes that

shareholders, investment analysts and other readers find such

measures helpful in understanding the Company’s financial

performance. Non-GAAP financial measures and adjusted EBITDA per

share ratio do not have any standardized meaning prescribed by IFRS

and may not have been calculated in the same way as similarly named

financial measures presented by other companies.

The Company uses the following non-GAAP

measures:

Revenues and Financial results excluding

the impact of hyperinflation under IAS 29: Revenues and

financial results under IFRS are adjusted to remove the impact of

hyperinflation under IAS 29. Impact of hyperinflation under IAS 29

is calculated by applying an appropriate general price index to

express the effects of inflation. After applying the effects of

translation, the statement of income is converted using the closing

foreign exchange rate of the month.

Revenues/financial results at constant currency

allow revenues/financial results to be viewed without the impact of

fluctuations in foreign currency exchange rates thereby

facilitating the comparison of results period over period. The

presentation of revenues/financial results under constant currency

is considered to be a non-GAAP measure and does not have any

standardized meaning under GAAP. As a result, the information

presented may not be comparable to similar measures presented by

other companies.

EBITDA: Operating income or

loss adjusted to exclude amortization and impairment of non-current

assets, depreciation, purchase price allocation accounting

adjustments, and the impact of IAS 29 (accounting under

hyperinflation) but to include costs related to leases.

Adjusted EBITDA: EBITDA

adjusted for acquisition costs and non-recurring expenses.

Adjustments include the following:

- With the adoption of IFRS 16, the

lease payments of Knight are not reflected in operating expenses.

The IFRS 16 adjustment approximates the cash outflow related to

leases of Knight.

- Acquisition costs relate to costs

incurred on legal, consulting and advisory fees for the

acquisitions.

- Other non-recurring expenses relate

to expenses incurred by Knight that are not due to, and are not

expected to occur in, the ordinary course of business.

For the three months ended March 31, the Company calculated

EBITDA and adjusted EBITDA as follows:

| |

|

|

Change |

|

|

Q1-23 |

|

Q1-22 |

|

$1 |

|

%2 |

|

| Operating (loss)

income |

5,633 |

|

(316 |

) |

5,949 |

|

n/a4 |

|

| Adjustments to operating (loss)

income: |

|

|

|

|

| Amortization and impairment of

intangible assets |

11,171 |

|

11,288 |

|

(117 |

) |

1 |

% |

| Depreciation of property, plant

and equipment and ROU assets |

1,912 |

|

2,093 |

|

(181 |

) |

9 |

% |

| Lease costs (IFRS 16

adjustment) |

(731 |

) |

(646 |

) |

(85 |

) |

13 |

% |

|

Impact of IAS 29 |

252 |

|

893 |

|

(641 |

) |

72 |

% |

|

EBITDA3 |

18,237 |

|

13,312 |

|

4,925 |

|

37 |

% |

|

Acquisition and transaction costs |

— |

|

— |

|

— |

|

n/a4 |

|

| Other non-recurring expenses |

— |

|

— |

|

— |

|

n/a4 |

|

|

Adjusted EBITDA3 |

18,237 |

|

13,312 |

|

4,925 |

|

37 |

% |

1 A positive variance represents a positive

impact to net income (loss) and a negative variance represents a

negative impact to net income (loss)2 Percentage change is

presented in absolute values3 EBITDA and adjusted EBITDA are

non-GAAP measures, refer to the definitions in section “Non-GAAP

measures” for additional details4 Percentage change not

relevant

Adjusted EBITDA per share:

Adjusted EBITDA over number of common shares outstanding at the end

of the respective period.

The Company calculated adjusted EBITDA per share

as follows:

|

|

|

Q1-23 |

|

Q1-22 |

|

| Adjusted

EBITDA1 |

|

18,237 |

|

13,312 |

|

| Adjusted EBITDA per common

share1 |

|

0.166 |

|

0.114 |

|

| Number of

common shares outstanding at period end (in thousands) |

110,082 |

|

116,546 |

|

1 Ajusted EBITDA is

non-GAAP measure and adjusted EBITDA per share is a non-GAAP

ratio, refer to the definition in section "Non-GAAP Measures" for

additional details

INTERIM CONSOLIDATED BALANCE

SHEETS[In thousands of Canadian dollars][Unaudited]

|

As at |

|

|

|

|

|

March 31, 2023 |

|

December 31, 2022 |

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

| Current |

|

|

|

|

| Cash and cash equivalents |

56,218 |

|

71,679 |

|

| Marketable securities |

89,094 |

|

85,826 |

|

| Trade receivables |

103,573 |

|

94,890 |

|

| Other receivables |

13,254 |

|

12,930 |

|

| Inventories |

98,988 |

|

92,489 |

|

| Prepaids and deposits |

1,773 |

|

1,704 |

|

| Other current financial

assets |

38,062 |

|

33,716 |

|

|

Income taxes receivable |

2,248 |

|

2,385 |

|

|

Total current assets |

403,210 |

|

395,619 |

|

|

|

|

|

|

|

| Marketable securities |

15,157 |

|

15,169 |

|

| Prepaids and deposits |

3,927 |

|

4,355 |

|

| Right-of-use assets |

5,455 |

|

5,827 |

|

| Property, plant and

equipment |

16,810 |

|

16,806 |

|

| Intangible assets |

331,518 |

|

338,780 |

|

| Goodwill |

84,797 |

|

82,274 |

|

| Other financial assets |

126,746 |

|

142,847 |

|

| Deferred income tax

assets |

13,509 |

|

9,310 |

|

| Other

long-term receivables |

43,645 |

|

43,849 |

|

|

Total non-current assets |

641,564 |

|

659,217 |

|

|

Total assets |

1,044,774 |

|

1,054,836 |

|

INTERIM CONSOLIDATED BALANCE SHEETS

(continued)[In thousands of Canadian

dollars][Unaudited]

|

As at |

|

|

March 31, 2023 |

|

December 31, 2022 |

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

| Current |

|

|

|

|

| Accounts payable and accrued

liabilities |

107,989 |

|

106,061 |

|

| Lease liabilities |

2,132 |

|

2,578 |

|

| Other liabilities |

1,687 |

|

5,793 |

|

| Bank loans |

20,293 |

|

17,674 |

|

| Income taxes payable |

2,252 |

|

2,274 |

|

| Other balances payable |

1,099 |

|

6,941 |

|

|

Total current liabilities |

135,452 |

|

141,321 |

|

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

3,005 |

|

2,669 |

|

| Lease liabilities |

5,172 |

|

5,050 |

|

| Bank loan |

55,040 |

|

52,398 |

|

| Other balances payable |

21,903 |

|

23,176 |

|

| Deferred income tax

liabilities |

5,333 |

|

4,365 |

|

|

Total liabilities |

225,905 |

|

228,979 |

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

| Share capital |

587,173 |

|

599,055 |

|

| Warrants |

117 |

|

117 |

|

| Contributed surplus |

24,447 |

|

23,664 |

|

| Accumulated other comprehensive

loss |

48,154 |

|

41,266 |

|

|

Retained earnings |

158,978 |

|

161,755 |

|

|

Total shareholders’ equity |

818,869 |

|

825,857 |

|

|

Total liabilities and

shareholders’ equity |

1,044,774 |

|

1,054,836 |

|

INTERIM CONSOLIDATED STATEMENTS OF

LOSS[In thousands of Canadian dollars, except for share

and per share amounts][Unaudited]

|

|

Three months ended March 31, |

|

|

|

2023 |

|

2022 |

|

|

|

|

|

| Revenues |

82,597 |

|

63,807 |

|

|

Cost of goods sold |

41,835 |

|

31,330 |

|

|

Gross margin |

40,762 |

|

32,477 |

|

|

|

|

|

| Expenses |

|

|

| Selling and marketing |

10,665 |

|

9,690 |

|

| General and administrative |

9,106 |

|

8,832 |

|

| Research and development |

4,187 |

|

2,983 |

|

| Amortization and impairment of

intangible assets |

11,171 |

|

11,288 |

|

|

Operating (loss) income |

5,633 |

|

(316 |

) |

| |

|

|

| Interest income on financial

instruments measured at amortized cost |

(2,179 |

) |

(346 |

) |

| Other interest income |

(1,173 |

) |

(1,134 |

) |

| Interest expense |

2,791 |

|

1,111 |

|

| Other expense |

94 |

|

90 |

|

| Net loss on financial instruments

measured at fair value through profit or loss |

11,847 |

|

16,363 |

|

| Foreign exchange (gain) loss |

(73 |

) |

6,189 |

|

| Gain on hyperinflation |

(728 |

) |

(277 |

) |

|

Income (loss) before income taxes |

(4,946 |

) |

(22,312 |

) |

| |

|

|

| Income tax |

|

|

| Current |

2,106 |

|

173 |

|

|

Deferred |

(3,115 |

) |

(3,674 |

) |

|

Income tax recovery |

(1,009 |

) |

(3,501 |

) |

|

Net loss for the period |

(3,937 |

) |

(18,811 |

) |

|

|

|

|

| Basic and diluted net loss per

share |

(0.04 |

) |

(0.16 |

) |

|

Basic and diluted weighted average number of common shares

outstanding |

111,518,305 |

|

117,173,258 |

|

INTERIM CONSOLIDATED STATEMENTS OF CASH

FLOWS[In thousands of Canadian dollars][Unaudited]

|

|

Three months endedMarch 31, |

|

|

|

2023 |

|

2022 |

|

|

OPERATING ACTIVITIES |

|

|

| Net loss for the

period |

(3,937 |

) |

(18,811 |

) |

| Adjustments reconciling net

income to operating cash flows: |

|

|

|

Depreciation and amortization |

13,083 |

|

13,381 |

|

|

Net gain on financial instruments |

11,847 |

|

16,363 |

|

|

Unrealized foreign exchange loss |

(1,253 |

) |

6,650 |

|

|

Other operating activities |

(1,104 |

) |

(2,811 |

) |

|

|

18,636 |

|

14,772 |

|

| Changes in non-cash working

capital and other items |

(14,925 |

) |

(1,893 |

) |

|

Cash inflow from operating activities |

3,711 |

|

12,879 |

|

|

|

|

|

| INVESTING

ACTIVITIES |

|

|

| Purchase of marketable

securities |

(109,216 |

) |

(15,808 |

) |

| Proceeds on maturity of

marketable securities |

105,968 |

|

36,546 |

|

| Investment in funds |

(22 |

) |

(40 |

) |

| Purchase of intangible

assets |

(7,667 |

) |

(234 |

) |

| Other investing activities |

2,223 |

|

354 |

|

|

Cash (outflow) inflow from investing

activities |

(8,714 |

) |

20,818 |

|

|

|

|

|

| FINANCING

ACTIVITIES |

|

|

| Repurchase of common shares

through Normal Course Issuer Bid |

(10,514 |

) |

(6,663 |

) |

| Principal repayment on bank

loans |

(587 |

) |

— |

|

| Proceeds from bank loans |

647 |

|

422 |

|

| Other financing activities |

(813 |

) |

(571 |

) |

|

Cash outflow from financing activities |

(11,267 |

) |

(6,812 |

) |

|

|

|

|

| Increase (decrease) in

cash and cash equivalents during the period |

(16,270 |

) |

26,885 |

|

| Cash and cash equivalents,

beginning of the period |

71,679 |

|

85,963 |

|

|

Net foreign exchange difference |

809 |

|

609 |

|

|

Cash and cash equivalents, end of the period |

56,218 |

|

113,457 |

|

|

|

|

|

| Cash and cash equivalents |

56,218 |

|

113,457 |

|

| Marketable securities |

104,251 |

|

42,939 |

|

|

Total cash, cash equivalents and marketable

securities |

160,469 |

|

156,396 |

|

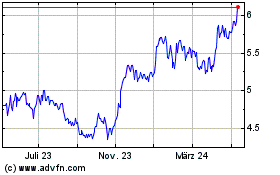

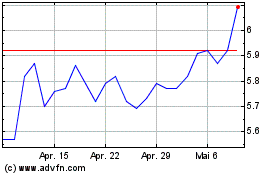

Knight Therapeutics (TSX:GUD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Knight Therapeutics (TSX:GUD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024