0000884614false00008846142024-01-312024-01-310000884614us-gaap:CommonStockMember2024-01-312024-01-310000884614us-gaap:CapitalUnitsMember2024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2024

UGI Corporation

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| | |

| Pennsylvania | 1-11071 | 23-2668356 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

500 North Gulph Road, King of Prussia, PA 19406

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: 610 337-1000

Not Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, without par value | UGI | New York Stock Exchange |

| Corporate Units | UGIC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 31, 2024, UGI Corporation (the “Company”) issued a press release announcing financial results for the Company for the fiscal quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On February 1, 2024, the Company will hold a live Internet Audio Webcast of its conference call to discuss its financial results for the fiscal quarter ended December 31, 2023.

Presentation materials containing certain historical and forward-looking information relating to the Company (the “Presentation Materials”) have been made available on the Company’s website. A copy of the Presentation Materials is furnished as Exhibit 99.2 to this report and is incorporated herein by reference in this Item 7.01. All information in Exhibit 99.2 is presented as of the particular dates referenced therein, and the Company does not undertake any obligation to, and disclaims any duty to, update any of the information provided.

In accordance with General Instruction B.2 of Form 8-K, the information in this report, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in that filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being furnished herewith:

| | | | | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| UGI Corporation |

| | |

| February 1, 2024 | By: | /s/ Sean P. O'Brien |

| Name: | Sean P. O'Brien |

| Title: | Chief Financial Officer |

Press Release

Press Release

UGI Reports First Quarter Fiscal 2024 Results

January 31, 2024

VALLEY FORGE, PA - UGI Corporation (NYSE: UGI) today reported financial results for the fiscal quarter ended December 31, 2023.

HIGHLIGHTS

•Q1 GAAP diluted EPS of $0.44 and adjusted diluted EPS of $1.20 compared to GAAP diluted EPS of $(4.54) and adjusted diluted EPS of $1.14 in the prior-year period.

•Q1 reportable segments earnings before interest expense and income taxes1 ("EBIT") of $425 million compared to $411 million in the prior-year period.

•Strong first quarter results despite warmer than normal weather across our service territories, largely due to a 77% increase in EBIT from UGI International attributable to the continued exit of the non-core energy marketing business, higher LPG volumes, and increased unit margins.

•Available liquidity of approximately $1.5 billion as of December 31, 2023.

•Received approval from the West Virginia Public Service Commission for Mountaineer's gas rate case. The settlement permitted a $13.9 million annual distribution rate increase, effective January 1, 2024, and a weather normalization adjustment mechanism effective October 1, 2024.

"Our fiscal first quarter results reflect the strong performance of UGI International and the natural gas businesses, and underscores our commitment to our customers, shareholders and employees," said Mario Longhi, Interim President and Chief Executive Officer. “As previously anticipated and discussed on our year-end earnings call, AmeriGas experienced a decline in its year-over-year financial results. While effort was made to address the segment's performance, it is clear that there is a need for renewed focus on execution.

"Our strategic priorities are geared towards delivering reliable earnings growth, returning cash to shareholders through dividends, achieving sustainable cost savings, and strengthening the balance sheet. We have initiated actions to align our cost structure with the performance of each business, adjusted our capital allocation priorities, and lowered capital expenditures in the near term. Diligent execution of these actions should strengthen our core businesses and better position UGI to deliver sustainable value for its shareholders."

EARNINGS CALL AND WEBCAST

UGI Corporation will hold a live Internet Audio Webcast of its conference call to discuss the quarterly earnings and other current activities at 9:00 AM ET on Thursday, February 1, 2024. Interested parties may listen to the audio webcast both live and in replay on the Internet at https://www.ugicorp.com/investors/financial-reports/presentations or by visiting the company website https://www.ugicorp.com and clicking on Investors and then Presentations. A replay of the webcast will be available after the event through to 11:59 PM ET January 31, 2025.

CONTACT INVESTOR RELATIONS

Tel: +1 610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

Shelly Oates, ext. 3202

ABOUT UGI

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

USE OF NON-GAAP MEASURES

Management uses "adjusted net income attributable to UGI Corporation" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP").

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

The tables on the last page of this press release reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

1 Reportable segments' EBIT represents an aggregate of our reportable operating segment level EBIT, as determined in accordance with GAAP.

USE OF FORWARD-LOOKING STATEMENTS

This press release contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws. Among them are adverse weather conditions (including increasingly uncertain weather patterns due to climate change) resulting in reduced demand, the seasonal nature of our business, and disruptions in our operations and supply chain; cost volatility and availability of energy products, including propane and other LPG, natural gas, and electricity, as well as the availability of LPG cylinders, and the capacity to transport product to our customers; changes in domestic and foreign laws and regulations, including safety, health, tax, transportation, consumer protection, data privacy, accounting, and environmental matters, such as regulatory responses to climate change; the inability to timely recover costs through utility rate proceedings; increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; adverse labor relations and our ability to address existing or potential workforce shortages; the impact of pending and future legal or regulatory proceedings, inquiries or investigations; competitive pressures from the same and alternative energy sources; failure to acquire new customers or retain current customers, thereby reducing or limiting any increase in revenues; liability for environmental claims; customer, counterparty, supplier, or vendor defaults; liability for uninsured claims and for claims in excess of insurance coverage, including those for personal injury and property damage arising from explosions, acts of war, terrorism, natural disasters, pandemics and other catastrophic events that may result from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and LPG in all forms; transmission or distribution system service interruptions; political, regulatory and economic conditions in the United States, Europe and other foreign countries, including uncertainties related to the war between Russia and Ukraine, the European energy crisis, and foreign currency exchange rate fluctuations (particularly the euro); credit and capital market conditions, including reduced access to capital markets and interest rate fluctuations; changes in commodity market

prices resulting in significantly higher cash collateral requirements; impacts of our indebtedness and the restrictive covenants in our debt agreements; reduced distributions from subsidiaries impacting the ability to pay dividends or service debt; changes in Marcellus and Utica Shale gas production; the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our businesses; our ability to successfully integrate acquired businesses and achieve anticipated synergies; the interruption, disruption, failure, malfunction, or breach of our information technology systems, and those of our third-party vendors or service providers, including due to cyber-attack; the inability to complete pending or future energy infrastructure projects; our ability to achieve the operational benefits and cost efficiencies expected from the completion of pending and future business transformation initiatives, including the impact of customer service disruptions resulting in potential customer loss due to the transformation activities; our ability to attract, develop, retain and engage key employees; uncertainties related to global pandemics; the impact of proposed or future tax legislation; the impact of declines in the stock market or bond market, and a low interest rate environment, on our pension liability; our ability to protect our intellectual property; and our ability to overcome supply chain issues that may result in delays or shortages in, as well as increased costs of, equipment, materials or other resources that are critical to our business operations.

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

Utilities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal quarter ended December 31, | | 2023 | | 2022 | | Increase (Decrease) |

| Revenues | | $ | 493 | | | $ | 592 | | | $ | (99) | | | (17) | % |

| Total margin (a) | | $ | 265 | | | $ | 256 | | | $ | 9 | | | 4 | % |

| Operating and administrative expenses | | $ | 88 | | | $ | 91 | | | $ | (3) | | | (3) | % |

| Operating income | | $ | 134 | | | $ | 126 | | | $ | 8 | | | 6 | % |

| Earnings before interest expense and income taxes | | $ | 135 | | | $ | 128 | | | $ | 7 | | | 5 | % |

| Gas Utility system throughput - billions of cubic feet | | | | | | | | |

| Core market | | 30 | | | 34 | | | (4) | | | (12) | % |

| Total | | 104 | | | 94 | | | 10 | | | 11 | % |

| Gas Utility heating degree days - % (warmer) than normal (b) | | (11.0) | % | | 0.2 | % | | | | |

| Capital expenditures | | $ | 82 | | | $ | 117 | | | $ | (35) | | | (30) | % |

•Gas Utility service territory experienced temperatures that were 11% warmer than normal as well as the prior-year period.

•Core market volumes decreased due to warmer than prior-year weather partially offset by growth in core market customers.

•Total volumes increased largely due to higher large firm delivery service and interruptible delivery service volumes.

•Total margin increased $9 million primarily due to the increase in our PA gas base rates, higher DSIC and IREP benefits, and continued customer growth. The effect of the warmer weather was partially offset by the weather normalization adjustment.

•Operating income increased $8 million due to the higher total margin ($9 million) and lower operating and administrative expenses ($3 million), partially offset by higher depreciation expense ($4 million) from continued distribution system capital expenditure activity.

Midstream & Marketing

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal quarter ended December 31, | | 2023 | | 2022 | | (Decrease) Increase |

| Revenues | | $ | 394 | | | $ | 669 | | | $ | (275) | | | (41) | % |

| Total margin (a) | | $ | 155 | | | $ | 155 | | | $ | — | | | — | % |

| Operating and administrative expenses | | $ | 31 | | | $ | 29 | | | $ | 2 | | | 7 | % |

| Operating income | | $ | 99 | | | $ | 106 | | | $ | (7) | | | (7) | % |

| Earnings before interest expense and income taxes | | $ | 102 | | | $ | 107 | | | $ | (5) | | | (5) | % |

| Heating degree days - % warmer than normal (b) | | (9.4) | % | | (1.0) | % | | | | |

| Capital expenditures | | $ | 19 | | | $ | 11 | | | $ | 8 | | | 73 | % |

•Temperatures were 9% warmer than normal and 11% warmer than the prior-year period.

•Total margin was comparable with the prior year period as higher margins from natural gas marketing activities were offset by lower margins from renewable energy marketing activities.

•Operating and administrative expenses increased $2 million largely due to the recovery of an uncollectible account in the prior year.

UGI International

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal quarter ended December 31, | | 2023 | | 2022 | | (Decrease) Increase |

| Revenues | | $ | 725 | | | $ | 877 | | | $ | (152) | | | (17) | % |

| Total margin (a) | | $ | 279 | | | $ | 215 | | | $ | 64 | | | 30 | % |

| Operating and administrative expenses (a) | | $ | 147 | | | $ | 143 | | | $ | 4 | | | 3 | % |

| Operating income | | $ | 113 | | | $ | 56 | | | $ | 57 | | | 102 | % |

| Earnings before interest expense and income taxes | | $ | 117 | | | $ | 66 | | | $ | 51 | | | 77 | % |

| LPG retail gallons sold (millions) | | 214 | | | 205 | | | 9 | | | 4 | % |

| Heating degree days - % warmer than normal (b) | | (12.0) | % | | (12.3) | % | | | | |

| Capital expenditures | | $ | 12 | | | $ | 27 | | | $ | (15) | | | (56) | % |

UGI International base-currency results are translated into U.S. dollars based upon exchange rates experienced during the reporting periods. Differences in these translation rates affect the comparison of line item amounts presented in the table above. The functional currency of a significant portion of our UGI International results is the euro and, to a much lesser extent, the British pound sterling. During the 2023 and 2022 three-month periods, the average unweighted euro-to-dollar translation rates were approximately $1.08 and $1.02, respectively, and the average unweighted British pound sterling-to-dollar translation rates were approximately $1.24 and $1.17, respectively.

•Temperatures were 12% warmer than normal and 1.5% colder than the prior-year period.

•Retail volume increased 4% primarily due to colder than prior-year weather.

•Total margin increased $64 million primarily due to the continued exist from the non-core energy marketing operations, higher LPG unit margins and the translation effects of the stronger foreign currencies (~$15 million).

•Operating and administrative expenses increased $4 million reflecting the translation effects of the stronger foreign currencies (~$9 million), partially offset by lower personnel-related expenses.

•Operating income increased $57 million reflecting increased total margin, partially offset by higher operating and administrative expenses and lower foreign currency transaction gains ($4 million).

AmeriGas Propane | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal quarter ended December 31, | | 2023 | | 2022 | | (Decrease) Increase |

| Revenues | | $ | 629 | | | $ | 766 | | | $ | (137) | | | (18) | % |

| Total margin (a) | | $ | 346 | | | $ | 380 | | | $ | (34) | | | (9) | % |

| Operating and administrative expenses | | $ | 243 | | | $ | 235 | | | $ | 8 | | | 3 | % |

| Operating loss/loss before interest expense and income taxes | | $ | 71 | | | $ | 110 | | | $ | (39) | | | (35) | % |

| Retail gallons sold (millions) | | 206 | | | 236 | | | (30) | | | (13) | % |

| Heating degree days - % (warmer) colder than normal (b) | | (6.4) | % | | 6.2 | % | | | | |

| Capital expenditures | | $ | 20 | | | $ | 23 | | | $ | (3) | | | (13) | % |

•Temperatures were 6% warmer than normal and 12% warmer than the prior-year period.

•Retail gallons sold decreased 13% due to warmer weather and continued customer attrition.

•Total margin decreased $34 million primarily due to the impact of lower volumes.

•Operating and administrative expenses increased $8 million largely reflecting higher employee compensation and benefits ($5 million), as the business increased its delivery capacity, and increased vehicle fuel and maintenance expenses ($4 million).

•Operating income decreased $39 million reflecting lower total margin and higher operating and administrative expenses, partially offset by higher other income ($3 million) largely attributable to gain on asset sales.

(a)Total margin represents total revenue less total cost of sales. In the case of Utilities, total margin is also reduced by certain revenue-related taxes.

(b)Deviation from average heating degree days is determined on a 10-year period utilizing volume-weighted weather data.

REPORT OF EARNINGS – UGI CORPORATION

(Millions of dollars, except per share)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | | | | |

| Utilities | | | | | $ | 493 | | | $ | 592 | | | $ | 1,755 | | | $ | 1,793 | |

| Midstream & Marketing | | | | | 394 | | | 669 | | | 1,572 | | | 2,460 | |

| UGI International | | | | | 725 | | | 877 | | | 2,813 | | | 3,514 | |

| AmeriGas Propane | | | | | 629 | | | 766 | | | 2,444 | | | 2,931 | |

| Corporate & Other (a) | | | | | (120) | | | (145) | | | (294) | | | (506) | |

| Total revenues | | | | | $ | 2,121 | | | $ | 2,759 | | | $ | 8,290 | | | $ | 10,192 | |

| Earnings (loss) before interest expense and income taxes: | | | | | | | | | | | |

| Utilities | | | | | $ | 135 | | | $ | 128 | | | $ | 372 | | | $ | 366 | |

| Midstream & Marketing | | | | | 102 | | | 107 | | | 286 | | | 294 | |

| UGI International | | | | | 117 | | | 66 | | | 285 | | | 238 | |

| AmeriGas Propane | | | | | 71 | | | 110 | | | 229 | | | 331 | |

| Total reportable segments | | | | | 425 | | | 411 | | | 1,172 | | | 1,229 | |

| Corporate & Other (a) | | | | | (205) | | | (1,642) | | | (1,179) | | | (683) | |

| Total earnings (loss) before interest expense and income taxes | | | | | 220 | | | (1,231) | | | (7) | | | 546 | |

| Interest expense: | | | | | | | | | | | |

| Utilities | | | | | (23) | | | (21) | | | (84) | | | (70) | |

| Midstream & Marketing | | | | | (11) | | | (11) | | | (45) | | | (42) | |

| UGI International | | | | | (11) | | | (7) | | | (41) | | | (28) | |

| AmeriGas Propane | | | | | (41) | | | (43) | | | (161) | | | (162) | |

| Corporate & Other, net (a) | | | | | (14) | | | (10) | | | (56) | | | (38) | |

| Total interest expense | | | | | (100) | | | (92) | | | (387) | | | (340) | |

| Income (loss) before income taxes | | | | | 120 | | | (1,323) | | | (394) | | | 206 | |

| Income tax (expenses) benefits (b) | | | | | (26) | | | 369 | | | (60) | | | 10 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income (loss) attributable to UGI Corporation | | | | | $ | 94 | | | $ | (954) | | | $ | (454) | | | $ | 216 | |

| Earnings (loss) per share attributable to UGI shareholders: | | | | | | | | | | | |

| Basic | | | | | $ | 0.45 | | | $ | (4.54) | | | $ | (2.16) | | | $ | 1.03 | |

| Diluted | | | | | $ | 0.44 | | | $ | (4.54) | | | $ | (2.16) | | | $ | 1.00 | |

| Weighted Average common shares outstanding (thousands): | | | | | | | | | | | |

| Basic | | | | | 209,782 | | | 209,934 | | | 209,778 | | | 210,012 | |

| Diluted | | | | | 215,570 | | | 209,934 | | | 209,778 | | | 215,880 | |

| Supplemental information: | | | | | | | | | | | |

| Net income (loss) attributable to UGI Corporation: | | | | | | | | | | | |

| Utilities | | | | | $ | 86 | | | $ | 81 | | | $ | 224 | | | $ | 224 | |

| Midstream & Marketing | | | | | 92 | | | 77 | | | 208 | | | 189 | |

| UGI International | | | | | 83 | | | 45 | | | 210 | | | 163 | |

| AmeriGas Propane | | | | | 16 | | | 49 | | | 38 | | | 127 | |

| Total reportable segments | | | | | 277 | | | 252 | | | 680 | | | 703 | |

| Corporate & Other (a) | | | | | (183) | | | (1,206) | | | (1,134) | | | (487) | |

| Total net income (loss) attributable to UGI Corporation | | | | | $ | 94 | | | $ | (954) | | | $ | (454) | | | $ | 216 | |

(a) Corporate & Other includes specific items attributable to our reportable segments that are not included in profit measures used by our Chief Operating Decision Maker in assessing our reportable segments' performance or allocating resources. These specific items are shown in the section titled "Non-GAAP Financial Measures - Adjusted Net Income (Loss) Attributable to UGI and Adjusted Diluted Earnings Per Share" below. Corporate & Other also includes the elimination of certain intercompany transactions.

(b) Income tax expense for the twelve months ended December 31, 2022 includes $20 million income tax benefit from adjustments as a result of the changes in

the Pennsylvania corporate income tax rates for future years, signed into law in July 2022.

Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share

The following tables reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconcile diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to previously:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| Adjusted net income (loss) attributable to UGI Corporation (millions): | | | | | | | | | | | | |

| Net income (loss) attributable to UGI Corporation | | | | | | | $ | 94 | | | $ | (954) | | | $ | (454) | | | $ | 216 | |

| Net losses on commodity derivative instruments not associated with current-period transactions (net of tax of $(18), $(363), $(74) and $(112), respectively) | | | | | | | 77 | | | 999 | | | 303 | | | 249 | |

| Unrealized losses (gains) on foreign currency derivative instruments (net of tax of $(6), $(11), $(6) and $1, respectively) | | | | | | | 14 | | | 29 | | | 12 | | | (3) | |

| Loss associated with impairment of AmeriGas Propane goodwill (net of tax of $0, $0, $4, and $0, respectively) | | | | | | | — | | | — | | | 660 | | | — | |

| Loss on extinguishment of debt (net of tax of $0, $0, $(2) and $0, respectively) | | | | | | | — | | | — | | | 7 | | | — | |

| | | | | | | | | | | | | | |

| Business transformation expenses (net of tax of $0, $(1), $(2), and $(2), respectively) | | | | | | | — | | | 1 | | | 6 | | | 7 | |

| Costs associated with exit of the UGI International energy marketing business (net of tax of $(13), $(68), $(12) and $(69), respectively) | | | | | | | 65 | | | 166 | | | 80 | | | 170 | |

| Impact of change in tax law | | | | | | | — | | | — | | | — | | | (19) | |

| | | | | | | | | | | | | | |

| AmeriGas operations enhancement for growth project (net of tax of $(2), $(2), $(6) and $(4), respectively) | | | | | | | 5 | | | 5 | | | 18 | | | 8 | |

| Impairment of certain equity method investments (net of tax of $0, $0, $0 and $(13), respectively) | | | | | | | — | | | — | | | — | | | 22 | |

| Restructuring costs (net of tax of $(1), $0, $(1) and $(8), respectively) | | | | | | | 3 | | | — | | | 3 | | | 21 | |

| | | | | | | | | | | | | | |

| Net gain on sale of UGI headquarters building (net of tax of $0, $0, $4 and $0, respectively) | | | | | | | — | | | — | | | (10) | | | — | |

| | | | | | | | | | | | | | |

| Total adjustments (1) | | | | | | | 164 | | | 1,200 | | | 1,079 | | | 455 | |

| Adjusted net income attributable to UGI Corporation | | | | | | | $ | 258 | | | $ | 246 | | | $ | 625 | | | $ | 671 | |

| | | | | | | | | | | | | | |

| Adjusted diluted earnings per share: | | | | | | | | | | | | |

| UGI Corporation earnings (loss) per share — diluted (2) | | | | | | | $ | 0.44 | | | $ | (4.54) | | | $ | (2.16) | | | $ | 1.00 | |

| Net losses on commodity derivative instruments not associated with current-period transactions | | | | | | | 0.37 | | | 4.73 | | | 1.36 | | | 1.15 | |

| Unrealized losses (gains) on foreign currency derivative instruments | | | | | | | 0.06 | | | 0.14 | | | 0.06 | | | (0.01) | |

| Loss associated with impairment of AmeriGas Propane goodwill | | | | | | | — | | | — | | | 3.15 | | | — | |

| Loss on extinguishment of debt | | | | | | | — | | | — | | | 0.03 | | | — | |

| | | | | | | | | | | | | | |

| Business transformation expenses | | | | | | | — | | | — | | | 0.03 | | | 0.03 | |

| Costs associated with the exit of the UGI International energy marketing business | | | | | | | 0.30 | | | 0.79 | | | 0.38 | | | 0.79 | |

| Impact of change in tax law | | | | | | | — | | | — | | | — | | | (0.09) | |

| | | | | | | | | | | | | | |

| AmeriGas operations enhancement for growth project | | | | | | | 0.02 | | | 0.02 | | | 0.09 | | | 0.03 | |

| Impairment of certain equity method investments | | | | | | | — | | | — | | | — | | | 0.10 | |

| Restructuring costs | | | | | | | 0.01 | | | — | | | 0.01 | | | 0.10 | |

| | | | | | | | | | | | | | |

| Net gain on sale of UGI headquarters building | | | | | | | — | | | — | | | (0.05) | | | — | |

| | | | | | | | | | | | | | |

| Total adjustments (2) | | | | | | | 0.76 | | | 5.68 | | | 5.06 | | | 2.10 | |

| Adjusted diluted earnings per share (2) | | | | | | | $ | 1.20 | | | $ | 1.14 | | | $ | 2.90 | | | $ | 3.10 | |

(1)Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

(2)The loss per share for the twelve months ended December 31, 2023, was determined excluding the effect of 5.97 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the twelve months ended December 31, 2023, was determined based upon fully diluted shares of 215.75 million. The loss per share for the three months ended December 31, 2022, was determined excluding the effect of 6.43 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the three months ended December 31, 2022, were determined based upon fully diluted shares of 216.37 million.

1 1 First Quarter Fiscal 2024 Results M a r i o L o n g h i Interim President and CEO, UGI Corporation S e a n O ’ B r i e n Chief Financial Officer, UGI Corporation Ro b e r t F. B e a rd Chief Operations Officer, UGI Corporation 1

2 2 About This Presentation This presentation contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws. Among them are adverse weather conditions (including increasingly uncertain weather patterns due to climate change) resulting in reduced demand, the seasonal nature of our business, and disruptions in our operations and supply chain; cost volatility and availability of energy products, including propane and other LPG, natural gas, and electricity, as well as the availability of LPG cylinders, and the capacity to transport product to our customers; changes in domestic and foreign laws and regulations, including safety, health, tax, transportation, consumer protection, data privacy, accounting, and environmental matters, such as regulatory responses to climate change; the inability to timely recover costs through utility rate proceedings; increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; adverse labor relations and our ability to address existing or potential workforce shortages; the impact of pending and future legal or regulatory proceedings, inquiries or investigations; competitive pressures from the same and alternative energy sources; failure to acquire new customers or retain current customers, thereby reducing or limiting any increase in revenues; liability for environmental claims; customer, counterparty, supplier, or vendor defaults; liability for uninsured claims and for claims in excess of insurance coverage, including those for personal injury and property damage arising from explosions, acts of war, terrorism, natural disasters, pandemics and other catastrophic events that may result from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and LPG in all forms; transmission or distribution system service interruptions; political, regulatory and economic conditions in the United States, Europe and other foreign countries, including uncertainties related to the war between Russia and Ukraine, the conflict in the Middle East, the European energy crisis, and foreign currency exchange rate fluctuations (particularly the euro); credit and capital market conditions, including reduced access to capital markets and interest rate fluctuations; changes in commodity market prices resulting in significantly higher cash collateral requirements; impacts of our indebtedness and the restrictive covenants in our debt agreements; reduced distributions from subsidiaries impacting the ability to pay dividends or service debt; changes in Marcellus and Utica Shale gas production; the success of our strategic initiatives and investments intended to advance our business strategy; our ability to successfully integrate acquired businesses and achieve anticipated synergies; the interruption, disruption, failure, malfunction, or breach of our information technology systems, and those of our third-party vendors or service providers, including due to cyber-attack; the inability to complete pending or future energy infrastructure projects; our ability to attract, develop, retain and engage key employees; uncertainties related to global pandemics; the impact of a material impairment of our assets; the impact of proposed or future tax legislation; the impact of declines in the stock market or bond market, and a low interest rate environment, on our pension liability; our ability to protect our intellectual property; our ability to overcome supply chain issues that may result in delays or shortages in, as well as increased costs of, equipment, materials or other resources that are critical to our business operations; and our ability to control operating costs and realize cost savings.

3 3 UGI Supplemental Footnotes Management uses “adjusted net income attributable to UGI Corporation”, “adjusted diluted earnings per share (“EPS”)” and “UGI Corporation Adjusted Earnings before Interest, Taxes, Depreciation, and Amortization (“EBITDA”)”, all of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The tables in the Appendix reconcile adjusted diluted earnings per share (EPS), adjusted net income attributable to UGI Corporation and UGI Corporation Adjusted EBITDA to their nearest GAAP measures.

4 The Journey Ahead ➢ Renewed focus on execution to better position UGI for the long-term ➢ Effectively operate the core businesses and provide operational clarity to create stability and improved financial performance ➢ Implement actions to drive sustainable operational efficiencies and achieve permanent cost reduction ➢ Execute prudent actions to strengthen the balance sheet, improve our credit metrics and create more financial flexibility ➢ Allocate capital to businesses with proven and attractive returns ➢ Drive a customer-focused, high-performing and integrated organizational culture

5 • Q1 FY24 GAAP diluted EPS of $0.44 vs. ($4.54) in Q1 FY23 • Year-over-year growth in EBIT from our reportable segments largely due to o Increased total margin at UGI International which partially offset the effect of lower volumes at AmeriGas Propane o Continued strong performance from our natural gas businesses despite warmer weather • Other key highlights o Deployed $133 million of capital, with $82 million (62%) at the Utilities o Added 3,500+ residential and commercial heating customers at the Utilities o At Mountaineer Gas Company, received regulatory approval for: ▪ ~$14 million increase in gas base effective January 1, 2024 ▪ 5-year pilot for weather normalization beginning on October 1, 2024 o Exited substantially all of the non-core European energy marketing business ▪ Completed the sale of select portfolios in France and Netherlands in Q1 FY24 o Available liquidity3 of $1.5 billion as of December 31, 2023 5 1. Adjusted diluted EPS is a non-GAAP measure. See Appendix for reconciliation. 2. EBIT is defined as Earnings before interest expense and income taxes. 3. Liquidity is defined as cash and cash equivalents, and available borrowing capacity on our revolving credit facilities. 4. Excludes Corporate & Other. Q1 FY24 Highlights Adjusted Diluted EPS1 $1.14 $1.20 Q1 FY23 Q1 FY24 Reportable Segments EBIT2,4 $411 $425 Q1 FY23 Q1 FY24

6 Q1 FY24 Results Recap Q1 FY24 GAAP diluted EPS of $0.44 vs. ($4.54) in Q1 FY23 Q1 FY24 Adjusted Diluted EPS – Comparison with Q1 FY23 Key Drivers Natural Gas businesses • Warmer than prior year weather • Higher gas and electric base rates • Weather normalization adjustment • Lower tax expense Corporate & Other • Interest expense • Income taxes Global LPG businesses • Warmer than prior year weather (US) • Higher total margins from the European LPG and non-core energy marketing business • Lower domestic LPG volumes $1.14 $1.20

7 Weather Q1 FY23 EBIT Q1 FY24 EBIT Total Margin OPEX D&A Other Total margin represents total revenue less total cost of sales. In the case of Utilities, the total margin is also reduced by certain revenue-related taxes. OPEX stands for Operating & Administrative Expenses, and D&A stands for Depreciation and Amortization. DSIC stands for Distribution System Improvement Charge and IREP strands for Infrastructure Replacement and Expansion Program. Q1 FY24 Segment Results Recap – Natural Gas Q1 FY24 EBIT - Comparison with Q1 FY23 ($ in million) Utilities Key Drivers • Total margin growth due to increased gas base rates (effective October 1, 2023) and higher benefits from DSIC and IREP • Weather normalization adjustment (effective November 1, 2022) partially offset the effect of warmer weather • Lower OPEX reflects lower contract labor costs and maintenance expenses • Higher depreciation expense reflects the effects of continued distribution system capital expenditure activity 11.0% 11.2% Vs. Normal Vs. PY Increase Decrease WarmerColder Weather Midstream & Marketing Key Drivers • Total margin include higher margins from natural gas marketing activities, including the effects of peaking and capacity management activities, largely offset by lower margins from renewable energy • Higher OPEX largely due to the recovery of an uncollectible account in the prior year 9.4% 10.5% Vs. Normal Vs. PY Q1 FY23 EBIT Q1 FY24 EBIT Total Margin OPEX D&A Other

8 Weather• Total retail gallons increased 4% largely attributable to increased customer conversion and weather that was slightly colder than Q1 FY23 • Total margin growth due to improved results from the non-core energy marketing business, higher volumes, higher LPG unit margin and and the translation effects of the stronger foreign currencies (~$15 million) • Lower foreign currency transaction gains ($4 million) Q1 FY24 Segment Results Recap – Global LPG UGI International Key Drivers 12.0% 1.5% Vs. Normal Vs. PY Increase Decrease WarmerColder Weather• Total retail gallons sold decreased 13% primarily due to warmer weather and continuing customer attrition • Higher OPEX largely reflects the higher salaries and benefits expenses due to increased investment in the business, and higher vehicle expenses, partially offset by lower advertising expenses • Other income largely due to gain on asset sale AmeriGas Propane Key Drivers 6.4% 12.0% Vs. Normal Vs. PY Q1 FY24 EBIT - Comparison with Q1 FY23 ($ in million) Q1 FY23 EBIT Q1 FY24 EBIT Total Margin OPEX D&A OtherQ1 FY23 EBIT Q1 FY24 EBIT Total Margin OPEX D&A Other

9 $0.3 $0.3 $0.3 $0.2 $0.2 $0.9 $1.6 $1.5 $1.4 $1.3 $1.2 $1.9 $1.8 $1.6 $1.5 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Cash and cash equivalents Available Credit Facilities Liquidity and Balance Sheet Update • As of December 31, 2023 o $1.5 billion in available liquidity, comprising cash and cash equivalents and available borrowing capacity on revolving credit facilities o UGI and its subsidiaries were in compliance with all debt covenant requirements, after consideration of the equity cure provision at AmeriGas • On January 31st, our Board of Directors declared a quarterly dividend of $0.375 per share 1.. As of December 31, 2023. Long-term debts with maturities of less than $10 million in a particular year have not been represented in the chart. 2. Long-term debt with maturities between FY29 and FY52. UGI Corporation Long-Term Debt Maturities ($ in million)1Available Liquidity ($ in billion) $700 $675 $525 $500 $331 $443 $792 $281 $70 $40 $1,480 $38 $912 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2024 2025 2026 2027 2028 2029 - 52 AmeriGas Propane UGI International Midstream & Marketing Utilities UGI Corporation 2

10 Focused on strong execution to better position the company for the long-term

11 11 Appendix

12 12 Utilities 34% Midstream & Marketing 29% UGI International 26% AmeriGas Propane 11% A Diversified Energy Provider UGI Corporation is a distributor and marketer of energy products and services, including natural gas, LPG, electricity and renewable energy solutions 141 years of providing energy 18 countries 10,000+ employees1 4 diversified businesses 2.6+ million customers1 1. As of September 30, 2023. 2. Excludes Corporate & other. Adjusted Net Income is a non-GAAP measure. See Appendix for reconciliation. FY23 Adjusted Net Income2 G lo ba lL PG , 3 7% N atural G as,63% Core Values Safety Respect Integrity Sustainability Excellence Reliability 139 years of paying dividends

13 13 Our Natural Gas Businesses The information on this slide is as of September 30, 2023. 1. Based on total customers. 2. The forward-looking information used on this slide is for illustrative purposes only. Actual results may differ substantially from the information presented. • ~$4 billion rate base • 2nd largest regulated gas utility in Pennsylvania (PA)1 and largest regulated gas utility in West Virginia (WV)1 • Weather normalization at the PA Gas Utility; promotes earnings stability • Authorized gas ROEs of 10.15% (DSIC) in PA and 9.75% (IREP) in WV • First utility in Pennsylvania to receive approval from PUC to purchase RNG on behalf of customers • Expected rate base growth of ~9% (FY23 – 27)2 • FY23 Volume: ~375 bcf • Full suite of midstream services and gas marketing on 47 gas utility systems and 20 electric utility systems • LNG Peaking • Pipeline and Gathering Capacity (~4,600,000 Dth/day) • Underground Natural Gas Storage (15,000,000 Dth) • Gathering services • Significant strategic assets in the Marcellus Shale / Utica production area • 86% fee-based income, including minimum volume commitments and take or pay arrangements • FY23 Volume: ~295 bcf Utilities Segment Midstream & Marketing Segment Legacy Assets Appalachia Assets LNG assets

14 14 Our Global LPG Businesses The information on this slide is as of September 30, 2023. 1. Based on the volume of propane gallons distributed annually. UGI International Segment AmeriGas Propane Segment • LPG distribution in 17 countries in Europe through 6 well-known brands o Largest LPG distributor1 in France, Austria, Belgium, Denmark and Luxembourg; among leading distributors1 in Norway, Poland, the Czech Republic, Slovakia, the Netherlands, Sweden and Switzerland • Strategically located supply assets; ownership interests in 10 primary storage facilities and 80+ secondary storage facilities • Exiting non-core energy marketing business • FY23 Volume: ~900 million gallons • Largest retail LPG distributor in the US1 with broad geographic footprint serving all 50 states • Serving ~1.2 million customers through ~1,380 retail distribution locations • Significant supply and transportation network across the nation • Strong track record of attractive unit margins despite fluctuating commodity price environments • FY23 Volume: ~940 million gallons

15 Our Strategic and Financial Priorities Focused on effectively operating our business portfolio to deliver reliable earnings growth, achieve sustainable cost savings, and strengthen the balance sheet while pursuing a strategic review focused on the LPG business Cost Reduction and Optimization Actions Strengthen the Balance Sheet Strategic Review of the LPG Businesses Continued Growth of the Natural Gas businesses 1 2 3 4 Completed Underway Initiated actions to achieve operational efficiencies and targeted cost savings Achieve ~$70 - $100M of cost savings by FY25 Revised capital allocation outlook and priorities to achieve and sustain optimal capital structure Execute on our strategy to enhance liquidity and reduce leverage at AmeriGas Propane and UGI Corporation Review of strategic alternatives, with a focus on AmeriGas Propane Exit the non-core European energy marketing business ▪ UK, Belgium and substantially all of France and the Netherlands ▪ Remaining ~5,500 locations – France and the Netherlands1 Continue investing in our Utility infrastructure to promote safety and reliability while balancing customer affordability Leverage the strategic midstream assets to continue driving earnings and cash flow stability 1. On track to exit the remaining portions of the non-core European energy marketing business by the end of CY25.

16 • 4% long-term dividend growth target • Maintain an attractive dividend payout ratio for our business mix • Consider share repurchase as leverage decreases Capital Allocation Outlook and Priorities Dividend Payment and Shareholder Return • Growth and regulatory capital investments in the regulated utilities businesses, which attract a strong return on equity • Anticipate investing $2B+ between FY24 – FY272 • Prioritize consolidated reduction in leverage ratio1 to achieve range of 3.25x – 3.75x2 • Further strengthen consolidated liquidity • Support organic growth in the natural gas businesses through disciplined capital investment while maintaining a healthy balance sheet • Execute committed projects to develop renewable energy solutions that achieve return criteria 1 2 3 Capital Investments at the Utilities Balance Sheet Improvement Investments in Strategic Growth Opportunities 4 1. Total debt over Adjusted EBITDA. Adjusted EBITDA is a non-GAAP measure. 2. The information on this slide is as of November 17, 2023. The forward-looking information used on this slide is for illustrative purposes only. Actual results may differ substantially from the information presented. 3. Includes acquisitions of business and assets, and other equity investments. 4. Includes growth capital expenditure related to our Midstream & Marketing, UGI International and AmeriGas Propane segments. Capital Allocation – By Category ($ in million) Cash Returned to Shareholders Capital Expenditure3 17% 16% 20% 21% 18% 18% 45% 45% ~$1,100 ~$960 $330 $330 - $335 Renewables Maintenance Capital Growth Capital4 Regulated Utilities (Growth) Capital ~80% of FY24 capital expenditure and investments allocated to Natural Gas and Renewables FY23 FY24E2

17 17 Q1 FY24 Adjusted Diluted Earnings per Share Q1 FY24 Q1 FY23 Utilities 0.40 0.38 Midstream & Marketing 0.43 0.35 UGI International 0.39 0.21 AmeriGas Propane $0.07 $0.23 Corporate & Other (a) (0.85) (5.71) Loss per share – diluted (b) 0.44 (4.54) Net losses on commodity derivative instruments not associated with current-period transactions 0.37 4.73 Unrealized losses on foreign currency derivative instruments 0.06 0.14 AmeriGas operations enhancement for growth project 0.02 0.02 Restructuring costs 0.01 - Costs associated with exit of UGI International energy marketing business 0.30 0.79 Total adjustments (a) 0.76 5.68 Adjusted earnings per share – diluted (b) $1.20 $1.14 (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our Chief Operating Decision Maker in assessing segment performance and allocating resources. (b) The loss per share for Q1 FY23 and Q1 FY22 was determined excluding the dilutive share of 6.43 million and 6.49 million, respectively, as the impact of such shares would have been antidilutive. Adjusted earnings per share was determined based upon fully dilutive shares of 216.37 million and 216.16 million, respectively.

18 18 Q1 FY24 Adjusted Net Income ($ in Million) Q1 FY24 Q1 FY23 Utilities $86 81 Midstream & Marketing 92 77 UGI International 83 45 AmeriGas Propane 16 $49 Corporate & Other (a) (183) (1,206) Net loss attributable to UGI Corporation 94 (954) Net losses on commodity derivative instruments not associated with current-period transactions (net of tax of $(18) and $(363), respectively) 77 999 Unrealized losses on foreign currency derivative instruments (net of tax of $(6) and $(11), respectively) 14 29 Business transformation expenses (net of tax of $0 and $(1), respectively) - 1 AmeriGas operations enhancement for growth project (net of tax of $(2) and $(2), respectively) 5 5 Restructuring costs (net of tax of $(1) and $0, respectively) 3 - Costs associated with exit of UGI International energy marketing business (net of tax of $(13) and $(68), respectively) 65 166 Total adjustments (a) (b) 164 1,200 Adjusted net income attributable to UGI Corporation $258 $246 (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our Chief Operating Decision Maker in assessing segment performance and allocating resources. (b) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

19 19 FY23 Adjusted Net Income (Dollars in Millions) FY23 FY22 Utilities $219 $206 Midstream & Marketing 193 163 UGI International 172 175 AmeriGas Propane 71 112 Corporate & Other (a) (2,157) 417 Net income attributable to UGI Corporation (1,502) 1,073 Net losses (gains) on commodity derivative instruments not associated with current-period transactions (net of tax of $(419) and $140, respectively) 1,225 (458) Unrealized losses (gains) on foreign currency derivative instruments (net of tax of $(11) and $14, respectively) 27 (36) Loss associated with impairment of AmeriGas Propane goodwill (net of tax of $4 and $0, respectively) 660 — Loss on extinguishments of debt (net of tax of $(2) and $(3), respectively) 7 8 Acquisition and integration expenses associated with the Mountaineer Acquisition (net of tax of $0 and $(1), respectively) — 1 Business transformation expenses (net of tax of $(3) and $(2), respectively) 7 7 AmeriGas operations enhancement for growth project (net of tax of $(6) and $(2), respectively) 18 3 Impairments of certain equity method investments (net of tax of $0 and $(13), respectively) — 22 Restructuring costs (net of tax of $0 and $(8), respectively) — 21 Costs associated with exit of the UGI International energy marketing business (net of tax of $(67) and $(1), respectively) 181 4 Net gain on sale of UGI headquarters building (net of tax of $4 and $0, respectively) (10) — Impact of change in tax law — (19) Total adjustments (a) (b) 2,115 (447) Adjusted net income attributable to UGI Corporation $613 $626 (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our Chief Operating Decision Maker in assessing segment performance and allocating resources. (b) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

20 Non-GAAP Reconciliation: UGI Corporation Adjusted EBITDA and Leverage ($ in millions) Year Ended September 30, Quarter Ended December 31, 2021 2022 2023 LTM Dec'22 LTM Dec'23 2021 2022 2023 Net income including noncontrolling interests $1,467 $1,074 ($1,502) $216 ($454) ($96) ($954) $94 Income taxes 522 313 (335) (10) 60 (46) (369) 26 Interest expense 310 329 379 340 387 81 92 100 Depreciation and amortization 502 518 532 520 538 129 131 137 EBITDA 2,801 2,234 (926) 1,066 531 68 (1,100) 357 Unrealized losses (gains) on commodity derivative instruments (1,390) (598) 1,644 361 377 403 1,362 95 Unrealized (gains) losses on foreign currency derivative instruments (8) (50) 38 (4) 18 (6) 40 20 Loss on extinguishments of debt - 11 9 - 9 11 - - Acquisition and integration expenses associated with the CMG Acquisition 1 - - - - - - Acquisition and integration expenses associated with the Mountaineer Acquisition 14 2 - 1 - 1 - - Business transformation expenses 101 9 10 9 8 2 2 - Impairments of certain equity method investments 93 35 - 35 - - - - Impairment of customer relationship intangible 20 - - - - - - - Restructuring costs - 29 - 29 4 - - 4 Loss associated with impairment of AmeriGas Propane goodwill - - 656 - 656 - - - Costs associated with exit of the UGI International energy marketing business - 5 248 239 92 - 234 78 Net gain on sale of UGI headquarters building - - (14) - (14) - - - AmeriGas operations enhancement for growth project - 5 24 12 24 - 7 7 Adjusted EBITDA $1,632 $1,682 $1,689 $1,748 $1,705 $479 $545 $561 Total Debt $6,816 $7,000 $7,249 $7,716 $7,380

21 21 Q1 FY24 Segment Reconciliation (GAAP) ($ in Million) 1. For US GAAP purposes, certain revenue-related taxes within our Utilities segment are included in “Operating and administrative expenses” above. Such costs reduce margin for Management’s Results of Operations reported in our periodic filings. 1 1 Total Uti l i ties Midstream & Marketing UGI International AmeriGas Propane Corp & Other Revenues $2,121 $493 $394 $725 $629 ($120) Cost of sales (1,202) (221) (239) (446) (283) (13) Total margin 919 272 155 279 346 (133) Operating and administrative expenses (530) (95) (31) (147) (243) (14) Depreciation and amortization (137) (41) (22) (30) (44) - Loss on disposal of UGI International energy marketing business (28) - - - - (28) Other operating income (expense), net 8 (2) (3) 11 12 (10) Operating income (loss) 232 134 99 113 71 (185) Income (loss) from equity investees 1 - 3 (2) - - Other non-operating (expense) income, net (13) 1 - 6 - (20) Earnings (loss) before income taxes and interest expense 220 135 102 117 71 (205) Interest expense (100) (23) (11) (11) (41) (14) Income (loss) before income taxes 120 112 91 106 30 (219) Income tax (expense) benefit (26) (26) 1 (23) (14) 36 Net income (loss) income attr ibutable to UGI Corporation $94 $86 $92 $83 $16 $(183)

22 22 Investor Relations: Tameka Morris 610-456-6297 morrista@ugicorp.com Arnab Mukherjee 610-768-7498 mukherjeea@ugicorp.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CapitalUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

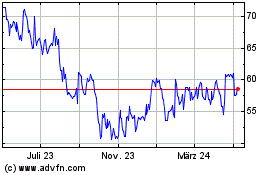

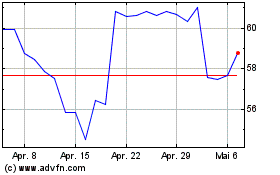

UGI (NYSE:UGIC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UGI (NYSE:UGIC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024