DRI Healthcare Trust Announces C$90 Million Bought Deal Public Offering of Units

12 September 2023 - 9:43PM

DRI Healthcare Trust (TSX: DHT.UN/DHT.U) (the "Trust"), a global

leader in providing financing to advance innovation in the life

sciences industry, announced today that it has entered into an

agreement with a syndicate of underwriters led by Scotiabank, CIBC

Capital Markets and RBC Capital Markets (collectively, the

“Underwriters”), pursuant to which the Trust will issue from

treasury, and the Underwriters will purchase on a “bought deal”

basis, 8,200,000 units (the “Units”) of the Trust, at a price of

C$11.00 per Unit (the “Offering Price”) for gross proceeds of

approximately C$90.2 million (the “Offering”).

The Trust has granted the Underwriters an option

(the “Over-Allotment Option”), exercisable in whole or in part, at

any time for a period of 30 days from the closing of the Offering,

to purchase from the Trust up to an additional 1,230,000 Units at

the Offering Price, for additional gross proceeds of approximately

C$13.5 million.

The Trust intends to use the net proceeds of the

Offering to fund its near term pipeline of royalty transactions.

The Trust is currently in various stages of negotiations and due

diligence with counterparties on several potential royalty

transactions that would meet its transaction criteria.

Closing of the Offering is expected to occur on

or about September 20, 2023, subject to customary conditions

including the approval of applicable securities regulatory

authorities and the Toronto Stock Exchange.

The Units will be offered in all provinces of

Canada by way of a prospectus supplement to the short form base

shelf prospectus of the Trust dated May 9, 2022 and may be offered

in the United States on a private placement basis pursuant to an

exemption from the registration requirements of the United States

Securities Act of 1933, as amended, and applicable state securities

laws, and certain other jurisdictions outside of Canada and the

United States.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of the securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

the registration or qualification under the securities laws of any

such jurisdiction. The securities offered have not been registered

under the United States Securities Act of 1933, as amended, and may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements.

About DRI Healthcare Trust

DRI Healthcare Trust is managed by DRI Capital

Inc. (“DRI Capital”), the pioneer in global pharmaceutical royalty

monetization with a more than 30-year history of accelerating

innovation by providing capital to inventors, academic institutions

and biopharma companies. Since our founding in 1989, DRI Capital

has deployed more than US$2.5 billion, acquiring more than 70

royalties on 40-plus drugs, including Eylea, Spinraza, Zytiga,

Remicade, Keytruda and Stelara. DRI Healthcare Trust’s units are

listed and trade on the Toronto Stock Exchange in Canadian dollars

under the symbol “DHT.UN” and in U.S. dollars under the symbol

“DHT.U”. To learn more, visit drihealthcare.com or follow us

on LinkedIn. References in this news release to “DRI Healthcare”

refer to the Trust and its subsidiaries, on a consolidated

basis.

Caution concerning forward-looking

statements

This news release may contain forward-looking

information within the meaning of applicable securities

legislation. Forward-looking information generally can be

identified by the use of words such as “expect”, “continue”,

“anticipate”, “intend”, “aim”, “plan”, “believe”, “budget”,

“estimate”, “forecast”, “foresee”, “close to”, “target” or negative

versions thereof and similar expressions. Some of the specific

forward-looking information in this news release may include, among

other things, statements regarding the anticipated use of proceeds

of the Offering and timing of closing the Offering. Forward-looking

information is based on a number of assumptions and is subject to a

number of risks and uncertainties, many of which are beyond the

Trust’s control that could cause actual results to differ

materially from those that are disclosed in or implied by such

forward-looking information. These risks and uncertainties include,

but are not limited to, those that are disclosed in the Trust’s

most recent annual information form. All forward-looking

information in this news release speaks as of the date of this news

release. The Trust does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise except as required by law. Additional

information about these assumptions and risks and uncertainties is

contained in the Trust’s filings with securities regulators,

including its latest annual information form and management’s

discussion and analysis. These filings are also available at the

Trust’s website at drihealthcare.com.

For further information, please

contact:

David LevineDirector, Investor Relations Tel:

(416) 324-5738ir@drihealthcare.com

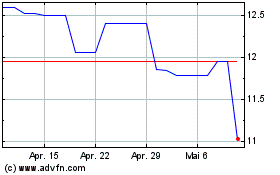

DRI Healthcare (TSX:DHT.U)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

DRI Healthcare (TSX:DHT.U)

Historical Stock Chart

Von Apr 2023 bis Apr 2024