Trinseo (“Trinseo” or “the Company”) (NYSE: TSE), a specialty

material solutions provider, today announced that it has obtained

$1.077 billion in aggregate principal amount of secured term loan

financing (“New Term Loan Facility”) arranged by Angelo, Gordon

& Co., L.P. (“Angelo Gordon”) and Oaktree Capital Management,

L.P. (“Oaktree”), with funds managed by Angelo Gordon, Oaktree and

Apollo Global Management, Inc. (“Apollo”) as lenders. Proceeds will

be used to refinance the entirety of the Company’s outstanding 2024

term loan and $385 million of its existing $500 million 2025 Senior

Notes.

Key Terms of the New Term Loan Facility include:

- $1.077 billion of aggregate new principal amount for net cash

proceeds of $1.045 billion

- Annual cash interest rate of SOFR + 8.50%

- Option to elect partial payment-in-kind (“PIK”) interest for up

to 24 months at an annual cash interest rate of SOFR + 4.25% and a

PIK interest rate of 5.25%

- Call protections of a customary make-whole from months 0 to 18;

3.0% from months 18 to 30; 2.0% from months 30 to 42; par

thereafter

- Final maturity date of May 3, 2028

Commenting on the transaction, Frank Bozich, Trinseo’s President

and Chief Executive Officer, said, “We are very pleased with this

transaction as it addresses the entirety of our 2024 debt maturity

and over 75% of our debt maturing in 2025. The financing process

was very competitive, a testament to investors’ strong belief in

the long-term outlook for the business. We welcome the support and

partnership from leading investors Oaktree, Angelo Gordon and

Apollo.”

Bozich continued, “I want to thank our employees, customers and

suppliers for their partnerships in managing through the current

challenging demand environment. With our nearest-term maturity now

addressed, we will continue to progress on our transformation while

developing value-added solutions for our customers and creating

long-term value for our shareholders.”

“We are delighted to be a capital partner to Trinseo and have

the opportunity to help strengthen its balance sheet by refinancing

the majority of its near-dated maturities,” said Joseph Lenz,

Managing Director at Angelo Gordon.

Brook Hinchman, Managing Director at Oaktree, added “We

appreciate the opportunity to work with Frank, David and the full

Trinseo team to provide a capital structure solution to allow

Trinseo to focus on its leading position in the styrene derivative

and PMMA value chains and on innovative polymer recycling

technologies.”

Centerview Partners LLC acted as financial advisor and Ropes

& Gray LLP acted as legal counsel to Trinseo on this

transaction. Paul Hastings LLP acted as legal counsel to Oaktree,

Angelo Gordon, and Apollo.

About Trinseo

Trinseo (NYSE: TSE), a specialty material solutions provider,

partners with companies to bring ideas to life in an imaginative,

smart and sustainably focused manner by combining its premier

expertise, forward-looking innovations and best-in-class materials

to unlock value for companies and consumers.

From design to manufacturing, Trinseo taps into decades of

experience in diverse material solutions to address customers’

unique challenges in a wide range of industries, including building

and construction, consumer goods, medical and mobility.

Trinseo’s approximately 3,300 employees bring endless creativity

to reimagining the possibilities with clients all over the world

from the company’s locations in North America, Europe and Asia

Pacific. Trinseo reported net sales of approximately $5.0 billion

in 2022. Discover more by visiting www.trinseo.com and connecting

with Trinseo on LinkedIn, Twitter, Facebook and WeChat.

Cautionary Note on Forward-Looking Statements

This press release may contain forward-looking statements

including, without limitation, statements concerning plans,

objectives, goals, projections, forecasts, strategies, future

events or performance, and underlying assumptions and other

statements, which are not statements of historical facts or

guarantees or assurances of future performance. Forward-looking

statements may be identified by the use of words like "expect,"

"anticipate," “believe,” "intend," "forecast," "outlook," "will,"

"may," "might," "see," "tend," "assume," "potential," "likely,"

"target," "plan," "contemplate," "seek," "attempt," "should,"

"could," "would" or expressions of similar meaning. Forward-looking

statements reflect management’s evaluation of information currently

available and are based on our current expectations and assumptions

regarding our business, the economy, our current indebtedness and

other future conditions. Because forward-looking statements relate

to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict. Factors

that might cause future results to differ from those expressed by

the forward-looking statements include, but are not limited to, our

ability to successfully execute our business and transformation

strategy; increased costs or disruption in the supply of raw

materials; increased energy costs; our ability to successfully

implement proposed restructuring initiatives, including the closure

of certain plants and product lines, and to successfully generate

cost savings and increase profitability; compliance with laws and

regulations impacting our business; conditions in the global

economy and capital markets; our ability to meet the covenants

under our existing indebtedness; our ability to successfully

investigate and remediate chemical releases on or from our sites,

make related capital expenditures, reimburse third-party cleanup

costs or settle potential regulatory penalties or other claims; and

those discussed in our Annual Report on Form 10-K, under Part I,

Item 1A —"Risk Factors" and elsewhere in our other reports, filings

and furnishings made with the U.S. Securities and Exchange

Commission from time to time. As a result of these or other

factors, our actual results, performance or achievements may differ

materially from those contemplated by the forward-looking

statements. Therefore, we caution you against relying on any of

these forward-looking statements. The forward-looking statements

included in this press release are made only as of the date hereof.

We undertake no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230908832352/en/

Trinseo Andy Myers Tel: +1 610-240-3221 Email:

aemyers@trinseo.com

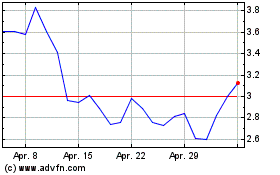

Trinseo (NYSE:TSE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Trinseo (NYSE:TSE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024