Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) today announces second quarter

production results and provides a commissioning update at the

Company’s Premier Gold Mine (“

Premier”), located

on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of

northwestern British Columbia. Initial commissioning material was

introduced into the grinding circuit of the mill on March 31, 2024,

initial commissioning ore started to be processed on April 8, 2024,

and first gold was poured on April 20, 2024. During the remainder

of the quarter, the Company continued commissioning the mill, water

treatment plant, and established the secondary underground egress

at the Big Missouri deposit to commence production in its planned

stoping areas. Many of the commissioning challenges encountered in

the mill have been addressed, which is starting to demonstrate an

increasing frequency and quantity of gold pours.

SECOND QUARTER 2024

HIGHLIGHTS

- Established the second egress and exhaust vent raise at the Big

Missouri deposit on June 18th

- Project to date development of 3,861 metres, of which 89%

relates to Big Missouri and 11% relates to Premier Northern Lights

(“PNL”)

- Second quarter development of 1,764 metres, of which 1,381

metres related to Big Missouri and 383 metres relates to PNL.

Significant progress in the second half of the quarter has been

made at PNL where the development rates have increased to over 6

metres per day

- The operation is moving from mining lower-grade commissioning

ore from the development headings to mining of the planned

higher-grade stoping areas.

- During the quarter, Ascot processed 85,436 dry tonnes of mostly

development ore in the commissioning of the mill, containing an

estimated total of 5,713 ounces of gold

- Poured 839 ounces of gold and 1,288 ounces of silver, and an

estimated 3,178 ounces of gold-in-process remains in the mill

circuit

- Sold 735 ounces of gold to the offtaker at an average realized

price of US$2,357/oz (C$3,229/oz)

- Delivered 42 ounces of gold and 562 ounces of sliver per stream

and royalty arrangements

- The Company addressed a number of commissioning issues in the

mill related to the gravity circuit, elution circuit, and

thickening process

- Cash balance at June 30, 2024 of approximately C$12

million

Derek White, President & CEO, and Director

commented, "Ascot progressed through many important milestones in

the second quarter, including the start of processing commissioning

ore in the mill, the first gold pour from the gravity circuit, and

subsequent pours from the carbon-in-leach circuit as a part of the

commissioning process. While various challenges were encountered

within the mill startup, many corrective measures and changes have

been made, resulting in an upward trajectory in processing

reliability, throughput, and the ensuing gold pours. With stoping

activity in higher-grade areas having started at the Big Missouri

deposit, we anticipate a noticeable increase in gold pours in the

very near term.”

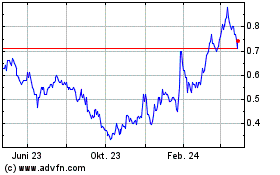

Figure 1 – Q2 2024 daily tonnes

milled

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/86b438bc-9c11-46fb-bd1e-b609b010f1e9

MiningThe pace of underground

mine development at the Big Missouri deposit increased in Q2 2024.

Total lateral development in the quarter was 1,764 metres,

comprising 525 metres in development ore and 1,239 metres in waste

at Big Missouri, and 383 metres of decline development at PNL. A

total of 47,158 wet tonnes of ore was mined in Q2 2024, and was

primarily sourced from development headings, with stoping activity

being commenced in late June after secondary egress was

established. The remaining mill feed came from previously mined

stockpiles. In various locations, waste development headings

encountered mineralized material approximately 20–30 metres or more

before reaching stope shapes, and as such that mined material was

stockpiled and fed to the mill as commissioning material.

As at June 30, 2024, there were approximately

11,614 tonnes of stockpiled ore to be processed in addition to the

live feed from Big Missouri underground stoping ore. Since the

secondary egress is in place, mining is now targeting planned

higher-grade stope blocks which have been averaging approximately

800 tonnes per day over the last weeks of June. This trend is

expected to continue in July.

At the Premier-Northern Light

(“PNL”) deposit near the mill, development rates

in the single-heading decline accelerated in the quarter, with the

mining contractor consistently achieving approximately 6 metres per

day for the month of June. Total development in Q2 2024 was 390

metres and 565 metres to go until the Company reaches the first

development ore which is anticipated in September of 2024 with

stope production commencing in October.

Mill CommissioningSince the

introduction of rock into the mill at the end of Q1 2024, there has

been a steady increase in crushing and grinding performance. To

June 30, 2024, the mill has processed 85,436 tonnes, achieving over

2,000 tonnes per day for 13 days in that period and reaching

nameplate capacity of approximately 2,500 tonnes per day on June

21, 2024. This has proved the mill can achieve nameplate milling

targets and has satisfied key vendor requirements.

On April 20, 2024, the first gold was poured

from gold recovered through the gravity circuit as a part of the

commissioning process. The first pour from gold recovered from the

CIL circuit was completed in late May 2024, with subsequent pours

having been completed in June and now continuing on a regular

basis. The first gold pour using both the gravity and CIL circuit

was completed on June 27, 2024, and that was the largest pour to

date.

During Q2 2024, the Company faced commissioning

challenges throughout the process plant but particularly in the

areas of the elution circuit boiler, carbon management, thickener

flocculation, and metallurgical sampling and estimation. In

addition, global supply chain challenges and vendor support have

been the source of some delays in implementing changes in the mill.

These challenges have mostly been surmounted with many process

changes made in June, and the Company is starting to see the

benefits of those changes in the amount of gold contained in each

pour.

The average grade processed to date is estimated

to be approximately 2 g/t gold. This is an estimate because during

commissioning, as is customary, there is an amount of gold being

built up in the processing circuit. This gold-in-circuit inventory

is currently estimated to be approximately 3,178 ounces.

Cash Balance and

LiquidityAscot’s cash balance at the end of Q1 2024 was

C$47 million. By the end of Q2 2024, this decreased to

approximately C$12 million. The decrease in cash is attributable to

the aforementioned mill commissioning challenges and delays in gold

pours. However, with the process changes being implemented, and

with the ability to mine stope ore at Big Missouri and feed higher

grade material to the mill, the gold pours are now being conducted

on a regular basis and generating more revenue. Ascot management is

evaluating the potential requirement for additional capital,

including an inventory prepay facility and/or a modest equity

financing in order to maintain a sufficient cash balance through

the commissioning process and meet the Company’s debt covenants. As

at June 30, 2024, the Company was in technical non-compliance with

certain covenants in its lending and stream arrangements. The

Company has obtained waivers for this non-compliance through the

end of July. The Company continues to work constructively with its

lenders and stream provider.

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President & CEO,

Director

For further information

contact: David Stewart, P.Eng.

VP, Corporate Development & Shareholder

Communications dstewart@ascotgold.com 778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian mining company focused on

commissioning its 100%-owned Premier Gold Mine, which poured first

gold in April 2024 and is located on Nisga’a Nation Treaty Lands,

in the prolific Golden Triangle of northwestern British Columbia.

Concurrent with commissioning Premier towards commercial production

anticipated in the second half of 2024, the Company continues to

explore its properties for additional high-grade gold

mineralization. Ascot’s corporate office is in Vancouver, and its

shares trade on the TSX under the ticker AOT and on the OTCQX under

the ticker AOTVF. Ascot is committed to the safe and responsible

operation of the Premier Gold Mine in collaboration with Nisga’a

Nation and the local communities of Stewart, BC and Hyder,

Alaska.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements").

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "believe", "plan",

"estimate", "expect", "targeted", "outlook", "on track" and

"intend" and statements that an event or result "may", "will",

"should", "could", “would” or "might" occur or be achieved and

other similar expressions. All statements, other than statements of

historical fact, included herein are forward-looking statements,

including statements in respect of the advancement and development

of the PGP and the timing related thereto, the completion of the

PGP mine, the Company’s ability to raise financing and be in

compliance with its debt and stream agreements, the production of

gold and management’s outlook for the remainder of 2024 and beyond.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including the business of Ascot; risks related to

exploration and potential development of Ascot's projects; business

and economic conditions in the mining industry generally;

fluctuations in commodity prices and currency exchange rates;

uncertainties relating to interpretation of drill results and the

geology, continuity and grade of mineral deposits; the need for

cooperation of government agencies and indigenous groups in the

exploration and development of Ascot’s properties and the issuance

of required permits; the need to obtain additional financing to

develop properties and uncertainty as to the availability and terms

of future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; and other risk factors as detailed

from time to time in Ascot's filings with Canadian securities

regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024 in the section entitled "Risk

Factors". Forward-looking statements are based on assumptions made

with regard to: the estimated costs associated with construction of

the project; the ability to maintain throughput and production

levels at the PGP mill; the tax rate applicable to the Company;

future commodity prices; the grade of mineral resources and mineral

reserves; the ability of the Company to convert inferred mineral

resources to other categories; the ability of the Company to reduce

mining dilution; the ability to reduce capital costs; and

exploration plans. Forward-looking statements are based on

estimates and opinions of management at the date the statements are

made. Although Ascot believes that the expectations reflected in

such forward-looking statements and/or information are reasonable,

undue reliance should not be placed on forward-looking statements

since Ascot can give no assurance that such expectations will prove

to be correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

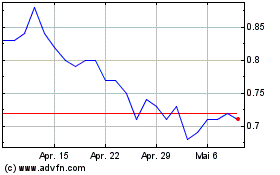

Ascot Resources (TSX:AOT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ascot Resources (TSX:AOT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024