0001616000false00016160002024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

Xenia Hotels & Resorts, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-36594 | | 20-0141677 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

200 S. Orange Avenue, Suite 2700

Orlando, Florida 32801

(Address of Principal Executive Offices)

(407) 246-8100

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

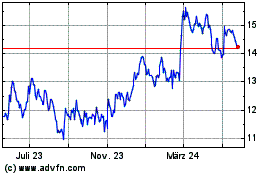

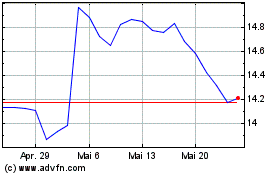

| Common Stock | | XHR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2024, Xenia Hotels & Resorts, Inc. (the “Company”) issued a press release announcing its results for the quarter and year ended December 31, 2023. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished under Item 2.02 and Exhibit 99.1 in this Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

On February 27, 2024, the Company published supplemental financial information which may be accessed through the Company’s investor relations website. A copy of the supplemental financial information is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

The information furnished under Item 7.01 and Exhibit 99.2 in this Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Press Release of Xenia Hotels & Resorts, Inc., dated as of February 27, 2024 (furnished pursuant to Item 2.02) |

| | Xenia Hotels & Resorts, Inc. Supplemental Financial Information (furnished pursuant to Item 7.01) |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Xenia Hotels & Resorts, Inc. |

| |

| Date: February 27, 2024 | | By: | /s/ Atish Shah |

| | Name: | Atish Shah |

| | Title: | Executive Vice President and Chief Financial Officer |

Date: February 27, 2024

Date: February 27, 2024 XENIA HOTELS & RESORTS REPORTS FOURTH QUARTER

AND FULL YEAR 2023 RESULTS

Orlando, FL – February 27, 2024 – Xenia Hotels & Resorts, Inc. (NYSE: XHR) (“Xenia” or the “Company”) today announced results for the quarter and year ended December 31, 2023.

Fourth Quarter 2023 Highlights

•Net Income: Net income attributable to common stockholders was $7.6 million, or $0.07 per share

•Adjusted EBITDAre: $59.4 million, decreased 8.0% compared to the fourth quarter of 2022

•Adjusted FFO per Diluted Share: $0.41, flat compared to the fourth quarter of 2022

•Same-Property Occupancy: 61.9%, decreased 50 basis points compared to the fourth quarter of 2022

•Same-Property ADR: $254.56, decreased 2.7% compared to the fourth quarter of 2022

•Same-Property RevPAR: $157.69, decreased 3.4% compared to the fourth quarter of 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, which is undergoing a transformative renovation, RevPAR was $162.51, an increase of 1.2% compared to the fourth quarter of 2022.

•Same-Property Hotel Net Income: $30.0 million, decreased 8.0% compared to the fourth quarter of 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, Hotel Net Income was $31.0 million, an increase of 14.9% compared to the fourth quarter of 2022.

•Same-Property Hotel EBITDA: $63.7 million, decreased 8.4% compared to the fourth quarter of 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, Same-Property Hotel EBITDA was $63.4 million, an increase of 2.5% compared to the fourth quarter of 2022.

•Same-Property Hotel EBITDA Margin: 25.1%, decreased 162 basis points compared to the fourth quarter of 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, Hotel EBITDA Margin was 25.7%, a decrease of 10 basis points compared to the fourth quarter of 2022.

•Capital Markets Activities & Dividends: The Company repurchased a total of 3,897,777 shares of common stock at a weighted-average price of $12.57 per share for a total consideration of approximately $49.0 million. The Company also declared its fourth quarter dividend of $0.10 per share to common stockholders of record on December 29, 2023.

“We are pleased that our Adjusted EBITDAre and Adjusted FFO per share exceeded our expectations for the fourth quarter, despite our ongoing transformative renovation at Hyatt Regency Scottsdale and the now completed renovation at Grand Bohemian Hotel Orlando which weighed on our portfolio RevPAR growth during the quarter,” said Marcel Verbaas, Chair and Chief Executive Officer of Xenia. “Continued focus on expense controls drove our results during the quarter, helping us achieve a Hotel EBITDA Margin that, excluding Hyatt Regency Scottsdale, was only slightly below prior year’s results.”

“Reflecting on 2023, our overall performance was supported by ongoing asset management initiatives as lodging demand across our markets started to normalize. We benefited from good cost control during a time of continued expense pressures and normalization of staffing levels at our assets. On the project management side, we completed several important capital projects, including comprehensive renovations at Kimpton Canary Hotel Santa Barbara, Kimpton Hotel Monaco Salt Lake City and Grand Bohemian Hotel Orlando, and made substantial progress on our largest and most impactful renovation project, the transformative renovation and upbranding of Hyatt Regency Scottsdale,” continued Mr. Verbaas. "Finally, we balanced capital allocation priorities by returning over $177 million to shareholders through a combination of share repurchases and dividends. We are continuing this commitment to return capital to shareholders by increasing our common dividend 20% to $0.12 per share for the first quarter of 2024, reflecting a current annualized yield of approximately 3.7%.”

Full Year 2023 Highlights

•Net Income: Net income attributable to common stockholders was $19.1 million, or $0.17 per share

•Adjusted EBITDAre: $251.7 million, decreased 2.0% compared to 2022

•Adjusted FFO per Diluted Share: $1.54, flat compared to 2022

•Same-Property Occupancy: 65.1%, increased 250 basis points compared to 2022

•Same-Property ADR: $260.40, approximately flat compared to 2022

•Same-Property RevPAR: $169.46, increased 3.9% compared to 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, RevPAR was $170.57, an increase of 6.4% compared to 2022.

•Same-Property Hotel Net Income: $130.4 million, increased 0.1% compared to 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, Hotel Net Income was $121.5 million, an increase of 7.8% compared to 2022.

•Same-Property Hotel EBITDA: $271.5 million, decreased 1.5% compared to 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, Same-Property Hotel EBITDA was $254.7 million, an increase of 3.5% compared to 2022.

•Same-Property Hotel EBITDA Margin: 26.5%, decreased 153 basis points compared to 2022. Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, Hotel EBITDA Margin was 26.2%, a decrease of 92 basis points compared to 2022.

•Financing Activity: Entered into a new $675 million credit facility in the first quarter, proceeds of which were used to pay off the a $125 million term loan and a $99.5 million mortgage loan collateralized by Renaissance Atlanta Waverly Hotel & Convention Center. The mortgage loan collateralized by Andaz Napa was also amended, extending its maturity through January 2028. In the second quarter, the variable Term SOFR index on all outstanding variable debt was hedged to fixed.

•Capital Markets Activities & Dividends: The Company repurchased a total of 10,414,262 shares of common stock at a weighted-average price of $12.74 per share for a total consideration of approximately $132.7 million. The Company also repurchased, and subsequently retired, a total of approximately $35.3 million in the aggregate principal amount of its 6.375% Senior Notes due August 2025. For the full year 2023, the Company declared a total of $0.40 of dividends per share to common stockholders.

“Despite a challenging operating environment and various renovation activity, for the full-year 2023, our Same-Property portfolio achieved a 6.4% RevPAR increase when excluding results at Hyatt Regency Scottsdale,” said Mr. Verbaas. "Most importantly, we are pleased to have delivered Adjusted FFO per share near the high end of our guidance range during a year where we have invested in the quality and future growth prospects of the portfolio."

"We are excited about further opportunities for growth in 2024 and beyond as we expect to benefit from continued recovery across our portfolio, improving results of recently acquired properties, and favorable returns on several meaningful capital projects. We believe that our diversified portfolio will continue to benefit from the expected recovery in business transient and group demand as the year progresses. Additionally, the transformation of Hyatt Regency Scottsdale into a Grand Hyatt luxury resort is expected to benefit our portfolio later in 2024, and well into the future," continued Mr. Verbaas. “The year is off to an encouraging start as we estimate that our quarter-to-date Same-Property RevPAR, excluding Hyatt Regency Scottsdale, increased approximately 4.9% through February 22, 2024, compared to the same period last year.”

Operating Results

The Company’s results include the following:

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | |

| 2023 | | 2022 | | | | Change | | |

| ($ amounts in thousands, except hotel statistics and per share amounts) |

| Net income attributable to common stockholders | $ | 7,599 | | | $ | 35,261 | | | | | (78.4) | % | | |

| Net income per share available to common stockholders - basic and diluted | $ | 0.07 | | | $ | 0.31 | | | | | (77.4) | % | | |

| | | | | | | | | |

Same-Property Number of Hotels(1) | 32 | | | 32 | | | | | — | | | |

Same-Property Number of Rooms(1)(5) | 9,514 | | | 9,508 | | | | | 6 | | | |

Same-Property Occupancy(1) | 61.9 | % | | 62.4 | % | | | | (50) | bps | | |

Same-Property Average Daily Rate(1) | $ | 254.56 | | | $ | 261.70 | | | | | (2.7) | % | | |

Same-Property RevPAR(1) | $ | 157.69 | | | $ | 163.32 | | | | | (3.4) | % | | |

Same-Property Hotel Net Income(1) | $ | 29,955 | | | $ | 32,557 | | | | | (8.0) | % | | |

Same-Property Hotel EBITDA(1)(2) | $ | 63,705 | | | $ | 69,533 | | | | | (8.4) | % | | |

Same-Property Hotel EBITDA Margin(1)(2) | 25.1 | % | | 26.8 | % | | | | (162) | bps | | |

| | | | | | | | | |

Total Portfolio Number of Hotels(3) | 32 | | | 32 | | | | | — | | | |

Total Portfolio Number of Rooms(3)(5) | 9,514 | | | 9,508 | | | | | 6 | | | |

Total Portfolio RevPAR(4) | $ | 157.69 | | | $ | 162.93 | | | | | (3.2) | % | | |

| | | | | | | | | |

Adjusted EBITDAre(2) | $ | 59,442 | | | $ | 64,583 | | | | | (8.0) | % | | |

Adjusted FFO(2) | $ | 44,045 | | | $ | 46,608 | | | | | (5.5) | % | | |

Adjusted FFO per diluted share(2) | $ | 0.41 | | | $ | 0.41 | | | | | — | % | | |

1."Same-Property” includes all hotels owned as of December 31, 2023 and also includes renovation disruption for multiple capital projects during the periods presented.

2.EBITDA, EBITDAre, Adjusted EBITDAre, FFO, Adjusted FFO, and Same-Property Hotel EBITDA and Hotel EBITDA Margin are non-GAAP financial measures. See definitions and tables later in this press release for how we define these non-GAAP financial measures and for reconciliations from net income to Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre"), Adjusted EBITDAre, Funds From Operations ("FFO"), Adjusted FFO, Same-Property Hotel EBITDA and Hotel EBITDA Margin.

3.As of end of periods presented.

4.Results of all hotels as owned during the periods presented, including the results of hotels sold or acquired for the actual period of ownership by the Company.

5.Three rooms were added at The Ritz-Carlton, Denver in April 2023 and three rooms were added at Marriott Woodlands Waterway Hotel & Convention Center in October 2023.

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, | |

| 2023 | | 2022 | | Change |

| ($ amounts in thousands, except hotel statistics and per share amounts) |

| Net income attributable to common stockholders | $ | 19,142 | | | $ | 55,922 | | | (65.8) | % |

| Net income per share available to common stockholders - basic and diluted | $ | 0.17 | | | $ | 0.49 | | | (65.3) | % |

| | | | | |

Same-Property Number of Hotels(1) | 32 | | | 32 | | | — | |

Same-Property Number of Rooms(1)(5) | 9,514 | | | 9,508 | | | 6 | |

Same-Property Occupancy(1) | 65.1 | % | | 62.6 | % | | 250 | bps |

Same-Property Average Daily Rate(1) | $ | 260.40 | | | $ | 260.52 | | | — | % |

Same-Property RevPAR(1) | $ | 169.46 | | | $ | 163.11 | | | 3.9 | % |

Same-Property Hotel Net Income(1) | $ | 130,379 | | | $ | 130,247 | | | 0.1 | % |

Same-Property Hotel EBITDA(1)(2) | $ | 271,513 | | | $ | 275,614 | | | (1.5) | % |

Same-Property Hotel EBITDA Margin(1)(2) | 26.5 | % | | 28.0 | % | | (153) | bps |

| | | | | |

Total Portfolio Number of Hotels(3) | 32 | | | 32 | | | — | |

Total Portfolio Number of Rooms(3)(5) | 9,514 | | | 9,508 | | | 6 | |

Total Portfolio RevPAR(4) | $ | 169.46 | | | $ | 162.75 | | | 4.1 | % |

| | | | | |

Adjusted EBITDAre(2) | $ | 251,740 | | | $ | 256,988 | | | (2.0) | % |

Adjusted FFO(2) | $ | 170,211 | | | $ | 177,316 | | | (4.0) | % |

Adjusted FFO per diluted share(2) | $ | 1.54 | | | $ | 1.54 | | | — | % |

1."Same-Property” includes all hotels owned as of December 31, 2023 and also includes disruption from the COVID-19 pandemic and renovation disruption for multiple capital projects during the periods presented. "Same-Property" also includes pre-acquisition historical operating results for W Nashville that were obtained from the seller and/or manager of the hotel for a portion of the year ended December 31, 2022.

2.EBITDA, EBITDAre, Adjusted EBITDAre, FFO, Adjusted FFO, and Same-Property Hotel EBITDA and Hotel EBITDA Margin are non-GAAP financial measures. See definitions and tables later in this press release for how we define these non-GAAP financial measures and for reconciliations from net income to Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre"), Adjusted EBITDAre, Funds From Operations ("FFO"), Adjusted FFO, Same-Property Hotel EBITDA and Hotel EBITDA Margin.

3.As of end of periods presented.

4.Results of all hotels as owned during the periods presented, including the results of hotels sold or acquired for the actual period of ownership by the Company.

5.Three rooms were added at The Ritz-Carlton, Denver in April 2023 and three rooms were added at Marriott Woodlands Waterway Hotel & Convention Center in October 2023.

Liquidity and Balance Sheet

As of December 31, 2023, the Company had total outstanding debt of approximately $1.4 billion with a weighted-average interest rate of 5.47%. The Company had approximately $165 million of cash and cash equivalents, including hotel working capital, and full availability on its revolving line of credit, resulting in total liquidity of approximately $615 million as of December 31, 2023. In addition, the Company held approximately $58 million of restricted cash and escrows at the end of the fourth quarter.

In January 2023, the Company entered into a new $675 million credit facility comprised of a $450 million revolving line of credit, a $125 million term loan, and a $100 million term loan. The revolving line of credit matures in January 2027 and the term loans mature in March 2026. Proceeds from the term loans were used to pay off the a $125 million term loan and a $99.5 million mortgage loan collateralized by Renaissance Atlanta Waverly Hotel & Convention Center. In addition, the mortgage loan collateralized by Andaz Napa was amended, changing the variable rate on the $55 million loan from LIBOR-based to SOFR-based and extending the maturity date through January 2028. In the second quarter, the Company fixed the variable Term SOFR index on all outstanding variable debt and is currently 100% fixed or hedged-to-fixed.

The Company has no debt maturities until August 2025 and maintains full availability on its revolving line of credit.

Capital Markets

In the quarter, the Company repurchased a total of 3,897,777 shares of common stock at a weighted-average price of $12.57 per share for a total consideration of approximately $49.0 million. For the year ended December 31, 2023, the Company repurchased a total of 10,414,262 shares of common stock at a weighted-average price of $12.74 per share for a total consideration of approximately $132.7 million.

The Company repurchased 463,707 shares of common stock year-to-date through February 26, 2024 at a weighted-average price of $13.51 per share for total consideration of approximately $6.3 million. The Company currently has $127.5 million in capacity remaining under its repurchase authorization inclusive of the additional $100 million authorized by the Company's Board of Directors in the fourth quarter 2023.

The Company did not issue any shares of its common stock through its At-The-Market ("ATM") program in the quarter and had $200 million of remaining availability as of December 31, 2023.

For the year ended December 31, 2023, the Company repurchased in the open market, and subsequently retired, a total of approximately $35.3 million in the aggregate principal amount of its 6.375% Senior Notes due August 2025 for a total consideration of $34.9 million exclusive of accrued interest.

First Quarter 2024 Dividend

The Company's Board of Directors has increased the quarterly cash dividend by 20% to $0.12 per share of the Company’s common stock for the first quarter of 2024. The dividend will be paid on April 15, 2024 to all holders of record of the Company’s common stock as of the close of business on March 28, 2024. Consistent with prior practice, all future dividend determinations are subject to approval by the Company’s Board of Directors.

Capital Expenditures

During the quarter and year ended December 31, 2023, the Company invested $51.4 million and $120.9 million in portfolio improvements, respectively. For the full year 2023, significant projects in the Company’s portfolio included:

•Grand Bohemian Hotel Orlando, Autograph Collection – Earlier in the year, completed the comprehensive renovation of public spaces including meeting space, lobby, restaurant, bar, Starbucks, and creation of a rooftop bar. A comprehensive renovation of the guest rooms began in the second quarter and was completed in November.

•Park Hyatt Aviara Resort, Golf Club & Spa – Completed the significant upgrade to the resort’s spa and wellness amenities which have reopened as a Miraval Life in Balance Spa.

•Kimpton Hotel Monaco Salt Lake City – Completed the comprehensive renovation of meeting space, lobby, restaurant, bar and guest rooms in the third quarter.

•Kimpton Canary Hotel Santa Barbara – Completed the comprehensive guest room renovation in the second quarter.

•The Ritz-Carlton, Denver – Completed the renovation and reconfiguration of premium suites resulting in the addition of three keys in the second quarter.

•Waldorf Astoria Atlanta Buckhead – Substantially completed the renovation of meeting rooms.

Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch Update

In June, the Company commenced the approximately $110 million transformative renovation and upbranding of the 491-room Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch to a Grand Hyatt which includes the following components:

•Pool complex, pool bars, and amenities – Full renovation, including significant redesign of the pool, pool deck, and pool bars. The adult pool and H2Oasis pool bar were completed in mid-January and the remainder of the pool complex is expected to be completed and fully operational by the end of the first quarter.

•Guest rooms and corridors – Full renovation of all guest rooms including new case goods, soft goods, and fan coil units. In order to minimize disruption, guest rooms are being completed on a continual phased basis with over 150 already completed, and the remaining, including the addition of five guest rooms, expected to be completed by the end of the third quarter.

•Arizona Ballroom expansion and meeting space renovation – Expansion of the Arizona Ballroom by approximately 12,000 square feet. Renovation of existing ballrooms, meeting rooms, and pre-function spaces, all expected to be completed by the end of 2024.

•Public spaces and food & beverage outlets – Major renovation of all areas, including lobby, reconcepting and redesign of all food & beverage venues, including the addition of a specialty dining venue, expanded outdoor dining space, all expected to be completed by the end of the third quarter.

•Building façade, infrastructure, and grounds – Redesign of several elements of the building façade, replacement of all exterior lighting, redesign of existing solar panels, new exterior signage, and a redesign of the parking facilities, all expected to be completed by the end of 2024.

Full Year 2024 Outlook and Guidance

The Company is providing its full year 2024 outlook. The range below reflects the Company's limited visibility in forecasting due to macroeconomic uncertainty and is based on the current economic environment and does not take into account any unanticipated impacts to the business or operations. Furthermore, this guidance assumes no additional acquisitions, dispositions, equity issuances, or share and/or senior note repurchases. The Same-Property (32 Hotel) RevPAR change shown includes all hotels owned as of December 31, 2023. The Same-Property (31 Hotel) RevPAR change shown includes all hotels owned as of December 31, 2023, except Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch.

| | | | | | | | | | | | | | | |

| Full Year 2024 Guidance | | | | |

| Low End | High End | | | | | | | |

| ($ in millions, except stats and per share data) |

| Net Income | $15 | $35 | | | | | | | |

| Same-Property (32 Hotel) RevPAR Change (vs. 2023) | 2.0% | 5.0% | | | | | | | |

Excluding Hyatt Regency Scottsdale, Same-Property (31 Hotel) RevPAR Change (vs. 2023) | 2.5% | 5.5% | | | | | | | |

| Adjusted EBITDAre | $244 | $264 | | | | | | | |

| Adjusted FFO | $165 | $185 | | | | | | | |

| Adjusted FFO per Diluted Share | $1.59 | $1.78 | | | | | | | |

| Capital Expenditures | $120 | $130 | | | | | | | |

Full year 2024 guidance is inclusive of the following assumptions:

•Disruption due to renovations is expected to negatively impact Adjusted EBITDAre and Adjusted FFO by approximately $14 million, or approximately $4 million less than the impact of disruption due to renovations in 2023

•General and administrative expense of approximately $25 million, excluding non-cash share-based compensation

•Interest expense of approximately $77 million, excluding non-cash loan related costs

•Income tax expense of approximately $2 million

•$65 - $70 million of capital expenditures for Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch

•104.0 million weighted-average diluted shares/units

Supplemental Financial Information

Please refer to the Company's Supplemental Financial Information package for the Fourth Quarter 2023 available online through the Press Release section of the Company's Investor Relations website for additional financial information.

Fourth Quarter 2023 Earnings Call

The Company will conduct its quarterly conference call on Tuesday, February 27, 2024 at 1:00 PM Eastern Time. To participate in the conference call, please dial (833) 470-1428, access code 878829. Additionally, a live webcast of the conference call will be available through the Company’s website, www.xeniareit.com. A replay of the conference call will be archived and available online through the Investor Relations section of the Company’s website for 90 days.

About Xenia Hotels & Resorts, Inc.

Xenia Hotels & Resorts, Inc. is a self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the top 25 lodging markets as well as key leisure destinations in the United States. The Company owns 32 hotels and resorts comprising 9,514 rooms across 14 states. Xenia’s hotels are in the luxury and upper upscale segments, and are operated and/or licensed by industry leaders such as Marriott, Hyatt, Kimpton, Fairmont, Loews, Hilton, The Kessler Collection, and Davidson. For more information on Xenia’s business, refer to the Company website at www.xeniareit.com.

This press release, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Forward-looking statements are not historical facts but are based on certain assumptions of management and describe the Company's future plans, strategies and expectations. Forward-looking statements are generally identifiable by use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "guidance," "predict," "potential," "continue," "likely," "will," "would," "illustrative," references to "outlook" and "guidance" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Forward-looking statements in this press release include, among others, statements about our plans, strategies, or other future events, the outlook related to macroeconomic factors and general economic uncertainty and a potential contraction in the U.S. or global economy or low levels of economic growth, including such effects on the demand for travel, transient and group business, capital expenditures, timing of renovations, financial performance and potential dividends, prospects or future events. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements, which are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company's control and which could materially affect actual results, performances or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, (i) general economic uncertainty and a contraction in the U.S. or global economy or low levels of economic growth; (ii) macroeconomic and other factors beyond our control that can adversely affect and

reduce demand for hotel rooms, food and beverage services, and/or meeting facilities, such as wars, prolonged geopolitical unrest, actual or threatened terrorist or cyber-attacks, mass casualty events, government shutdowns and closures, travel-related health concerns, global outbreaks of pandemics (such as the COVID-19 pandemic) or contagious diseases, or fear of such outbreaks, weather and climate-related events, such as hurricanes, tornadoes, floods, wildfires, and droughts, and natural or man-made disasters; (iii) inflation and inflationary pressures which increases our labor and other costs of providing services to guests and meeting hotel brand standards, as well as costs related to construction and other capital expenditures, property and other taxes, and insurance which could result in reduced operating profit margins; (iv) bank failures and concerns over a near-term recession; (v) the Company’s dependence on third-party managers of its hotels, including its inability to implement strategic business decisions directly; (vi) risks associated with the hotel industry, including competition, increases in wages and benefits, energy costs and other operating costs, cyber incidents, information technology failures, downturns in general and local economic conditions, prolonged periods of civil unrest in our markets, and cancellation of or delays in the completion of anticipated demand generators; (vii) the availability and terms of financing and capital and the general volatility of securities markets; (viii) risks associated with the real estate industry, including environmental contamination and costs of complying with the Americans with Disabilities Act and similar laws; (ix) interest rate increases; (x) ability to successfully negotiate amendments and covenant waivers with its unsecured and secured indebtedness; (xi) the Company's ability to comply with covenants, restrictions, and limitations in any existing or revised loan agreements with our unsecured and secured lenders; (xii) the possible failure of the Company to qualify as a REIT and the risk of changes in laws affecting REITs; (xiii) the possibility of uninsured or underinsured losses, including those relating to natural disasters, terrorism, government shutdowns and closures, civil unrest, or cyber incidents; (xiv) risks associated with redevelopment and repositioning projects, including disruption, delays and cost overruns; (xv) levels of spending in business and leisure segments as well as consumer confidence; (xvi) declines in occupancy and average daily rate; (xvii) the seasonal and cyclical nature of the real estate and hospitality businesses; (xviii) changes in distribution arrangements, such as through Internet travel intermediaries; (xix) relationships with labor unions and changes in labor laws, including increases to minimum wages; (xx) the impact of changes in the tax code and uncertainty as to how some of those changes may be applied; (xxi) monthly cash expenditures and the uncertainty around predictions; (xxii) labor shortages; (xxiii) disruptions in supply chains resulting in delays or inability to procure required products; and (xiv) the risk factors discussed in the Company’s Annual Report on Form 10-K, as updated in its Quarterly Reports. Accordingly, there is no assurance that the Company's expectations will be realized. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this press release. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

For further information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s SEC filings, including, but not limited to, its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which may be obtained at the Investor Relations section of the Company’s website at www.xeniareit.com.

All information in this press release is as of the date of its release. The Company undertakes no duty to update the statements in this press release to conform the statements to actual results or changes in the Company’s expectations.

Availability of Information on Xenia's Website

Investors and others should note that Xenia routinely announces material information to investors and the marketplace using U.S. Securities and Exchange Commission (SEC) filings, press releases, public conference calls, webcasts, and the Investor Relations section of Xenia's website. While not all the information that the Company posts to the Xenia website is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in Xenia to review the information that it shares at the Investor Relations link located on www.xeniareit.com. Users may automatically receive email alerts and other information about the Company when enrolling an email address by visiting "Email Alerts / Investor Information" in the "Corporate Overview" section of Xenia’s Investor Relations website at www.xeniareit.com.

Contact:

Atish Shah, Executive Vice President and Chief Financial Officer, Xenia Hotels & Resorts, (407) 246-8100

For additional information or to receive press releases via email, please visit our website at www.xeniareit.com.

Xenia Hotels & Resorts, Inc.

Consolidated Balance Sheets

As of December 31, 2023 and December 31, 2022

($ amounts in thousands, except per share data)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | (Unaudited) | | (Audited) |

| Investment properties: | | | |

| Land | $ | 460,307 | | | $ | 460,536 | |

| Buildings and other improvements | 3,097,711 | | | 3,086,785 | |

| Total | $ | 3,558,018 | | | $ | 3,547,321 | |

| Less: accumulated depreciation | (963,052) | | | (945,786) | |

| Net investment properties | $ | 2,594,966 | | | $ | 2,601,535 | |

| Cash and cash equivalents | 164,725 | | | 305,103 | |

| Restricted cash and escrows | 58,350 | | | 60,807 | |

| Accounts and rents receivable, net of allowance for doubtful accounts | 32,432 | | | 37,562 | |

| Intangible assets, net of accumulated amortization | 4,898 | | | 5,060 | |

| Other assets | 46,856 | | | 69,988 | |

| | | |

| Total assets | $ | 2,902,227 | | | $ | 3,080,055 | |

| Liabilities | | | |

| Debt, net of loan premiums, discounts and unamortized deferred financing costs | $ | 1,394,906 | | | $ | 1,429,105 | |

| Accounts payable and accrued expenses | 102,389 | | | 107,097 | |

| Distributions payable | 10,788 | | | 11,455 | |

| Other liabilities | 76,647 | | | 72,390 | |

| | | |

| Total liabilities | $ | 1,584,730 | | | $ | 1,620,047 | |

| Commitments and Contingencies | | | |

| Stockholders' equity | | | |

Common stock, $0.01 par value, 500,000,000 shares authorized, 102,372,589 and 112,519,672 shares issued and outstanding as of December 31, 2023 and December 31, 2022, respectively | $ | 1,024 | | | $ | 1,126 | |

| Additional paid in capital | 1,934,775 | | | 2,063,273 | |

| Accumulated other comprehensive income | 2,439 | | | — | |

| Accumulated distributions in excess of net earnings | (647,246) | | | (623,216) | |

| Total Company stockholders' equity | $ | 1,290,992 | | | $ | 1,441,183 | |

| Non-controlling interests | 26,505 | | | 18,825 | |

| Total equity | $ | 1,317,497 | | | $ | 1,460,008 | |

| Total liabilities and equity | $ | 2,902,227 | | | $ | 3,080,055 | |

Xenia Hotels & Resorts, Inc.

Consolidated Statements of Operations and Comprehensive Income

For the Three Months and Years Ended December 31, 2023 and 2022

($ amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) | | (Unaudited) | | (Audited) |

| Revenues: | | | | | | | |

| Rooms revenues | $ | 138,023 | | | $ | 144,897 | | | $ | 588,278 | | | $ | 576,279 | |

| Food and beverage revenues | 94,142 | | | 97,123 | | | 354,114 | | | 337,792 | |

| Other revenues | 21,215 | | | 21,121 | | | 83,051 | | | 83,536 | |

| Total revenues | $ | 253,380 | | | $ | 263,141 | | | $ | 1,025,443 | | | $ | 997,607 | |

| Expenses: | | | | | | | |

| Rooms expenses | 36,408 | | | 35,786 | | | 145,274 | | | 137,589 | |

| Food and beverage expenses | 61,516 | | | 62,595 | | | 235,961 | | | 224,391 | |

| Other direct expenses | 5,920 | | | 6,032 | | | 23,467 | | | 23,847 | |

| Other indirect expenses | 65,937 | | | 68,483 | | | 263,833 | | | 249,992 | |

| Management and franchise fees | 8,417 | | | 8,698 | | | 35,235 | | | 36,456 | |

| Total hotel operating expenses | $ | 178,198 | | | $ | 181,594 | | | $ | 703,770 | | | $ | 672,275 | |

| Depreciation and amortization | 31,698 | | | 33,521 | | | 132,023 | | | 132,648 | |

| Real estate taxes, personal property taxes and insurance | 12,295 | | | 10,936 | | | 50,491 | | | 44,388 | |

| Ground lease expense | 771 | | | 758 | | | 3,016 | | | 2,793 | |

| General and administrative expenses | 8,839 | | | 8,409 | | | 37,219 | | | 34,250 | |

| Gain on business interruption insurance | — | | | — | | | (218) | | | (2,487) | |

| Other operating expenses | 714 | | | 1,070 | | | 1,530 | | | 1,070 | |

| Impairment and other losses | — | | | — | | | — | | | 1,278 | |

| Total expenses | $ | 232,515 | | | $ | 236,288 | | | $ | 927,831 | | | $ | 886,215 | |

| Operating income | $ | 20,865 | | | $ | 26,853 | | | $ | 97,612 | | | $ | 111,392 | |

| Gain on sale of investment properties | — | | | 27,286 | | | — | | | 27,286 | |

| Other income | 3,683 | | | 1,507 | | | 9,895 | | | 4,178 | |

| Interest expense | (20,689) | | | (21,253) | | | (84,997) | | | (82,727) | |

| Loss on extinguishment of debt | — | | | — | | | (1,189) | | | (294) | |

| Net income before income taxes | $ | 3,859 | | | $ | 34,393 | | | $ | 21,321 | | | $ | 59,835 | |

| Income tax (expense) benefit | 3,935 | | | 1,943 | | | (1,447) | | | (2,205) | |

| Net income | $ | 7,794 | | | $ | 36,336 | | | $ | 19,874 | | | $ | 57,630 | |

| Net income attributable to non-controlling interests | (195) | | | (1,075) | | | (732) | | | (1,708) | |

| Net income attributable to common stockholders | $ | 7,599 | | | $ | 35,261 | | | $ | 19,142 | | | $ | 55,922 | |

Xenia Hotels & Resorts, Inc.

Consolidated Statements of Operations and Comprehensive Income - Continued

For the Three Months and Years Ended December 31, 2023 and 2022

($ amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) | | (Unaudited) | | (Audited) |

| Basic and diluted income per share: | | | | | |

| Net income per share available to common stockholders - basic and diluted | $ | 0.07 | | | $ | 0.31 | | | $ | 0.17 | | | $ | 0.49 | |

| | | | | | | |

| Weighted-average number of common shares (basic) | 104,767,518 | | | 113,273,383 | | | 108,192,148 | | | 114,068,733 | |

| | | | | | | |

| Weighted-average number of common shares (diluted) | 104,980,819 | | | 113,515,951 | | | 108,412,485 | | | 114,418,177 | |

| | | | | | | |

| Comprehensive income: | | | | | | | |

| Net income | $ | 7,794 | | | $ | 36,336 | | | $ | 19,874 | | | $ | 57,630 | |

| Other comprehensive income: | | | | | | | |

| Unrealized gain (loss) on interest rate derivative instruments | (2,362) | | | — | | | 5,220 | | | 2,932 | |

| Reclassification adjustment for amounts recognized in net income (interest expense) | (1,147) | | | (97) | | | (2,690) | | | 1,600 | |

| $ | 4,285 | | | $ | 36,239 | | | $ | 22,404 | | | $ | 62,162 | |

| Comprehensive (income) loss attributable to non-controlling interests | (26) | | | 3 | | | (823) | | | (2,151) | |

| Comprehensive income attributable to the Company | $ | 4,259 | | | $ | 36,242 | | | $ | 21,581 | | | $ | 60,011 | |

Non-GAAP Financial Measures

The Company considers the following non-GAAP financial measures to be useful to investors as key supplemental measures of its operating performance: EBITDA, EBITDAre, Adjusted EBITDAre, Same-Property Hotel EBITDA, Same-Property Hotel EBITDA Margin, FFO, Adjusted FFO, and Adjusted FFO per diluted share. These non-GAAP financial measures should be considered along with, but not as alternatives to, net income or loss, operating profit, cash from operations, or any other operating performance measure as prescribed per GAAP.

EBITDA, EBITDAre and Adjusted EBITDAre

EBITDA is a commonly used measure of performance in many industries and is defined as net income or loss (calculated in accordance with GAAP) excluding interest expense, provision for income taxes (including income taxes applicable to sale of assets) and depreciation and amortization. The Company considers EBITDA useful to investors in evaluating and facilitating comparisons of its operating performance between periods and between REITs by removing the impact of its capital structure (primarily interest expense) and asset base (primarily depreciation and amortization) from its operating results, even though EBITDA does not represent an amount that accrues directly to common stockholders. In addition, EBITDA is used as one measure in determining the value of hotel acquisitions and dispositions and, along with FFO and Adjusted FFO, is used by management in the annual budget process for compensation programs.

The Company calculates EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts ("Nareit"). Nareit defines EBITDAre as EBITDA plus or minus losses and gains on the disposition of depreciated property, including gains or losses on change of control, plus impairments of depreciated property and of investments in unconsolidated affiliates caused by a decrease in the value of depreciated property in the affiliate, and adjustments to reflect the entity's share of EBITDAre of unconsolidated affiliates.

The Company further adjusts EBITDAre to exclude the impact of non-controlling interests in consolidated entities other than its Operating Partnership Units because its Operating Partnership Units may be redeemed for common stock. The Company also adjusts EBITDAre for certain additional items such as depreciation and amortization related to corporate assets, terminated transaction and pre-opening expenses, amortization of share-based compensation, non-cash ground rent and straight-line rent expense, the cumulative effect of changes in accounting principles, and other costs it believes do not represent recurring operations and are not indicative of the performance of its underlying hotel property entities. The Company believes it is meaningful for investors to understand Adjusted EBITDAre attributable to all common stock and unit holders.The Company believes Adjusted EBITDAre attributable to common stock and unit holders provides investors with another useful financial measure in evaluating and facilitating comparison of operating performance between periods and between REITs that report similar measures.

Same-Property Hotel EBITDA and Same-Property Hotel EBITDA Margin

Same-Property hotel data includes the actual operating results for all hotels owned as of the end of the reporting period. The Company then adjusts the Same-Property hotel data for comparability purposes by including pre-acquisition operating results of asset(s) acquired during the period, which provides investors a basis for understanding the acquisition(s) historical operating trends and seasonality. The pre-acquisition operating results for the comparable period are obtained from the seller and/or manager of the hotel(s) during the acquisition due diligence process and have not been audited or reviewed by our independent auditors. The Company further adjusts the Same-Property hotel data to remove dispositions during the respective reporting periods, and, in certain cases, hotels that are not fully open due to significant renovation, re-positioning, or disruption or whose room counts have materially changed during either the current or prior year as these historical operating results are not indicative of or expected to be comparable to the operating performance of the hotel portfolio on a prospective basis.

Same-Property Hotel EBITDA represents net income or loss excluding: (1) interest expense, (2) income taxes, (3) depreciation and amortization, (4) corporate-level costs and expenses, (5) terminated transaction and pre-opening expenses, and (6) certain state and local excise taxes resulting from ownership structure. The Company believes that Same-Property Hotel EBITDA provides investors a useful financial measure to evaluate hotel operating performance excluding the impact of capital structure (primarily interest expense), asset base (primarily depreciation and amortization), income taxes, and corporate-level expenses (corporate expenses and terminated transaction costs). The Company believes property-level results provide investors with supplemental information on the ongoing operational performance of its hotels and the effectiveness of third-party management companies that operate our business on a property-level basis. Same-Property Hotel EBITDA Margin is calculated by dividing Same-Property Hotel EBITDA by Same-Property Total Revenues.

As a result of these adjustments the Same-Property hotel data presented does not represent the Company's total revenues, expenses, operating profit or net income and should not be used to evaluate performance as a whole. Management compensates for these limitations by separately considering the impact of these excluded items to the extent they are material to operating decisions or assessments of operating performance. Our consolidated statements of operations and comprehensive income include such amounts, all of which should be considered by investors when evaluating our performance.

We include Same-Property hotel data as supplemental information for investors. Management believes that providing Same-Property hotel data is useful to investors because it represents comparable operations for our portfolio as it exists at the end of the respective reporting periods presented, which allows investors and management to evaluate the period-to-period performance of our hotels and facilitates comparisons with other hotel REITs and hotel owners. In particular, these measures assist management and investors in distinguishing whether increases or decreases in revenues and/or expenses are due to growth or decline of operations at Same-Property hotels or from other factors, such as the effect of acquisitions or dispositions.

FFO and Adjusted FFO

The Company calculates FFO in accordance with standards established by Nareit, as amended in the 2018 Restatement White Paper, which defines FFO as net income or loss (calculated in accordance with GAAP), excluding real estate-related depreciation, amortization and impairments, gains or losses from sales of real estate, the cumulative effect of changes in accounting principles, similar adjustments for unconsolidated partnerships and consolidated variable interest entities, and items classified by GAAP as extraordinary. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most industry investors consider presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. The Company believes that the presentation of FFO provides useful supplemental information to investors regarding operating performance by excluding the effect of real estate depreciation and amortization, gains or losses from sales for real estate, impairments of real estate assets, extraordinary items and the portion of these items related to unconsolidated entities, all of which are based on historical cost accounting and which may be of lesser significance in evaluating current performance. The Company believes that the presentation of FFO can facilitate comparisons of operating performance between periods and between REITs, even though FFO does not represent an amount that accrues directly to common stockholders. The calculation of FFO may not be comparable to measures calculated by other companies who do not use the Nareit definition of FFO or do not calculate FFO per diluted share in accordance with Nareit guidance. Additionally, FFO may not be helpful when comparing Xenia to non-REITs. The Company presents FFO attributable to common stock and unit holders, which includes its Operating Partnership Units because its Operating Partnership Units may be redeemed for common stock. The Company believes it is meaningful for investors to understand FFO attributable to common stock and unit holders.

The Company further adjusts FFO for certain additional items that are not in Nareit’s definition of FFO such as terminated transaction and pre-opening expenses, amortization of debt origination costs and share-based compensation, non-cash ground rent and straight-line rent expense, and other items we believe do not represent recurring operations. The Company believes that Adjusted FFO provides investors with useful supplemental information that may facilitate comparisons of ongoing operating performance between periods and between REITs that make similar adjustments to FFO and is beneficial to investors’ complete understanding of our operating performance.

Adjusted FFO per diluted share

The diluted weighted-average common share count used for the calculation of Adjusted FFO per diluted share differs from diluted weighted-average common share count used to derive net income or loss per share available to common stockholders. The Company calculates Adjusted FFO per diluted share by dividing the Adjusted FFO by the diluted weighted-average number of shares of common stock outstanding plus the weighted-average vested Operating Partnership Units. Any anti-dilutive securities are excluded from the diluted earnings per share calculation.

Xenia Hotels & Resorts, Inc.

Reconciliation of Net Income to EBITDA, EBITDAre, Adjusted EBITDAre and Same-Property Hotel EBITDA

For the Three Months Ended December 31, 2023 and 2022

(Unaudited)

($ amounts in thousands)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, |

| | | | | 2023 | | 2022 | | |

| Net income | | | | | $ | 7,794 | | | $ | 36,336 | | | |

| Adjustments: | | | | | | | | | |

| Interest expense | | | | | 20,689 | | | 21,253 | | | |

| Income tax benefit | | | | | (3,935) | | | (1,943) | | | |

| Depreciation and amortization | | | | | 31,698 | | | 33,521 | | | |

| EBITDA | | | | | $ | 56,246 | | | $ | 89,167 | | | |

| | | | | | | | | |

| Gain on sale of investment properties | | | | | — | | | (27,286) | | | |

| | | | | | | | | |

| EBITDAre | | | | | $ | 56,246 | | | $ | 61,881 | | | |

| | | | | | | | | |

| Reconciliation to Adjusted EBITDAre | | | | | | | | | |

| Depreciation and amortization related to corporate assets | | | | | $ | (78) | | | $ | (133) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization of share-based compensation expense | | | | | 3,307 | | | 2,813 | | | |

| Non-cash ground rent and straight-line rent expense | | | | | (33) | | | 9 | | | |

| Other non-recurring expenses | | | | | — | | | 13 | | | |

| Adjusted EBITDAre attributable to common stock and unit holders | | | | | $ | 59,442 | | | $ | 64,583 | | | |

| Corporate-level costs and expenses | | | | | 4,355 | | | 5,818 | | | |

Pro forma hotel adjustments, net(1) | | | | | (92) | | | (868) | | | |

| | | | | | | | | |

| | | | | | | | | |

Same-Property Hotel EBITDA attributable to common stock and unit holders(2) | | | | | $ | 63,705 | | | $ | 69,533 | | | |

1.Includes adjustments for revenues and expenses from hotels that were acquired or sold during the periods presented.

2.See the reconciliation of Total Revenues and Total Hotel Operating Expenses on a consolidated GAAP basis to Total Same-Property Revenues and Total Same-Property Hotel Operating Expenses and the calculation of Same-Property Hotel EBITDA and Hotel EBITDA Margin for the three months ended December 31, 2023 and 2022 on page 20.

Xenia Hotels & Resorts, Inc.

Reconciliation of Net Income to EBITDA, EBITDAre, Adjusted EBITDAre and Same-Property Hotel EBITDA

For the Years Ended December 31, 2023 and 2022

(Unaudited)

($ amounts in thousands)

| | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | | | 2023 | | 2022 | | |

| Net income | | | | | $ | 19,874 | | | $ | 57,630 | | | |

| Adjustments: | | | | | | | | | |

| Interest expense | | | | | 84,997 | | | 82,727 | | | |

| Income tax expense | | | | | 1,447 | | | 2,205 | | | |

| Depreciation and amortization | | | | | 132,023 | | | 132,648 | | | |

| EBITDA | | | | | $ | 238,341 | | | $ | 275,210 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Gain on sale of investment properties | | | | | — | | | (27,286) | | | |

| EBITDAre | | | | | $ | 238,341 | | | $ | 247,924 | | | |

| | | | | | | | | |

| Reconciliation to Adjusted EBITDAre | | | | | | | | | |

| Depreciation and amortization related to corporate assets | | | | | $ | (348) | | | $ | (444) | | | |

Gain on insurance recoveries(1) | | | | | (535) | | | (3,550) | | | |

| Loss on extinguishment of debt | | | | | 1,189 | | | 294 | | | |

| | | | | | | | | |

| Amortization of share-based compensation expense | | | | | 13,168 | | | 11,411 | | | |

| Non-cash ground rent and straight-line rent expense | | | | | (75) | | | 44 | | | |

| | | | | | | | | |

Other non-recurring expenses(2) | | | | | — | | | 1,309 | | | |

| Adjusted EBITDAre attributable to common stock and unit holders | | | | | $ | 251,740 | | | $ | 256,988 | | | |

| Corporate-level costs and expenses | | | | | 19,850 | | | 23,942 | | | |

Pro forma hotel level adjustments, net(3) | | | | | (77) | | | (5,316) | | | |

| | | | | | | | | |

| | | | | | | | | |

Same-Property Hotel EBITDA attributable to common stock and unit holders(4) | | | | | $ | 271,513 | | | $ | 275,614 | | | |

1.During the years ended December 31, 2023 and 2022, the Company recorded $0.5 million and $3.6 million, respectively, of insurance proceeds in excess of recognized losses related to damage sustained at Loews New Orleans Hotel during Hurricane Ida in August 2021. These gains on insurance recoveries are included in other income on the consolidated statements of operations and comprehensive income for the periods then ended.

2.During the year ended December 31, 2022, the Company recorded hurricane-related repair and cleanup costs of $1.3 million which is included in impairment and other losses on the consolidated statement of operations and comprehensive income for the period then ended.

3.Includes adjustments for revenues and expenses from hotels that were acquired or sold during the periods presented. Includes pre-acquisition historical operating results for W Nashville that were obtained from the seller and/or manager of the hotel for a portion of the year ended December 31, 2022.

4.See the reconciliation of Total Revenues and Total Hotel Operating Expenses on a consolidated GAAP basis to Total Same-Property Revenues and Total Same-Property Hotel Operating Expenses and the calculation of Same-Property Hotel EBITDA and Hotel EBITDA Margin for the years ended December 31, 2023 and 2022 on page 20.

Xenia Hotels & Resorts, Inc.

Reconciliation of Net Income to FFO and Adjusted FFO

For the Three Months Ended December 31, 2023 and 2022

(Unaudited)

($ amounts in thousands)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, |

| | | | | 2023 | | 2022 | | |

| Net income | | | | | $ | 7,794 | | | $ | 36,336 | | | |

| Adjustments: | | | | | | | | | |

| Depreciation and amortization related to investment properties | | | | | 31,620 | | | 33,388 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Gain on sale of investment properties | | | | | — | | | (27,286) | | | |

| FFO attributable to common stock and unit holders | | | | | $ | 39,414 | | | $ | 42,438 | | | |

| | | | | | | | | |

| Reconciliation to Adjusted FFO | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Loan related costs, net of adjustment related to non-controlling interests(1) | | | | | 1,357 | | | 1,335 | | | |

| Amortization of share-based compensation expense | | | | | 3,307 | | | 2,813 | | | |

| Non-cash ground rent and straight-line rent expense | | | | | (33) | | | 9 | | | |

| | | | | | | | | |

| Other non-recurring expenses | | | | | — | | | 13 | | | |

| Adjusted FFO attributable to common stock and unit holders | | | | | $ | 44,045 | | | $ | 46,608 | | | |

Weighted-average shares outstanding - Diluted(2) | | | | | 106,643 | | | 114,621 | | | |

| Adjusted FFO per diluted share | | | | | $ | 0.41 | | | $ | 0.41 | | | |

1.Loan related costs include amortization of debt premiums, discounts and deferred loan origination costs.

2.Diluted weighted-average number of shares of common stock outstanding plus the weighted-average vested Operating Partnership Units for the respective periods presented in thousands.

Xenia Hotels & Resorts, Inc.

Reconciliation of Net Income to FFO and Adjusted FFO

For the Years Ended December 31, 2023 and 2022

(Unaudited)

($ amounts in thousands)

| | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | | | 2023 | | 2022 | | |

| Net income | | | | | $ | 19,874 | | | $ | 57,630 | | | |

| Adjustments: | | | | | | | | | |

| Depreciation and amortization related to investment properties | | | | | 131,675 | | | 132,204 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Gain on sale of investment properties | | | | | — | | | (27,286) | | | |

| FFO attributable to common stock and unit holders | | | | | $ | 151,549 | | | $ | 162,548 | | | |

| | | | | | | | | |

| Reconciliation to Adjusted FFO | | | | | | | | | |

Gain on insurance recoveries(1) | | | | | (535) | | | (3,550) | | | |

| Loss on extinguishment of debt | | | | | 1,189 | | | 294 | | | |

| | | | | | | | | |

Loan related costs, net of adjustment related to non-controlling interests(2) | | | | | 4,915 | | | 5,260 | | | |

| Amortization of share-based compensation expense | | | | | 13,168 | | | 11,411 | | | |

| Non-cash ground rent and straight-line rent expense | | | | | (75) | | | 44 | | | |

| | | | | | | | | |

Other non-recurring expenses(3) | | | | | — | | | 1,309 | | | |

| Adjusted FFO attributable to common stock and unit holders | | | | | $ | 170,211 | | | $ | 177,316 | | | |

Weighted-average shares outstanding - Diluted(4) | | | | | 110,187 | | | 115,490 | | | |

| Adjusted FFO per diluted share | | | | | $ | 1.54 | | | $ | 1.54 | | | |

1.During the years ended December 31, 2023 and 2022, the Company recorded $0.5 million and $3.6 million, respectively, of insurance proceeds in excess of recognized losses related to damage sustained at Loews New Orleans Hotel during Hurricane Ida in August 2021. These gains on insurance recoveries are included in other income on the consolidated statements of operations and comprehensive income for the periods then ended.

2.Loan related costs included amortization of debt premiums, discounts and deferred loan origination costs.

3.During the year ended December 31, 2022, the Company recorded hurricane-related repair and cleanup costs of $1.3 million which is included in impairment and other losses on the consolidated statement of operations and comprehensive income for the period then ended.

4.Diluted weighted-average number of shares of common stock outstanding plus the weighted-average vested Operating Partnership Units for the respective periods presented in thousands.

Xenia Hotels & Resorts, Inc.

Reconciliation of Net Income to Adjusted EBITDAre

for Full Year 2024 Guidance

($ amounts in millions)

| | | | | |

| |

| |

| Guidance Midpoint |

| |

| Net income | $ | 25 | |

| Adjustments: | |

Interest expense(1) | 82 | |

| Income tax expense | 2 | |

| Depreciation and amortization | 132 | |

| |

| |

| EBITDA and EBITDAre | $ | 241 | |

| Amortization of share-based compensation expense | 13 | |

| Other | — | |

| |

| Adjusted EBITDAre | $ | 254 | |

Reconciliation of Net Income to Adjusted FFO

for Full Year 2024 Guidance

($ amounts in millions)

| | | | | |

| Guidance Midpoint |

| |

| Net income | $ | 25 | |

| Adjustments: | |

| Depreciation and amortization related to investment properties | 132 | |

| |

| FFO | $ | 157 | |

| Amortization of share-based compensation expense | 13 | |

Other(1) | 5 | |

| Adjusted FFO | $ | 175 | |

1.Includes non-cash loan amortization costs.

Xenia Hotels & Resorts, Inc.

Debt Summary as of December 31, 2023

(Unaudited)

($ amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Rate Type | | Rate(1) | | Maturity Date | |

Outstanding as of December 31, 2023 |

| | | | | | | |

| | | | | | | |

| Mortgage Loans | | | | | | | |

| Grand Bohemian Hotel Orlando, Autograph Collection | Fixed | | 4.53 | % | | March 2026 | | $ | 54,522 | |

| Marriott San Francisco Airport Waterfront | Fixed | | 4.63 | % | | May 2027 | | 108,111 | |

Andaz Napa(2) | Fixed(2) |

| 5.72 | % | | January 2028 | | 55,000 | |

| Total Mortgage Loans | | | 4.88 | % | (3) | | | $ | 217,633 | |

| Corporate Credit Facilities | | | | | | | |

Corporate Credit Facility Term Loan(4) | Fixed(5) | | 5.50 | % | | March 2026 | | $ | 125,000 | |

Corporate Credit Facility Term Loan(4) | Fixed(5) | | 5.50 | % | | March 2026 | | 100,000 | |

Revolving Line of Credit(6) | Variable | | 7.11 | % | | January 2027 | | — | |

| Total Corporate Credit Facilities | | | | | | | $ | 225,000 | |

| 2020 Senior Notes | Fixed | | 6.38 | % | | August 2025 | | 464,747 | |

| 2021 Senior Notes | Fixed | | 4.88 | % | | June 2029 | | 500,000 | |

Loan premiums, discounts and unamortized deferred financing costs, net(7) | | | | | | | (12,474) | |

Total Debt, net of loan premiums, discounts and unamortized deferred financing costs | | | 5.47 | % | (3) | | | $ | 1,394,906 | |

1.Represents annual interest rates.

2.A variable interest loan for which SOFR has been fixed through January 1, 2027, after which the rate reverts to variable.

3.Weighted-average interest rate.

4.A variable interest loan for which the credit spread may vary, as it is determined by the Company's leverage ratio.

5.A variable interest loan for which SOFR has been fixed through mid-February 2025, after which the rate reverts to variable.

6.The Revolving Line of Credit had undrawn capacity of $450 million. The spread to SOFR may vary, as it is determined by the Company's leverage ratio.

7.Includes loan premiums, discounts and deferred financing costs, net of accumulated amortization.

Xenia Hotels & Resorts, Inc.

Same-Property(1) Hotel EBITDA and Hotel EBITDA Margin

For the Three Months and Years Ended December 31, 2023 and 2022

($ amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Same-Property Occupancy(1) | | 61.9 | % | | 62.4 | % | | (50) | bps | | 65.1 | % | | 62.6 | % | | 250 | bps |

Same-Property Average Daily Rate(1) | | $ | 254.56 | | | $ | 261.70 | | | (2.7)% | | $ | 260.40 | | | $ | 260.52 | | | —% |

Same-Property RevPAR(1) | | $ | 157.69 | | | $ | 163.32 | | | (3.4)% | | $ | 169.46 | | | $ | 163.11 | | | 3.9% |

Same-Property Revenues(1): | | | | | | | | | | | | |

| Rooms revenues | | $ | 138,023 | | | $ | 142,800 | | | (3.3)% | | $ | 588,278 | | | $ | 566,093 | | | 3.9% |

| Food and beverage revenues | | 94,142 | | | 96,064 | | | (2.0)% | | 354,133 | | | 335,346 | | | 5.6% |

| Other revenues | | 21,215 | | | 20,940 | | | 1.3% | | 83,051 | | | 82,639 | | | 0.5% |

| Total Same-Property revenues | | $ | 253,380 | | | $ | 259,804 | | | (2.5)% | | $ | 1,025,462 | | | $ | 984,078 | | | 4.2% |

Same-Property Expenses(1): | | | | | | | | | | | | |

| Rooms expenses | | $ | 36,408 | | | $ | 35,290 | | | 3.2% | | $ | 145,239 | | | $ | 135,418 | | | 7.3% |

| Food and beverage expenses | | 61,516 | | | 61,710 | | | (0.3)% | | 235,919 | | | 222,770 | | | 5.9% |

| Other direct expenses | | 5,920 | | | 5,945 | | | (0.4)% | | 23,497 | | | 23,496 | | | —% |

| Other indirect expenses | | 64,224 | | | 66,923 | | | (4.0)% | | 260,376 | | | 244,646 | | | 6.4% |

| Management and franchise fees | | 8,417 | | | 8,556 | | | (1.6)% | | 35,235 | | | 35,664 | | | (1.2)% |

| Real estate taxes, personal property taxes and insurance | | 12,406 | | | 11,076 | | | 12.0% | | 50,614 | | | 43,624 | | | 16.0% |

| Ground lease expense | | 784 | | | 771 | | | 1.7% | | 3,069 | | | 2,846 | | | 7.8% |

| Total Same-Property hotel operating expenses | | $ | 189,675 | | | $ | 190,271 | | | (0.3)% | | $ | 753,949 | | | $ | 708,464 | | | 6.4% |

Same-Property Hotel EBITDA(1) | | $ | 63,705 | | | $ | 69,533 | | | (8.4)% | | $ | 271,513 | | | $ | 275,614 | | | (1.5)% |

Same-Property Hotel EBITDA Margin(1) | | 25.1 | % | | 26.8 | % | | (162) | bps | | 26.5 | % | | 28.0 | % | | (153) | bps |

1.“Same-Property” includes all properties owned as of December 31, 2023 and includes disruption from the COVID-19 pandemic in the year ended December 31, 2022 and renovation disruption for multiple capital projects during the periods presented. "Same-Property" also includes pre-acquisition historical operating results for W Nashville that were obtained from the seller and/or manager of the hotel for a portion of the year ended December 31, 2022. The following is a reconciliation of Total Revenues and Total Hotel Operating Expenses consolidated on a GAAP basis to Total Same-Property Revenues and Total Same-Property Hotel Operating Expenses for the three months and years ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total Revenues - GAAP | | $ | 253,380 | | | $ | 263,141 | | | $ | 1,025,443 | | | $ | 997,607 | |

| | | | | | | | |

Pro forma hotel level adjustments(a) | | — | | | (3,337) | | | 19 | | | (13,529) | |

| Total Same-Property Revenues | | $ | 253,380 | | | $ | 259,804 | | | $ | 1,025,462 | | | $ | 984,078 | |

| | | | | | | | |

| Total Hotel Operating Expenses - GAAP | | $ | 178,198 | | | $ | 181,594 | | | $ | 703,770 | | | $ | 672,275 | |

| Real estate taxes, personal property taxes and insurance | | 12,295 | | | 10,936 | | | 50,491 | | | 44,388 | |

Ground lease expense, net(b) | | 785 | | | 771 | | | 3,069 | | | 2,846 | |

| Other income | | (1,374) | | | (32) | | | (1,596) | | | (227) | |

| Corporate-level costs and expenses | | (360) | | | (540) | | | (1,710) | | | (1,808) | |

Pro forma hotel level adjustments, net(a) | | 131 | | | (2,458) | | | (75) | | | (9,010) | |

| Total Same-Property Hotel Operating Expenses | | $ | 189,675 | | | $ | 190,271 | | | $ | 753,949 | | | $ | 708,464 | |

a.Includes adjustments for revenues and expenses from hotels that were acquired or sold during the periods presented. Includes pre-acquisition historical operating results for W Nashville that were obtained from the seller and/or manager of the hotel for a portion of the year ended December 31, 2022.

b.Excludes non-cash ground rent expense.

This supplemental is being furnished in conjunction with the earnings release dated February 27, 2024 which contains additional reconciliations of Non-GAAP measures to Total Revenues and Total Hotel Operating Expenses on a consolidated GAAP basis for the three months and years ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | |

| | TABLE OF CONTENTS | | Page |

| | | | |

| | Same-Property(1) Portfolio Data by Market, Ranked by Hotel EBITDA | | 2 - 3 |

| | | | |

| | Same-Property(1) Portfolio Data by Market, for the Three Months and Years Ended December 31, 2023 and 2022 | | 4 - 5 |

| | | | |

| | Same-Property(1) Historical Operating Data and Reconciliation to Hotel Net Income | | 6 |

| | | | |

| | Same-Property(1) Historical Operating Data and Reconciliation to Hotel Net Income Excluding Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch | | 7 |

| | | | |

| | Statistical Data by Property for the Years Ended December 31, 2023 and 2022 | | 8 - 9 |

| | | | |

| | Financial Data by Property for the Years Ended December 31, 2023 and 2022 | | 10 - 11 |

| | | | |

| | Reconciliation of Hotel Net Income (Loss) to Hotel EBITDA by Property (2023 and 2022) | | 12 - 15 |

| | | | |

| | Reconciliation of Hotel Net Income (Loss) to Hotel EBITDA by Market (2023) | | 16 - 17 |

| | | | |

| | Non-GAAP Financial Measures & Disclosures | | 18 - 22 |

1."Same-Property” includes all hotels owned as of December 31, 2023. "Same-Property" also includes disruption from the COVID-19 pandemic and renovation disruption for multiple capital projects during the periods presented. "Same-Property" also includes pre-acquisition historical operating results for W Nashville that were obtained from the seller and/or manager of the hotel for a portion of the year ended December 31, 2022.

Xenia Hotels & Resorts, Inc.

Same-Property(1) Portfolio Data by Market, Ranked by Hotel EBITDA | | | | | | | | | | | | | | | | | | | | | | | |

Market(2) | % of 2023

Hotel Net Income (Loss) - GAAP | | % of 2023 Hotel EBITDA(3) | | Number of Hotels | | Number of Rooms (4)(5) |

| Orlando | 17% | | 15% | | 2 | | 1,026 |

| Houston | 17% | | 14% | | 3 | | 1,223 |

| Phoenix | 11% | | 10% | | 2 | | 610 |

| Dallas | 13% | | 8% | | 2 | | 961 |

| San Diego | 6% | | 8% | | 2 | | 486 |

| Atlanta | 10% | | 7% | | 2 | | 649 |

| Nashville | (1)% | | 5% | | 1 | | 346 |

| San Francisco/San Mateo | 3% | | 4% | | 1 | | 688 |

| Florida Keys | 8% | | 4% | | 1 | | 120 |

| Portland | 1% | | 4% | | 2 | | 685 |

| Washington, DC-MD-VA | 1% | | 3% | | 2 | | 472 |

| California North | 2% | | 3% | | 1 | | 141 |

| Savannah | 3% | | 3% | | 2 | | 226 |

| San Jose/Santa Cruz | 2% | | 2% | | 1 | | 505 |

| Denver | —% | | 2% | | 1 | | 205 |

| Birmingham | 2% | | 2% | | 1 | | 99 |

| Pittsburgh | 2% | | 1% | | 1 | | 185 |

| Louisiana South | 1% | | 1% | | 1 | | 285 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Xenia Hotels & Resorts, Inc.

Same-Property(1) Portfolio Data by Market, Ranked by Hotel EBITDA (Continued)

| | | | | | | | | | | | | | | | | | | | | | | |

Market(2) | % of 2023

Hotel Net Income (Loss) - GAAP | | % of 2023 Hotel EBITDA(3) | | Number of Hotels | | Number of Rooms (4)(5) |

| Philadelphia | 1% | | 1% | | 1 | | 230 |

| Charleston | 1% | | 1% | | 1 | | 50 |

| California Central Coast | —% | | 1% | | 1 | | 97 |

| Salt Lake City/Ogden, UT | —% | | 1% | | 1 | | 225 |

Same-Property Portfolio(1) | 100% | | 100% | | 32 | | 9,514 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

1."Same-Property” includes all hotels owned as of December 31, 2023 and also includes renovation disruption for multiple capital projects during the period presented.

2.As defined by STR, Inc.

3.See tables beginning on page 16 of this supplemental for reconciliations from Hotel Net Income (Loss) to Hotel Earnings Before Interest, Taxes, Depreciation and Amortization ("Hotel EBITDA"), Same-Property Hotel EBITDA, and Hotel EBITDA Margin. Hotel EBITDA, Same-Property Hotel EBITDA, and Hotel EBITDA Margin are non-GAAP financial measures.

4.As of December 31, 2023.

5.Three rooms were added at The Ritz-Carlton, Denver in April 2023 and three rooms were added at Marriott Woodlands Waterway Hotel & Convention Center in October 2023.

Xenia Hotels & Resorts, Inc.

Same-Property(1) Portfolio Data by Market (2023)

For the Three Months and Years Ended December 31, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended | | | Year Ended | | Year Ended | | |

| December 31, 2023 | | December 31, 2022 | | % Change | December 31, 2023 | | December 31, 2022 | | % Change |

Market(2) | Occupancy | ADR | RevPAR | | Occupancy | ADR | RevPAR | | RevPAR | Occupancy | ADR | RevPAR | | Occupancy | ADR | RevPAR | | RevPAR |

| | | | | | | | | | | | | | | | | | |

| Orlando | 72.9 | % | $ | 217.28 | | $ | 158.30 | | | 71.2 | % | $221.38 | $157.65 | | 0.4 | % | 73.7 | % | $226.84 | $167.18 | | 73.9 | % | $218.77 | $161.71 | | 3.4 | % |

| Houston | 60.7 | % | 228.27 | | 138.64 | | | 61.6 | % | 217.93 | 134.31 | | 3.2 | % | 61.4 | % | 227.34 | 139.51 | | 54.7 | % | 212.69 | 116.37 | | 19.9 | % |

| Phoenix | 33.0 | % | 378.07 | | 124.83 | | | 61.2 | % | 392.71 | 240.52 | | (48.1) | % | 43.6 | % | 421.94 | 183.92 | | 61.5 | % | 383.41 | 235.70 | | (22.0) | % |

| Dallas | 64.6 | % | 197.64 | | 127.77 | | | 61.3 | % | 187.73 | 115.16 | | 10.9 | % | 66.1 | % | 193.88 | 128.11 | | 60.4 | % | 179.89 | 108.69 | | 17.9 | % |

| San Diego | 56.6 | % | 356.72 | | 201.88 | | | 58.7 | % | 350.30 | 205.80 | | (1.9) | % | 61.1 | % | 378.53 | 231.09 | | 58.9 | % | 391.52 | 230.42 | | 0.3 | % |

| Atlanta | 55.7 | % | 252.62 | | 140.69 | | | 56.3 | % | 243.29 | 136.97 | | 2.7 | % | 65.4 | % | 239.80 | 156.93 | | 61.9 | % | 230.64 | 142.72 | | 10.0 | % |

| Nashville | 53.4 | % | 378.98 | | 202.24 | | | 51.0 | % | 434.33 | 221.65 | | (8.8) | % | 62.9 | % | 381.21 | 239.83 | | 54.8 | % | 397.02 | 217.37 | | 10.3 | % |

| San Francisco/San Mateo | 73.0 | % | 204.51 | | 149.19 | | | 71.8 | % | 194.99 | 140.07 | | 6.5 | % | 78.7 | % | 204.98 | 161.23 | | 73.0 | % | 195.24 | 142.49 | | 13.2 | % |

| Florida Keys | 83.2 | % | 511.97 | | 426.03 | | | 83.0 | % | 552.32 | 458.27 | | (7.0) | % | 84.5 | % | 533.96 | 451.34 | | 86.3 | % | 590.44 | 509.79 | | (11.5) | % |

| Portland | 56.7 | % | 186.47 | | 105.78 | | | 47.1 | % | 192.52 | 90.62 | | 16.7 | % | 63.8 | % | 195.61 | 124.80 | | 50.9 | % | 197.10 | 100.31 | | 24.4 | % |