ALSTOM SA: Alstom Preview Note – Q2 and H1 2024/25 Preview

04 Oktober 2024 - 7:00AM

UK Regulatory

ALSTOM SA: Alstom Preview Note – Q2 and H1 2024/25 Preview

Alstom Note – Q2 and H1 2024/25

Preview

4 October 2024 – Alstom presents below a

preview to its Q2 and H1 2024/25 results.

Q2 2024/25 orders

The table below summarizes the large orders

(more than €200m) published and booked during the quarter.

Orders

|

Value

(in € million) |

Description |

Link to press release |

|

Proxima |

~850 |

France - 12 very High speed trains with 15Y maintenance |

Link to the PR

|

|

S-Bahn Köln |

~3,600 |

Germany – Frame agreement of 90 trains and 34 years maintenance for

~4bn, o/w ~3.6bn to be booked in Q2, and the rest at a later stage

(options) |

Link to the PR

|

|

Perth – Signalling |

~650 |

Western Australia – High capacity signalling project |

Link to the PR

|

|

Total large orders |

~5,100 |

|

|

- Deals

announced previously, but to be booked at a later

stage

-

Haifa-Nazareth Systems contract for ~€700m,

expected booking in FY 2025/26: link to the press

release

- CP (Portugal) for

~€700m, awarded to Alstom. Expecting end of

competitors’ challenge. Expected booking in FY 2024/25.

- Toronto electrification

for several € billions. Preliminary

design works on-going (joint development phase). Bookings are

expected in several batches from calendar year 2025 to 2028.

In addition to large orders disclosed in the

above table, we remind the guidance for base orders (less than €200

million) which typically account for €1.5b to €2.0b per quarter

since the merger with Bombardier.

The table below reminds the breakdown between

large and base orders during Q2 for the last three fiscal years,

keeping in mind a positive seasonality of small orders on H2

(H2>H1):

|

Q2 orders (in € billion) |

FY 2021/22 |

FY 2022/23 |

FY 2023/24 |

|

Base orders (less than €200m) |

1.9 |

1.7 |

3.2 |

|

Large orders (more than €200m) |

1.4 |

2.8 |

1.4 |

|

Total order intake |

3.3 |

4.5 |

4.6 |

- Reminder

- Guidance on orders

At FY 2023/24 release on 8 May 2024, we guided

for :

- Book-to-bill ratio above 1 for FY

2024/25 at Group level.

- Book-to-bill

ratio for Rolling Stock to be around 1 for the three years FY

204/25 to FY 2026/27.

***

H1 2024/25 Sales

At FY 2023/24 release on 8 May 2024:

- We guided for an

organic growth around 5% for FY 2024/25 at Group level

- We reminded of

usual seasonality (H1 2024/25 growth to be measured against first

half of last fiscal year)

Breakdown of sales by currency is given in the

appendix of the FY 2024/25 analysts presentation (page 42):

link to the presentation

We expect negative forex impact on sales of

~(0.9)% for the first half of FY 2024/25, primarily due to USD and

USD-pegged currencies against EUR.

We expect negative perimeter impact on H1

2024/25 sales of ~(0.7)%

- for ~(0.4)% due

to a change in control of two service JVs with RENFE in Spain,

following changes in the JV agreements: these JVs will now be

accounted for under the equity method and no more as joint

operations.

- for ~(0.3)% due

to the disposal of US conventional signalling to Knorr-Bremse,

closed on 31 August 2024

***

H1 2024/25 adjusted EBIT

At FY 2023/24 release on 8 May 2024:

- We guided for an

adjusted EBIT margin around 6.5% for the full year FY 2024/25, an

improvement of around 80bps versus FY 2023/24 driven by volume and

mix, cost savings initiatives and industrial efficiency

- We reminded of

usual seasonality, driving aEBIT margin to be more H2 weighted

During the Q1 analysts call on July 23,

2024:

- We gave

indication that H1 aEBIT margin would be consistent with FY 2023/24

aEBIT margin (reminder: 5.7%)

- We reiterated

full year guidance

***

Below aEBIT – reminder of FY 2024/25

guidance

- Non-operating

income and expenses:

At FY 2023/24 release on 8 May 2024, we

indicated that they should not exceed (€200m) for the FY 2024/25,

including:

- The final year of integration

costs, for an amount expected around €90m for the full year.

- Some restructuring, legal fees and

other non-operating costs

We indicated around €200m of P&L net expense

for FY 2024/25, with reduction of net interests paid by around €70m

but some increase in bank fees and hedging.

The depreciation table on page 46 of the FY

2023/24 presentation: link to the presentation

***

Free Cash Flow

At Q1 FY2024/25 trading update, we confirmed

- our FCF guidance

for the full year FY 2024/25 within the range €300m - €500m

- with seasonality

driving negative FCF within a range €(300m) - €(500m) for H1

2024/25

Reminder of main assumptions for guidance:

- Supportive market demand and FY

2024/25 downpayments consistent with FY 2023/24 (reminder: at

the time of Q1 analysts call on 23 July 2024, we confirmed that

these conditions were met)

- End of integration in FY

2024/25

- Balance sheet plan fully executed

in FY 2024/25 (update: this has been fully achieved following

the closing of the sale of US conventional signalling on 31/08/2024

– see link to press release here)

|

Alstom

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 64 countries and a talent base of over 84,700 people from 184

nationalities, the company focuses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €17.6 billion

for the fiscal year ending on 31 March 2024.

For more information, please visit www.alstom.com. |

|

|

|

| |

Contacts |

Investor Relations

Martin VAUJOUR – Tel.: +33 (0) 6 88 40 17 57

martin.vaujour@alstomgroup.com

Estelle MATURELL ANDINO – Tél.: +33 (0) 6 71 37 47 56

estelle.maturell@alstomgroup.com

|

|

This document contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This document does not constitute or form

part of a prospectus or any offer or invitation for the sale or

issue of, or any offer or inducement to purchase or subscribe for,

or any solicitation of any offer to purchase or subscribe for any

shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the visa from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, its affiliates, shareholders, and their

respective directors, officers, advisers, employees or

representatives undertake no obligation to provide the recipient

with access to any additional information.

- H1 2024-25 - Alstom Preview Note - Final

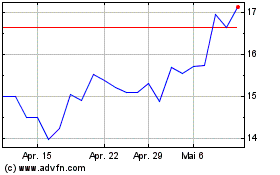

Alstom (TG:AOMD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alstom (TG:AOMD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024