false000071795400007179542024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 3, 2024

UNIFIRST CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

Massachusetts |

001-08504 |

04-2103460 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

68 Jonspin Road, Wilmington, Massachusetts |

01887 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (978) 658-8888

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.10 par value per share |

UNF |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 3, 2024, UniFirst Corporation (the “Company”) issued a press release (“Press Release”) announcing financial results for the first quarter of fiscal 2024, which ended on November 25, 2023. A copy of the Press Release is attached as Exhibit 99 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including the exhibit attached hereto, shall not be deemed “filed” for any purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act") or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

UNIFIRST CORPORATION |

|

|

|

|

Date: January 3, 2024 |

|

By: |

/s/ Steven S. Sintros |

|

|

|

Steven S. Sintros |

|

|

|

President and Chief Executive Officer |

|

|

|

|

|

|

By: |

/s/ Shane O’Connor |

|

|

|

Shane O’Connor |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99

Investor Relations Contact

Shane O'Connor, Executive Vice President & CFO

UniFirst Corporation

978-658-8888

shane_oconnor@unifirst.com

UNIFIRST ANNOUNCES FINANCIAL RESULTS FOR THE FIRST QUARTER OF FISCAL 2024

Wilmington, MA – January 3, 2024 – UniFirst Corporation (NYSE: UNF) (the “Company,” “UniFirst” or “we”) today reported results for its first quarter ended November 25, 2023 as compared to the corresponding period in the prior fiscal year:

Q1 2024 Financial Highlights

•Consolidated revenues for the first quarter increased 9.5% to $593.5 million.

•Operating income was $53.1 million, an increase of 22.4%.

•The quarterly tax rate decreased to 23.4% compared to 25.2% in the prior year.

•Net income increased to $42.3 million from $34.0 million in the prior year, or 24.6%.

•Diluted earnings per share increased to $2.26 from $1.81 in the prior year, or 24.9%.

•EBITDA increased to $86.2 million compared to $69.7 million in the prior year, or 23.7%.

The Company's financial results for the first quarter of fiscal 2024 and 2023 included approximately $2.9 million and $10.0 million, respectively, of costs directly attributable to its customer relationship management (“CRM”) computer system, enterprise resource planning (“ERP”) system and branding initiatives (the "Key Initiatives"). Investments in the branding initiatives concluded in fiscal 2023. The effect of the Key Initiatives on the first quarter of fiscal 2024 and 2023 combined to decrease:

•Both operating income and EBITDA by $2.9 million and $10.0 million, respectively.

•Net income by $2.4 million and $7.6 million, respectively.

•Diluted earnings per share by $0.12 and $0.40, respectively.

Steven Sintros, UniFirst President and Chief Executive Officer, said, “We are pleased with the results from our first quarter, which represent a solid start to our new fiscal year. I want to sincerely thank all of our Team Partners who continue to Always Deliver for each other and our customers as we strive towards our vision of being universally recognized as the best service provider in the industry. …all while living our Mission of Serving the People Who do the Hard Work.”

Segment Reporting Highlights

Core Laundry Operations

•Revenues for the quarter increased 9.8% to $524.0 million.

•Organic growth, which excludes the effect of acquisitions and fluctuations in the Canadian dollar, was 5.2%.

•Operating margin increased to 8.0% from 7.1%.

•Core Laundry Operations' EBITDA margin increased to 14.0% from 12.2%.

The costs incurred related to the Key Initiatives, discussed above, were recorded to the Core Laundry Operations' segment, and decreased both the Core Laundry Operations' operating and EBITDA margin for the first quarters of fiscal 2024 and 2023 by 0.6% and 2.1%, respectively.

The segment's operating and EBITDA margin comparisons were also impacted by investments in our corporate capabilities that we have made over the last year and higher merchandise costs, which were partially offset by lower energy costs as a percentage of revenues. The purchase accounting for the Company's March 2023 acquisition of Clean Uniform further impacted the segment’s operating margin, most notably in the form of elevated non-cash acquisition-related intangibles amortization.

Specialty Garments

•Revenues for the quarter were $44.7 million, an increase of 1.3%, which was driven by growth in the segment's cleanroom operations.

•Operating margin increased to 27.1% from 23.1% a year ago, primarily as a result of the strong top line performance.

•Specialty Garments consists of nuclear decontamination and cleanroom operations, and its results can vary significantly due to seasonality and the timing of reactor outages and projects.

Balance Sheet and Capital Allocation

•Cash, cash equivalents and Short-term investments totaled $88.8 million as of November 25, 2023.

•The Company had no long-term debt outstanding as of November 25, 2023.

•On October 24, 2023, our Board of Directors authorized a new share repurchase program to repurchase from time to time up to $100.0 million of our outstanding shares of Common Stock, inclusive of the amount which remained available under the share repurchase program previously authorized on October 18, 2021. Under the new share repurchase program, the Company repurchased 1,500 shares of Common Stock for $0.3 million in the first quarter of fiscal 2024. As of November 25, 2023, the Company had $99.7 million remaining under its new share repurchase program.

•Weighted average shares outstanding – Diluted for both the first quarter of fiscal 2024 and fiscal 2023 were 18.8 million.

Financial Outlook

Mr. Sintros continued, "At this time, we continue to expect our revenues for fiscal 2024 to be between $2.415 billion and $2.435 billion, however, due to recent trends in our Core Laundry Operations in the latter half of the quarter we anticipate that the lower half of the range is more likely. We continue to expect diluted earnings per share to be between $6.52 and $7.16.” As a reminder, our guidance for fiscal 2024 includes one extra week of operations compared to fiscal 2023 due to the timing of our fiscal calendar.

Conference Call Information

UniFirst Corporation will hold a conference call today at 9:00 a.m. (ET) to discuss its quarterly financial results, business highlights and outlook. A simultaneous live webcast of the call will be available over the Internet and can be accessed at www.unifirst.com.

About UniFirst Corporation

Headquartered in Wilmington, Mass., UniFirst Corporation (NYSE: UNF) is a North American leader in the supply and servicing of uniform and workwear programs, facility service products, as well as first aid and safety supplies and services. Together with its subsidiaries, the Company also manages specialized garment programs for the cleanroom and nuclear industries. In addition to partnering with leading brands, UniFirst manufactures its own branded workwear, protective clothing, and floorcare products at its five company-owned ISO-9001-certified manufacturing facilities. With more than 270 service locations, over 300,000 customer locations, and 16,000-plus employee Team Partners, the Company outfits more than 2 million workers every day. For more information, contact UniFirst at 888.296.2740 or visit UniFirst.com.

Forward-Looking Statements Disclosure

This public announcement contains forward-looking statements within the meaning of the federal securities laws that reflect the Company's current views with respect to future events and financial performance, including projected revenues, operating margin and earnings per share. Forward-looking statements contained in this public announcement are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995 and may be identified by words such as “guidance,” “outlook,” “estimates,” “anticipates,” “projects,” “plans,” “expects,” “intends,” “believes,” “seeks,” “could,” “should,” “may,” “will,” “strategy,” “objective,” “assume,” “strive,” “design,” “assumption,” “vision” or the negative versions thereof, and similar expressions and by the context in which they are used. Such forward-looking statements are based upon our current expectations and speak only as of the date made. Such statements are highly dependent upon a variety of risks, uncertainties and other important factors that could cause actual results to differ materially from those reflected in such forward-looking statements. Such factors include, but are not limited to, uncertainties caused by an economic recession or other adverse economic conditions, including, without limitation, as a result of continued high inflation rates or further increases in inflation or interest rates or extraordinary events or circumstances such as geopolitical conflicts like the conflict between Russia and Ukraine, disruption in the Middle East or the COVID-19 pandemic, and their impact on our customers' businesses and workforce levels, disruptions of our business and operations, including limitations on, or closures of, our facilities, or the business and operations of our customers or suppliers in connection with extraordinary events or circumstances such as the COVID-19 pandemic, uncertainties regarding our ability to consummate acquisitions and successfully integrate acquired businesses, including Clean Uniform, and the performance of such businesses, uncertainties regarding any existing or newly-discovered expenses and liabilities related to environmental compliance and remediation, any adverse outcome of pending or future contingencies or claims, our ability to compete successfully without any significant degradation in our margin rates, seasonal and quarterly fluctuations in business levels, our ability to preserve positive labor relationships and avoid becoming the target of corporate

labor unionization campaigns that could disrupt our business, the effect of currency fluctuations on our results of operations and financial condition, our dependence on third parties to supply us with raw materials, which such supply could be severely disrupted as a result of extraordinary events or circumstances such as the conflict between Russia and Ukraine, any loss of key management or other personnel, increased costs as a result of any changes in federal, state, international or other laws, rules and regulations or governmental interpretation of such laws, rules and regulations, uncertainties regarding, or adverse impacts from continued high price levels of natural gas, electricity, fuel and labor or increases in such costs, the negative effect on our business from sharply depressed oil and natural gas prices, the continuing increase in domestic healthcare costs, increased workers' compensation claim costs, increased healthcare claim costs, our ability to retain and grow our customer base, demand and prices for our products and services, fluctuations in our Specialty Garments business, political or other instability, supply chain disruption or infection among our employees in Mexico and Nicaragua where our principal garment manufacturing plants are located, our ability to properly and efficiently design, construct, implement and operate a new customer relationship management computer system, interruptions or failures of our information technology systems, including as a result of cyber-attacks, additional professional and internal costs necessary for compliance with any changes in or additional Securities and Exchange Commission (the “SEC”), New York Stock Exchange and accounting or other rules, including, without limitation, recent rules proposed by the SEC regarding climate-related and cybersecurity-related disclosures, strikes and unemployment levels, our efforts to evaluate and potentially reduce internal costs, economic and other developments associated with the war on terrorism and its impact on the economy, the impact of foreign trade policies and tariffs or other impositions on imported goods on our business, results of operations and financial condition, general economic conditions, our ability to successfully implement our business strategies and processes, including our capital allocation strategies, our ability to successfully remediate the material weakness in internal control over financial reporting disclosed in our Annual Report on Form 10-K for the year ended August 26, 2023 and the other factors described under Part I, Item 1A. “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended August 26, 2023, Part II, Item 1A. “Risk Factors” and elsewhere in our subsequent Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to update any forward-looking statements to reflect events or circumstances arising after the date on which they are made.

Consolidated Statements of Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended |

|

(In thousands, except per share data) |

|

November 25, 2023 |

|

|

November 26, 2022 |

|

Revenues |

|

$ |

593,525 |

|

|

$ |

541,798 |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Cost of revenues (1) |

|

|

383,796 |

|

|

|

353,972 |

|

Selling and administrative expenses (1) |

|

|

122,859 |

|

|

|

117,363 |

|

Depreciation and amortization |

|

|

33,733 |

|

|

|

27,045 |

|

Total operating expenses |

|

|

540,388 |

|

|

|

498,380 |

|

|

|

|

|

|

|

|

Operating income |

|

|

53,137 |

|

|

|

43,418 |

|

|

|

|

|

|

|

|

Other (income) expense: |

|

|

|

|

|

|

Interest income, net |

|

|

(2,834 |

) |

|

|

(2,769 |

) |

Other expense, net |

|

|

716 |

|

|

|

791 |

|

Total other income, net |

|

|

(2,118 |

) |

|

|

(1,978 |

) |

|

|

|

|

|

|

|

Income before income taxes |

|

|

55,255 |

|

|

|

45,396 |

|

Provision for income taxes |

|

|

12,930 |

|

|

|

11,439 |

|

|

|

|

|

|

|

|

Net income |

|

$ |

42,325 |

|

|

$ |

33,957 |

|

|

|

|

|

|

|

|

Income per share – Basic: |

|

|

|

|

|

|

Common Stock |

|

$ |

2.35 |

|

|

$ |

1.89 |

|

Class B Common Stock |

|

$ |

1.88 |

|

|

$ |

1.51 |

|

|

|

|

|

|

|

|

Income per share – Diluted: |

|

|

|

|

|

|

Common Stock |

|

$ |

2.26 |

|

|

$ |

1.81 |

|

|

|

|

|

|

|

|

Income allocated to – Basic: |

|

|

|

|

|

|

Common Stock |

|

$ |

35,566 |

|

|

$ |

28,525 |

|

Class B Common Stock |

|

$ |

6,759 |

|

|

$ |

5,432 |

|

|

|

|

|

|

|

|

Income allocated to – Diluted: |

|

|

|

|

|

|

Common Stock |

|

$ |

42,325 |

|

|

$ |

33,957 |

|

|

|

|

|

|

|

|

Weighted average shares outstanding – Basic: |

|

|

|

|

|

|

Common Stock |

|

|

15,111 |

|

|

|

15,082 |

|

Class B Common Stock |

|

|

3,590 |

|

|

|

3,590 |

|

|

|

|

|

|

|

|

Weighted average shares outstanding – Diluted: |

|

|

|

|

|

|

Common Stock |

|

|

18,769 |

|

|

|

18,754 |

|

(1)Exclusive of depreciation on the Company's property, plant and equipment and amortization on its intangible assets.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

(In thousands) |

|

November 25, 2023 |

|

|

August 26, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

77,380 |

|

|

$ |

79,443 |

|

Short-term investments |

|

|

11,394 |

|

|

|

10,157 |

|

Receivables, net |

|

|

299,494 |

|

|

|

279,078 |

|

Inventories |

|

|

148,513 |

|

|

|

148,334 |

|

Rental merchandise in service |

|

|

249,611 |

|

|

|

248,323 |

|

Prepaid taxes |

|

|

10,284 |

|

|

|

20,907 |

|

Prepaid expenses and other current assets |

|

|

62,262 |

|

|

|

53,876 |

|

Total current assets |

|

|

858,938 |

|

|

|

840,118 |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

766,532 |

|

|

|

756,540 |

|

Goodwill |

|

|

648,797 |

|

|

|

647,900 |

|

Customer contracts and other intangible assets, net |

|

|

138,468 |

|

|

|

145,618 |

|

Deferred income taxes |

|

|

615 |

|

|

|

567 |

|

Operating lease right-of-use assets, net |

|

|

65,389 |

|

|

|

62,565 |

|

Other assets |

|

|

123,313 |

|

|

|

116,667 |

|

Total assets |

|

$ |

2,602,052 |

|

|

$ |

2,569,975 |

|

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

86,315 |

|

|

$ |

92,730 |

|

Accrued liabilities |

|

|

155,419 |

|

|

|

156,408 |

|

Accrued taxes |

|

|

— |

|

|

|

352 |

|

Operating lease liabilities, current |

|

|

17,051 |

|

|

|

17,739 |

|

Total current liabilities |

|

|

258,785 |

|

|

|

267,229 |

|

Long-term liabilities: |

|

|

|

|

|

|

Accrued liabilities |

|

|

121,720 |

|

|

|

121,682 |

|

Accrued and deferred income taxes |

|

|

131,040 |

|

|

|

130,084 |

|

Operating lease liabilities |

|

|

50,334 |

|

|

|

47,020 |

|

Total liabilities |

|

|

561,879 |

|

|

|

566,015 |

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Common Stock |

|

|

1,513 |

|

|

|

1,510 |

|

Class B Common Stock |

|

|

359 |

|

|

|

359 |

|

Capital surplus |

|

|

99,537 |

|

|

|

99,303 |

|

Retained earnings |

|

|

1,962,688 |

|

|

|

1,926,549 |

|

Accumulated other comprehensive loss |

|

|

(23,924 |

) |

|

|

(23,761 |

) |

Total shareholders’ equity |

|

|

2,040,173 |

|

|

|

2,003,960 |

|

Total liabilities and shareholders’ equity |

|

$ |

2,602,052 |

|

|

$ |

2,569,975 |

|

Detail of Operating Results

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended November 25, 2023 |

|

|

Thirteen Weeks Ended November 26, 2022 |

|

|

|

Core Laundry |

|

Specialty |

|

First |

|

|

|

|

Core Laundry |

|

Specialty |

|

First |

|

|

|

|

|

Operations |

|

Garments |

|

Aid |

|

Total |

|

|

Operations |

|

Garments |

|

Aid |

|

Total |

|

Revenues |

|

$ |

523,989 |

|

$ |

44,669 |

|

$ |

24,867 |

|

$ |

593,525 |

|

|

$ |

477,398 |

|

$ |

44,079 |

|

$ |

20,321 |

|

$ |

541,798 |

|

Revenue Growth % |

|

|

9.8 |

% |

|

1.3 |

% |

|

22.4 |

% |

|

9.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income (Loss) (1), (2) |

|

$ |

42,091 |

|

$ |

12,117 |

|

$ |

(1,071 |

) |

$ |

53,137 |

|

|

$ |

33,831 |

|

$ |

10,183 |

|

$ |

(596 |

) |

$ |

43,418 |

|

Operating Margin |

|

|

8.0 |

% |

|

27.1 |

% |

|

-4.3 |

% |

|

9.0 |

% |

|

|

7.1 |

% |

|

23.1 |

% |

|

-2.9 |

% |

|

8.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (1), (2) |

|

$ |

73,320 |

|

$ |

13,148 |

|

$ |

(314 |

) |

$ |

86,154 |

|

|

$ |

58,435 |

|

$ |

11,171 |

|

$ |

66 |

|

$ |

69,672 |

|

EBITDA Margin |

|

|

14.0 |

% |

|

29.4 |

% |

|

-1.3 |

% |

|

14.5 |

% |

|

|

12.2 |

% |

|

25.3 |

% |

|

0.3 |

% |

|

12.9 |

% |

(1)The Company's financial results for the first quarter of fiscal 2024 and 2023 included approximately $2.9 million and $10.0 million, respectively, of costs directly attributable to its Key Initiatives.

(2)The Key Initiatives' costs resulted in a decrease in both Core Laundry Operations' operating margin and EBITDA margin for the first quarter of fiscal 2024 and 2023 of 0.6% and 2.1%, respectively.

Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

(In thousands) |

|

November 25, 2023 |

|

|

November 26, 2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

42,325 |

|

|

$ |

33,957 |

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization (1) |

|

|

33,733 |

|

|

|

27,045 |

|

Share-based compensation |

|

|

2,534 |

|

|

|

1,461 |

|

Accretion on environmental contingencies |

|

|

316 |

|

|

|

259 |

|

Accretion on asset retirement obligations |

|

|

233 |

|

|

|

227 |

|

Deferred income taxes |

|

|

640 |

|

|

|

765 |

|

Other |

|

|

79 |

|

|

|

(42 |

) |

Changes in assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

Receivables, less reserves |

|

|

(20,413 |

) |

|

|

(23,675 |

) |

Inventories |

|

|

(138 |

) |

|

|

8,154 |

|

Rental merchandise in service |

|

|

(1,330 |

) |

|

|

(12,961 |

) |

Prepaid expenses and other current assets and Other assets |

|

|

(9,692 |

) |

|

|

(9,076 |

) |

Accounts payable |

|

|

(6,663 |

) |

|

|

399 |

|

Accrued liabilities |

|

|

(6,172 |

) |

|

|

(6,655 |

) |

Prepaid and accrued income taxes |

|

|

10,218 |

|

|

|

7,840 |

|

Net cash provided by operating activities |

|

|

45,670 |

|

|

|

27,698 |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Acquisition of businesses, net of cash acquired |

|

|

— |

|

|

|

(6,556 |

) |

Capital expenditures, including capitalization of software costs |

|

|

(39,050 |

) |

|

|

(39,044 |

) |

Purchases of investments |

|

|

(11,394 |

) |

|

|

(107,000 |

) |

Maturities of investments |

|

|

10,217 |

|

|

|

— |

|

Proceeds from sale of assets |

|

|

606 |

|

|

|

240 |

|

Net cash used in investing activities |

|

|

(39,621 |

) |

|

|

(152,360 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from exercise of share-based awards |

|

|

2 |

|

|

|

2 |

|

Taxes withheld and paid related to net share settlement of equity awards |

|

|

(2,290 |

) |

|

|

(2,028 |

) |

Repurchase of Common Stock |

|

|

(255 |

) |

|

|

— |

|

Payment of cash dividends |

|

|

(5,573 |

) |

|

|

(5,570 |

) |

Net cash used in financing activities |

|

|

(8,116 |

) |

|

|

(7,596 |

) |

|

|

|

|

|

|

|

Effect of exchange rate changes |

|

|

4 |

|

|

|

33 |

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(2,063 |

) |

|

|

(132,225 |

) |

Cash and cash equivalents at beginning of period |

|

|

79,443 |

|

|

|

376,399 |

|

Cash and cash equivalents at end of period |

|

$ |

77,380 |

|

|

$ |

244,174 |

|

(1)Depreciation and amortization for the first quarter of fiscal 2024 and 2023 included approximately $4.6 million and $2.6 million, respectively, of non-cash amortization expense recognized on acquisition-related intangible assets.

Reconciliation of GAAP to Non-GAAP Financial Measures

The Company reports its consolidated financial results in accordance with generally accepted accounting principles (“GAAP”). To supplement the Company's consolidated financial results in this press release, the Company also presents EBITDA and EBITDA margin, which are non-GAAP financial measures. The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization. EBITDA margin is defined as EBITDA for a period divided by revenue for the same period.

The Company believes these non-GAAP financial measures provide useful supplemental information regarding the performance of the Company and its segments to both management and investors. These non-GAAP financial measures exclude certain items that may impact the comparability of the Company's results. In addition, by excluding certain items, these non-GAAP financial measures enable management and investors to further evaluate the underlying operating performance of the Company.

Supplemental reconciliations of the Company's consolidated net income on a GAAP basis to EBITDA and EBITDA margin, which are non-GAAP financial measures, are presented in the following tables. Investors are encouraged to review the reconciliations of the non-GAAP financial measures to their most directly comparable GAAP financial measures, which are provided below. EBITDA and EBITDA margin should be considered in addition to, and not as substitutes for, or in isolation from, measures prepared in accordance with GAAP.

The Company does not allocate its provision for income taxes to its business segments and as a result, presents it in a separate column in the following tables.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended November 25, 2023 |

|

|

|

Core Laundry |

|

|

Specialty |

|

|

First |

|

|

|

|

|

|

|

(In thousands, except percentages) |

|

Operations |

|

|

Garments |

|

|

Aid |

|

|

Other |

|

|

Total |

|

Revenue |

|

$ |

523,989 |

|

|

$ |

44,669 |

|

|

$ |

24,867 |

|

|

$ |

— |

|

|

$ |

593,525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

44,209 |

|

|

$ |

12,117 |

|

|

$ |

(1,071 |

) |

|

$ |

(12,930 |

) |

|

$ |

42,325 |

|

Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12,930 |

|

|

|

12,930 |

|

Interest income, net |

|

|

(2,834 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,834 |

) |

Depreciation and amortization |

|

|

31,945 |

|

|

|

1,031 |

|

|

|

757 |

|

|

|

— |

|

|

|

33,733 |

|

EBITDA |

|

$ |

73,320 |

|

|

$ |

13,148 |

|

|

$ |

(314 |

) |

|

$ |

— |

|

|

$ |

86,154 |

|

EBITDA Margin |

|

|

14.0 |

% |

|

|

29.4 |

% |

|

|

-1.3 |

% |

|

|

|

|

|

14.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended November 26, 2022 |

|

|

|

Core Laundry |

|

|

Specialty |

|

|

First |

|

|

|

|

|

|

|

(In thousands, except percentages) |

|

Operations |

|

|

Garments |

|

|

Aid |

|

|

Other |

|

|

Total |

|

Revenue |

|

$ |

477,398 |

|

|

$ |

44,079 |

|

|

$ |

20,321 |

|

|

$ |

— |

|

|

$ |

541,798 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

35,809 |

|

|

$ |

10,183 |

|

|

$ |

(596 |

) |

|

$ |

(11,439 |

) |

|

$ |

33,957 |

|

Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,439 |

|

|

|

11,439 |

|

Interest income, net |

|

|

(2,769 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,769 |

) |

Depreciation and amortization |

|

|

25,395 |

|

|

|

988 |

|

|

|

662 |

|

|

|

— |

|

|

|

27,045 |

|

EBITDA |

|

$ |

58,435 |

|

|

$ |

11,171 |

|

|

$ |

66 |

|

|

$ |

— |

|

|

$ |

69,672 |

|

EBITDA Margin |

|

|

12.2 |

% |

|

|

25.3 |

% |

|

|

0.3 |

% |

|

|

|

|

|

12.9 |

% |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

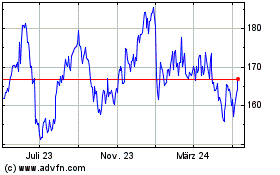

UniFirst (NYSE:UNF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

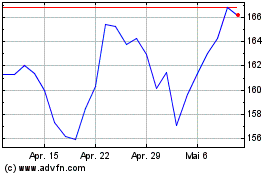

UniFirst (NYSE:UNF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024