This news release contains "forward-looking

information and statements" within the meaning of applicable

securities laws. For important information with respect to such

forward-looking information and statements and the further

assumptions and risks to which they are subject, see the

"Cautionary Statement Regarding Forward-Looking Information and

Statements" later in this news release.

Precision Drilling Corporation (“Precision” or “the Company”)

(TSX:PD; NYSE:PDS) today confirms its continued support for the

strategic share exchange merger (the “Precision Transaction”) with

Trinidad Drilling Ltd. (“Trinidad”) (TSX:TDG) on the basis of 0.445

of a Precision common share (a “Precision Share”) for each Trinidad

common share (a “Trinidad Share”).

The Company strongly encourages Trinidad

shareholders not to tender their Trinidad Shares to Ensign Energy

Services Inc’s. (“Ensign”) (TSX:ESI) opportunistic all cash

take-over offer for all of the Trinidad Shares (the “Ensign

Offer”), at near an all-time low value for Trinidad. Further, the

Trinidad Board of Directors (“Trinidad Board”) has unanimously

recommended that Trinidad shareholders REJECT the

inadequate Ensign Offer.

Trinidad shareholders do not need to take any

action if they wish to NOT tender their Trinidad Shares. Trinidad

shareholders that have questions or require assistance with

withdrawing their Trinidad Shares which were tendered in error

should contact Trinidad's Information Agent, D.F. King Canada, toll

free at 1.866.521.4427 (212.771.1133 by collect call) or by email

at inquiries@dfking.com. Trinidad and Precision shareholders will

have the opportunity to vote for the Precision Transaction on

December 11, 2018. If you are a beneficial shareholder that has not

received your materials for the securityholder meetings to approve

the Precision Transaction you are encouraged to contact your broker

directly for information on how to vote your shares.

The Precision Share price is positioned to

benefit in the near-term from potential macro developments and

Trinidad shareholders can participate in the potential upside by

not accepting the Ensign Offer and voting in favor of the Precision

Transaction. Strengthening natural gas prices, a potentially

supportive OPEC meeting on December 6th, new Permian pipelines set

to open in 2019 and 2020, and potential solutions to solve the

challenged Canadian WCS spread are all expected to be near-term

catalysts for Precision.

The acceleration by Ensign of the inadequate

Ensign Offer, at a historically low value for Trinidad, seeks to

deprive Trinidad shareholders the opportunity to properly consider

the Precision Transaction and to deny Trinidad shareholders the

value of time by forcing them to make a rash decision without the

potential benefit of exposure to near-term positive macro

events. The acceleration of the inadequate Ensign Offer

benefits Ensign at the expense of Trinidad shareholders. Ensign has

the ability to extend the timing of its offer to allow the Trinidad

shareholders more time to consider the merits of the Precision

Transaction.

Precision’s President and CEO Kevin Neveu

stated: “Precision’s operations continue to demonstrate strength

and we see a number of positive catalysts as we survey the energy

market outlook. We expect to generate significant free cash flow

from our industry-leading rig fleet, supported by several billion

dollars of capital investment this decade.”

“Current oilfield sector valuations are near

decade-low valuations, and this does not appear to be the time to

sell for cash. In fact, the Precision Board and management have

been buying Precision Shares over the past month. By voting to

combine with Precision, the Trinidad shareholders are well

positioned to benefit from the strength of the combined company and

the $52 million in annual synergies we expect to generate.”

“We remain committed to our offer and have had

positive conversations about the combination’s value creation

potential with both Trinidad and Precision shareholders. The

superior Precision Transaction offers Trinidad shareholders a clear

path to realize significant value and to share in the combined

company upside. Trinidad’s excellent assets, strong customer

relationships and highly-skilled personnel align well with

Precision’s High Performance, High Value operations. Trinidad

investors are not receiving appropriate value by selling to Ensign

and exiting their investment now as they will be surrendering their

unappreciated value to Ensign at a historically low price,”

concluded Mr. Neveu.

Precision comments on misinformation press

released by Ensign on November 16, 2018:

Ensign’s assertion: “Full and Fair Value for

Trinidad Shareholders.”

- Precision believes over time the value realized by Trinidad

shareholders by owning 29% of the combined company will be greater

than the cash value of $1.68 available now.

- The inadequate Ensign Offer solidifies Trinidad's value at a

low point in the industry and takes all the benefit of efficiency

gains and future industry improvement for Ensign shareholders, at

the expense of Trinidad shareholders.

Ensign’s assertion: “Precision’s depressed share

price means that Trinidad Shareholders will not receive full value

for their Common Shares.”

- The Precision Share price has fluctuated materially through

2018 and significant upside remains. Based on the exchange ratio of

0.445 of a Precision Share for each Trinidad Share, the value to

Trinidad shareholders at Precision’s 2018 high was $2.37 per share,

41% higher than the Ensign offer. This demonstrates the upside

potential beyond the current implied exchange price.

Ensign’s assertion: “Trinidad Shareholders

will be exposed to the risks of increased financial leverage.”

- Precision’s credit ratings are generally stronger than

Trinidad’s credit ratings and each credit agency following

Precision viewed the proposed combination with Trinidad

positively.

- The Precision Transaction is modestly deleveraging for

Precision with year-end 2019 Net Debt/Adjusted EBITDA estimated to

be below 3.0x, based on Precision-provided guidance supported by

industry research analysts.

- Precision’s credit facility is undrawn with approximately $867

million of liquidity in the combined company as at September 30,

2018.

- Precision’s first note maturity is due in December 2021, over

three years from today.

- As demonstrated through previously provided guidance, Precision

is expected to generate strong free cash flow and to continue to

reduce the combined company’s debt levels.

Ensign’s assertion: “The Inferior Precision

Offer is not in the best interest of Trinidad Shareholders.”

- The Trinidad Board has determined the Precision Transaction is

in the best interest of Trinidad shareholders.

- The Precision Transaction provides Trinidad shareholders with

the opportunity to be part of a combined company with significant

upside potential and immediately improved public markets scale and

liquidity.

Ensign’s assertion: “The Inferior Precision

Offer benefits current Precision shareholders at the expense of

Trinidad Shareholders.”

- The Precision Transaction allows Trinidad and Precision

shareholders to share in the synergies of the combined company,

whereas the inadequate Ensign Offer allows only Ensign shareholders

to realize the value of the synergies.

- The Precision Transaction was negotiated by both companies and

has the unanimous support of the Trinidad Board.

Precision comments on misinformation press

released by Ensign on November 22, 2018:

Ensign’s assertion: “Realization by Precision of

synergies from their proposed acquisition of Trinidad is equally

uncertain.”

- Precision has completed a detailed review of the combined

companies’ potential fixed cost synergies and operational

scale-based efficiencies and is confident that its estimate of $52

million in annualized synergies is attainable.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements contained in this news

release, including statements that contain words such as “could”,

“should”, “can”, “anticipate”, “estimate”, “intend”, “plan”,

“expect”, “believe”, “will”, “may”, “continue”, “project”,

“potential” and similar expressions and statements relating to

matters that are not historical facts constitute “forward-looking

information” within the meaning of applicable Canadian securities

legislation and “forward-looking statements” within the meaning of

the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking information and statements”).

In particular, forward-looking information and

statements include, but are not limited to, the following:

- potential macro developments and the potential impact thereon

on Precision and the Precision Share price;

- expectations regarding Precision’s ability to generate

significant free cash flow from its rig fleet;

- the upside potential of the Precision Shares;

- expected cost synergies arising from the Precision

Transaction;

- timing to realize expected synergies;

- the anticipated benefits of the Precision Transaction;

- expectation that the Precision Transaction will create

near-term and long-term value for shareholders of Precision and

Trinidad achieved through the share exchange structure;

- expected free cash flow generation potential of the Precision

Transaction;

- expectations regarding Trinidad's and Precision's ability to

carry out expansion and growth plans;

- the increased size and trading liquidity of the securities of

Precision following the completion of the combination

(“Post-Arrangement Precision”); and

- the expectation that the Precision Transaction will improve

Post-Arrangement Precision’s balance sheet and credit profile.

These forward-looking information and statements

are based on certain assumptions and analysis made by Precision in

light of our experience and our perception of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate under the circumstances. These include,

among other things:

- the timely receipt of required regulatory and Court

approvals;

- the satisfaction of other closing conditions in all material

respects and on a timely basis in accordance with the terms of the

arrangement agreement between Precision and Trinidad;

- Precision's anticipated financial performance;

- the success of Trinidad's and Precision's operations;

- prevailing commodity prices and exchange rates;

- future operating costs of Trinidad's and Precision's

assets;

- the market for Post-Arrangement Precision’s rigs;

- prevailing regulatory, tax and environmental laws and

regulations;

- stock market volatility and market valuations;

- that there will be no significant events occurring outside of

the normal course of business of Trinidad or Precision, as

applicable;

- the fluctuation in oil prices may pressure customers into

reducing or limiting their drilling budgets;

- the status of current negotiations with our customers and

vendors;

- customer focus on safety performance;

- existing term contracts are neither renewed nor terminated

prematurely;

- our ability to deliver rigs to customers on a timely basis;

and

- the general stability of the economic and political

environments in the jurisdictions where we operate.

Undue reliance should not be placed on

forward-looking information and statements. Whether actual results,

performance or achievements will conform to our expectations and

predictions is subject to a number of known and unknown risks and

uncertainties which could cause actual results to differ materially

from our expectations. Such risks and uncertainties include, but

are not limited to:

- failure to complete the transaction in all material respects in

accordance with the arrangement agreement between Precision and

Trinidad or at all;

- unforeseen delays in completing this transaction;

- unforeseen difficulties or delays in integrating the assets of

Trinidad into Precision's operations;

- volatility in the price and demand for oil and natural

gas;

- fluctuations in the demand for contract drilling, well

servicing and ancillary oilfield services;

- our customers’ inability to obtain adequate credit or financing

to support their drilling and production activity;

- changes in drilling and well servicing technology which could

reduce demand for certain rigs or put us at a competitive

disadvantage;

- shortages, delays and interruptions in the delivery of

equipment supplies and other key inputs;

- the effects of seasonal and weather conditions on operations

and facilities;

- the availability of qualified personnel and management;

- a decline in our safety performance which could result in lower

demand for our services;

- changes in environmental laws and regulations such as increased

regulation of hydraulic fracturing or restrictions on the burning

of fossil fuels and greenhouse gas emissions, which could have an

adverse impact on the demand for oil and gas;

- terrorism, social, civil and political unrest in the foreign

jurisdictions where we operate;

- fluctuations in foreign exchange, interest rates and tax rates;

and

- other unforeseen conditions which could impact the use of

services supplied by Precision and Precision’s ability to respond

to such conditions.

Readers are cautioned that the forgoing list of

risk factors is not exhaustive. Additional information on these and

other factors that could affect our business, operations or

financial results or those of Post-Arrangement Precision or that

could affect completion of the proposed combination of Precision

and Trinidad are included in reports on file with applicable

securities regulatory authorities, including but not limited to

Precision’s Annual Information Form for the year ended December 31,

2017 and the joint management information circular of Precision and

Trinidad dated November 5, 2018, which may be accessed on

Precision’s SEDAR profile at www.sedar.com or under Precision’s

EDGAR profile at www.sec.gov. The forward-looking information and

statements contained in this news release are made as of the date

hereof and Precision undertakes no obligation to update publicly or

revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, except as

required by law.

About Precision

Precision is a leading provider of safe and High

Performance, High Value services to the oil and gas industry.

Precision provides customers with access to an extensive fleet of

contract drilling rigs, directional drilling services, well service

and snubbing rigs, camps, rental equipment, and wastewater

treatment units backed by a comprehensive mix of technical support

services and skilled, experienced personnel.

Precision is headquartered in Calgary, Alberta,

Canada. Precision is listed on the Toronto Stock Exchange under the

trading symbol “PD” and on the New York Stock Exchange under the

trading symbol “PDS”.

For further information, please contact:

Carey Ford, CFASenior Vice President and Chief

Financial Officer713.435.6111

Ashley Connolly, CFAManager, Investor

Relations403.716.4725

Precision Drilling Corporation800, 525 - 8th

Avenue S.W.Calgary, Alberta, Canada T2P 1G1Website:

www.precisiondrilling.com

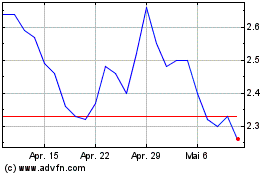

Ensign Energy Services (TSX:ESI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ensign Energy Services (TSX:ESI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024