ALSTOM SA: Alstom’s first half 2024/25: good commercial

performance, confirmation of FY 2024/25 outlook

Alstom’s first half 2024/25: good commercial

performance, confirmation of FY 2024/25 outlook

- H1 2024/25

highlights:

- Book-to-bill ratio at 1.25

and organic sales up

5.6%1

-

aEBIT2 of €515

million, up 18%, i.e. margin of 5.9%

- Free Cash

Flow2 at €(138)

million benefiting from favourable downpayments

phasing

- Net financial debt at

€(927) million down from €(2,994) million after deleveraging plan

execution

- FY 2024/25 outlook

- Book-to-bill above 1 and

sales organic growth around 5%

- aEBIT margin around

6.5%

- Free Cash Flow

within the range €300 million to €500 million

13 November 2024 – In the first

half of fiscal year 2024/25 (from 1st April to 30

September 2024), Alstom booked €10.9 billion of orders. The Group

sales reached €8.8 billion, resulting in a book-to-bill ratio at

1.25.

The backlog is now €94.4 billion, providing

strong visibility on future sales. Gross margin on

backlog2 reached 17.8% as of 30 September 2024, compared

to 17.5% on 31 March 2024.

In the first half of 2024/25, Alstom’s adjusted

EBIT was €515 million, up +18% versus last fiscal year, equivalent

to a 5.9% margin (+70bps), and EBIT before PPA was €382 million.

Adjusted net profit2 was €224 million, net income (group

share) was €53 million, and free cash flow was €(138) million for

the half-year.

"Demand remains robust, driven by green

mobility policies, proving resilient to geopolitical tensions, and

we had a solid commercial performance in this first half. We are

making steady progress on our roadmap, with backlog margins

returned to pre-merger levels and a focused shift towards Services

and Signalling. With a strengthened balance sheet and an Investment

grade rating with a stable outlook, we are focused on effectively

managing our projects portfolio, amid supply chain challenges,

while driving cost efficiencies to deliver on our financial

trajectory" said Henri Poupart-Lafarge, Chief

Executive Officer of Alstom.

***

Key figures3

Reported figures

(in € million) |

Half-year ended

30 September 2023 |

Half-year ended

30 September 2024 |

% Change Reported |

% Change Organic |

|

Orders received4 |

8,446 |

10,950 |

29.6% |

30.0% |

|

Sales |

8,443 |

8,775 |

3.9% |

5.6% |

|

Adjusted EBIT4 |

438 |

515 |

17.6% |

|

|

Adjusted EBIT margin4 |

5.2% |

5.9% |

|

|

|

EBIT before PPA4 |

275 |

382 |

|

Adjusted net profit4 |

174 |

224 |

|

|

|

Free Cash Flow |

(1,119) |

(138) |

|

|

|

(in € million) |

Full-year ended

31 March 2024 |

Half-year ended

30 September 2024 |

% Change Reported |

% Change Organic |

|

Backlog |

91,900 |

94,369 |

2.7% |

3.2% |

|

Gross margin % on backlog4 |

17.5% |

17.8% |

|

|

***

The €2 billion inorganic deleveraging

plan fully delivered

The hybrid bond issuance for €750 million and

the rights issue for €1 billion euros have been fully executed

during this semester.

On 30 August 2024, Alstom sold its North

American conventional Signalling business to Knorr-Bremse AG for a

purchase price of USD 689 million, following the binding agreement

signed on 19 April 2024.

Alstom has delivered all three components of the

deleveraging plan, resulting in the stabilisation of its Investment

Grade rating by Moody’s on June 13, 2024.

Progress on Alstom’s operational

priorities

During the first half of fiscal year 2024/25,

the Group mobilised around the commercial, operational and cost

efficiency plans:

- Quality of order intake during the

first half supports continuous growth in the margin in backlog, now

standing at 17.8% as of 30 September 2024, a +30bps improvement

versus 31 March 2024, in line with the expected +50bps per year

trajectory announced previously.

- With regards to production, the

Group is focusing on the ramp-up of several projects in startup

phase, with an expected output of 4,400 to 4,600 cars for the full

year, despite the recent supply chain issues encountered.

- Costs efficiency programs have been

progressing. SG&A over sales have reduced to 6.0% in September

2024 against the 6.6% baseline in March 2023.

***

Business update

-

Growth by offering greater value to customers

In the first half of fiscal year 2024/25, the

Group recorded €10.9 billion in orders, with commercial

success across multiple geographies, notably in Europe and across

various product lines, with a strong emphasis on Services. For the

same period last fiscal year, Alstom reported an order intake of

€8.4 billion. This 30% growth is largely attributed to the award of

the €3.6 billion S-Bahn Cologne

contract.

In Europe, Alstom achieved an order intake of €8.5

billion during the first half of fiscal year 2024/25, compared to

€5.2 billion for the same period in the previous fiscal year.

In Germany, Alstom was awarded a contract to

supply 90 Adessia Stream™ commuter trains to the local rail

passenger transport authorities, go.Rheinland and Verkehrsverbund

Rhein-Ruhr (VRR), for operation within the S-Bahn Köln network.

This contract also encompasses a long-term full-service agreement

lasting 34 years. Additionally, the Group entered into a framework

agreement with Hamburger Hochbahn AG to provide up to 374 new metro

trains and innovative signalling technology, with the first metro

trains call-off under this agreement for the initial section of the

U5 line valued at approximately €670 million.

In France, Alstom will supply 12 Avelia Horizon™

very high-speed trains to Proxima, a newly established private

operator. This marks a turning point for the French railway market,

as it opens the Atlantic coastlines to a private operator for the

first time in history. Avelia Horizon reduces operating costs

compared to other high-speed trains. The train has fewer bogies,

which account for 30% of the cost of preventive maintenance. With

the largest passenger capacity in the market, Avelia Horizon offers

great level of service and comfort, and consequently lowers

operating costs per seat. As part of this contract, Alstom will

also provide maintenance for 15 years, offering operational

performance while optimising the residual value to meet Proxima’s

specific needs. The total value of this order is nearly €850

million.

In Italy, the Group received a contract from

Mercitalia Rail for the supply of 70 Traxx™ Universal locomotives,

along with 12 years of comprehensive maintenance services. This

contract is valued at over €323 million and includes the option to

deliver an additional 30 locomotives and extend the maintenance

services.

In the Americas, Alstom

reported an order intake of €0.9 billion, compared to €1.5 billion

during the same period of the previous fiscal year, driven by the

awarding of several small contracts. Last year’s performance in the

Americas was largely influenced by two significant contracts: one

for the Southeastern Pennsylvania Transportation Authority (SEPTA)

and the other for the Connecticut Department of Transportation

(CTDOT).

In Asia/Pacific, the order

intake reached €1 billion, as compared to €1.7 billion over the

same period last fiscal year. In Australia, Alstom in partnership

with DT Infrastructures has been awarded by the Public Transport

Authority of Western Australia (PTA) a contract to provide the

design, supply, construction, installation, testing, commissioning,

and maintenance of high-capacity signalling technology for Perth’s

suburban rail network. Alstom’s contract share is valued at

approximately €0.7 billion.

In Africa/Middle East/Central

Asia, the Group reported €0.5 billion order intake driven

by a new services contract from an undisclosed customer, as

compared to €35 million over the same period last fiscal year.

As of 30 September 2024, the backlog stood at

€94.4 billion, providing the Group with strong visibility over

future sales.

Alstom’s sales amounted to €8,775 million for

the first half of fiscal year 2024/25, representing a growth of

3.9% on a reported basis and a strong 5.6% on an organic basis

compared with Alstom sales in the same period last fiscal year.

Rolling stock sales reached €4,531 million,

representing an increase of 2% on a reported basis and 2% on an

organic basis, driven by contracts ramp-up in France, Brazil and in

Asia/Pacific, offsetting legacy German and UK contracts phasing

out.

Services sales stood at €2,197 million, up 11%

on a reported basis and 12% on an organic basis, benefiting from

robust growth in Germany, Asia/Pacific and Middle East.

Signalling delivered consistent execution

year-on-year, achieving sales of €1,247 million, stable on a

reported basis and up 3% on an organic basis. The growth in

Asia/Pacific compensated for the ramp down in Canada and in the

US.

Systems sales grew 7% on a reported basis and

14% on an organic basis, and stood at €800 million, driven by a

good performance of projects in Mexico compensating the successful

completion of the Egyptian monorail.

***

2. Innovation by

Pioneering Smarter and Greener Mobility for All

As of end of September 2024, research and

development gross costs amounted to €(326) million, i.e. 3.7% of

sales, delivering on the Alstom In Motion strategy which is based

on three pillars: Autonomous mobility, Data factory and Mobility

orchestration. Net R&D amounts to €(256) million before PPA

amortisation.

Rolling Stock: homologation tests of the

Avelia Horizon™ double-deck high-speed trains are

planned in 2024 to enable a start of revenue service in 2025 for

SNCF in France. A new order for 12 trains based on the same product

has been received from Proxima and the development of international

configurations is ongoing.

Alstom is also continuously improving its single-deck high-speed

train now branded Avelia Stream™.

Meanwhile, Alstom has also further extended the Coradia

Stream™ range, with longer cars and 15kV traction chains,

primarily in Germany. This range will also include a battery

electric version.

Services: Alstom is progressing on the

development of its Maintenance Performance Centres in Europe, APAC

and North America, where Alstom will bring together expertise in

centralised locations to support multiple fleets, optimise

maintenance processes and better serve its customers. Alstom has

recently equipped the first trains from the Réseau express

métropolitain (REM) fleet with new predictive maintenance

technology, relying on AI algorithms to predict more accurately the

behaviour and condition of critical components, such as doors and

HVAC, to boost the overall operational performance and efficiency

of the system.

Signalling: this product line further enhances

its mainline portfolio and applications by accelerating

Onvia™ for ETCS Level 2 on the German market,

while working on ETCS onboard solutions for Level 2

and Level 3 including Automatic Train Operation. For metros

and trams, Alstom continues to advance its train-centric CBTC

solutions Urbalis™ (implemented in Paris L18,

Torino L1). This offering is completed by operational control

centres that support Alstom's extensive range of CBTC

solutions.

Alstom Innovation has continued to develop

its Autonomous Mobility solutions for passengers & freight

trains, successfully demonstrating remote driving tests and

autonomous driving & perception and remote driving capability

with its customer LNVG during InnoTrans. The company continues to

investigate on various fields, including Artificial Intelligence

for applications such as predictive maintenance, autonomous

systems, and operational efficiency, as well as simulations to test

and validate new technologies and systems prior to their deployment

in real-world scenarios.

***

3. Profitability

The adjusted EBIT margin has progressed from

5.2% over the first semester of fiscal year 2023/24 to 5.9% over

the first semester of fiscal year 2024/25, benefiting from an

increased volume for 20bps, a favourable mix for 5bps, industrial

efficiencies for 15bps as well as the costs savings programme

positive effects for 35bps, partly offset by scope impact for

negative (5)bps.

During the first half of fiscal year 2024/25, Alstom recorded €21

million capital gain mainly related to divestiture of the North

American conventional Signalling business for €18 million.

Costs related to the integration of Bombardier

Transportation were recorded for an amount of €(51) million. Other

expenses were recorded for a total of €(31) million, of which €(13)

million of legal fees.

Alstom’s EBIT before amortisation and impairment

of assets exclusively valued when determining the purchase price

allocation (“PPA”) stood at €382 million. This compares to €275

million in the same period last fiscal year.

Net financial result of the period amounted to

€(107) million as compared to €(98) million in the same period last

fiscal year, driven by lower net interest expenses due to the

execution of the deleveraging plan offset mainly by adverse FX

Forward Points and bank fees.

The effective tax rate before PPA has increased

temporarily, at 37% during this first half compared to 25% for the

same period last fiscal year, due to a non-cash write down of some

deferred tax assets in certain countries. Consistently with medium

term plan, the structural effective tax rate estimated remains at

around 27%.

The share in net income from equity investments

amounted to €60 million – excluding the amortisation of the

purchase price allocation (“PPA”) mainly from Chinese

joint-ventures of €(6) million.

Adjusted net profit, representing the group’s

share of net profit from continued operations excluding PPA and

impairment net of tax, amounts to €224 million for the first half

of fiscal year 2024/25. This compares to an adjusted net profit of

€174 million in the same period last fiscal year.

The Group’s Net profit/(loss) (Group share)

stood at €53 million for the first half of fiscal year 2024/25,

compared to €1 million in the same period last fiscal year.

***

4. Free cash flow

generation

The Group’s Free Cash Flow stands at €(138) million for the first

half of fiscal year 2024/25 as compared to €(1,119) million during

the same period last fiscal year.

Funds from Operations5 stand at €282

million, compared to €256 million in the same period last fiscal

year, driven by improved EBIT before PPA of €382 million compared

to €275 million in the same period last fiscal year and partially

offset by an increase in capital expenditure.

Cash generation was impacted by an unfavourable

€(420) million change in working capital compared to €(1,375)

million in the same period last fiscal year. This is mostly due to

the trade working capital5 build up by €(435) million,

impacted by the increase in inventory levels notably to prepare the

higher production in the second semester than in the first semester

due to seasonality of production.

Additionally, the Contract Working

Capital5 has improved by €15 million compared to €(645)

million in the same period last fiscal year. This evolution is due

to continued industrial activity, project working capital phasing

and supported by the level of downpayments received over the first

half of fiscal year 2024/25 and provisions usage.

***

5. Financial

structure

On 30 September 2024, the Group recorded a net debt position of

€(927) million, compared to the €(2,994) million net debt that was

reported on 31 March 2024, largely driven by the execution of

deleveraging plan for €2,321 million including capital increase,

issuance of subordinated perpetual securities and disposal of

business.

As announced at the time of the rights issue,

existing short-term debt as of 31 March 2024 was fully repaid for a

total amount of €1,208 million.

The Group’s cash and cash equivalents amounted

to €1,789 million on 30 September 2024, of which €949 million were

invested in cash equivalents.

In addition, the Group benefits from strong

liquidity with:

-

€1.75 billion short term Revolving Credit Facility maturing in

January 2027

-

€2.5 billion Revolving Credit Facility maturing in January

2029.

On 30 September 2024, both Revolving Credit

Facility lines remained undrawn.

As per Group’s conservative liquidity policy,

the €2.5 billion Revolving Credit Facility serves as a back-up of

the Group €2.5 billion NEU CP program in place.

Alstom has successfully executed its

deleveraging plan resulting in the termination of the additional

€2.25 billion credit facility agreement as announced

previously.

***

6. One Alstom team –

Agile, Inclusive and Responsible

Decarbonization is at the heart of Alstom’s strategy. The Group is

reducing its own direct and indirect emissions (Scope 1 & 2)

and is also committed to work with suppliers and customers (Scope

3) to contribute to Net Zero carbon in the mobility sector. Thus,

Alstom has signed a collaboration agreement with green steel

supplier SSAB which will support the objective of recycled content

materials in projects.

The Group confirmed its ambitious commitment to use 100% of

electricity from renewable energy sources by end of 2025, as part

of its global initiative to reduce its environmental footprint. At

the end of September 2024, the supply of electricity from renewable

sources reached 79%6 thanks to new green certificates

used in Canada on sites as La Pocatière and Saint-Bruno and in

Australia. In addition, Alstom continues installation of solar

panels on relevant sites.

Alstom’s Corporate Social Responsibility

performance is regularly evaluated by various rating agencies; the

Group maintained its presence among the CAC40 ESG index for the

4th consecutive year. Alstom strongly improved its

scoring to ECOVADIS questionnaire with a score of 86/100,

complemented by a “Platinum” distinction, ranking Alstom in the top

1% of the most engaged companies in environmental, sustainable

procurement, ethics, human rights, and social terms. Alstom kept an

AA score with the MSCI agency and is part of the 2024 Global 100

ranking from Corporate Knights. Those results reflect its strong

position and strategy on sustainability.

***

FY 2024/25 outlook

Following the full execution of the deleveraging

plan, outlook for FY 2024/25 is based on following main

assumptions:

- Supportive market demand

- FY 2024/25 downpayments consistent

with FY 2023/24

- End of integration of Bombardier

Transportation in FY 2024/25

Outlook for FY 2024/25:

- Book to bill above 1

- Sales organic growth: around

5%

- aEBIT margin around 6.5 %

- Free Cash Flow generation within

the €300 million to €500 million range

***

Mid to long-term ambitions are confirmed as per

the May 8, 2024, full year announcement.

***

Financial calendar

|

21 January 2025 |

FY 2024/25 Third Quarter – Orders & Sales |

|

13 May 2025 |

FY 2024/25 Full-Year results |

***

Conference Call

Alstom is pleased to invite the analysts to a

conference call presenting its half year results for fiscal year

2024/25 on Wednesday 13 November at 6:30 pm (Paris local time),

hosted by Henri Poupart-Lafarge, CEO and Bernard Delpit, EVP and

CFO.

A live audiocast will also be available on

Alstom’s website: Alstom’s Half Year results for FY 2024/25.

To participate in the Q&A session (audio

only), please use the dial-in numbers below:

- France: +33 (0) 1

7037 7166

- UK: +44 (0) 33 0551

0200

- USA: +1 786 697

3501

- Canada: 1 866 378

3566 (toll free)

Quote ALSTOM to the operator to

be transferred to the appropriate conference.

***

The Board of Directors met on November

13th, 2024, and reviewed the interim

financial statements and the management report as end of September

30th, 2024. The limited review

procedures on the condensed interim consolidated financial

statements were carried out by the statutory auditors. Their report

is currently being prepared. The consolidated financial statements

and notes related to this press release are available on the

www.alstom.com website.

ALSTOM™, Avelia™, Coradia™, Coradia Stream™ and

Traxx™ are protected trademarks of the Alstom Group.

1 3.9% on a reported basis

2 Non – GAAP. See definition in the appendix.

3 Geographic and product breakdowns of reported orders and sales

are provided in Appendix 1

4 Non - GAAP. See definition in the appendix.

5 Non - GAAP. See definition in the appendix.

6 12 months rolling

|

About Alstom

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

Signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 64 countries and a talent base of over 84,700 people from 184

nationalities, the company focuses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €17.6 billion

for the fiscal year ending on 31 March 2024.

For more information, please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:

Philippe MOLITOR - Tel.: +33 (0) 7 76 00 97

79

philippe.molitor@alstomgroup.com

Thomas ANTOINE - Tel. : +33 (0) 6 11 47 28 60

thomas.antoine@alstomgroup.com

Investor relations :

Martin VAUJOUR – Tel. : +33 (0) 6 88 40 17 57

martin.vaujour@alstomgroup.com

Estelle MATURELL ANDINO – Tel.: +33 (0) 6 71 37 47

56

estelle.maturell@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause reported results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or

form part of a prospectus or any offer or invitation for the sale

or issue of, or any offer or inducement to purchase or subscribe

for, or any solicitation of any offer to purchase or subscribe for

any shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the approval from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient, or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Joint Global Coordinators, their

affiliates, shareholders, and their respective directors, officers,

advisers, employees or representatives undertake no obligation to

provide the recipient with access to any additional

information.

APPENDIX 1A – GEOGRAPHIC

BREAKDOWN

|

Reported figures |

H1 |

% |

H1 |

% |

|

(in € million) |

2023/24 |

Contrib. |

2024/25 |

Contrib. |

|

Europe |

5,232 |

62% |

8,511 |

78% |

|

Americas |

1,456 |

17% |

887 |

8% |

|

Asia/Pacific |

1,723 |

21% |

1,022 |

9% |

|

Middle East/Africa/Central Asia |

35 |

0% |

530 |

5% |

|

Orders by destination |

8,446 |

100% |

10,950 |

100% |

|

Reported figures |

H1 |

% |

H1 |

% |

|

(in € million) |

2023/24 |

Contrib. |

2024/25 |

Contrib. |

|

Europe |

4,875 |

58% |

4,911 |

56% |

|

Americas |

1,664 |

20% |

1,813 |

21% |

|

Asia/Pacific |

1,165 |

14% |

1,312 |

15% |

|

Middle East/Africa/Central Asia |

739 |

8% |

739 |

8% |

|

Sales by destination |

8,443 |

100% |

8,775 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Reported figures |

H1 |

% |

H1 |

% |

|

(in € million) |

2023/24 |

Contrib. |

2024/25 |

Contrib. |

|

Rolling stock |

3,818 |

45% |

4,415 |

40% |

|

Services |

2,141 |

26% |

4,111 |

38% |

|

Systems |

1,548 |

18% |

443 |

4% |

|

Signalling |

939 |

11% |

1,981 |

18% |

|

Orders by product line |

8,446 |

100% |

10,950 |

100% |

|

Reported figures |

H1 |

% |

H1 |

% |

|

(in € million) |

2023/24 |

Contrib. |

2024/25 |

Contrib. |

|

Rolling stock |

4,463 |

53% |

4,531 |

52% |

|

Services |

1,986 |

23% |

2,197 |

25% |

|

Systems |

751 |

9% |

800 |

9% |

|

Signalling |

1,243 |

15% |

1,247 |

14% |

|

Sales by product line |

8,443 |

100% |

8,775 |

100% |

APPENDIX 2 – INCOME STATEMENT

|

Reported figures |

Half-Year ended |

Half-Year ended |

|

(in € million) |

30 September 2023 |

30 September 2024 |

|

Sales |

8,443 |

8,775 |

|

Adjusted Gross Margin before PPA* |

1,165 |

1,228 |

|

Adjusted Earnings Before Interest and Taxes

(aEBIT)* |

438 |

515 |

|

Capital gain and other non-operating income |

1 |

21 |

|

Restructuring and rationalisation costs |

(7) |

(1) |

|

Integration, impairments, and other costs |

(92) |

(82) |

|

Reversal of net interest in equity investees pick-up |

(65) |

(71) |

|

EARNING BEFORE INTEREST AND TAXES (EBIT) BEFORE

PPA* |

275 |

382 |

|

Financial result |

(98) |

(107) |

|

Tax result |

(44) |

(101) |

|

Share in net income of equity investees |

53 |

60 |

|

Minority interests from continued operations |

(12) |

(10) |

|

Adjusted Net profit |

174 |

224 |

|

PPA net of tax |

(173) |

(169) |

|

Net profit – Continued operations, Group

share |

1 |

55 |

|

Net profit (loss) from discontinued operations |

- |

(2) |

|

Net profit (Group share) |

1 |

53 |

* See definition below

APPENDIX 3 – FREE CASH FLOW

Reported figures

(in € million)

|

Half-Year ended |

Half-Year ended |

|

30 September 2023 |

30 September 2024 |

|

EBIT before PPA |

275 |

382 |

|

Depreciation and amortisation1 |

211 |

234 |

|

JVs dividends |

106 |

92 |

|

EBITDA before PPA + JVs dividends |

592 |

708 |

|

Capital expenditure |

(86) |

(131) |

| R&D

capitalisation |

(70) |

(83) |

| Financial &

Tax cash out |

(164) |

(179) |

|

Others |

(15) |

(33) |

|

Funds from Operations |

256 |

282 |

| Trade Working

Capital changes |

(730) |

(435) |

|

Contract Working Capital changes |

(645) |

15 |

|

Free Cash Flow |

(1,119) |

(138) |

1 Before PPA

APPENDIX 4 - NON-GAAP FINANCIAL

INDICATORS DEFINITIONS

This section presents financial indicators used by the Group that

are not defined by accounting standard setters.

Orders received

A new order is recognised as an order received only when the

contract creates enforceable obligations between the Group and its

customer. When this condition is met, the order is recognised

at the contract value. If the contract is denominated in a currency

other than the functional currency of the reporting unit, the Group

requires the immediate elimination of currency exposure using

forward currency sales. Orders are then measured using the spot

rate at inception of hedging instruments.

Book-to-Bill

The book-to-bill ratio is the ratio of orders received to the

amount of sales traded for a specific period.

Gross margin % on backlog

Gross Margin % on backlog is a KPI that presents the expected

performance level of firm contracts in backlog. It represents the

difference between the sales not yet recognized and the cost of

sales not yet incurred from the contracts in backlog. This % is an

average of the portfolio of contracts in backlog and is meaningful

to project mid- and long-term profitability.

Adjusted Gross Margin before

PPA

Adjusted Gross Margin before PPA is a KPI that presents the level

of recurring operational performance. It represents the sales minus

the cost of sales, adjusted to exclude the impact of amortisation

of assets exclusively valued when determining the PPA in the

context of business combination as well as significant,

non-recurring “one off” items that are not expected to occur again

in subsequent years.

EBIT before PPA

Following the Bombardier Transportation acquisition and with effect

from the fiscal year 2021/22 condensed consolidated financial

statements, Alstom decided to introduce the “EBIT before PPA” KPI

aimed at restating its Earnings Before Interest and Taxes (“EBIT”)

to exclude the impact of amortisation of assets exclusively valued

when determining the PPA in the context of business combination.

This KPI is also aligned with market practice.

Adjusted EBIT

Adjusted EBIT (“aEBIT”) is the Key Performance Indicator to present

the level of recurring operational performance. This indicator is

also aligned with market practice and comparable to direct

competitors.

Starting September 2019, Alstom has opted for the inclusion of the

share in net income of the equity-accounted investments into the

aEBIT when these are considered to be part of the operating

activities of the Group (because there are significant operational

flows and/or common project execution with these entities). This

mainly includes Chinese joint ventures, namely CASCO joint venture

for Alstom as well as, following the integration of Bombardier

Transportation, Alstom Sifang (Qingdao) Transportation Ltd.,

Jiangsu Alstom NUG Propulsion System Co. Ltd

aEBIT corresponds to Earning Before Interests and Tax adjusted for

the following elements:

- net

restructuring expenses (including rationalization costs)

- tangibles and

intangibles impairment

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity.

- any other

non-recurring items, such as some costs incurred to realize

business combinations and amortisation of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business.

- and including

the share in net income of the operational equity-accounted

investments

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.

Adjusted EBIT margin corresponds to Adjusted EBIT expressed as a

percentage of sales.

EBITDA + JV dividends

EBITDA before PPA plus dividends from joint ventures is the EBIT

before PPA, before depreciation and amortisation, with the addition

of the dividends received from joint ventures.

Adjusted net profit

The “Adjusted Net Profit” KPI restates Alstom’s net profit from

continued operations (Group share) to exclude the impact of

amortisation of assets exclusively valued when determining the PPA

in the context of business combination, net of the corresponding

tax effect. This indicator is also aligned with market

practice.

Free cash flow

Free Cash Flow is defined as net cash provided by operating

activities less capital expenditures including capitalised

development costs, net of proceeds from disposals of tangible and

intangible assets. Free Cash Flow does not include any proceeds

from disposals of activity.

The most directly comparable financial measure to Free Cash Flow

calculated and presented in accordance with IFRS is net cash

provided by operating activities.

Funds from Operations

Funds from Operations “FFO” in the EBIT to FCF statement refers to

the Free Cash Flow generated by Operations, before Working Capital

variations.

Contract and Trade Working

Capital

Contract Working Capital is the sum of:

- Contract Assets

& Liabilities, which includes the Customer Down-Payments

- Current

provisions, which includes Risks on contracts and Warranties

Trade Working Capital is the Working Capital

that is not strictly contractual, hence not included in Project

Working Capital. It includes:

- Inventories

- Trade

Receivables

- Trade

Payables

- Other elements

of Working Capital defined as the sum of Other Current

Assets/Liabilities and Non-Current provisions

Net cash/(debt)

The net cash/(debt) is defined as cash and cash equivalents,

marketable securities and other current financial asset, less

borrowings.

Pay-out ratio

The pay-out ratio is calculated by dividing the amount of the

overall dividend with the “Adjusted Net profit from continuing

operations attributable to equity holders of the parent, Group

share” as presented in the management report in the consolidated

financial statements.

Organic basis

This press release includes performance indicators presented on a

reported basis and on an organic basis. Figures given on an organic

basis eliminate the impact of changes in scope of consolidation and

changes resulting from the translation of the accounts into Euro

following the variation of foreign currencies against the Euro.

The Group uses figures prepared on an organic basis both for

internal analysis and for external communication, as it believes

they provide means to analyse and explain variations from one

period to another. However, these figures are not measurements of

performance under IFRS.

| |

H1 2023/24 |

|

H1 2024/25 |

|

|

|

|

|

(in € million) |

Reported

figures |

Exchange

rate and scope impact |

Comparable

Figures |

|

Actual

figures |

|

|

% Var Act. |

% Var Org. |

|

Orders |

8,446 |

(26) |

8,420 |

|

10,950 |

|

|

29.6% |

30.0% |

|

Sales |

8,443 |

(132) |

8,311 |

|

8,775 |

|

|

3.9% |

5.6% |

| |

Full Year-ended

31 March 2024 |

|

Half Year-ended

30 September 2024 |

|

|

|

|

|

(in € million) |

Reported

figures |

Exchange

rate and scope impact |

Comparable

Figures |

|

Actual

figures |

|

|

% Var Act. |

% Var Org. |

|

Backlog |

91,900 |

(455) |

91,445 |

|

94,369 |

|

|

2.7% |

3.2.% |

- PR Alstom H1 2024-25 Results- EN - Final

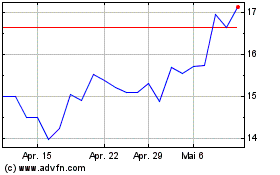

Alstom (TG:AOMD)

Historical Stock Chart

Von Dez 2024 bis Dez 2024

Alstom (TG:AOMD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024