U.S. Bank CFO Survey: Corporate Finance Leaders Tighten Belts Amid Uncertainty

25 April 2024 - 12:00PM

Business Wire

- Survey of more than 2,000 U.S. corporate finance leaders

reveals the top two priorities are cost control within finance

function and across the business

- Among top risks, geopolitical tensions rise while inflation

drops significantly

- Just 37% of finance leaders have a positive outlook for the

U.S. economy for the rest of 2024, but nearly 60% are optimistic

about the next three years

U.S. corporate finance leaders have increased focus on cutting

costs to prepare their firms for potential economic and

geopolitical uncertainty, according to the fourth annual U.S. Bank

CFO Insights Report.

The survey of more than 2,000 senior finance leaders nationwide

revealed the top two priorities are cutting costs within the

finance function and across the entire business. In contrast,

driving revenue growth is just the fifth most prevalent priority.

Cutting costs within the finance function has nearly doubled as a

priority since the U.S. Bank CFO Insights Report began in 2021.

Improving risk identification and mitigation also continues to

climb in importance, now the third most common top priority.

For specific top risks, finance leaders continue to identify

areas like talent shortages and pace of technology changes, but

geopolitical tension has jumped six spots from the 10th most cited

risk last year. Meanwhile, high inflation was cited less often this

year as a top risk (25%) compared to last year (38%), although it

remains an elevated risk for some industries, like Telecom and

Media (42%).

“The CFO’s job has always been a challenge. But today they face

higher inflation and interest rates, political uncertainty in the

U.S. and abroad, a difficult-to-forecast short-term economy and

incredible pressure to make the right technology investments their

firms will need to compete,” said Stephen Philipson, head of Global

Markets and Specialized Finance at U.S. Bank. “This year’s survey

showcased how finance leaders are working through this set of

circumstances by focusing on cost cuts and risk management without

neglecting their investment priorities.”

Key survey findings:

Economic outlook vs. business prospects

- 33% of finance leaders hold a negative outlook for the economy

for the rest of 2024. However, the long-term forecast is more

positive, with only 15% maintaining a negative outlook for the U.S.

economy over the next three years.

- Despite the challenging operating environment, 45% of finance

leaders remain optimistic about their business’s financial outlook

over the next 12 months. This number jumps to 61% when they look to

the next three years. For instance, in the automotive industry,

only 37% are positive about the next 12 months, but 63% are

optimistic over the next three years.

Top risks

- Talent shortages continue as the leading risk (41%), marking

the third consecutive year at the top, closely followed by the

challenges related to the pace of technology change/digital

disruption (38%). Industrial Products/Manufacturing (47%),

Hospitality and Leisure (46%) and Technology (46%) finance leaders

were most likely to list talent shortages as a top risk.

- Geopolitical tension and war have jumped to become the

fourth-most cited top risk (26%), climbing from 10th place last

year.

- Inflation comes in fifth place (25%) as a top risk. It has

decreased in urgency for finance leaders from last year’s 38%.

Finance leaders in Telecom and Media (42%) and Consumer and Retail

(36%) were most likely to list inflation as a top risk.

- Nearly four-in-ten of finance leaders (39%) said they’re not

confident about their ability to manage and mitigate new

risks.

Artificial Intelligence (AI) and areas for

efficiencies

- Finance leaders are prioritizing investments in technology

(47%) over layoffs (21%) as the primary solution for cutting costs

in the next 12 months. Comparatively, in 2021 layoffs were at

40%.

- After data analytics (52%), AI is the second-highest priority

for investment in the finance function (51%) and is most

prioritized by finance leaders in Insurance, Oil and Gas and Life

Sciences/Pharmaceutical sectors.

- Uses for AI in the finance function are primarily focused on

tackling risk (42%), identifying fraud (41%) and automating

processes (37%).

- While cost cuts are top of mind, this year’s survey found

finance leaders are more confident about balancing growth

initiatives and cost cutting. 50% said they struggle to balance the

need to cut costs with the need to invest in the future, down from

56% last year.

View the full 2024 U.S. Bank CFO Insights Report.

About the research

The results of this research are based on a survey conducted in

January and February 2024 of 2,030 senior finance leaders who work

in U.S. businesses across multiple sectors. Half of the survey

participants are company, regional or divisional CFOs. The

remainder are senior managers within the finance function. Every

surveyed finance leader works for a business that generates at

least $100 million in annual revenue, and 30% work for a business

that generates at least $2 billion.

About U.S. Bancorp

U.S. Bancorp, with more than 70,000 employees and $684 billion

in assets as of March 31, 2024, is the parent company of U.S. Bank

National Association. Headquartered in Minneapolis, the company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses including consumer banking,

business banking, commercial banking, institutional banking,

payments and wealth management. U.S. Bancorp has been recognized

for its approach to digital innovation, community partnerships and

customer service, including being named one of the 2024 World’s

Most Ethical Companies and Fortune’s most admired superregional

bank. Learn more at usbank.com/about.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425962462/en/

Todd Deutsch, U.S. Bank Public Affairs & Communications

todd.deutsch@usbank.com | 612.303.4148

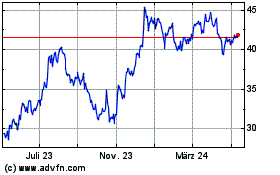

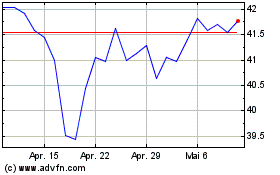

US Bancorp (NYSE:USB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024